Simple ARIMA Model

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import yfinance as yf

from sklearn.preprocessing import MinMaxScaler

from statsmodels.tsa.arima.model import ARIMA

import datetime

from google.colab import drive

# 授權 Google Drive

drive.mount('/content/drive')

# 下載資料的函數

def download_data(ticker, start_date):

data = yf.download(ticker, start=start_date)

data['Return'] = data['Adj Close'].pct_change()

data['Trade Amount'] = data['Volume'] * data['Adj Close']

data['MA7'] = data['Adj Close'].rolling(window=7).mean()

data['MA21'] = data['Adj Close'].rolling(window=21).mean()

data['MA50'] = data['Adj Close'].rolling(window=50).mean()

data['MA100'] = data['Adj Close'].rolling(window=100).mean()

data['RSI14'] = calculate_rsi(data['Adj Close'], 14)

data['Beta_60'] = calculate_beta(data['Return'], data['Return'].rolling(window=60).mean(), 60)

data['Beta_120'] = calculate_beta(data['Return'], data['Return'].rolling(window=120).mean(), 120)

return data

def calculate_rsi(series, period):

delta = series.diff(1)

gain = (delta.where(delta > 0, 0)).rolling(window=period).mean()

loss = (-delta.where(delta < 0, 0)).rolling(window=period).mean()

rs = gain / loss

rsi = 100 - (100 / (1 + rs))

return rsi

def calculate_beta(stock_returns, market_returns, window):

cov_matrix = stock_returns.rolling(window=window).cov(market_returns)

market_variance = market_returns.rolling(window=window).var()

beta = cov_matrix / market_variance

return beta

# 下載台股指數和個股資料

tickers = ["^TWII"]

data = {ticker: download_data(ticker, "2021-01-01") for ticker in tickers}

# 將資料保存為CSV文件到Google Drive

for ticker in tickers:

data[ticker].to_csv(f"/content/drive/My Drive/{ticker}.csv")

# 使用台灣股市指數的 Adj Close 數據

taiex_data = data["^TWII"]["Adj Close"]

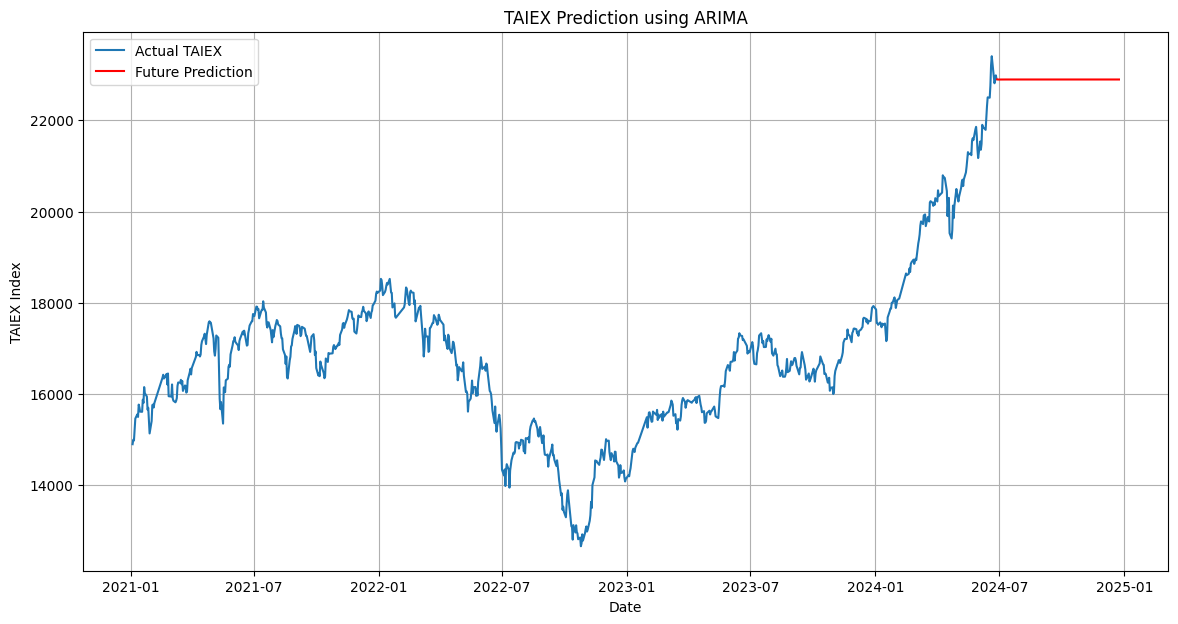

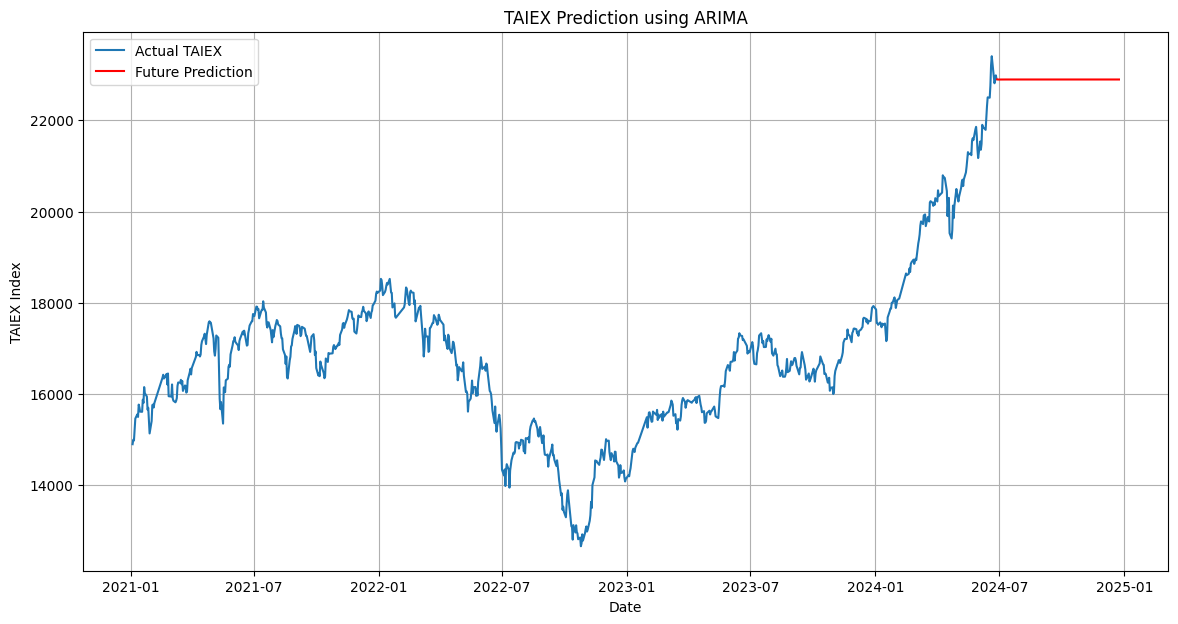

# 構建 ARIMA 模型

model = ARIMA(taiex_data, order=(5,1,0)) # ARIMA(p,d,q) 中選擇適當的 p, d, q 參數

model_fit = model.fit()

# 預測未來180天

forecast_steps = 180

forecast = model_fit.forecast(steps=forecast_steps)

# 生成未來日期索引

last_date = taiex_data.index[-1]

future_dates = pd.date_range(start=last_date, periods=forecast_steps + 1)[1:]

# 繪圖

plt.figure(figsize=(14, 7))

plt.plot(taiex_data.index, taiex_data.values, label='Actual TAIEX')

plt.plot(future_dates, forecast, label='Future Prediction', color='red')

plt.title('TAIEX Prediction using ARIMA')

plt.xlabel('Date')

plt.ylabel('TAIEX Index')

plt.legend()

plt.grid(True)

plt.show()