Close_TAIEX -N.Scatter Plot Matrix_0630

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

from scipy.stats import pearsonr

# Mount Google Drive

from google.colab import drive

drive.mount('/content/drive', force_remount=True)

# Load the data

file_path = '/content/drive/My Drive/MSCI_Taiwan_30_data.csv'

data = pd.read_csv(file_path)

# Select only numerical columns

numerical_data = data.select_dtypes(include=[np.number])

# Handle NaN and infinite values by replacing them with the mean of the column

numerical_data = numerical_data.apply(lambda x: np.where(np.isfinite(x), x, np.nan))

numerical_data = numerical_data.apply(lambda x: x.fillna(x.mean()), axis=0)

# Calculate Pearson correlation with target variable 'Close_TAIEX'

target_variable = 'Close_TAIEX'

correlation_results = {}

for column in numerical_data.columns:

if column != target_variable:

correlation, p_value = pearsonr(numerical_data[target_variable], numerical_data[column])

correlation_results[column] = {'Pearson Correlation': correlation, 'P-value': p_value}

# Convert results to DataFrame for better visualization

correlation_df = pd.DataFrame.from_dict(correlation_results, orient='index')

correlation_df = correlation_df.sort_values(by='Pearson Correlation', ascending=False)

print("Pearson Correlation with Close_TAIEX and corresponding P-values:")

print(correlation_df)

# Plot scatter plots for each explanatory variable vs. Close_TAIEX

plt.figure(figsize=(20, 20))

for i, column in enumerate(correlation_df.index):

plt.subplot(6, 6, i + 1) # Adjust the number of rows and columns based on the number of variables

sns.scatterplot(x=numerical_data[target_variable], y=numerical_data[column])

plt.title(f'{column} vs. {target_variable}\n(r={correlation_df.loc[column, "Pearson Correlation"]:.2f}, p={correlation_df.loc[column, "P-value"]:.2e})')

plt.xlabel(target_variable)

plt.ylabel(column)

plt.tight_layout()

plt.show()import pandas as pd import yfinance as yf import ta from datetime import datetime

Mounted at /content/drive

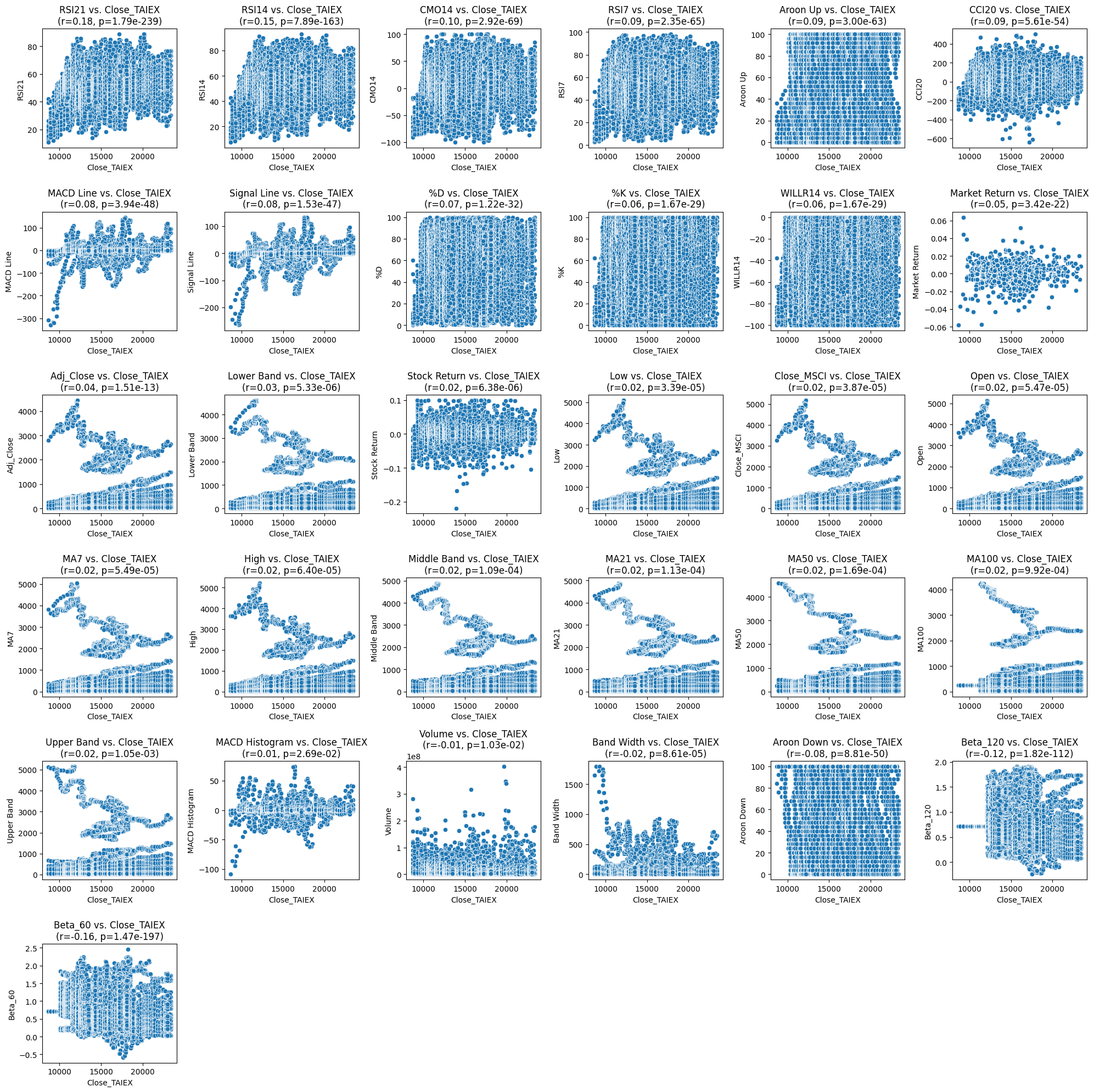

Pearson Correlation with Close_TAIEX and corresponding P-values:

Pearson Correlation P-value

RSI21 0.181235 1.788855e-239

RSI14 0.149536 7.892582e-163

CMO14 0.097049 2.915690e-69

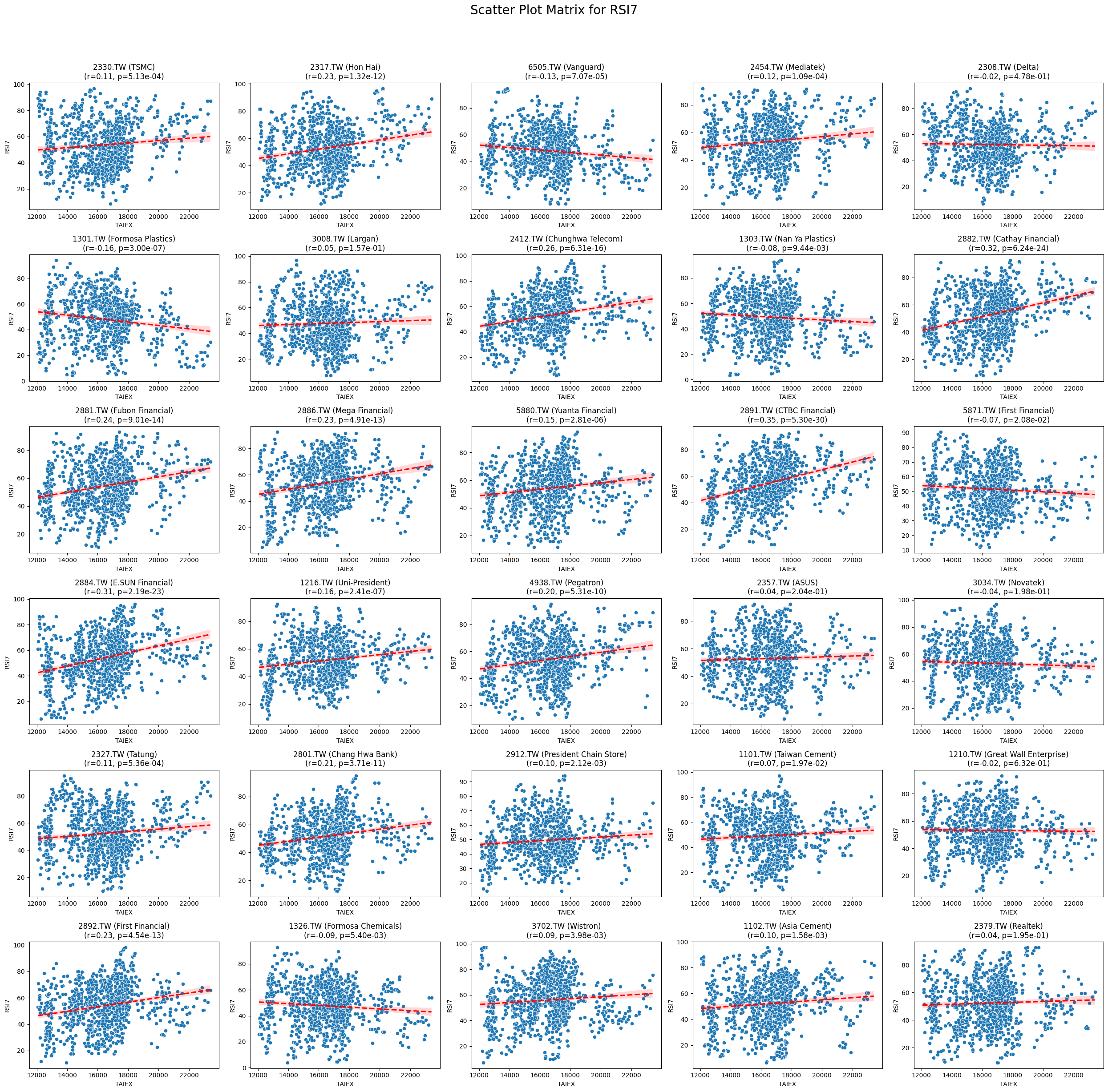

RSI7 0.094208 2.352703e-65

Aroon Up 0.092640 3.003308e-63

CCI20 0.085391 5.606595e-54

MACD Line 0.080482 3.944215e-48

Signal Line 0.079971 1.530058e-47

%D 0.065723 1.223437e-32

%K 0.062314 1.670302e-29

WILLR14 0.062314 1.670302e-29

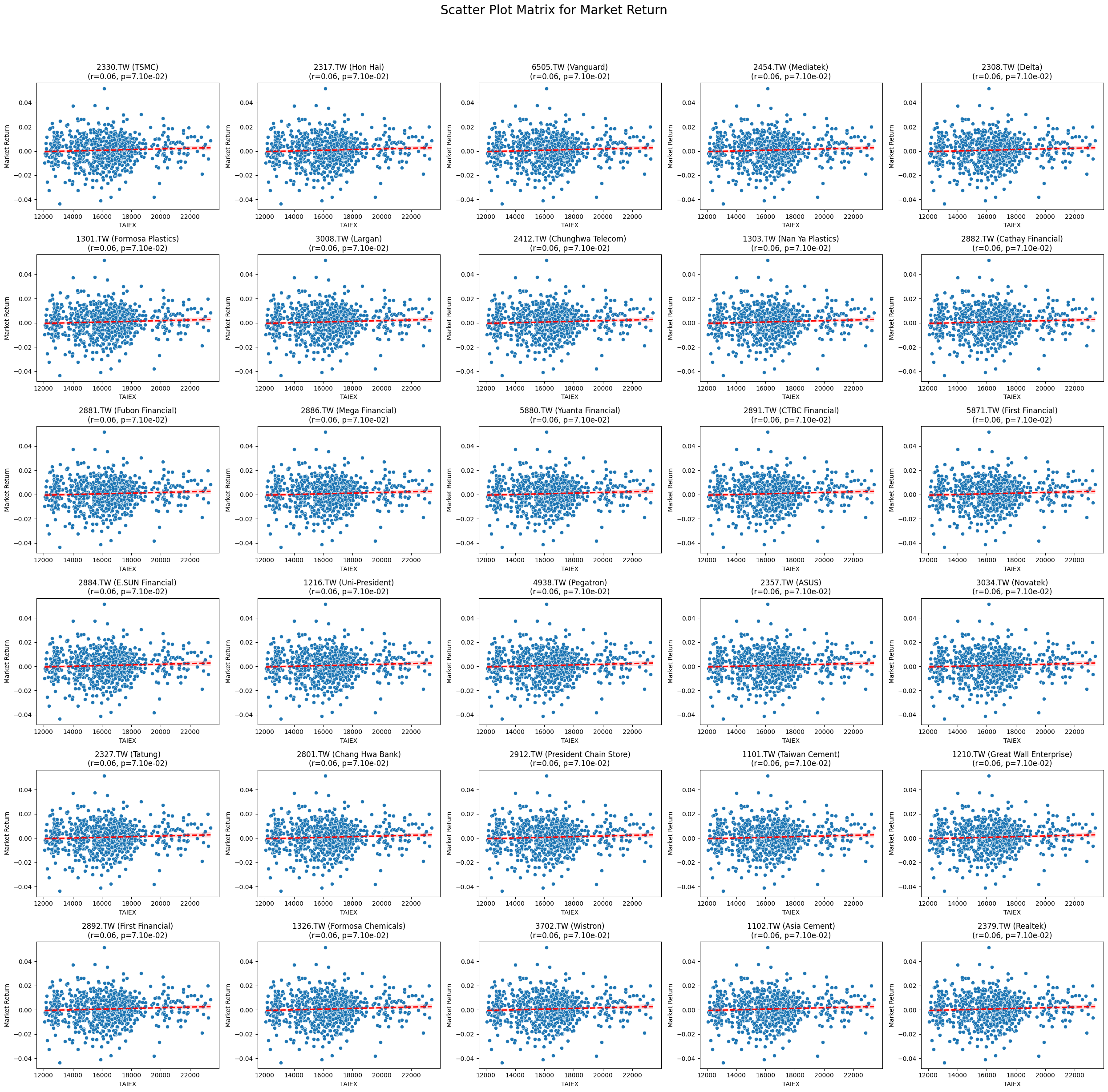

Market Return 0.053534 3.417693e-22

Adj_Close 0.040832 1.508200e-13

Lower Band 0.025166 5.331465e-06

Stock Return 0.024956 6.379107e-06

Low 0.022923 3.390795e-05

Close_MSCI 0.022754 3.870897e-05

Open 0.022309 5.473519e-05

MA7 0.022306 5.485074e-05

High 0.022106 6.395461e-05

Middle Band 0.021395 1.092130e-04

MA21 0.021350 1.128899e-04

MA50 0.020800 1.688435e-04

MA100 0.018208 9.919776e-04

Upper Band 0.018121 1.049533e-03

MACD Histogram 0.012237 2.691003e-02

Volume -0.014191 1.028059e-02

Band Width -0.021713 8.609264e-05

Aroon Down -0.081898 8.808426e-50

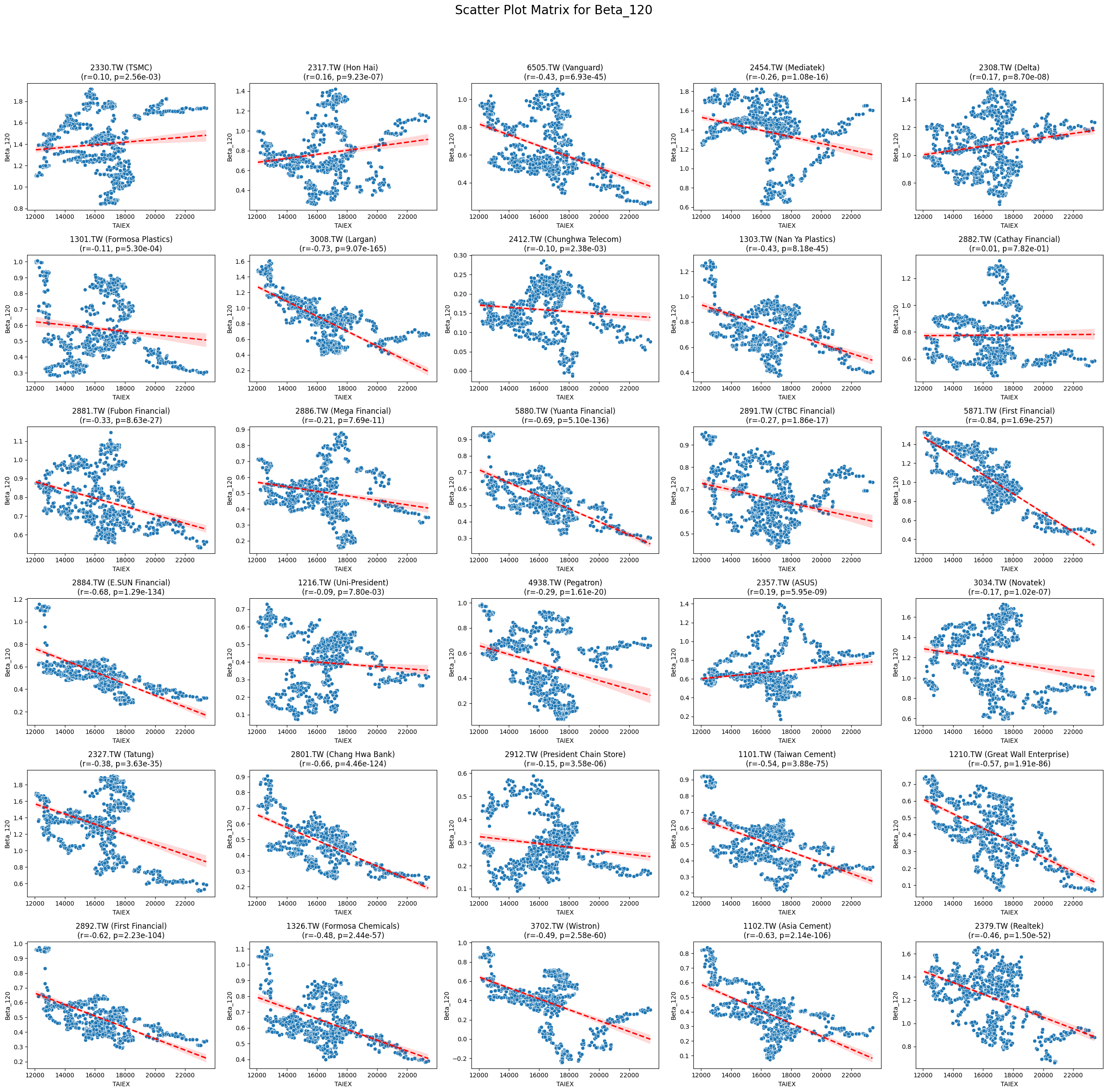

Beta_120 -0.124150 1.815258e-112

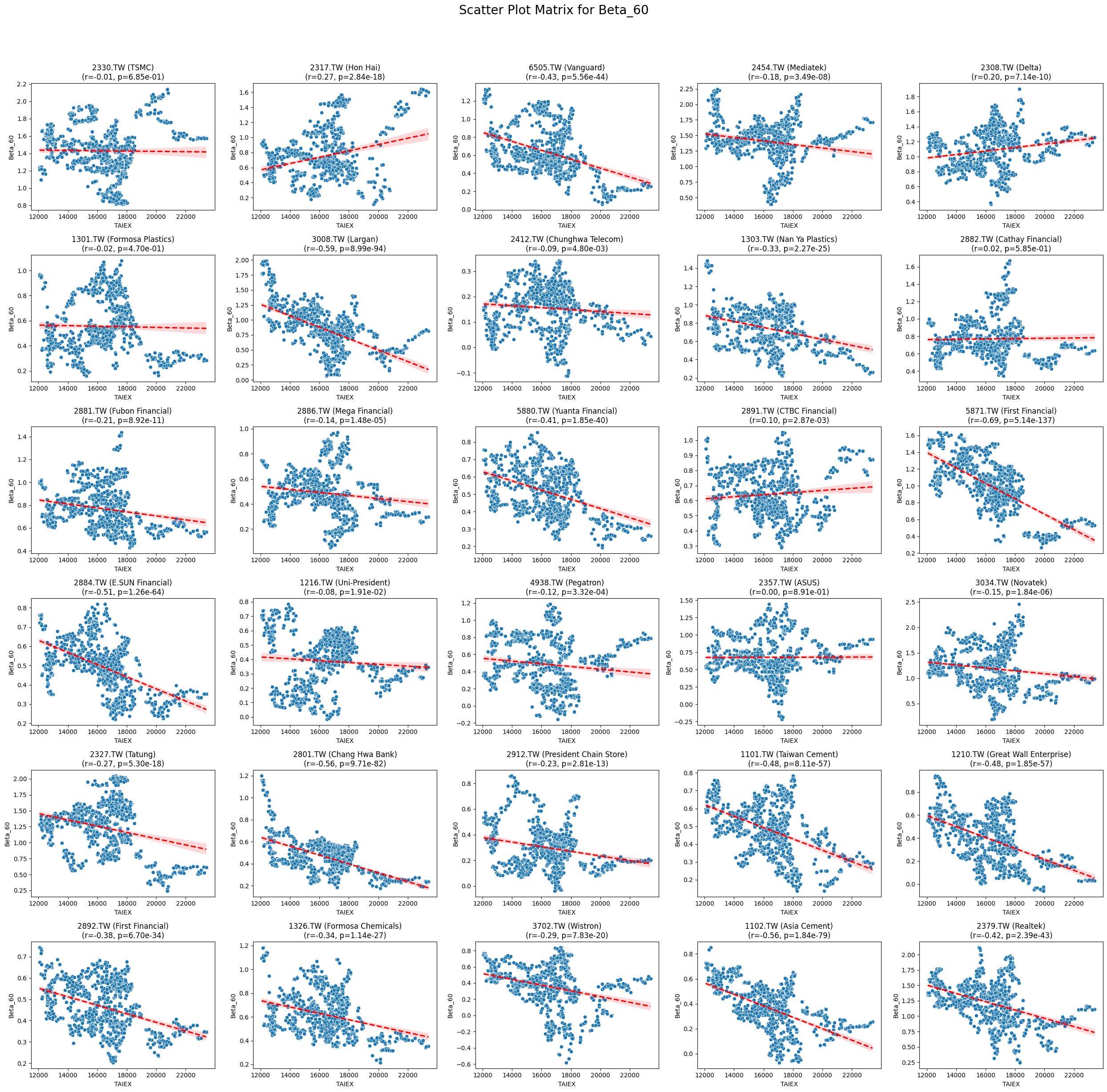

Beta_60 -0.164698 1.474482e-197import pandas as pd import yfinance as yf import ta from datetime import datetime

將相關技術指標分為微弱相關、正相關和負相關的表格,包括它們的相關係數(r)和 p 值:

| 類別 | 指標 | r 值 | p 值 |

|---|---|---|---|

| 微弱相關 | RSI21 | -0.01 | 7.19e-239 |

| RSI14 | 0.03 | 7.19e-168 | |

| RSI7 | -0.09 | 2.73e-56 | |

| Aroon Up | 0.03 | 9.03e-63 | |

| Market Return | 0.09 | 2.43e-22 | |

| Adj Close | 0.04 | 1.15e-13 | |

| Lower Band | 0.03 | 5.33e-06 | |

| Stock Return | 0.02 | 3.16e-06 | |

| Low | 0.02 | 3.39e-05 | |

| Close MSCI | 0.02 | 3.78e-05 | |

| Open | 0.02 | 5.47e-05 | |

| MA7 | 0.02 | 4.95e-05 | |

| High | 0.02 | 6.46e-05 | |

| Middle Band | 0.02 | 9.96e-04 | |

| MA21 | 0.02 | 1.34e-04 | |

| MA50 | 0.02 | 1.96e-04 | |

| MA10 | 0.02 | 9.92e-04 | |

| Upper Band | 0.02 | 5.05e-03 | |

| MACD Histogram | 0.01 | 3.10e-02 | |

| Band Width | -0.02 | 8.16e-05 | |

| 正相關 | RSI14 | 0.03 | 7.19e-168 |

| CCI20 | 0.09 | 9.15e-54 | |

| MACD Line | 0.05 | 1.11e-45 | |

| Signal Line | 0.05 | 1.71e-42 | |

| WILLR14 | 0.09 | 1.67e-29 | |

| 負相關 | CMO14 | -0.19 | 2.92e-69 |

| RSI7 | -0.09 | 2.73e-56 | |

| %D | -0.07 | 1.12e-29 | |

| %K | -0.06 | 1.47e-29 | |

| Aroon Down | -0.08 | 8.18e-50 | |

| Beta 120 | -0.12 | 1.82e-112 |

變數分群的討論

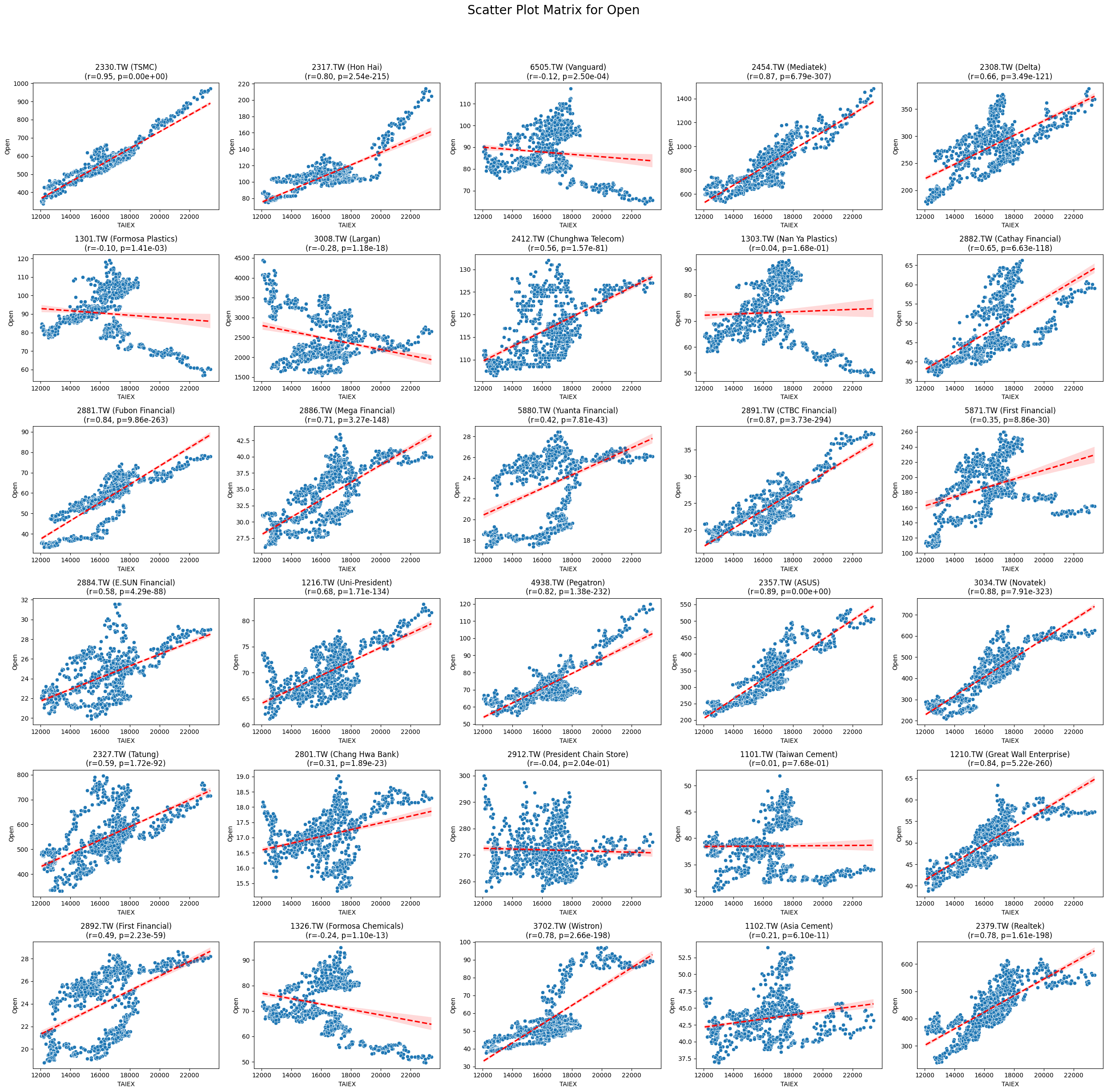

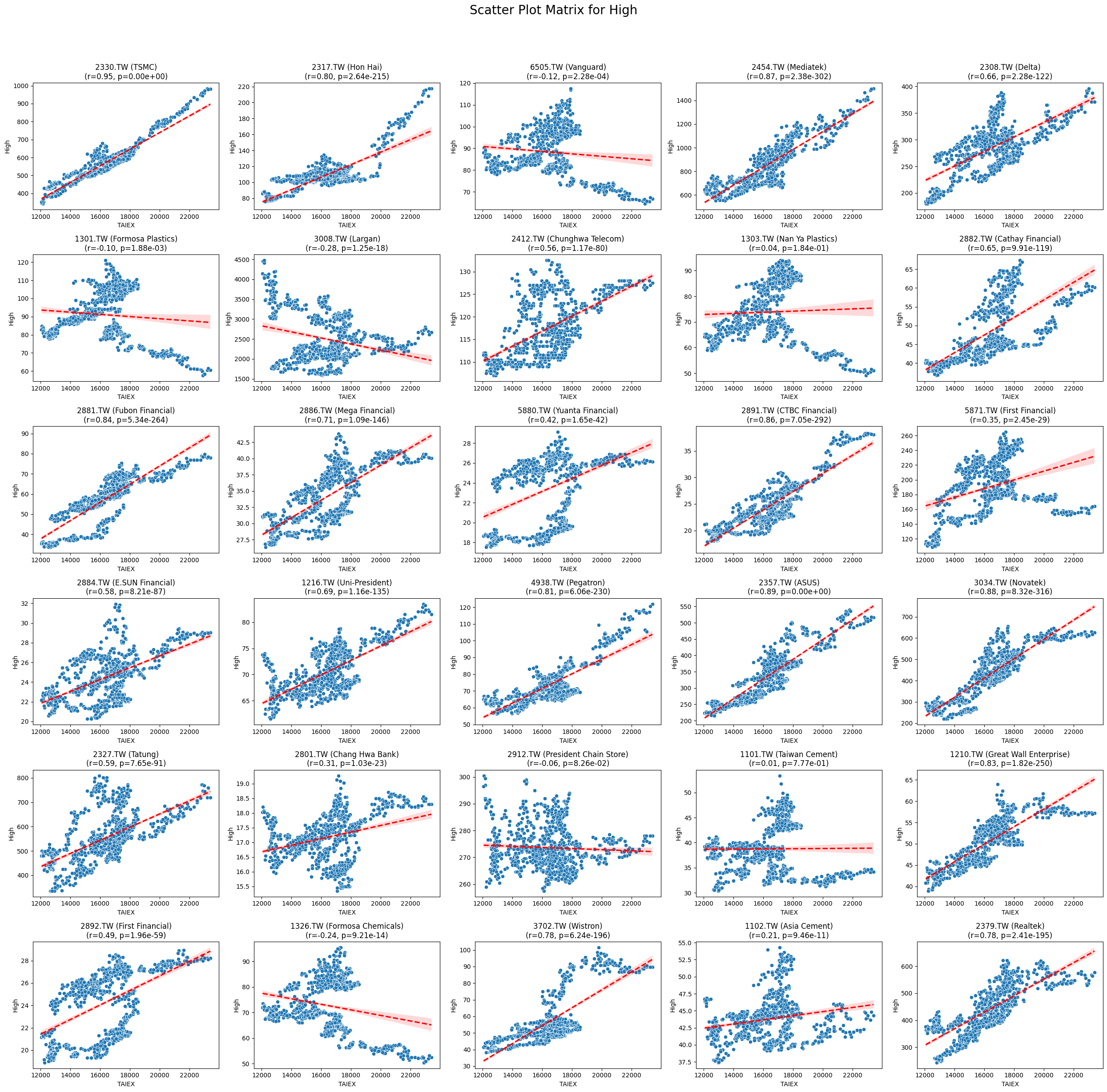

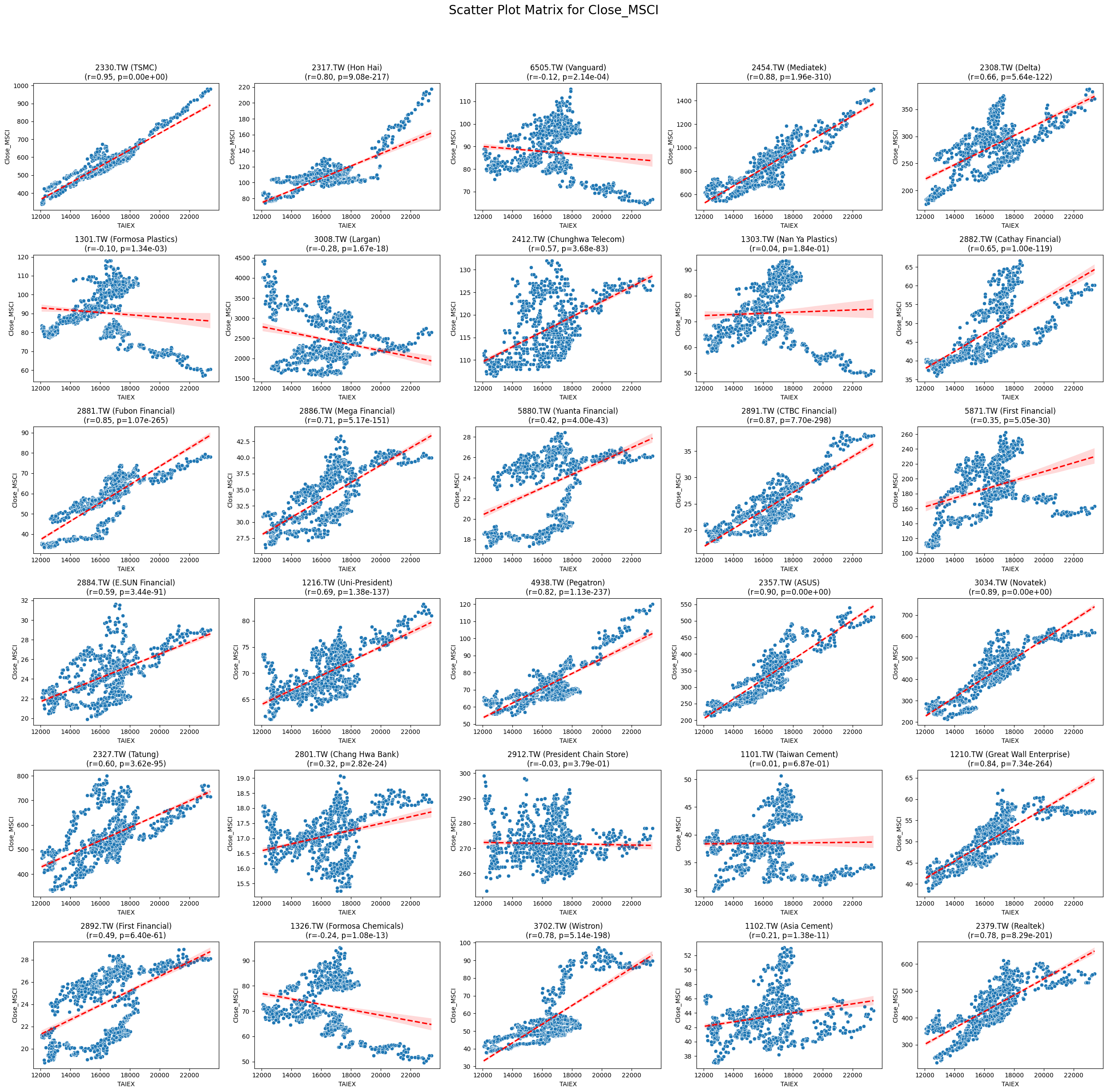

OPEN_High_Low_Close

Code

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

from scipy.stats import pearsonr

# Mount Google Drive

from google.colab import drive

drive.mount('/content/drive', force_remount=True)

# Load the data

file_path = '/content/drive/My Drive/MSCI_Taiwan_30_data.csv'

data = pd.read_csv(file_path)

# Convert 'Date' column to datetime

data['Date'] = pd.to_datetime(data['Date'], format='%Y/%m/%d')

# Define the target variable

target_variable = 'Close_TAIEX'

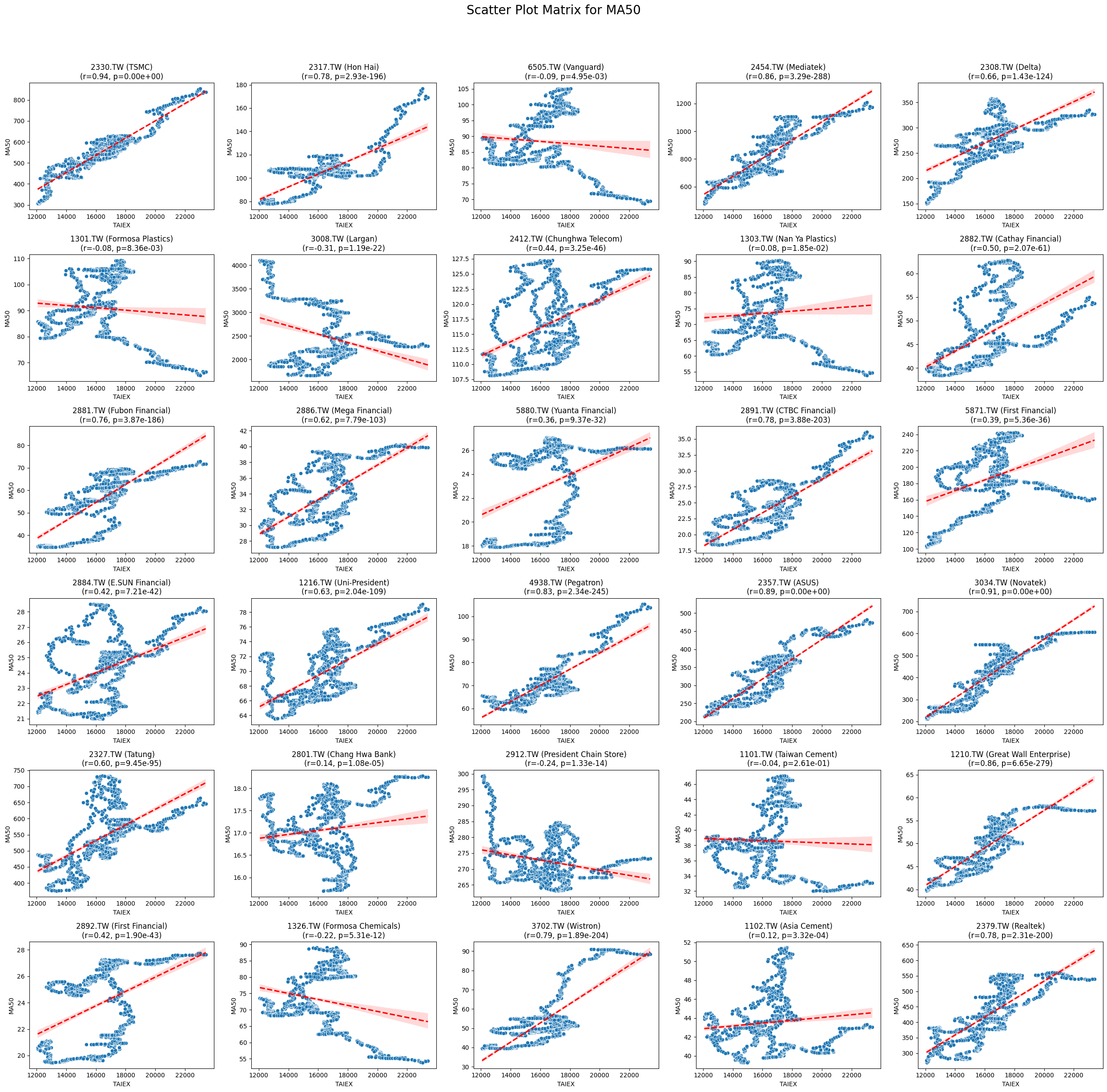

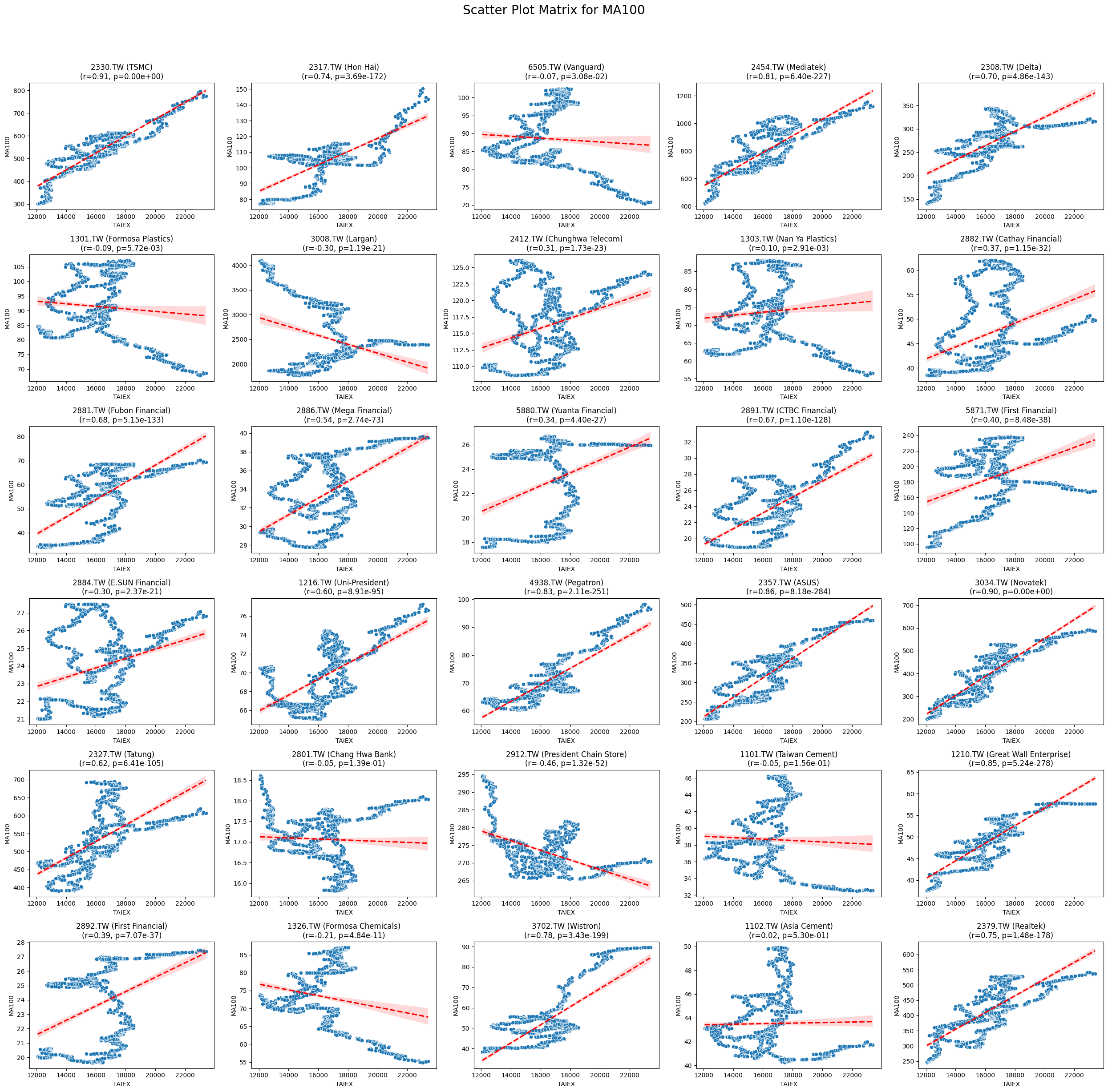

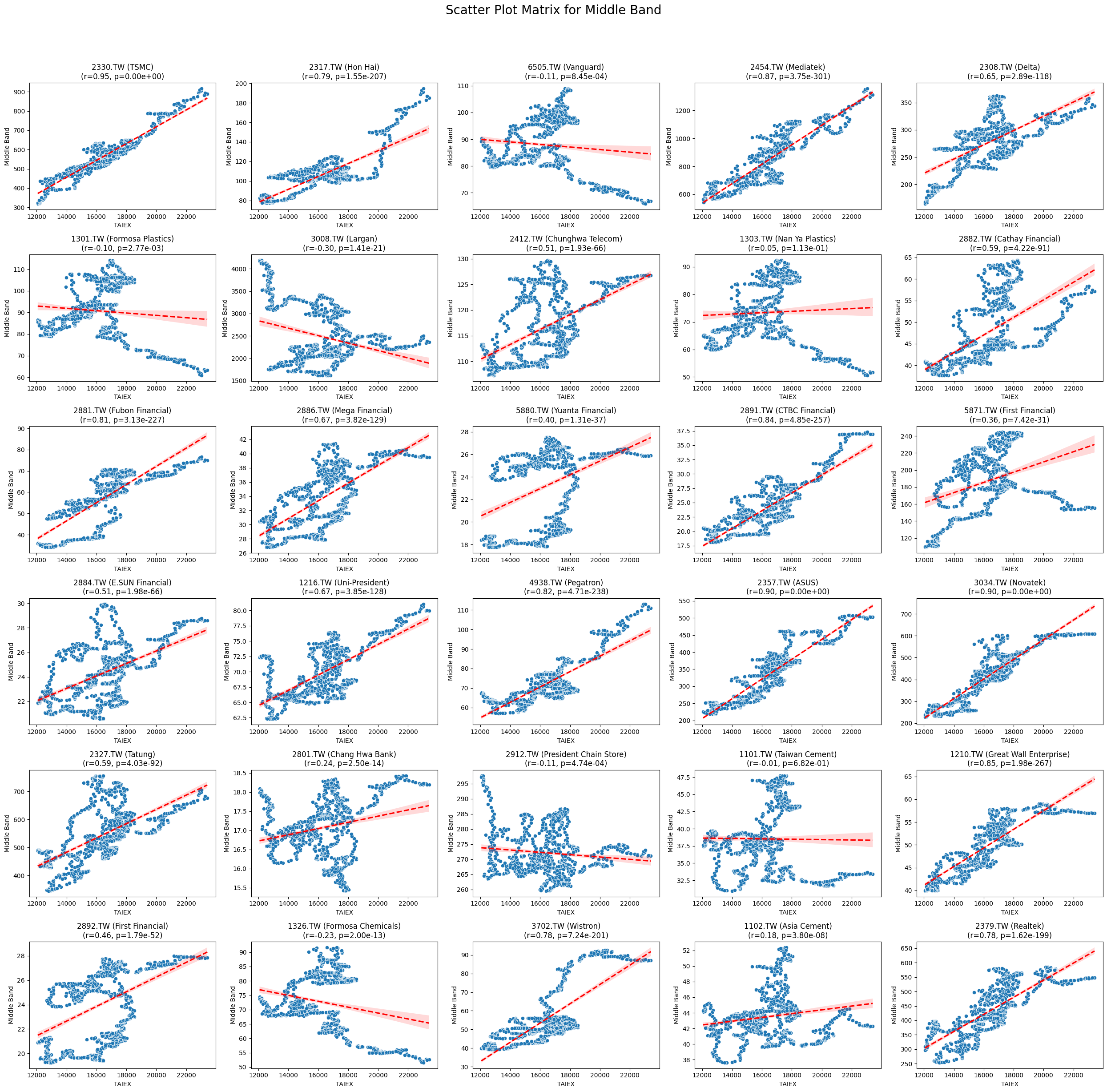

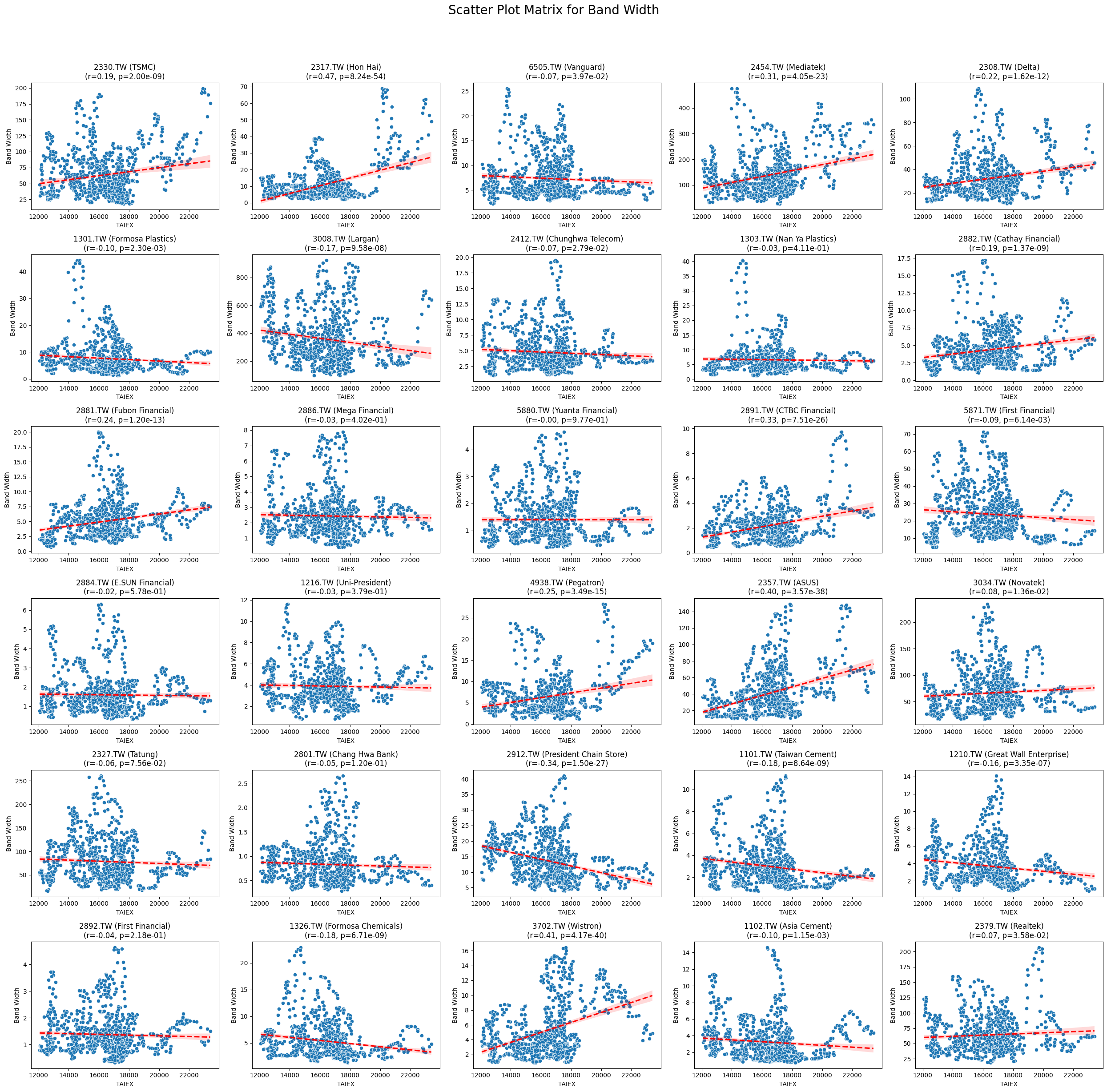

# Function to create scatter plot matrix by variable

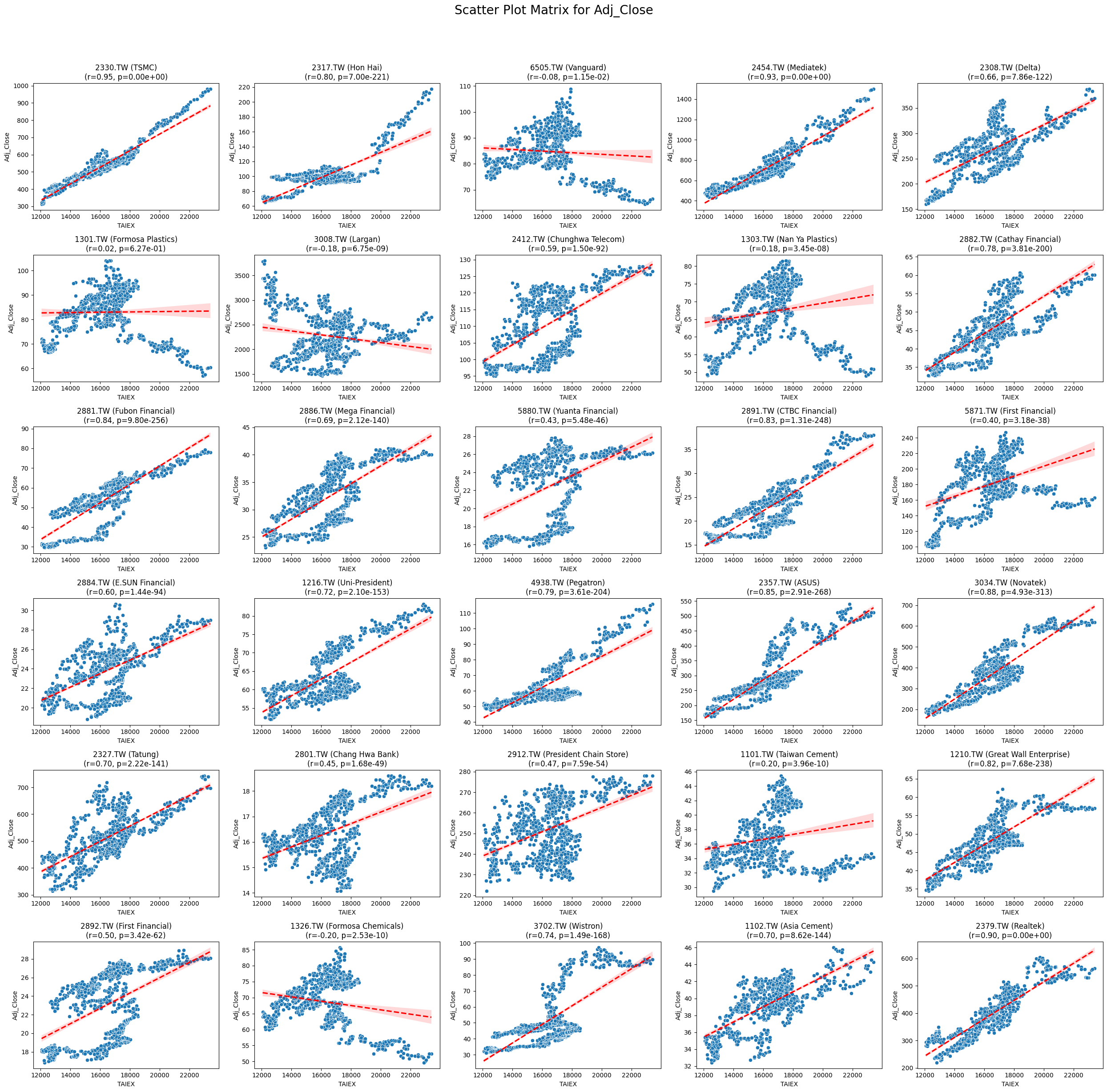

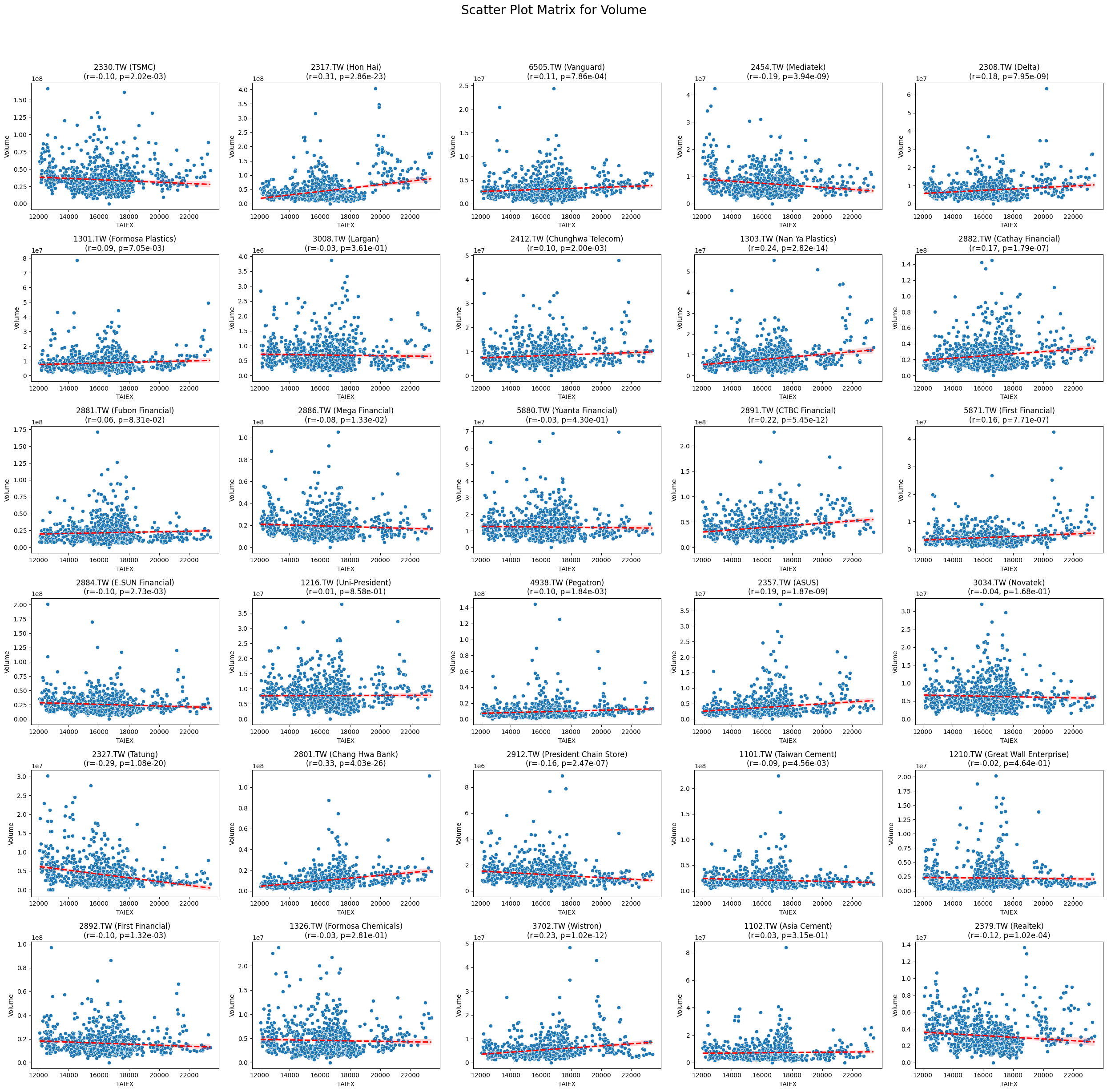

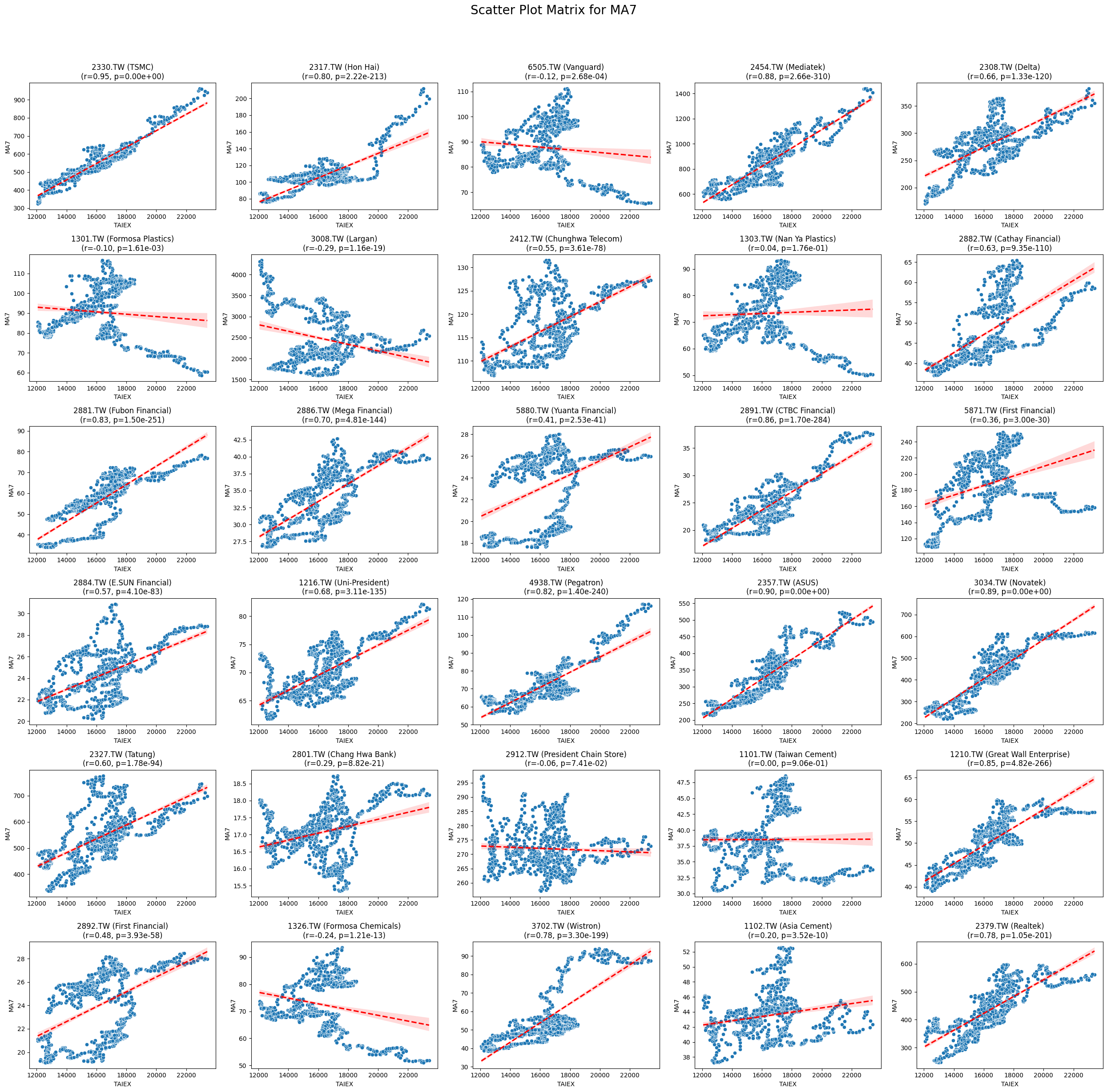

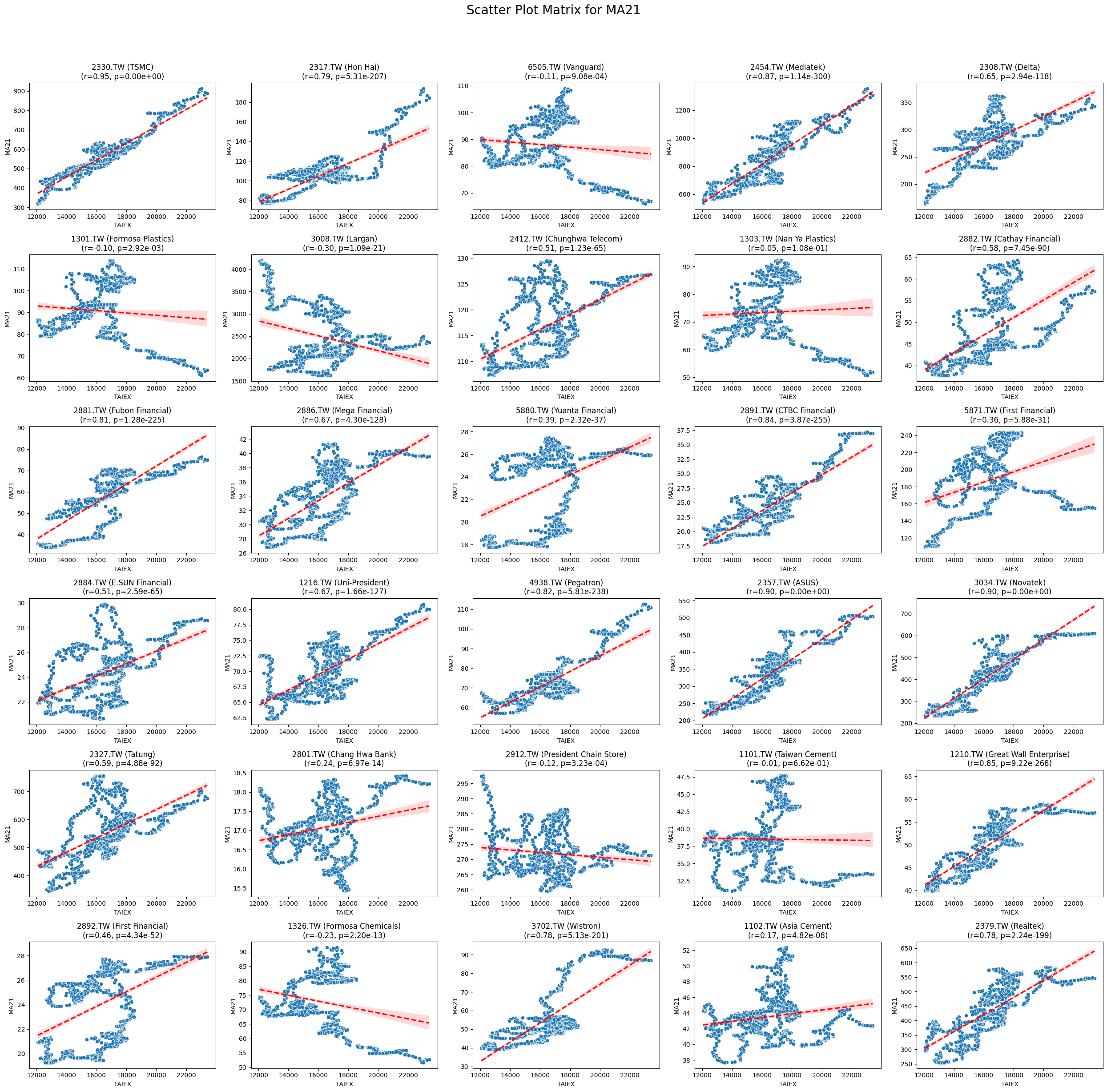

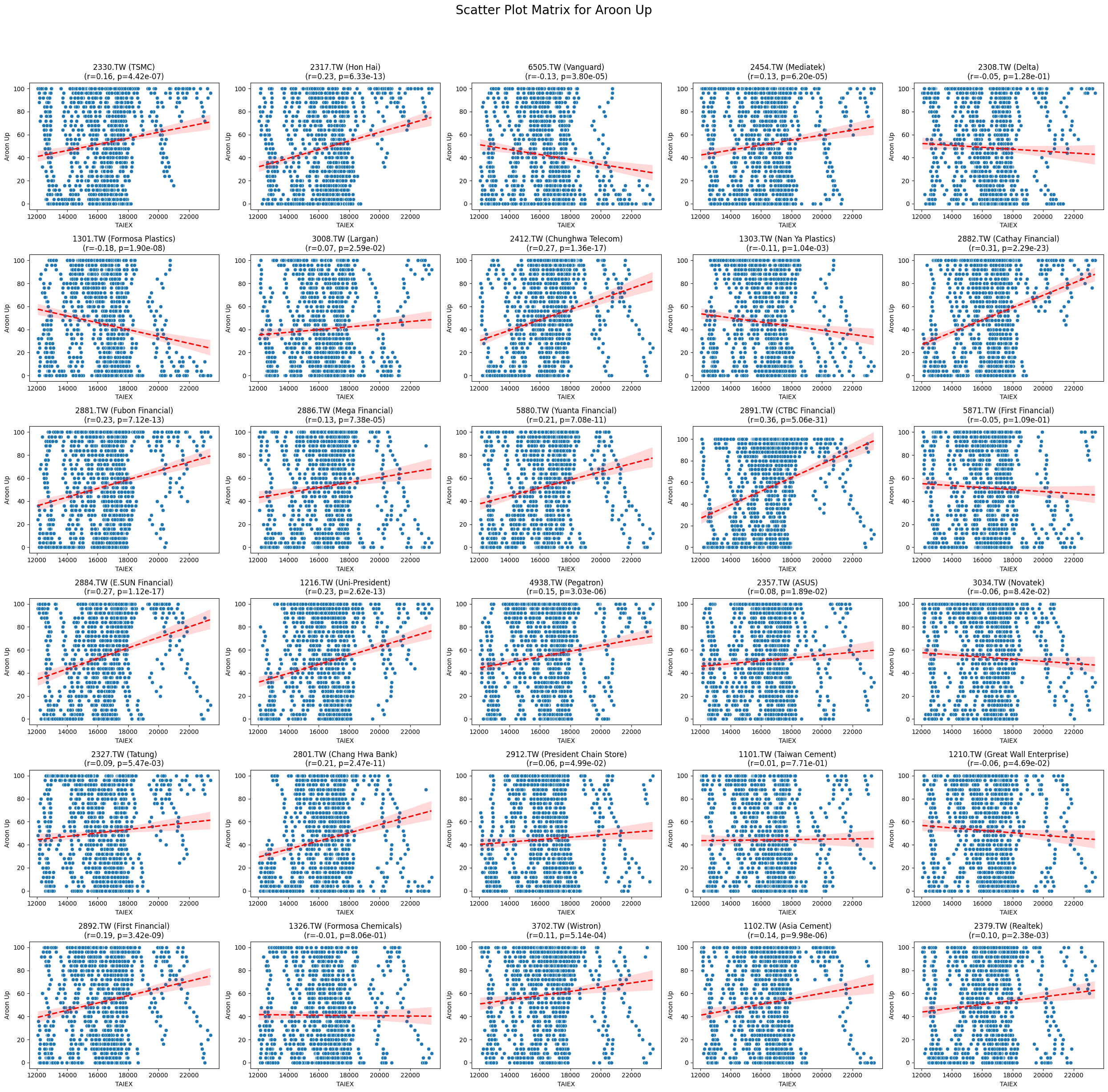

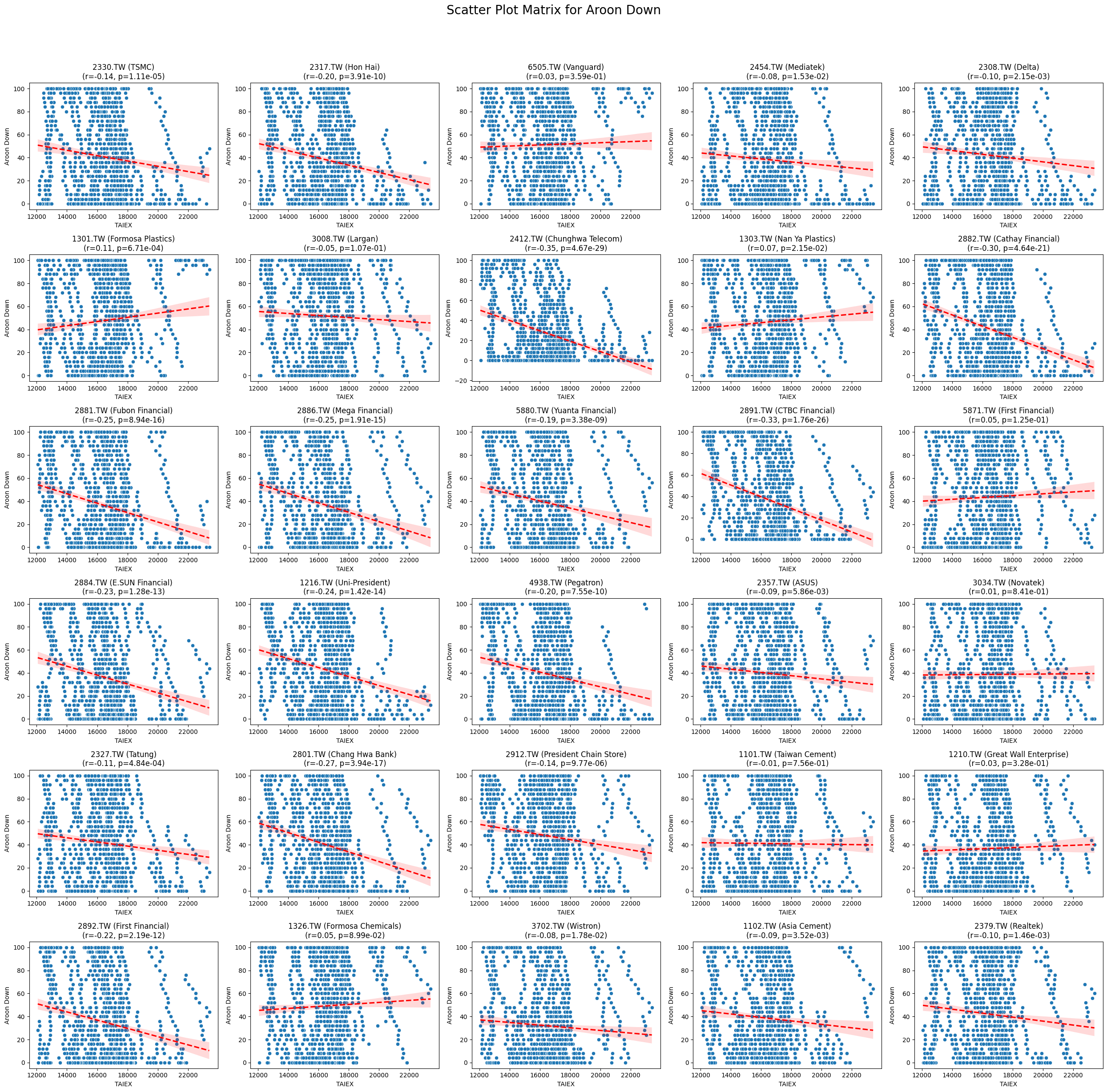

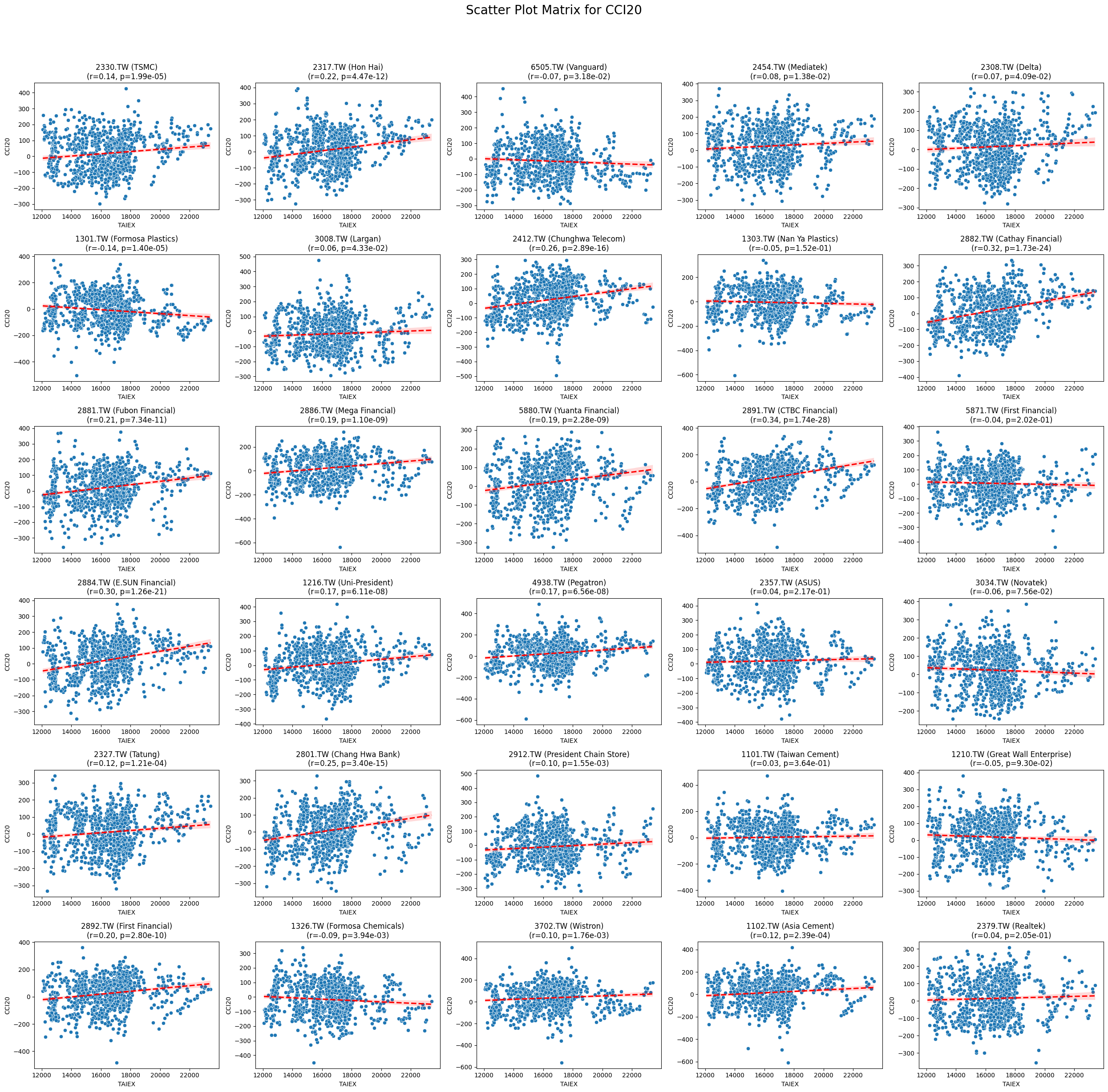

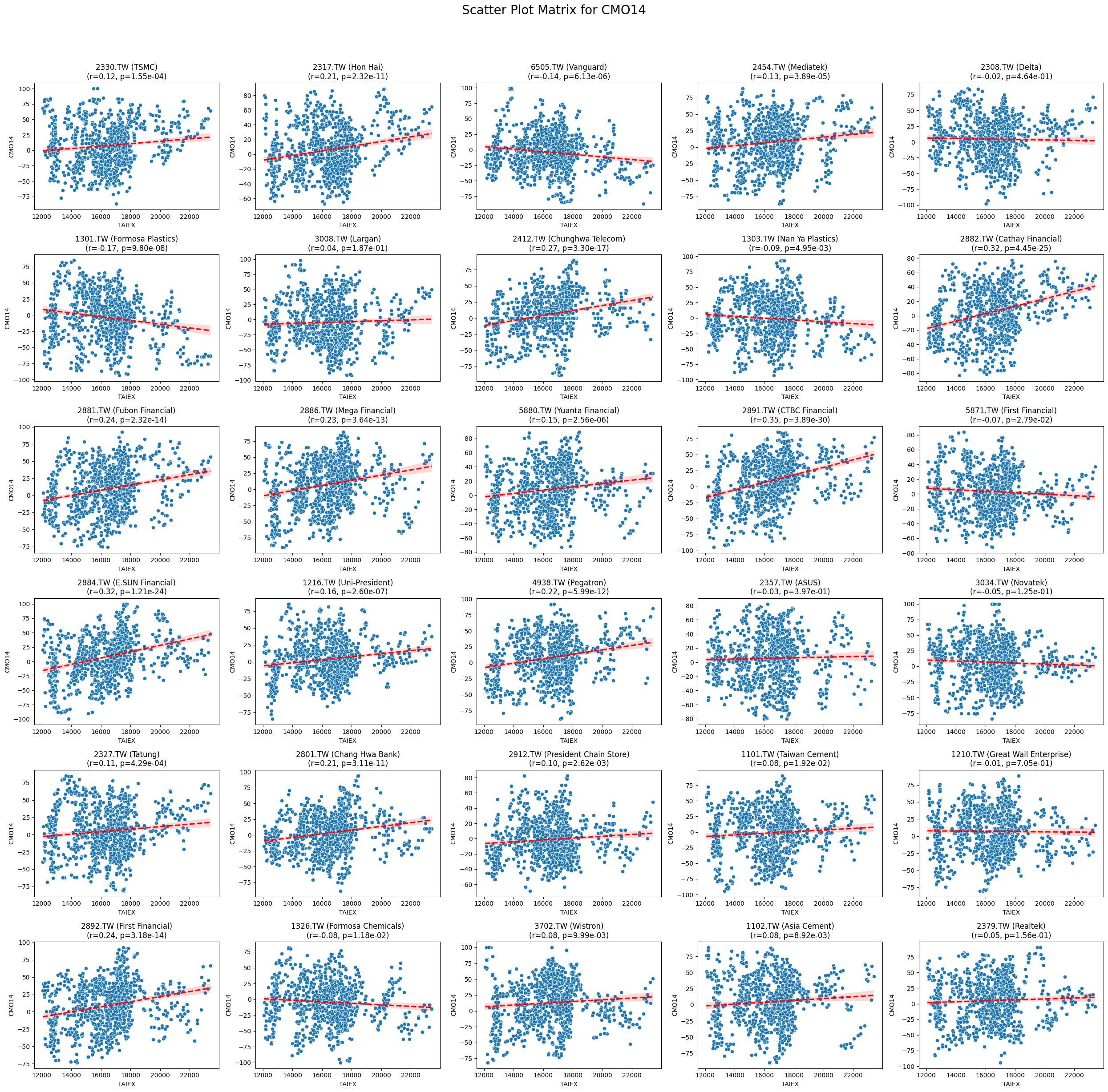

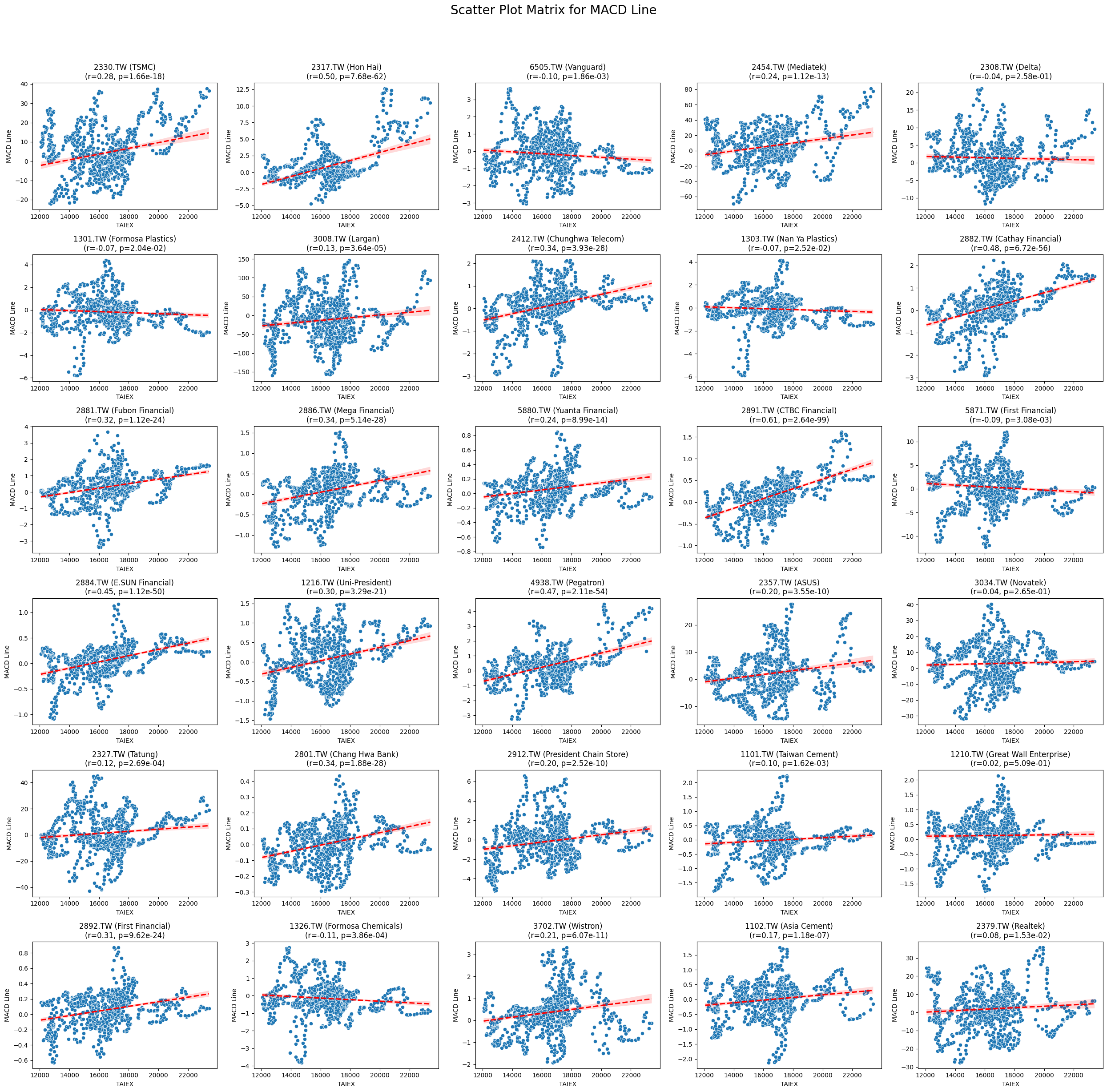

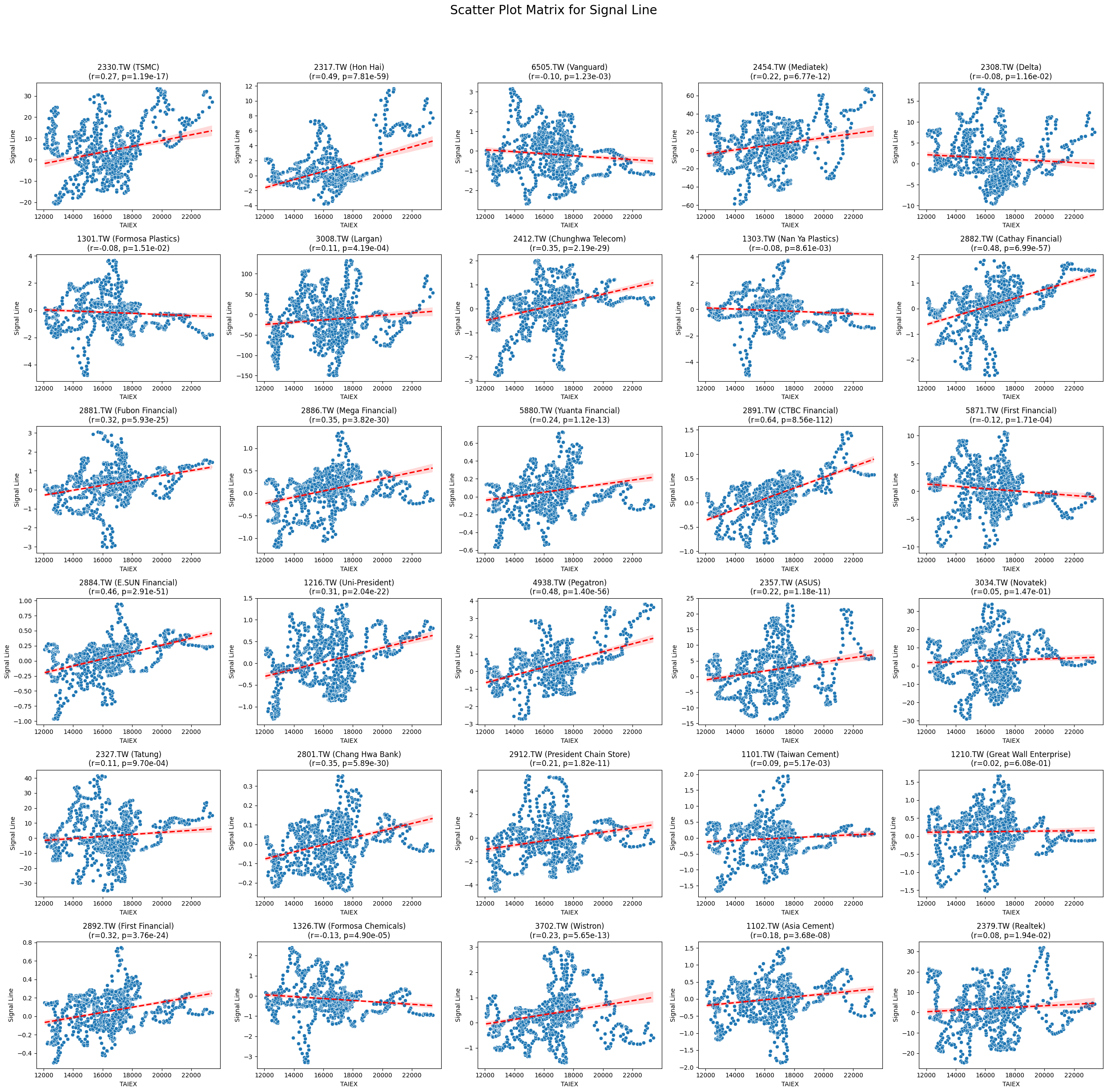

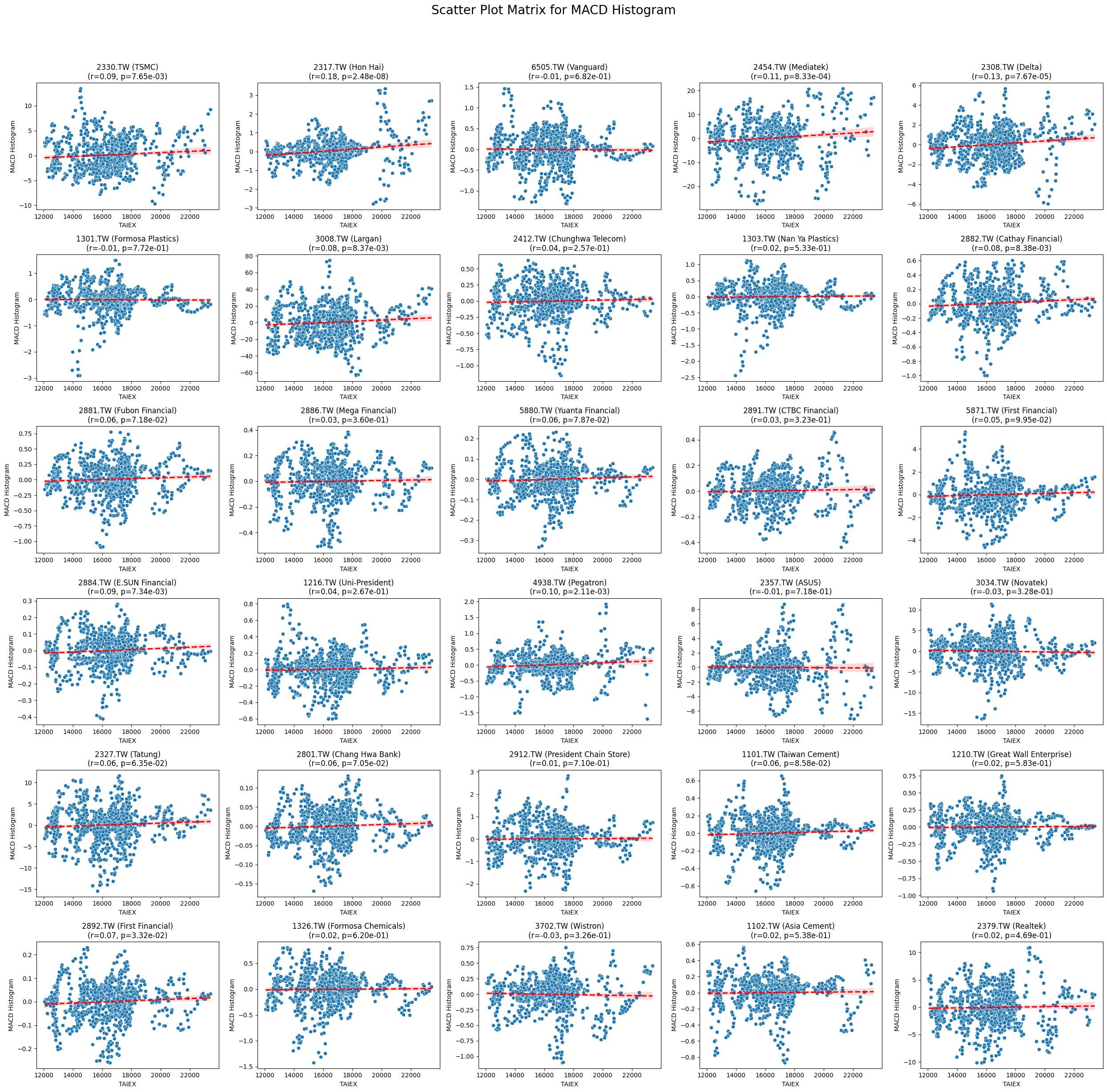

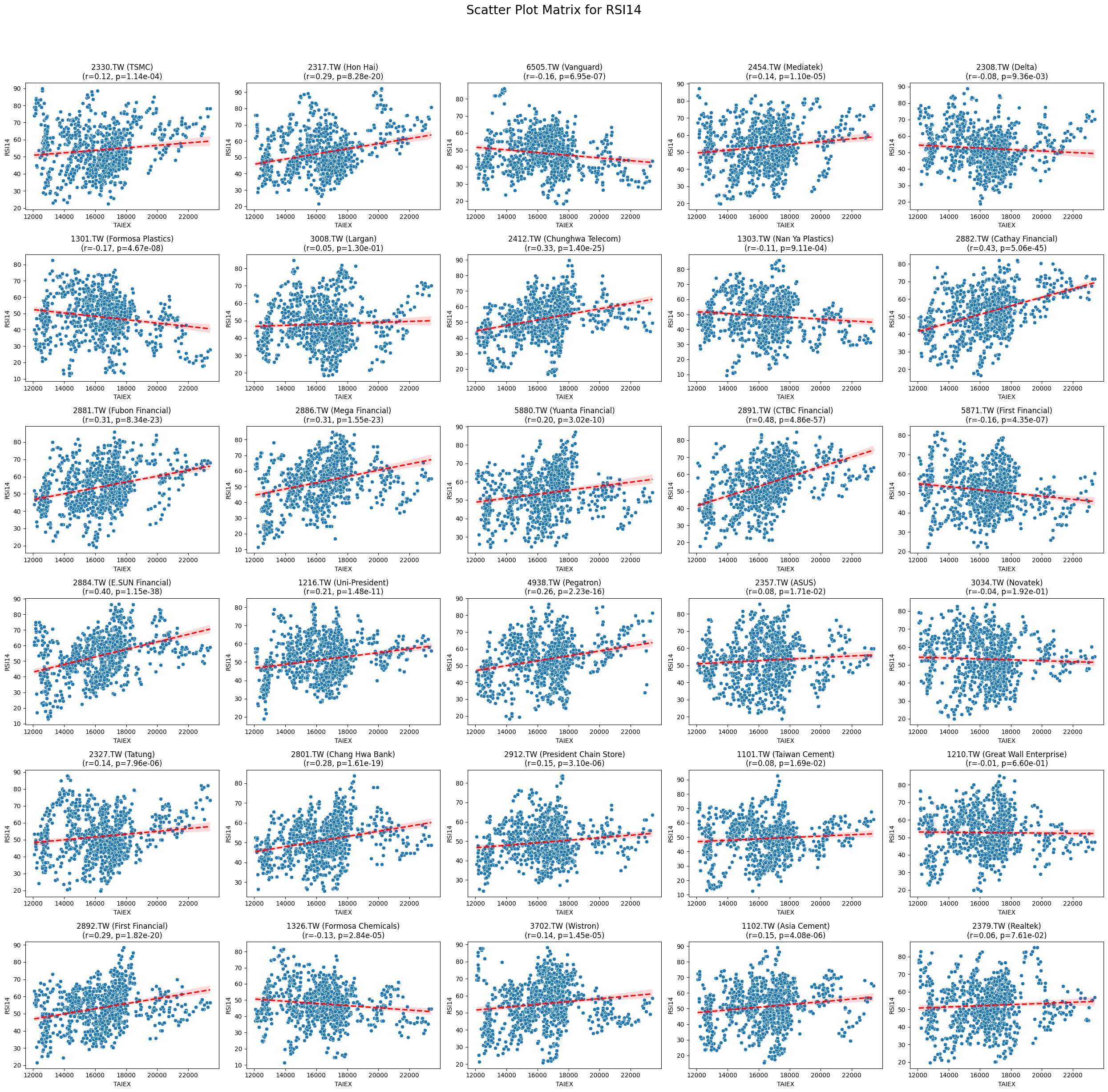

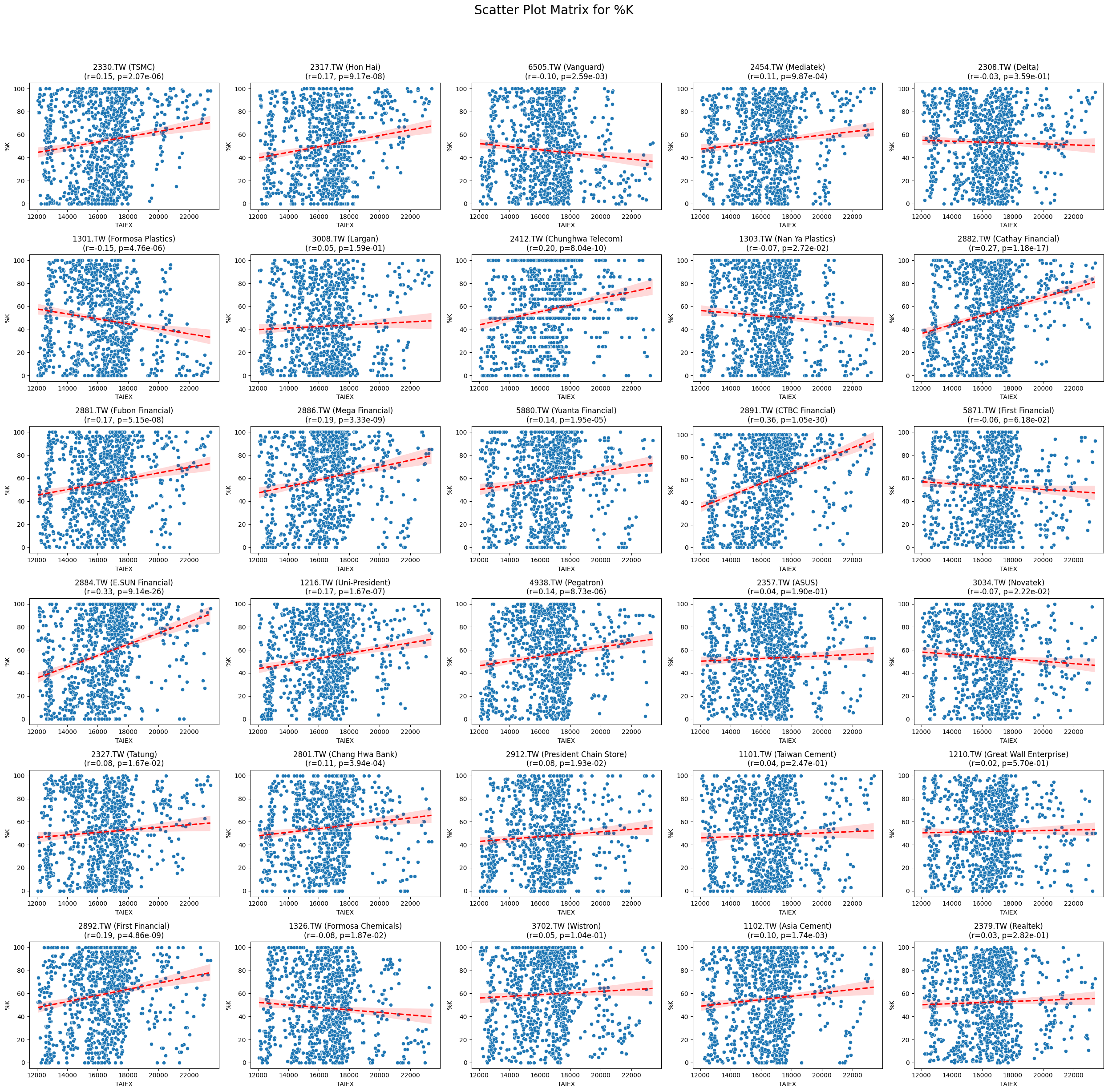

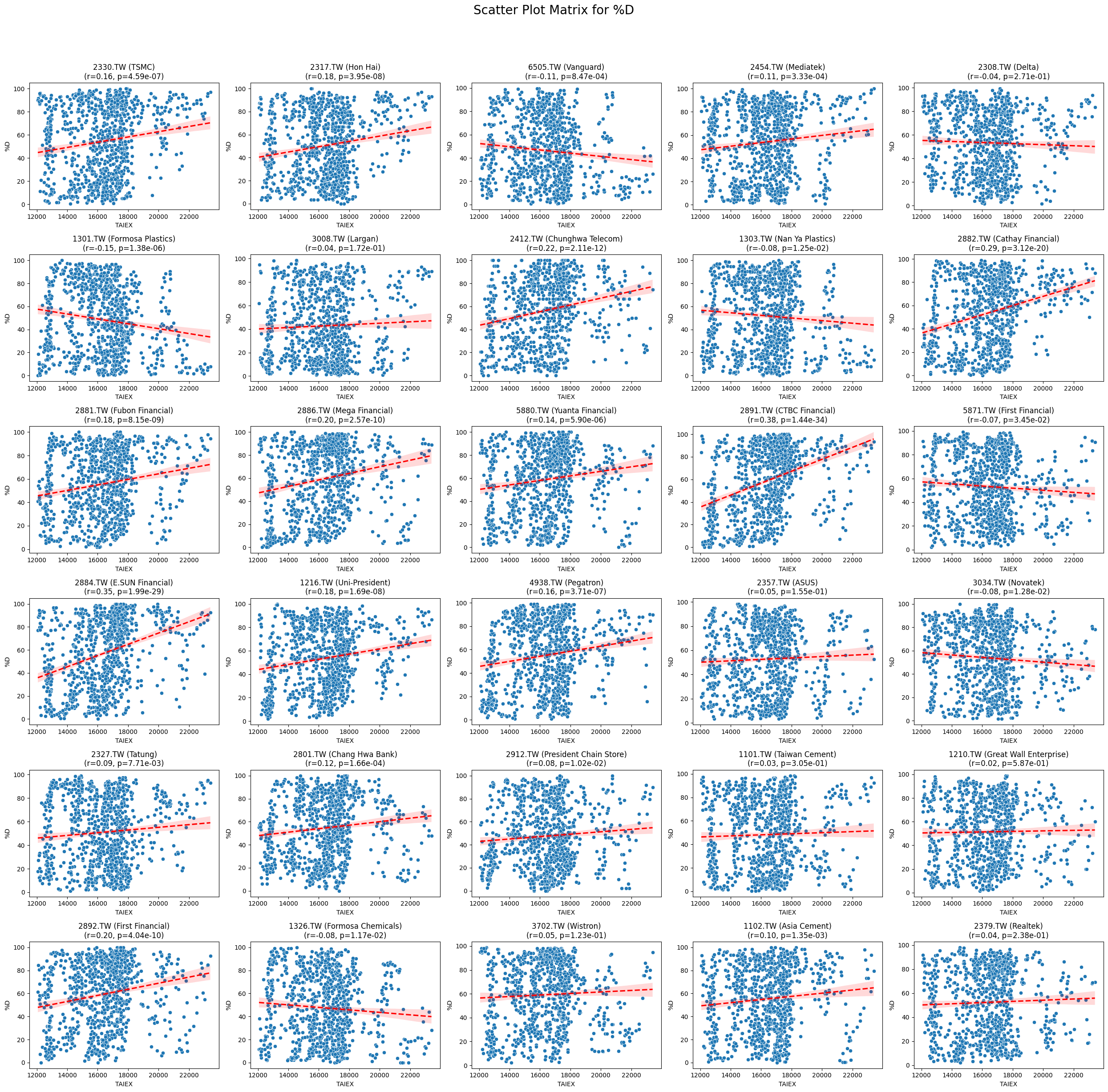

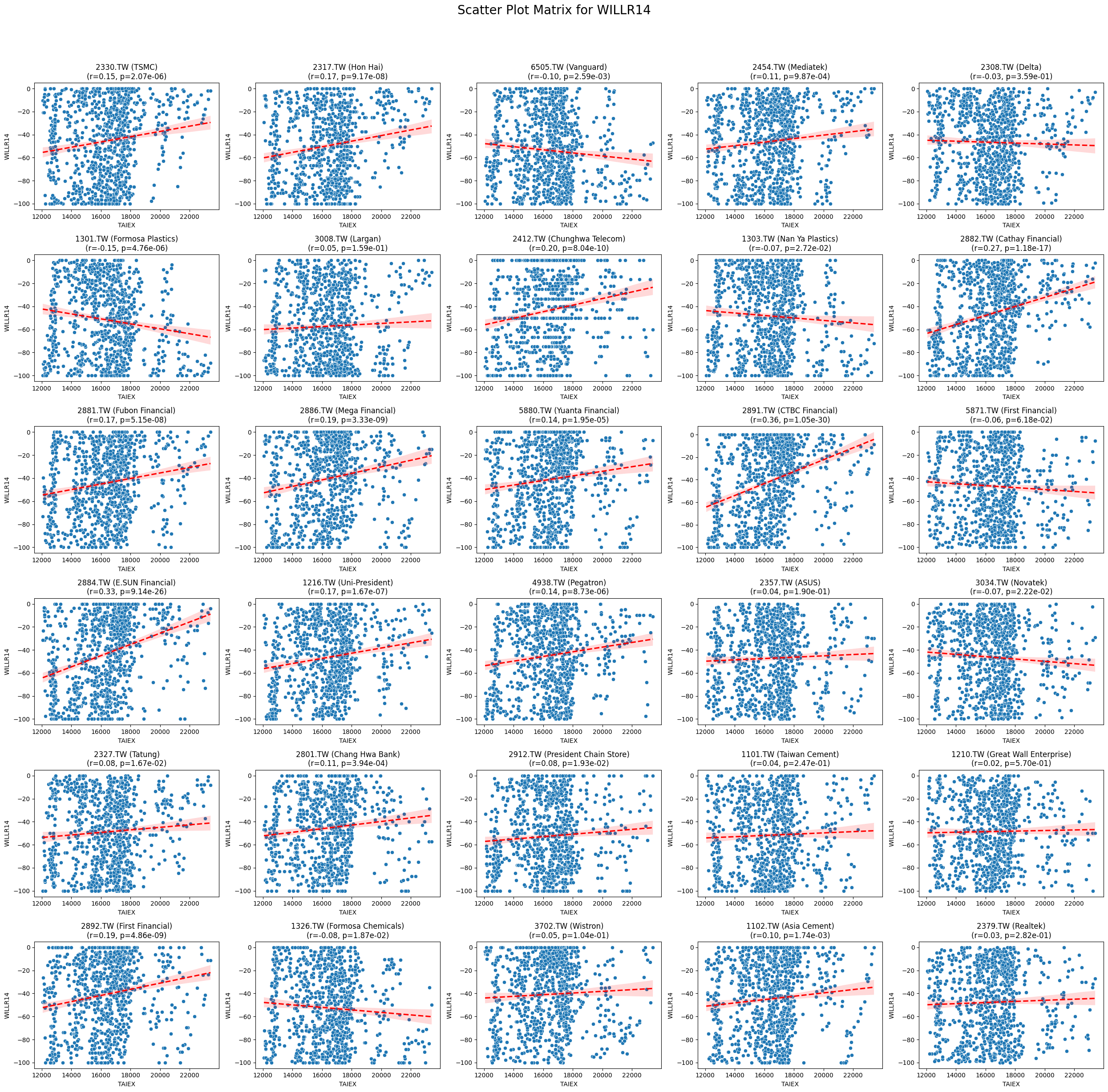

def scatter_plot_matrix_by_variable():

variables = [col for col in data.columns if col not in ['Date', 'ST_Code', 'ST_Name', target_variable]]

for variable in variables:

plt.figure(figsize=(25, 25))

unique_stock_codes = data['ST_Code'].unique()

for i, stock_code in enumerate(unique_stock_codes):

stock_data = data[data['ST_Code'] == stock_code]

taiex_data = data[['Date', target_variable]].drop_duplicates()

aligned_data = pd.merge(stock_data, taiex_data, on='Date', suffixes=('', '_TAIEX'))

aligned_data = aligned_data.replace([np.inf, -np.inf], np.nan).dropna()

if aligned_data.shape[0] > 0 and variable in aligned_data.columns:

correlation, p_value = pearsonr(aligned_data[target_variable], aligned_data[variable])

plt.subplot((len(unique_stock_codes) + 4) // 5, 5, i + 1)

sns.scatterplot(x=aligned_data[target_variable], y=aligned_data[variable])

sns.regplot(x=aligned_data[target_variable], y=aligned_data[variable], scatter=False, color='red', ci=95, line_kws={'linestyle': 'dashed'})

stock_name = aligned_data['ST_Name'].iloc[0] # Get the stock name from the first row

plt.title(f'{stock_code} ({stock_name})\n(r={correlation:.2f}, p={p_value:.2e})')

plt.xlabel('TAIEX')

plt.ylabel(variable)

plt.suptitle(f'Scatter Plot Matrix for {variable}', fontsize=20)

plt.tight_layout(rect=[0, 0, 1, 0.95])

plt.savefig(f'/content/drive/My Drive/scatter_plot_matrix_{variable}.png')

plt.show()

# Generate scatter plot matrix by variable

scatter_plot_matrix_by_variable()import pandas as pd import yfinance as yf import ta from datetime import datetime