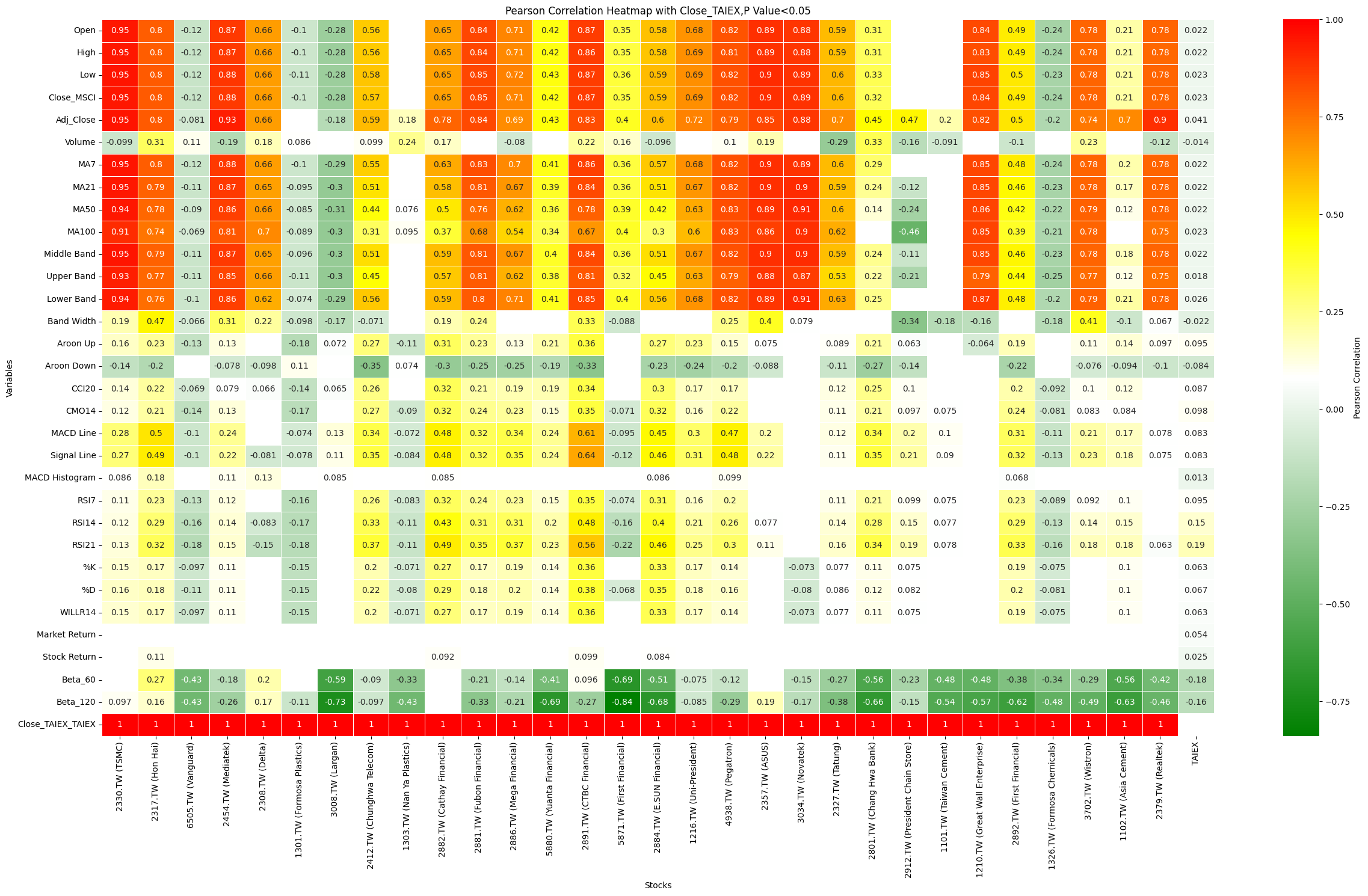

Heat MAP.MSCI 個股對 TAIEX 的 Pearson analysis.(f)0630

MSCI 個股對 TAIEX 的 Pearson analysis

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

from scipy.stats import pearsonr

# Mount Google Drive

from google.colab import drive

drive.mount('/content/drive', force_remount=True)

# Load the data

file_path = '/content/drive/My Drive/MSCI_Taiwan_30_data.csv'

data = pd.read_csv(file_path)

# Select only numerical columns

numerical_data = data.select_dtypes(include=[np.number])

# Handle NaN and infinite values by replacing them with the mean of the column

numerical_data = numerical_data.apply(lambda x: np.where(np.isfinite(x), x, np.nan))

numerical_data = numerical_data.apply(lambda x: x.fillna(x.mean()), axis=0)

# Define the target variable

target_variable = 'Close_TAIEX'

# Extract unique stock codes and names

stock_codes = data['ST_Code'].unique()

stock_names = data[['ST_Code', 'ST_Name']].drop_duplicates().set_index('ST_Code')

# Initialize dictionaries to store the correlation results and p-values

correlation_results = {}

p_value_results = {}

# Iterate over each stock code

for stock_code in stock_codes:

# Filter the data for the specific stock

stock_data = data[data['ST_Code'] == stock_code]

numerical_stock_data = stock_data.select_dtypes(include=[np.number])

# Align the lengths of the target variable and the stock data

common_index = numerical_data.index.intersection(numerical_stock_data.index)

aligned_target = numerical_data.loc[common_index, target_variable]

aligned_stock_data = numerical_stock_data.loc[common_index]

# Handle NaN and infinite values for the aligned stock data

aligned_stock_data = aligned_stock_data.apply(lambda x: np.where(np.isfinite(x), x, np.nan))

aligned_stock_data = aligned_stock_data.apply(lambda x: x.fillna(x.mean()), axis=0)

# Calculate Pearson correlation with target variable 'Close_TAIEX'

for column in aligned_stock_data.columns:

if column != target_variable:

correlation, p_value = pearsonr(aligned_target, aligned_stock_data[column])

correlation_results[(stock_names.loc[stock_code, 'ST_Name'], column)] = correlation

p_value_results[(stock_names.loc[stock_code, 'ST_Name'], column)] = p_value

# Convert results to DataFrame for better visualization

correlation_df = pd.DataFrame.from_dict(correlation_results, orient='index', columns=['Pearson Correlation']).reset_index()

correlation_df[['Stock Name', 'Variable']] = pd.DataFrame(correlation_df['index'].tolist(), index=correlation_df.index)

correlation_df = correlation_df.drop(columns=['index'])

p_value_df = pd.DataFrame.from_dict(p_value_results, orient='index', columns=['P-Value']).reset_index()

p_value_df[['Stock Name', 'Variable']] = pd.DataFrame(p_value_df['index'].tolist(), index=p_value_df.index)

p_value_df = p_value_df.drop(columns=['index'])

# Merge correlation and p-value DataFrames

merged_df = pd.merge(correlation_df, p_value_df, on=['Stock Name', 'Variable'])

# Filter for significant correlations (P < 0.05)

significant_df = merged_df[merged_df['P-Value'] < 0.05]

# Pivot the DataFrame for all correlations

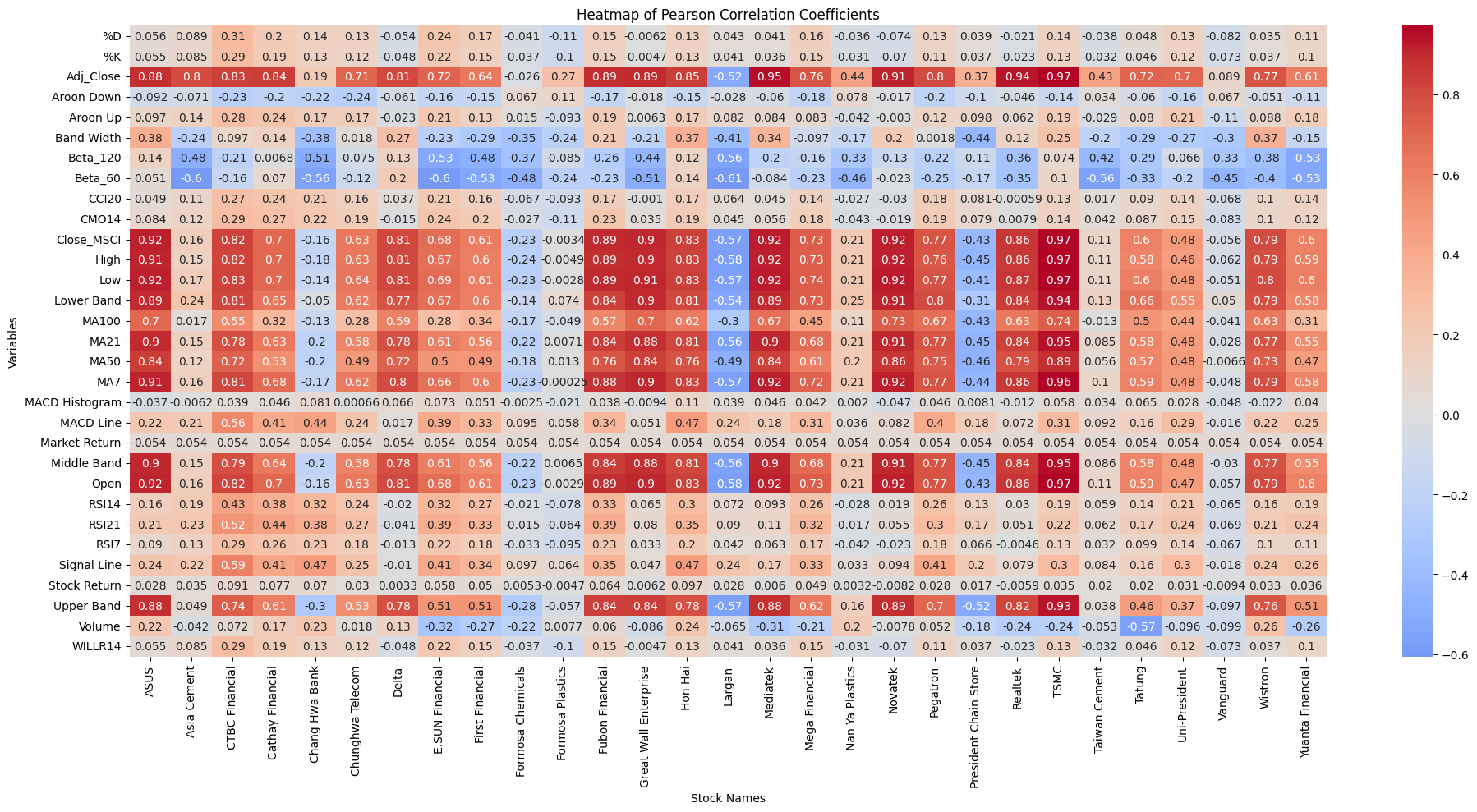

correlation_pivot = correlation_df.pivot_table(index='Variable', columns='Stock Name', values='Pearson Correlation')

# Pivot the DataFrame for significant correlations

significant_pivot = significant_df.pivot_table(index='Variable', columns='Stock Name', values='Pearson Correlation')

# Plot heatmap for all correlations

plt.figure(figsize=(20, 10))

sns.heatmap(correlation_pivot, annot=True, cmap='coolwarm', center=0)

plt.title('Heatmap of Pearson Correlation Coefficients')

plt.xlabel('Stock Names')

plt.ylabel('Variables')

plt.xticks(rotation=90)

plt.yticks(rotation=0)

plt.tight_layout()

plt.show()

# Plot heatmap for significant correlations (P < 0.05)

plt.figure(figsize=(20, 10))

sns.heatmap(significant_pivot, annot=True, cmap='coolwarm', center=0)

plt.title('Heatmap of Significant Pearson Correlation Coefficients (P < 0.05)')

plt.xlabel('Stock Names')

plt.ylabel('Variables')

plt.xticks(rotation=90)

plt.yticks(rotation=0)

plt.tight_layout()

plt.show()

import pandas as pd import yfinance as yf import ta from datetime import datetime

Heat Map, Pearson's analysis, P<0.05,Code

import pandas as pd

import numpy as np

import seaborn as sns

import matplotlib.pyplot as plt

from scipy.stats import pearsonr

from matplotlib.colors import LinearSegmentedColormap

# Mount Google Drive

from google.colab import drive

drive.mount('/content/drive', force_remount=True)

# Load the data

file_path = '/content/drive/My Drive/MSCI_Taiwan_30_data.csv'

data = pd.read_csv(file_path)

# Convert 'Date' column to datetime

data['Date'] = pd.to_datetime(data['Date'], format='%Y/%m/%d')

# Define the target variable

target_variable = 'Close_TAIEX'

# Calculate Pearson correlation and p-values

def calculate_pearson_correlation(data, target_variable):

correlation_results = {}

numerical_columns = data.select_dtypes(include=[np.number]).columns

for column in numerical_columns:

if column != target_variable:

cleaned_data = data[[target_variable, column]].dropna()

if cleaned_data.shape[0] > 0:

correlation, p_value = pearsonr(cleaned_data[target_variable], cleaned_data[column])

if p_value <= 0.05:

correlation_results[column] = correlation

else:

correlation_results[column] = np.nan

else:

correlation_results[column] = np.nan

return correlation_results

# Initialize an empty DataFrame to store correlation results

correlation_df = pd.DataFrame()

# Iterate over each unique stock code

for stock_code in data['ST_Code'].unique():

stock_data = data[data['ST_Code'] == stock_code].copy()

taiex_data = data[['Date', target_variable]].drop_duplicates().copy()

# Align indices by merging on 'Date'

aligned_data = pd.merge(stock_data, taiex_data, on='Date', suffixes=('', '_TAIEX'))

if aligned_data.shape[0] == 0:

print(f"No overlapping dates found for {stock_code} and {target_variable}.")

continue

# Handle NaN and infinite values by replacing them with the mean of the column

aligned_data = aligned_data.replace([np.inf, -np.inf], np.nan)

aligned_data = aligned_data.dropna()

# Calculate Pearson correlation for the aligned data

correlation_results = calculate_pearson_correlation(aligned_data, target_variable)

stock_name = aligned_data['ST_Name'].iloc[0]

correlation_df[f'{stock_code} ({stock_name})'] = pd.Series(correlation_results)

# Add TAIEX to the correlation DataFrame

taiex_correlation = calculate_pearson_correlation(data, target_variable)

correlation_df['TAIEX'] = pd.Series(taiex_correlation)

# Custom colormap

cmap = LinearSegmentedColormap.from_list(

'custom_cmap',

[(0, 'green'), (0.5, 'white'), (0.7, 'yellow'), (1, 'red')]

)

# Plot heatmap with swapped axes

plt.figure(figsize=(25, 15))

sns.heatmap(correlation_df, annot=True, cmap=cmap, linewidths=0.5, linecolor='white', cbar_kws={'label': 'Pearson Correlation'})

plt.title('Pearson Correlation Heatmap with Close_TAIEX')

plt.ylabel('Variables')

plt.xlabel('Stocks')

plt.xticks(rotation=90)

plt.yticks(rotation=0)

plt.tight_layout()

plt.savefig('/content/drive/My Drive/pearson_correlation_heatmap_swapped_axes.png')

plt.show()

import pandas as pd import yfinance as yf import ta from datetime import datetime