Mounted at /content/drive

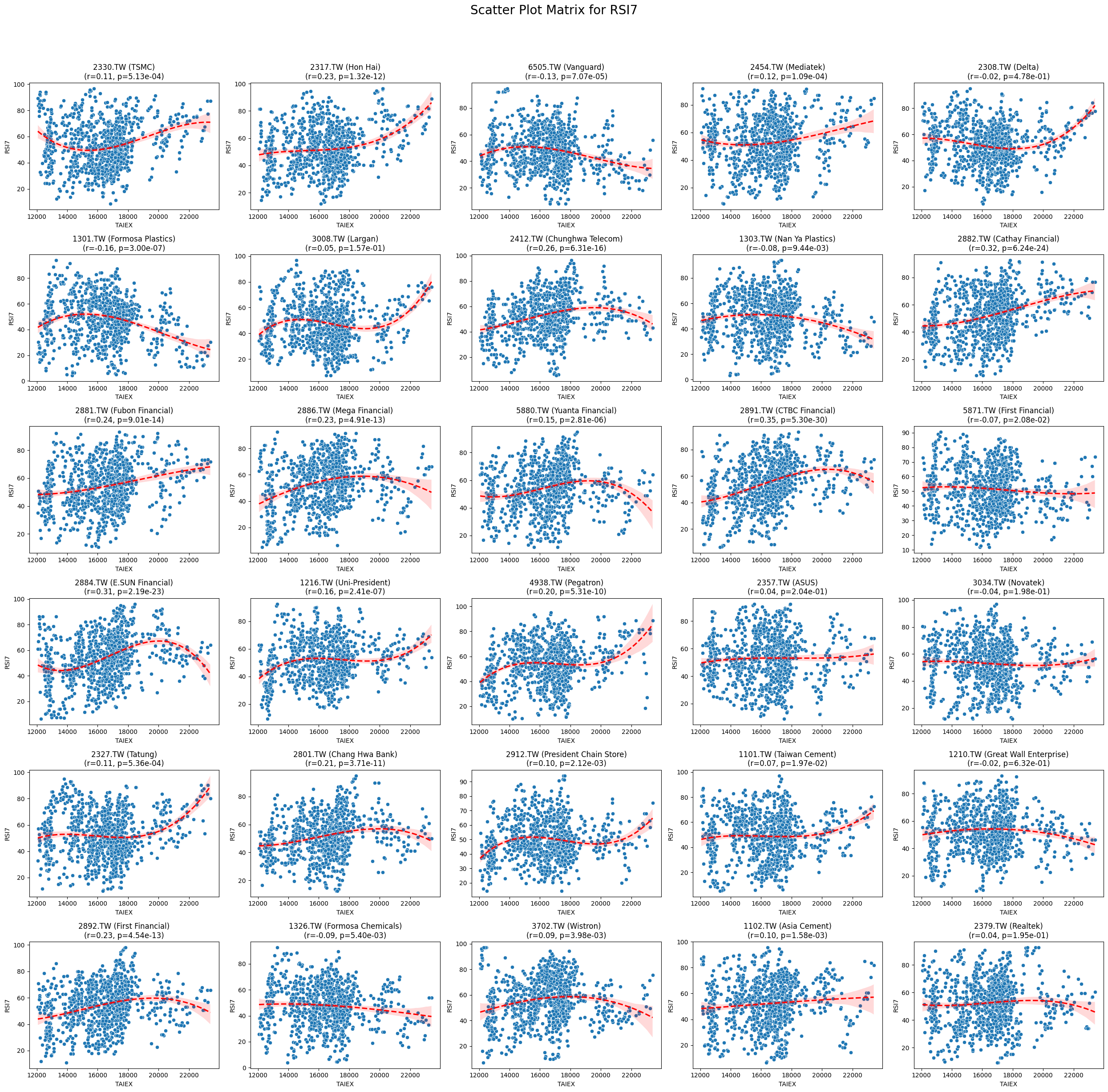

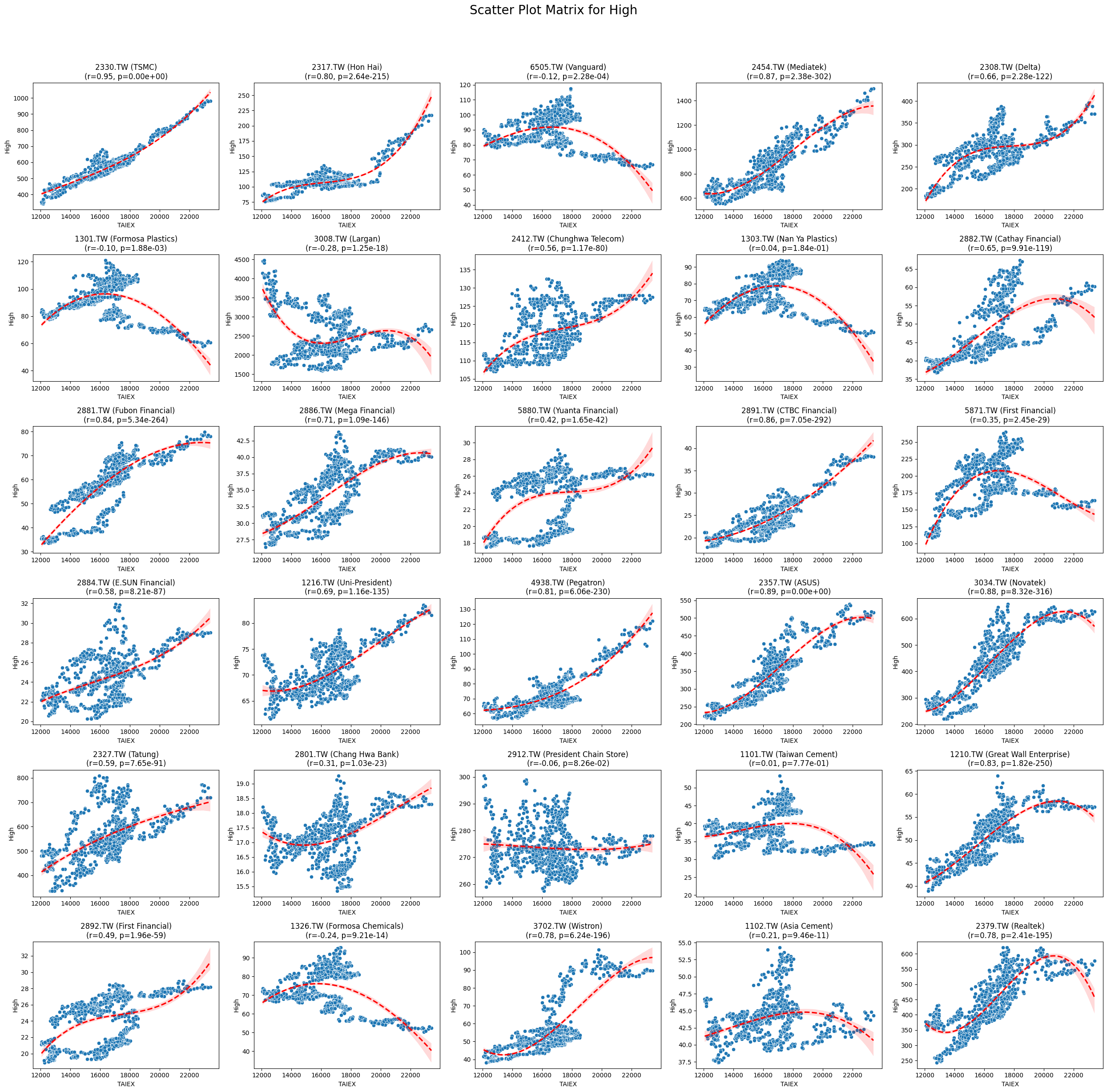

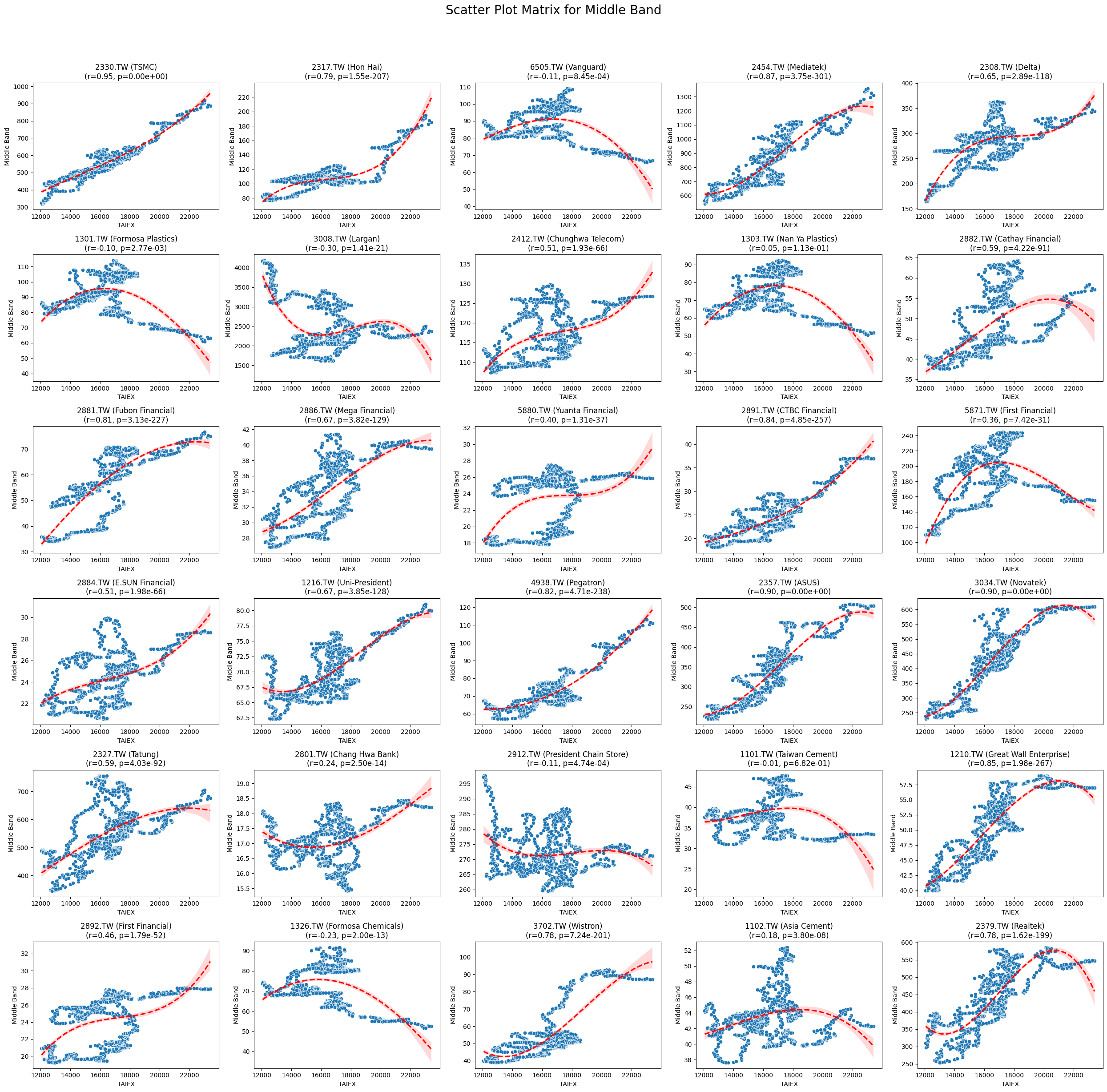

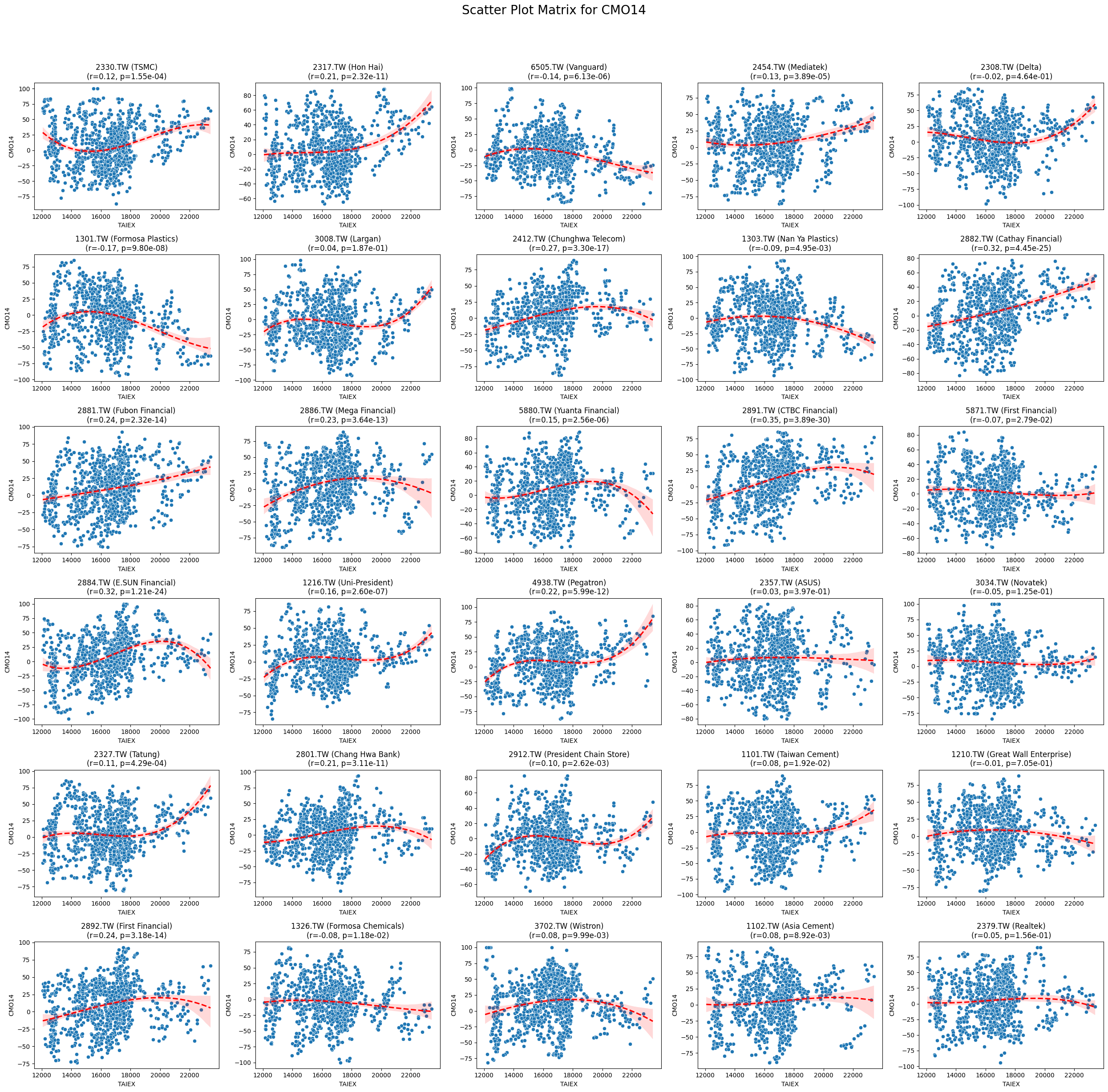

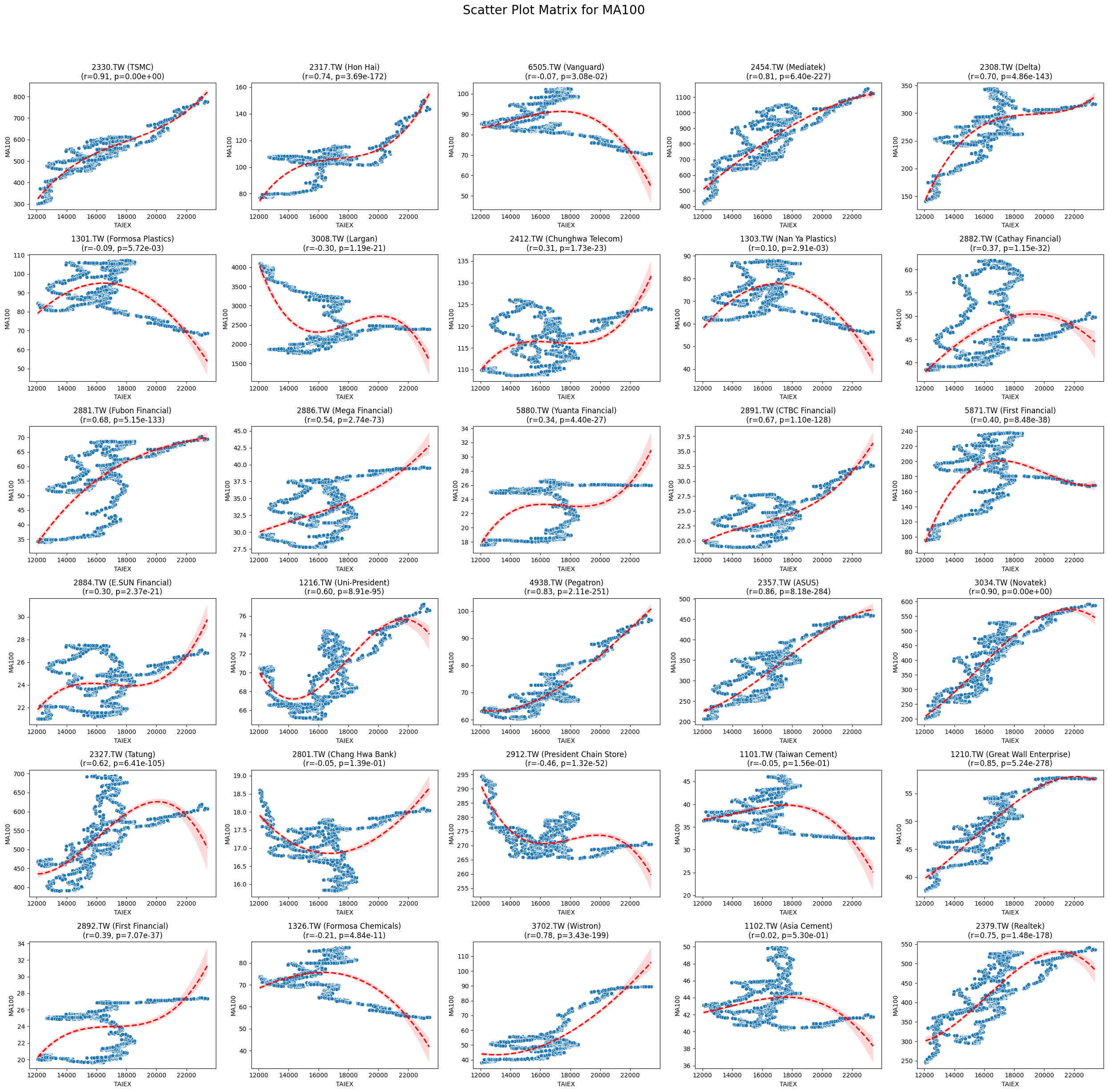

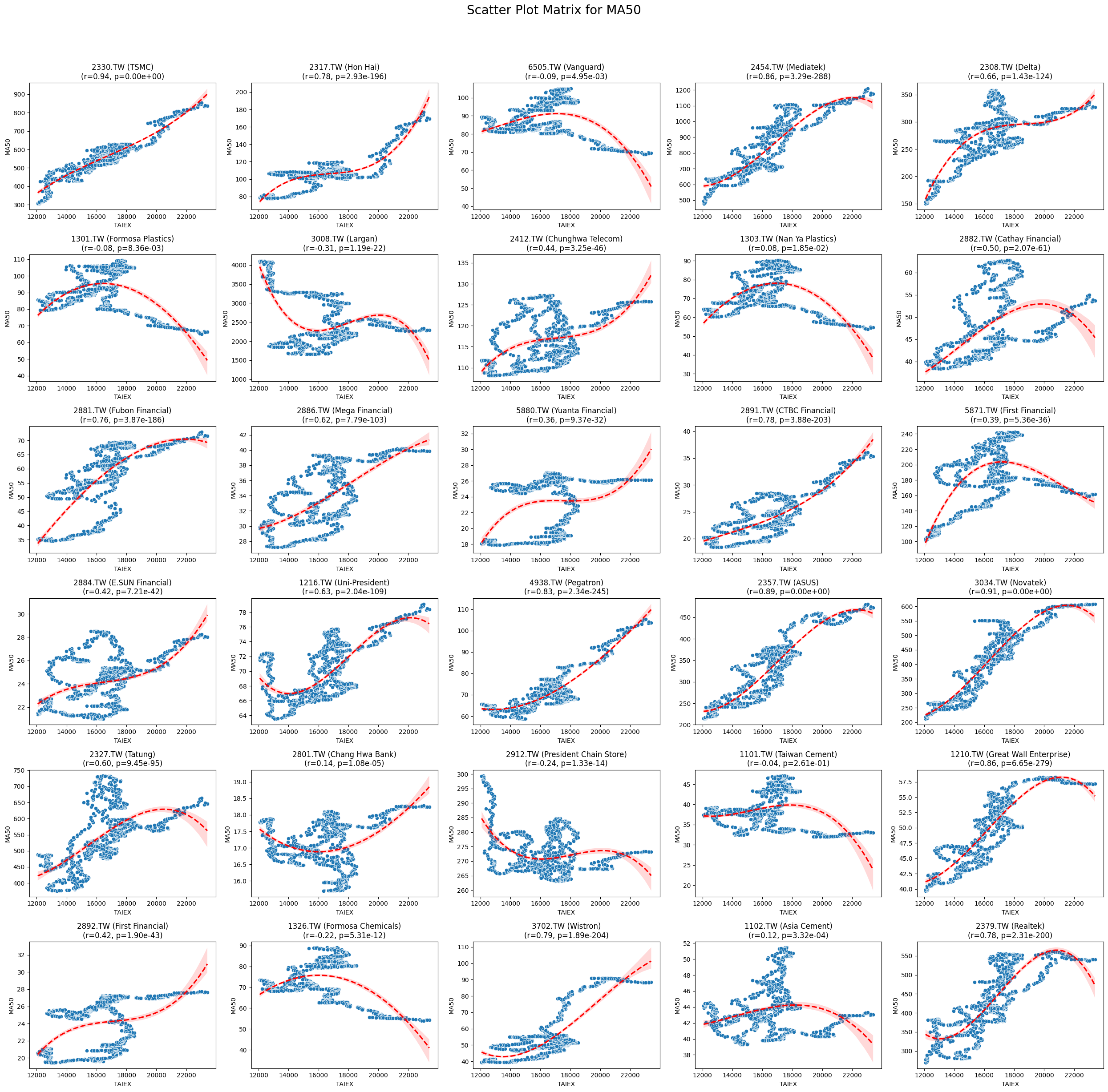

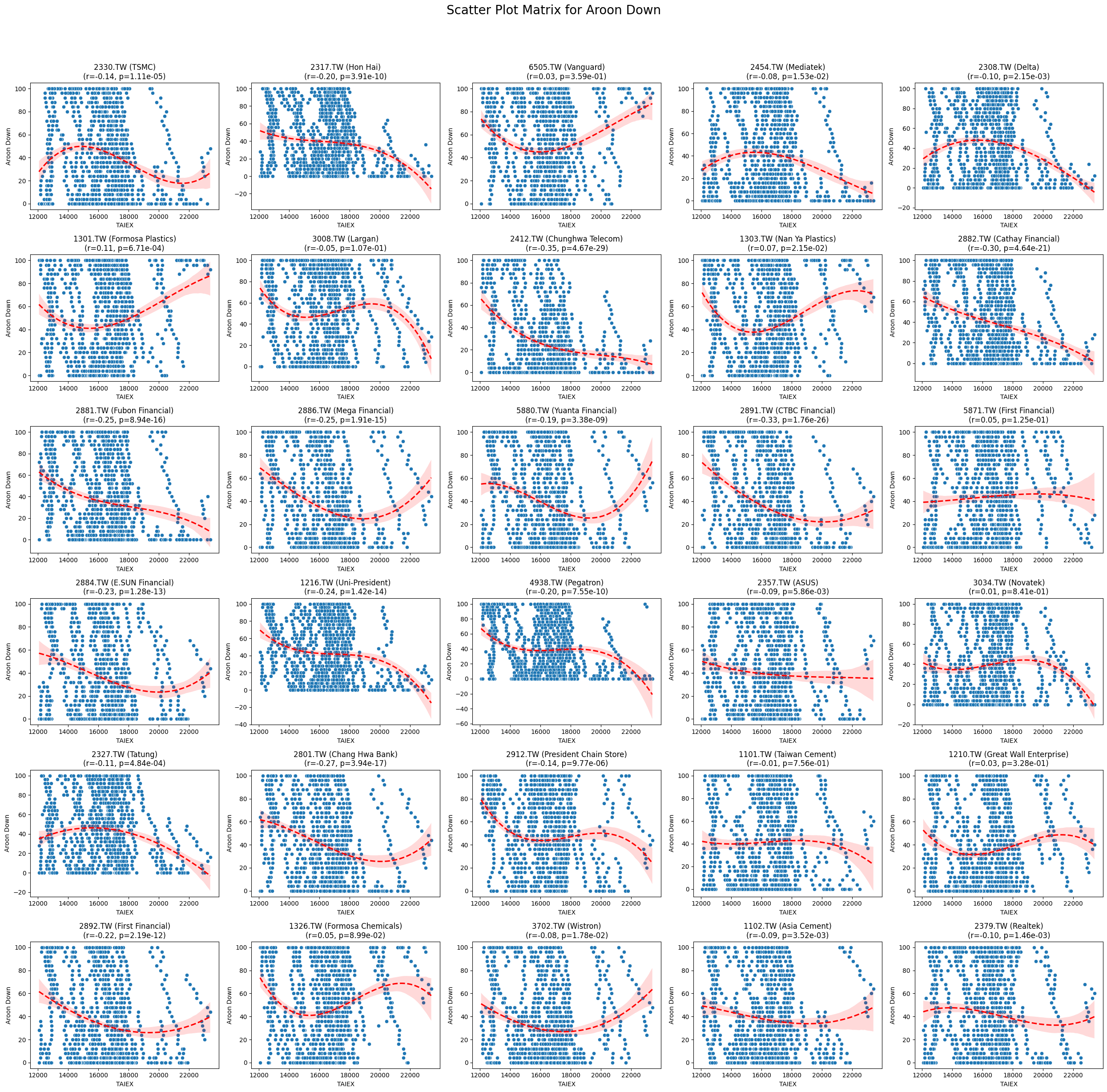

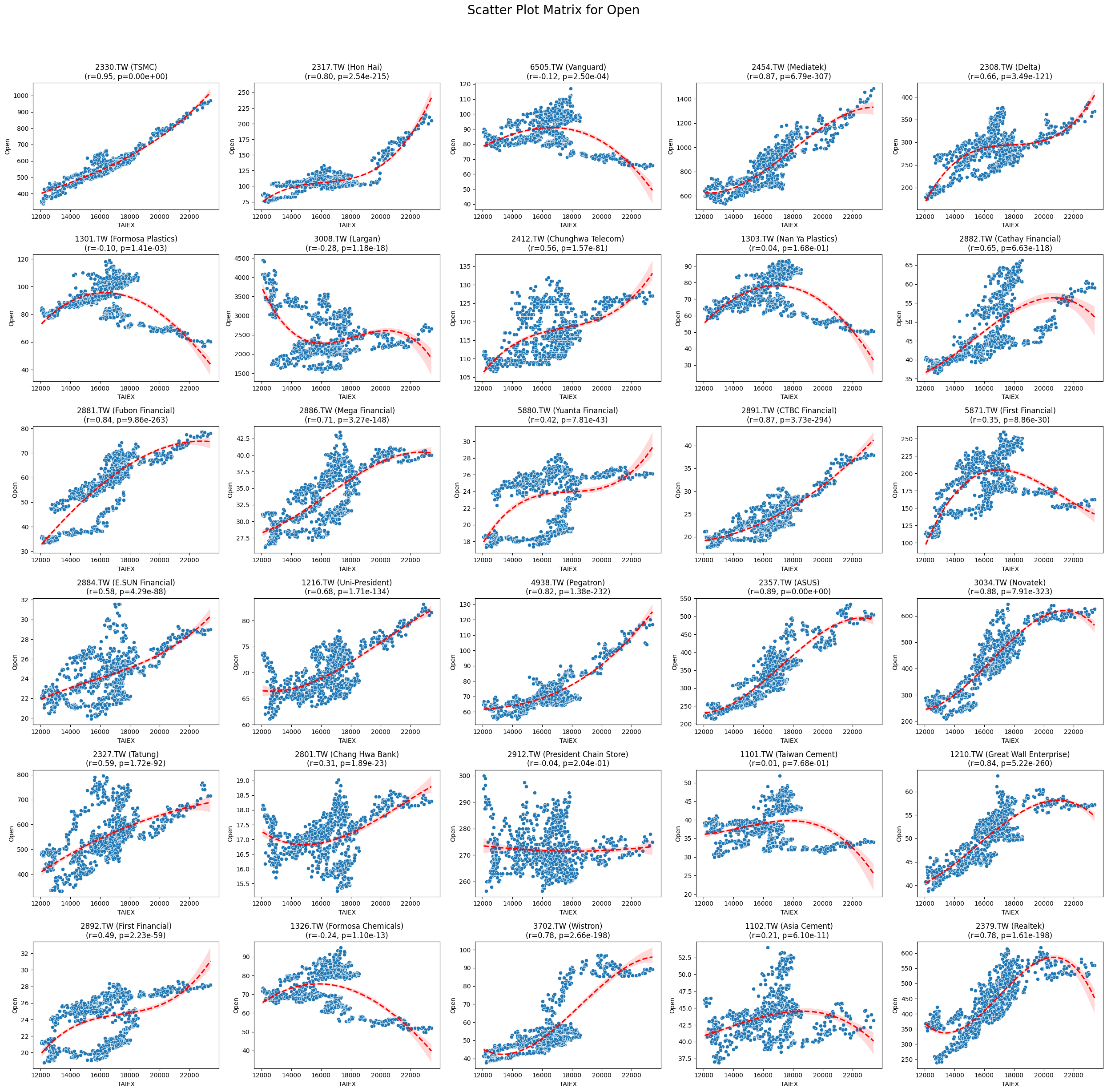

Overall Pearson Correlation with Close_TAIEX:

Pearson Correlation P-value

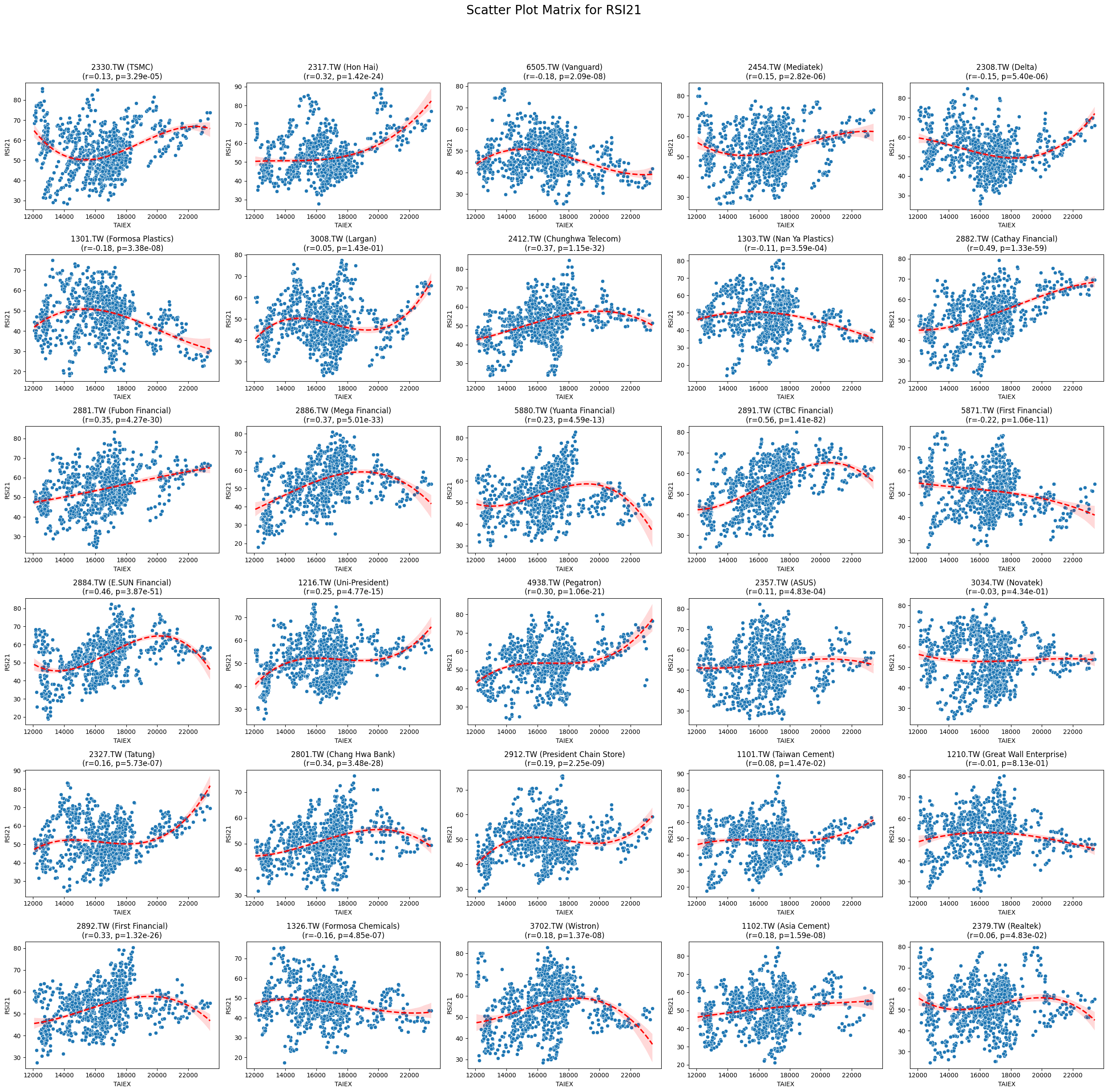

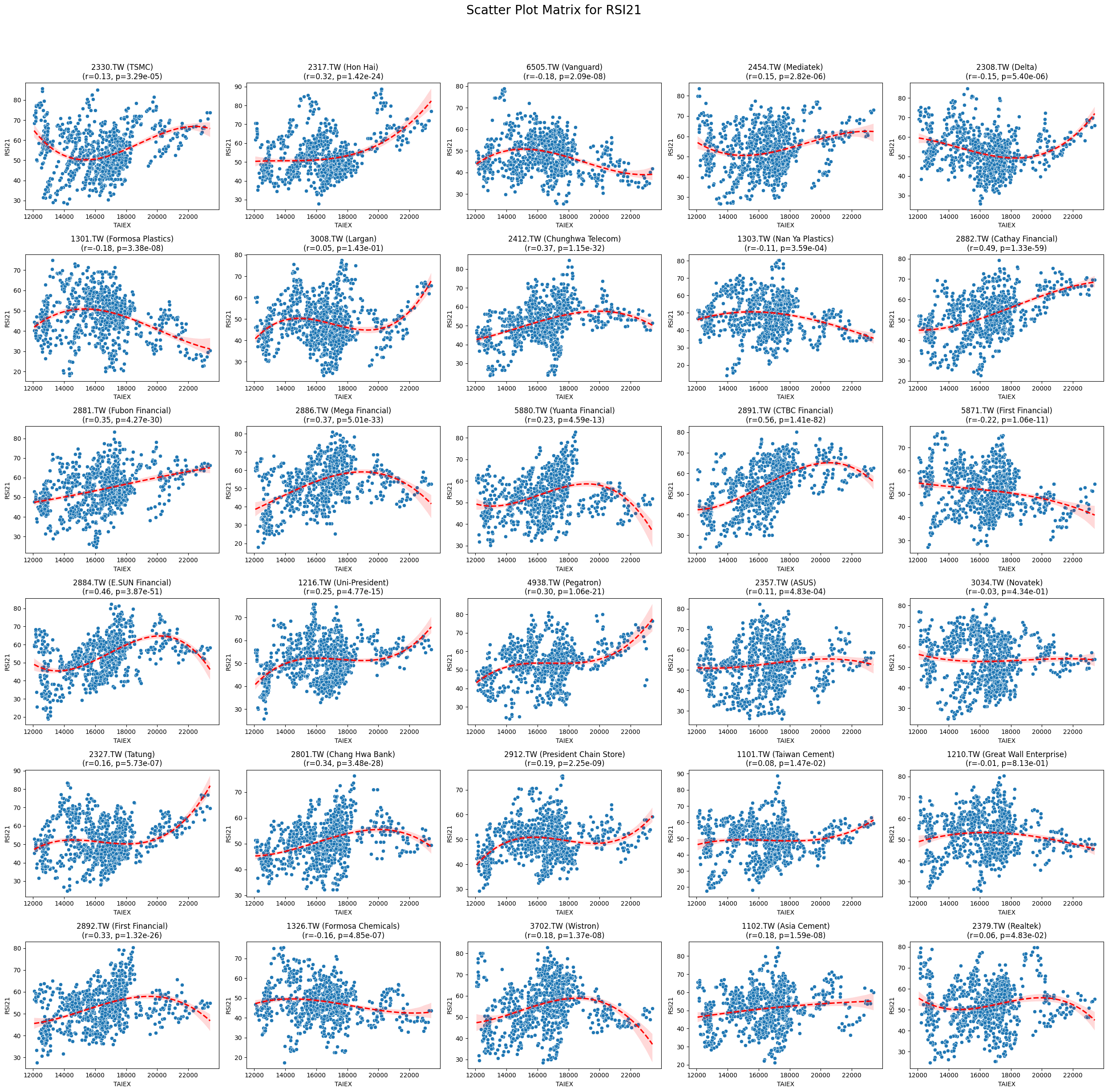

RSI21 0.185104 2.388407e-245

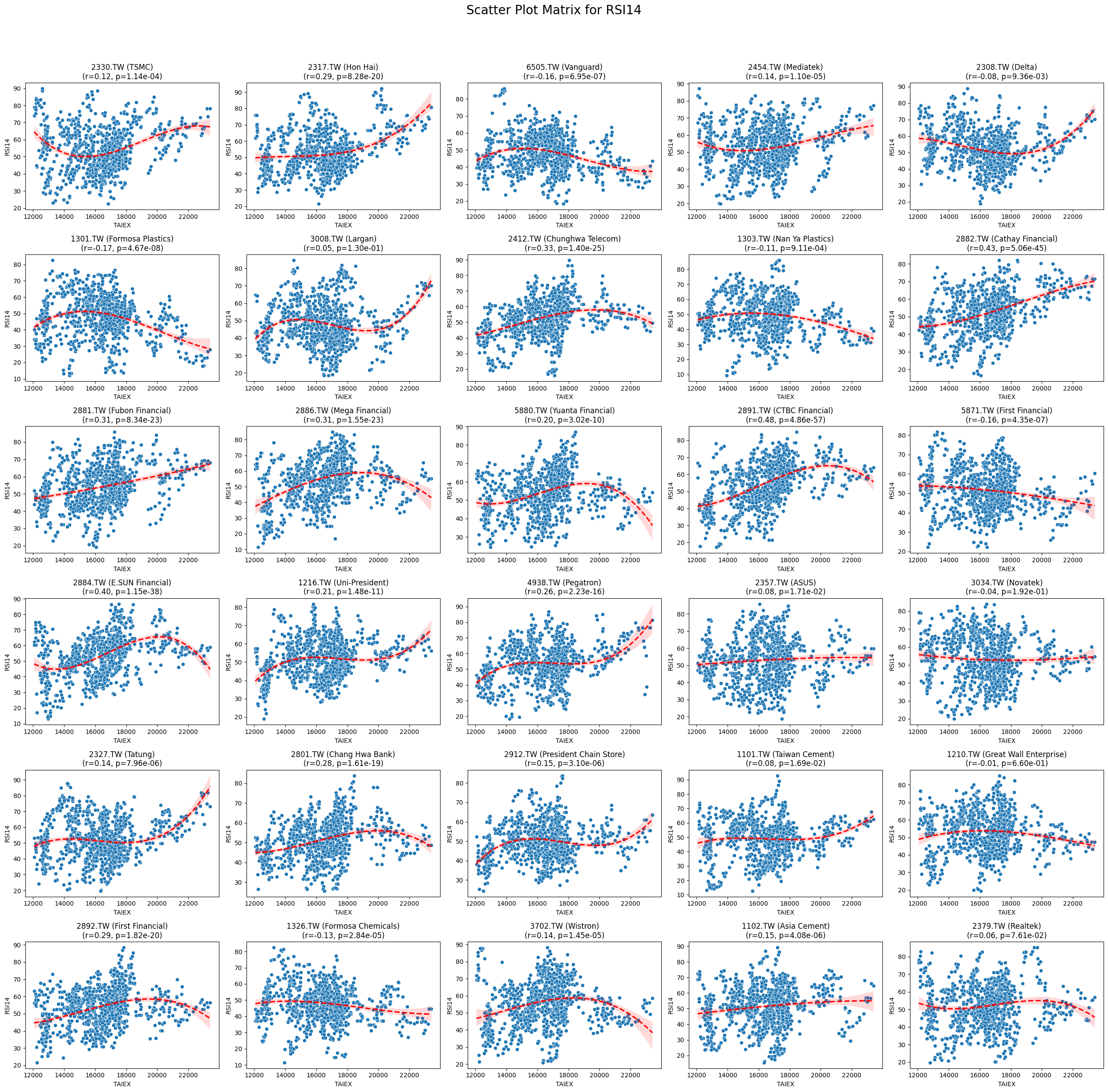

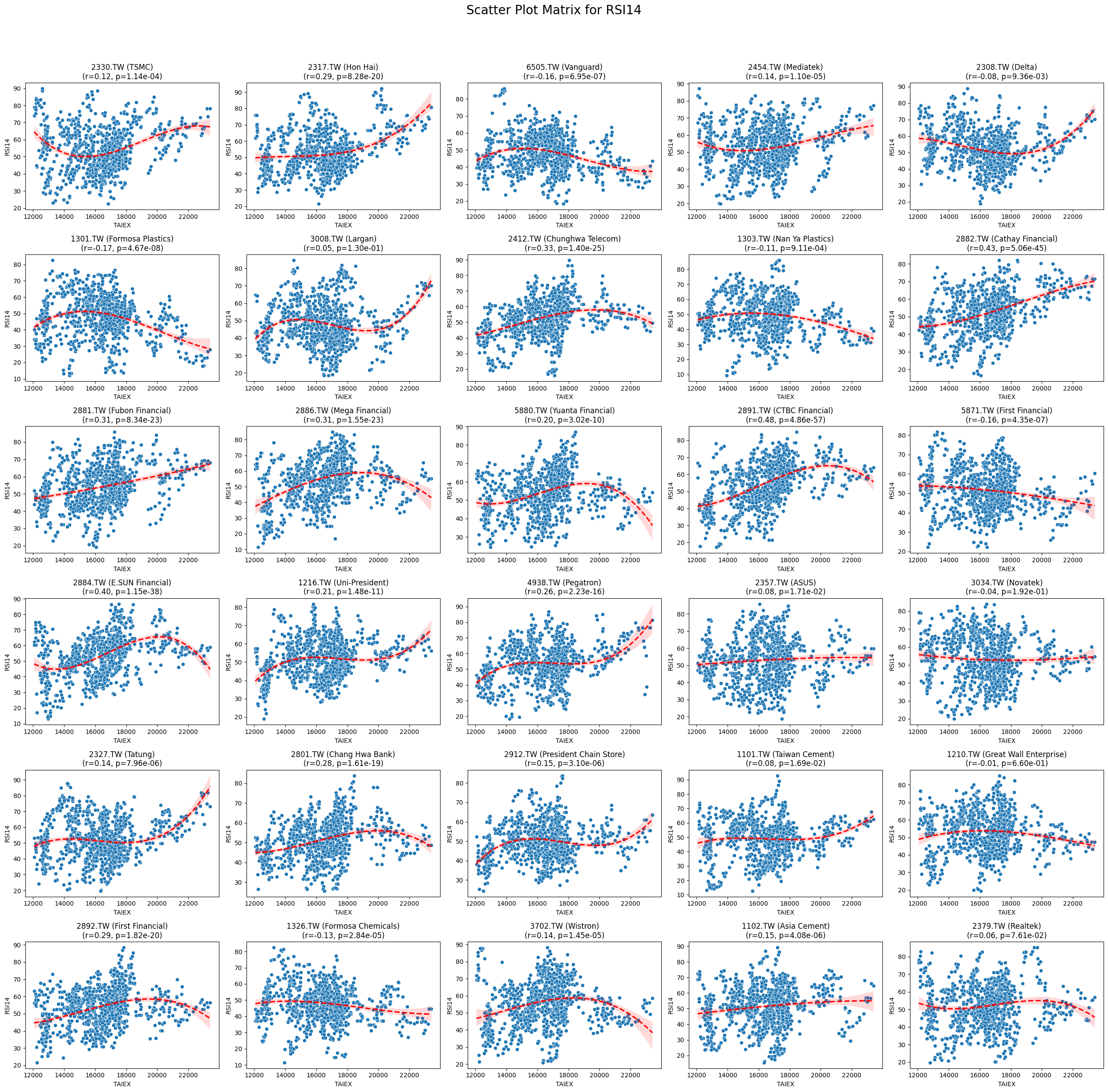

RSI14 0.151384 6.581929e-165

CMO14 0.098249 4.022700e-70

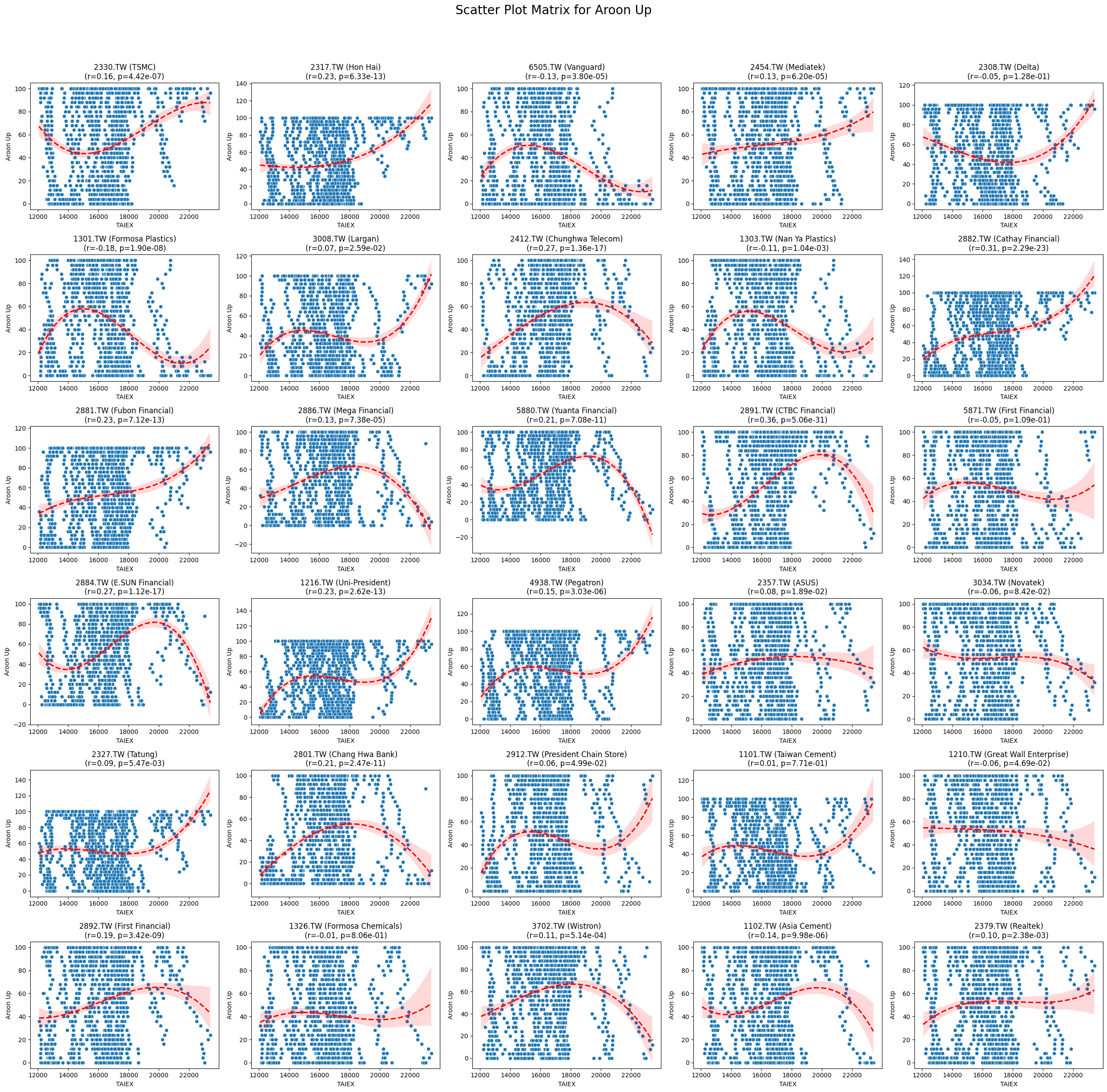

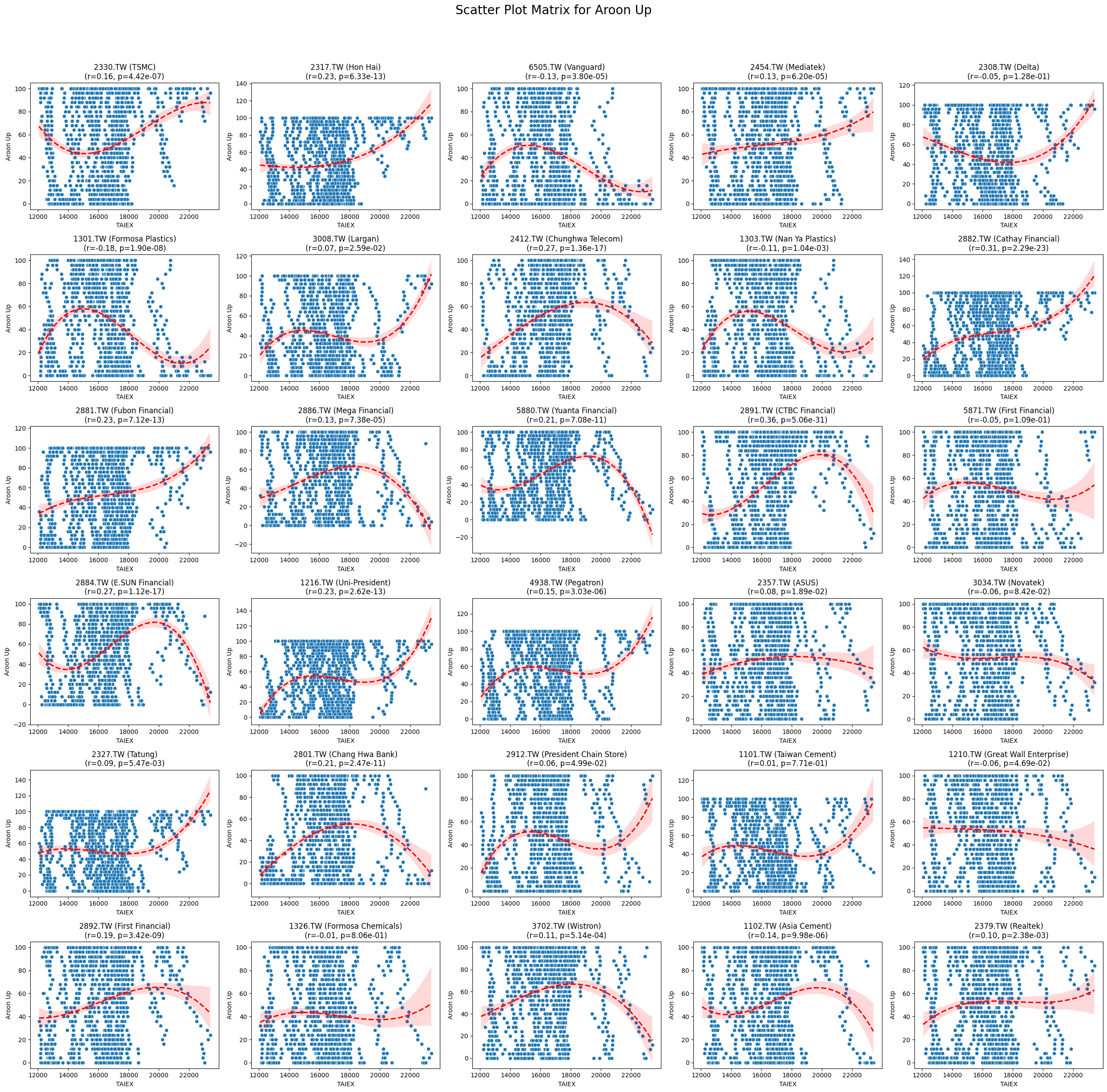

Aroon Up 0.095180 3.432801e-65

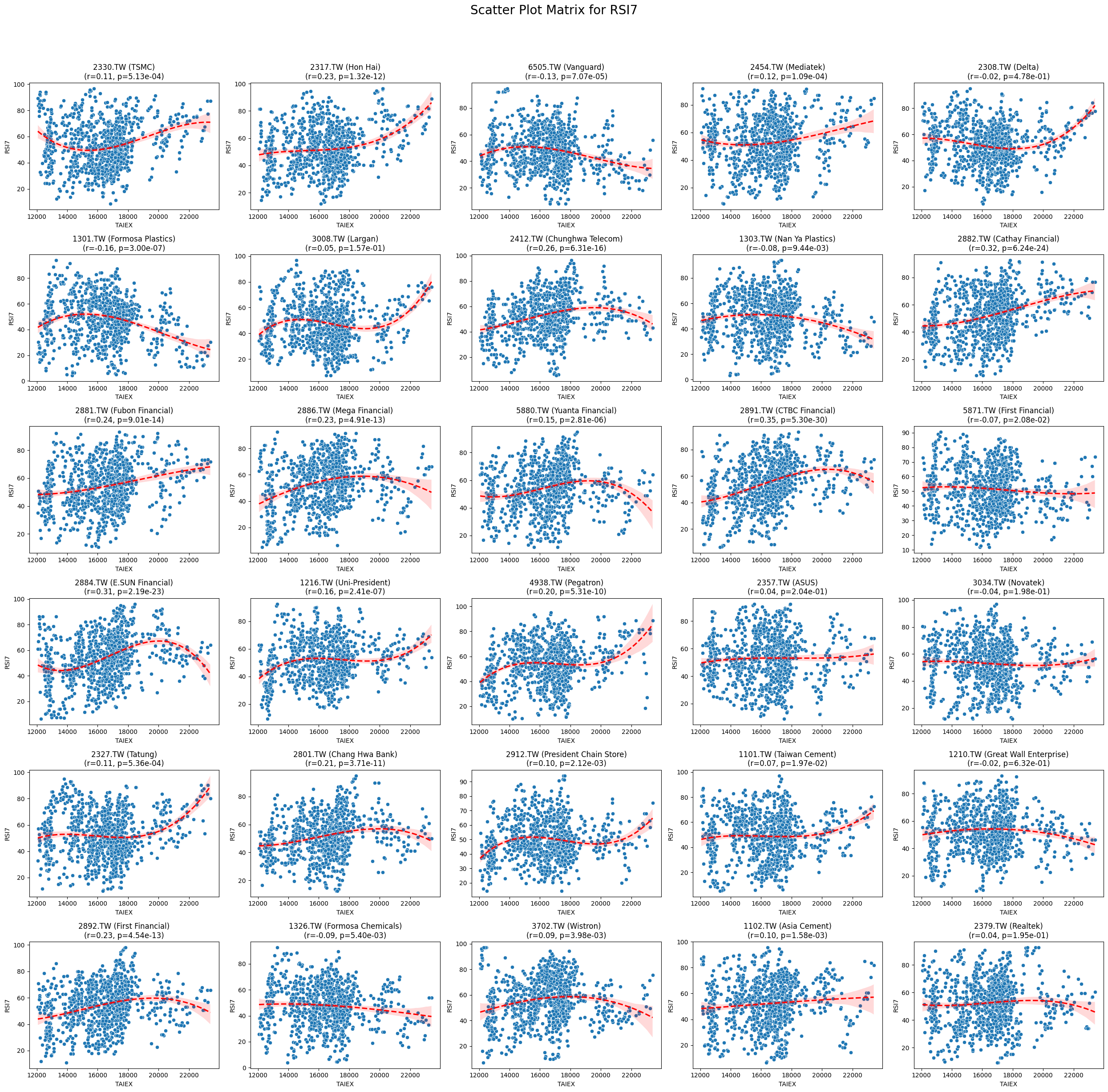

RSI7 0.094756 9.565736e-66

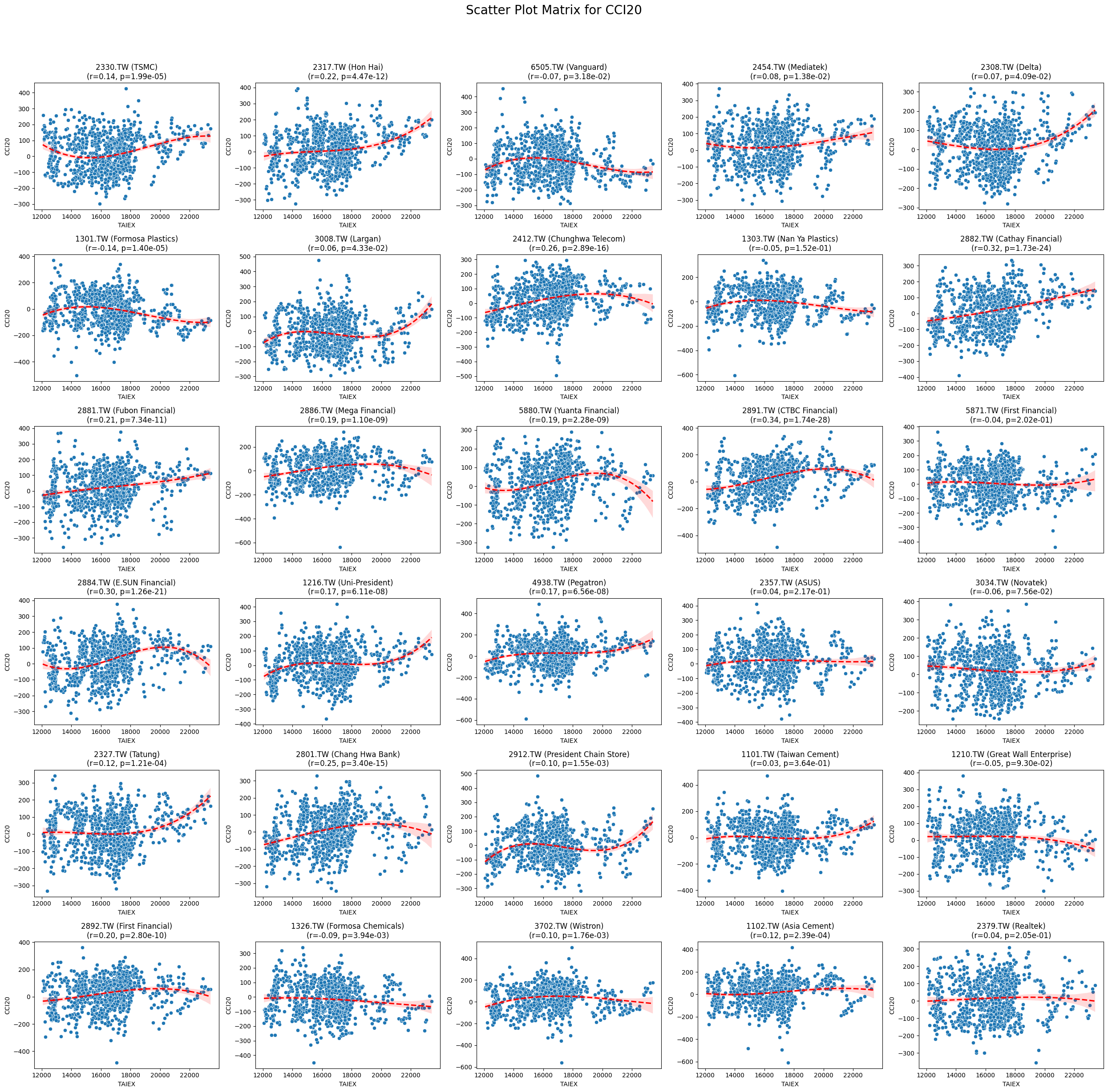

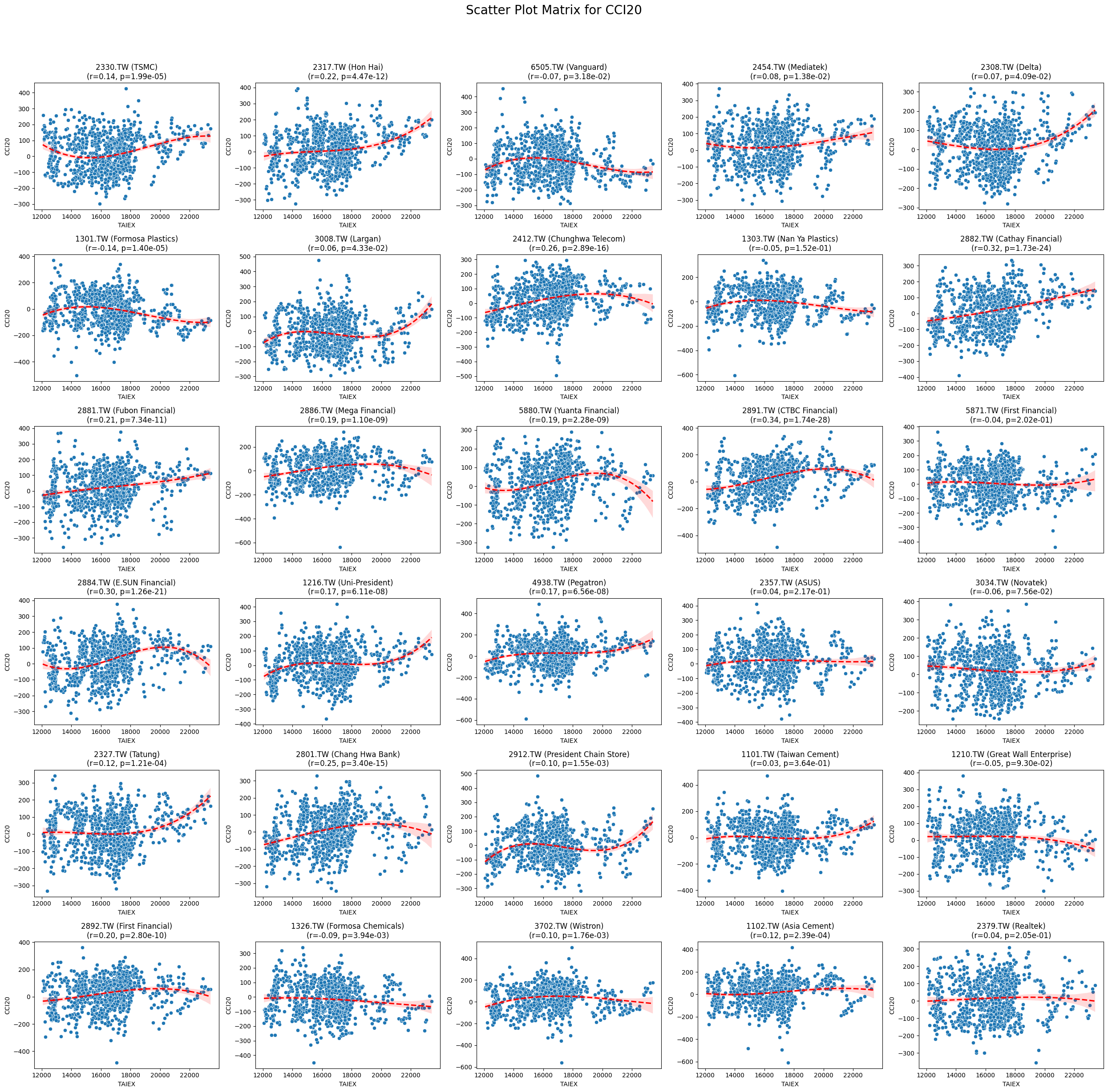

CCI20 0.087107 3.717489e-55

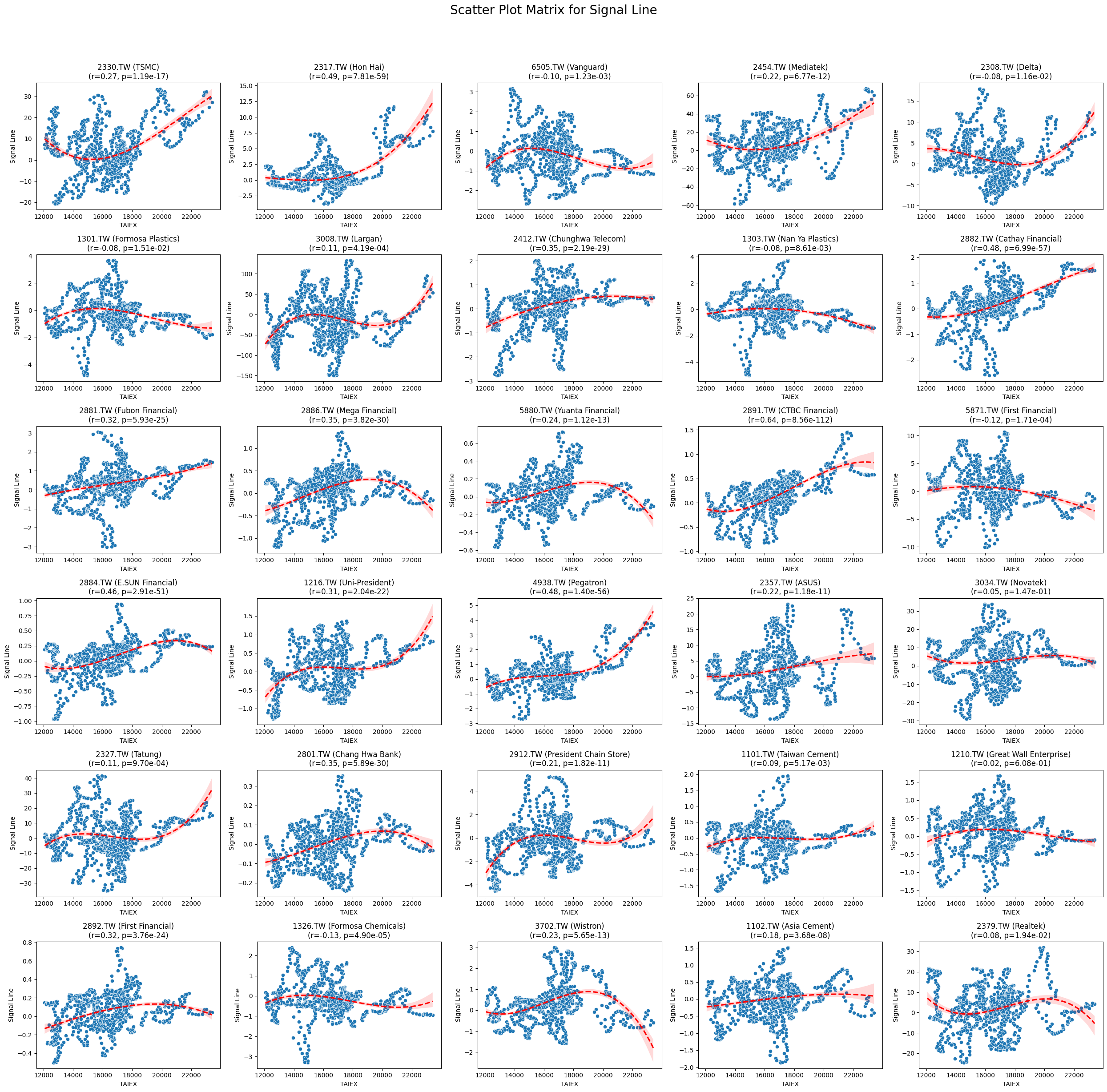

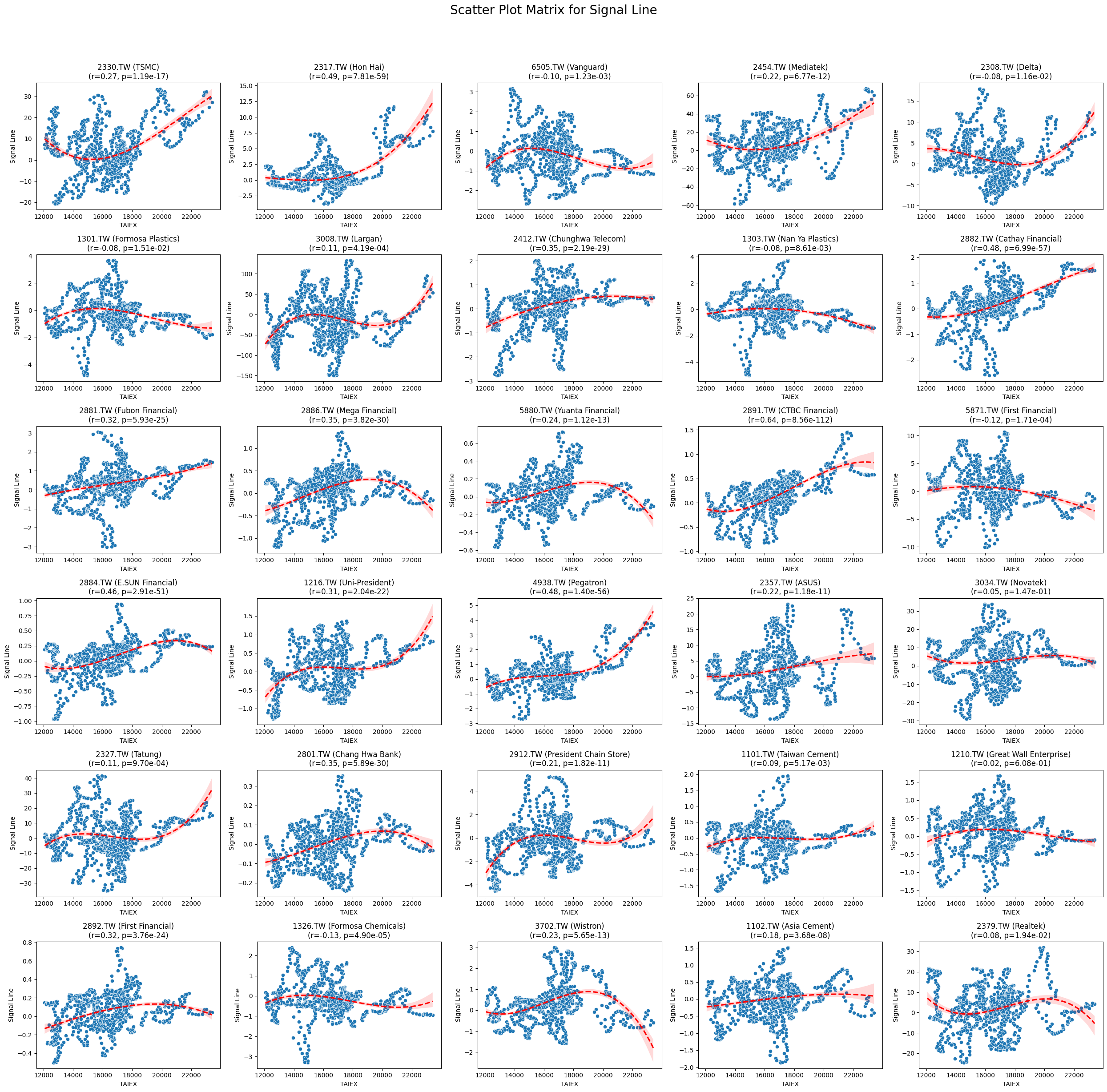

Signal Line 0.083004 1.343307e-49

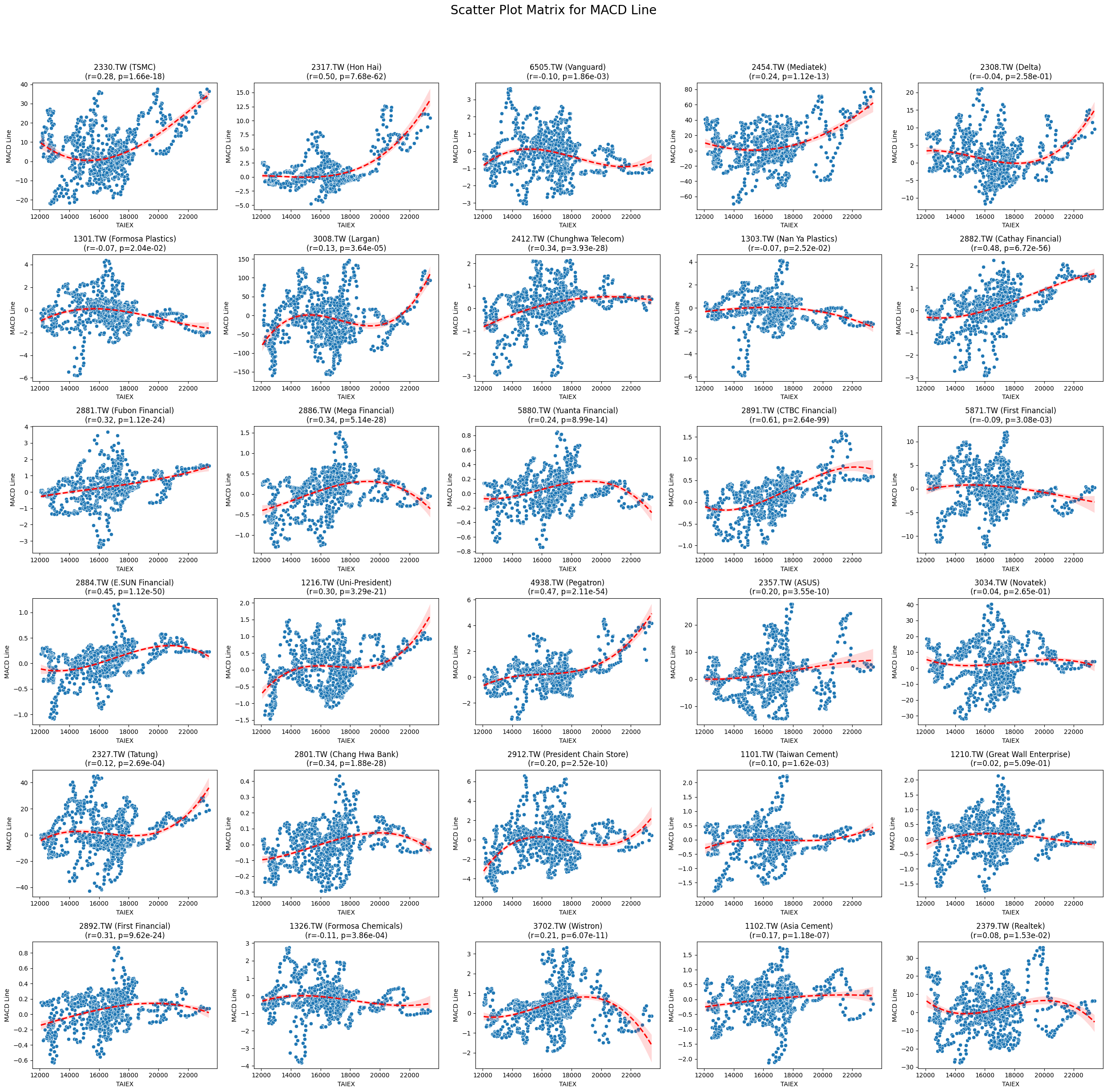

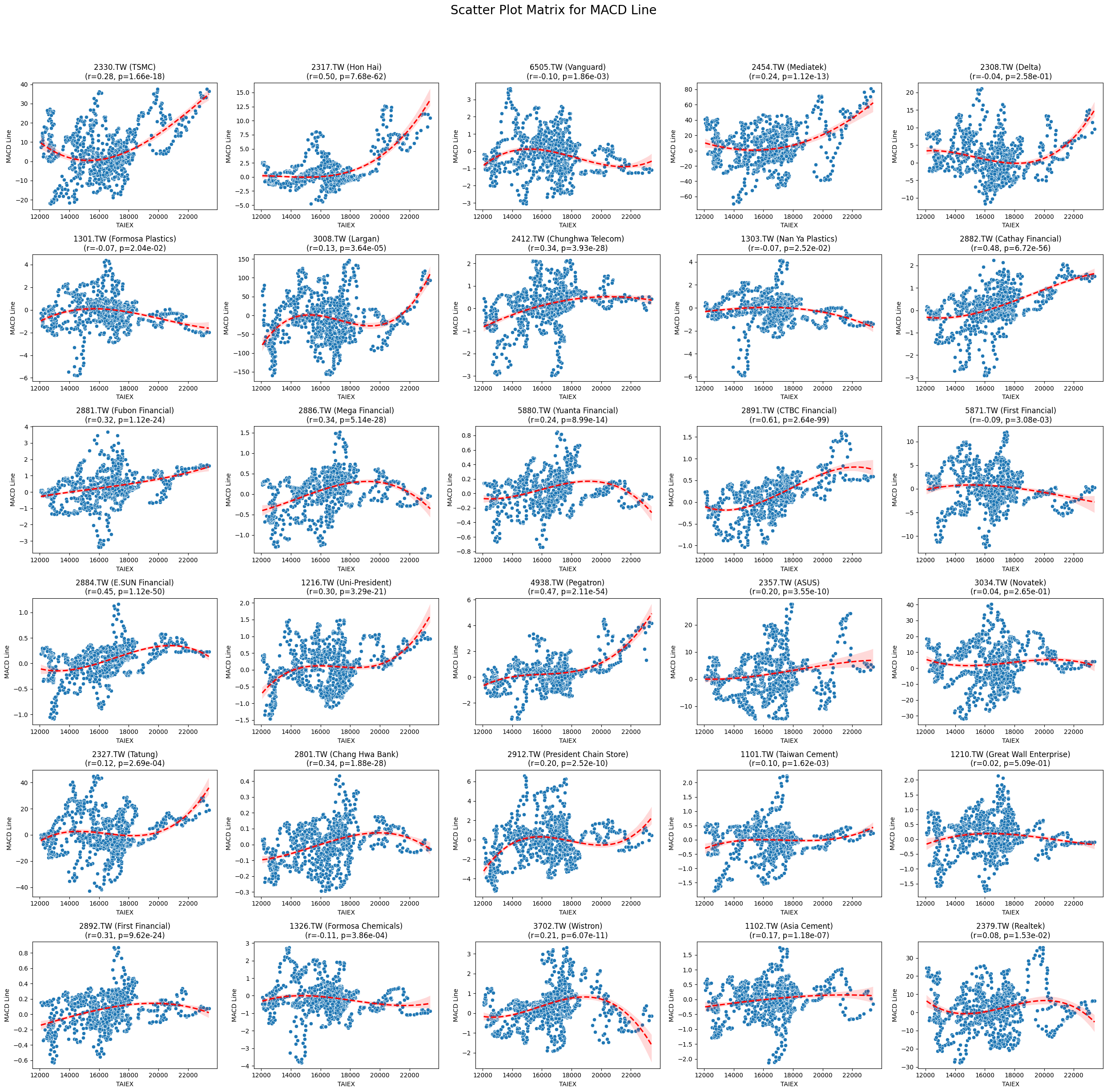

MACD Line 0.082689 1.358365e-49

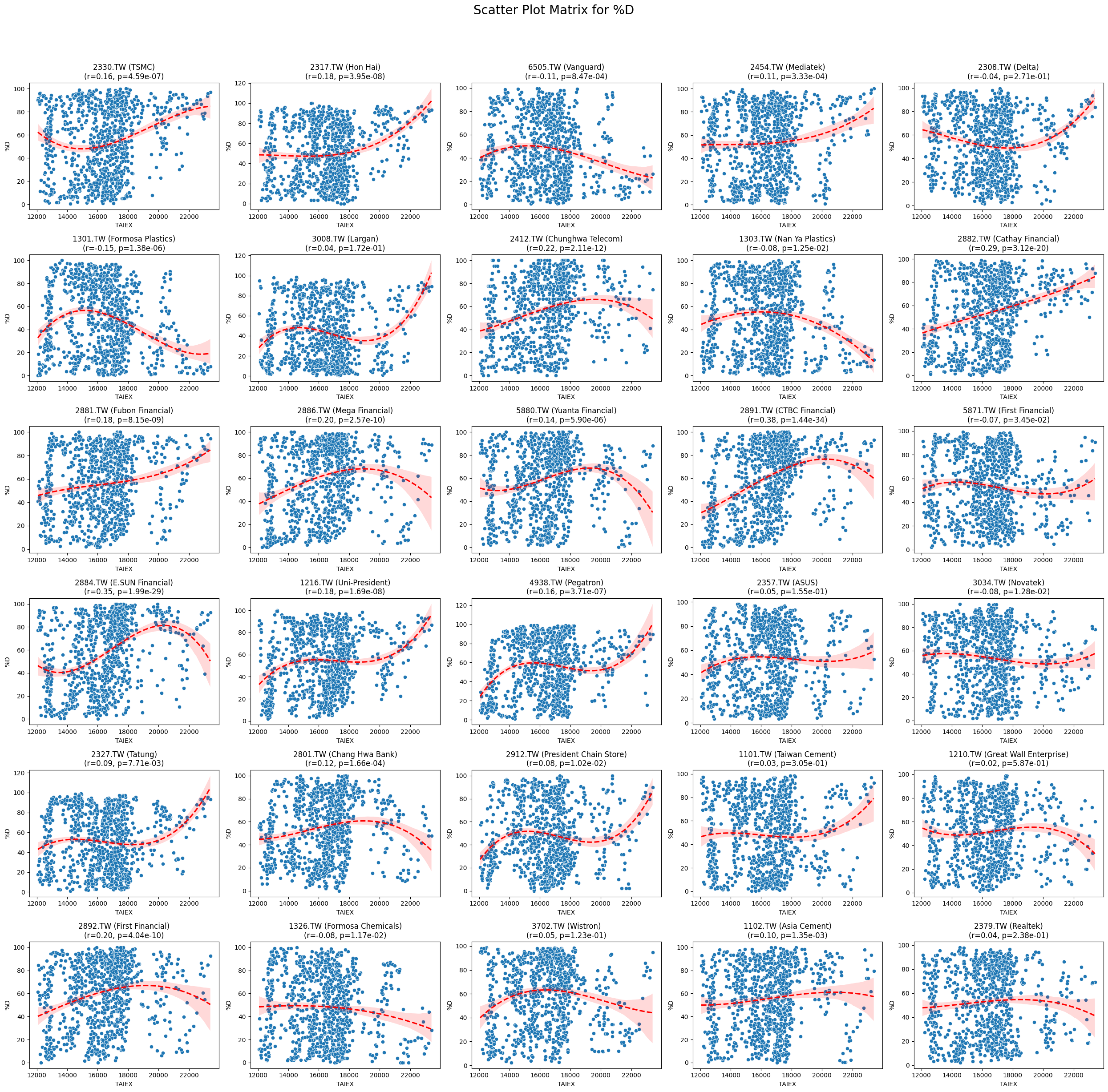

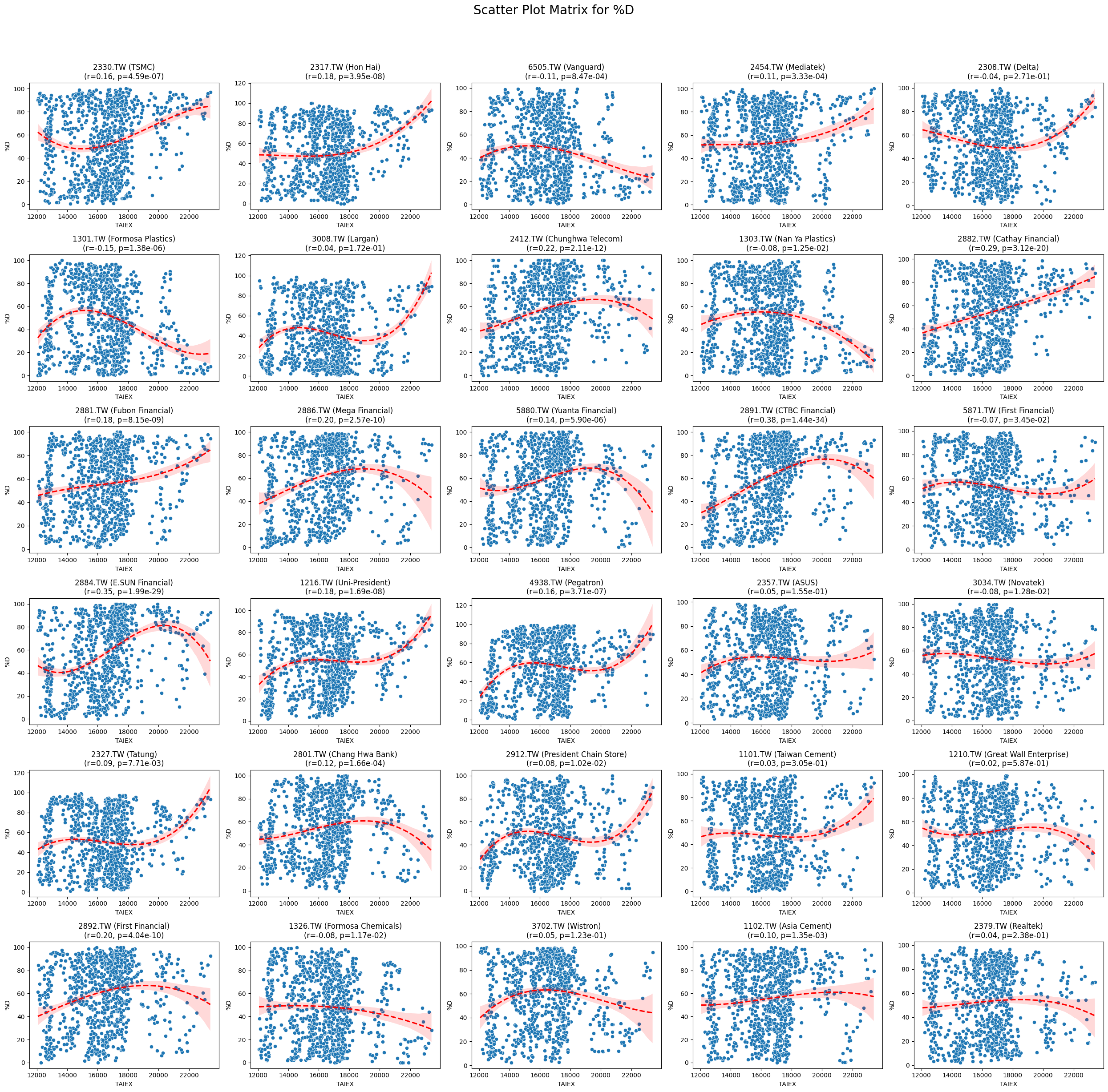

%D 0.066708 3.890501e-33

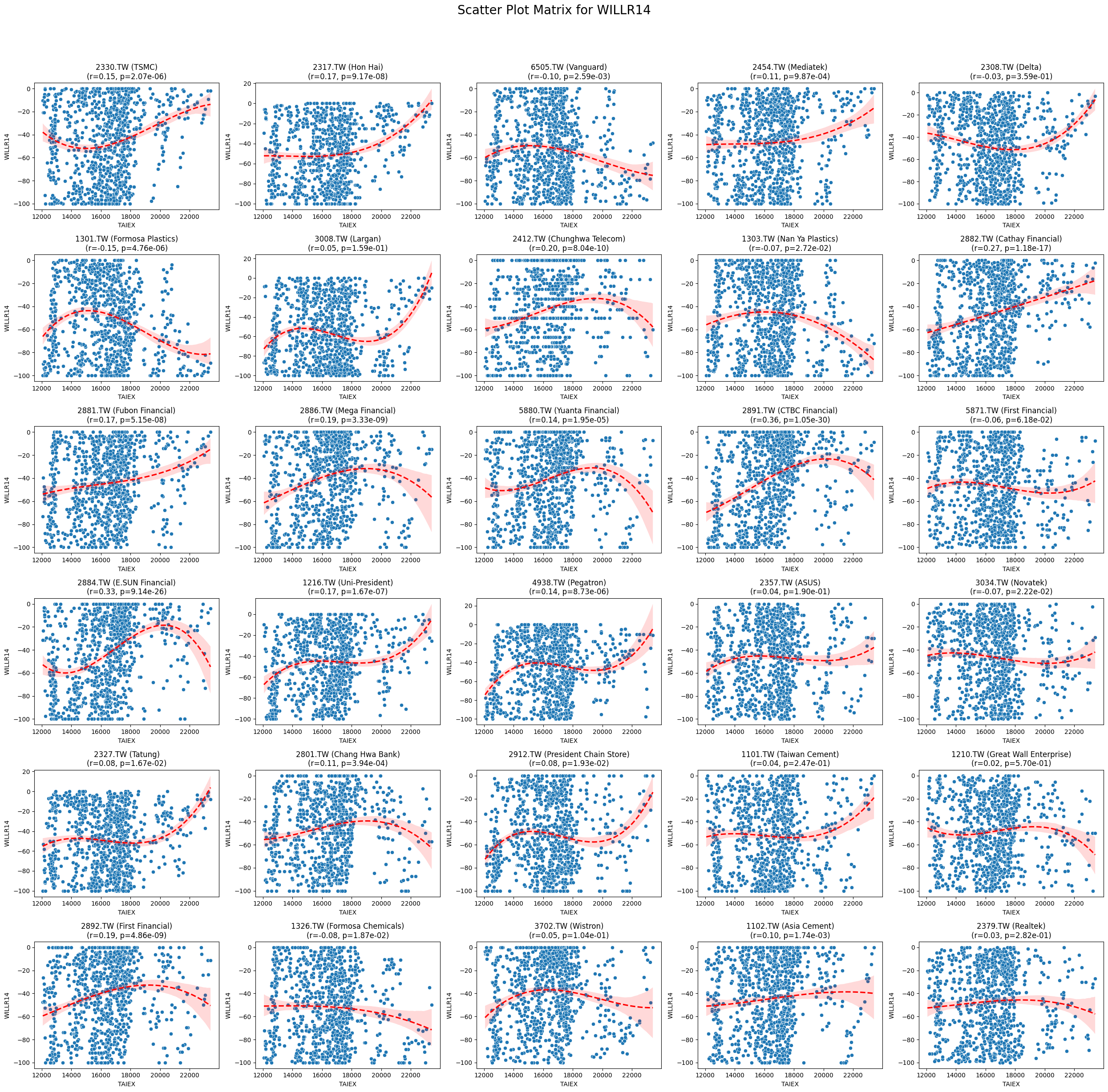

WILLR14 0.063084 7.404786e-30

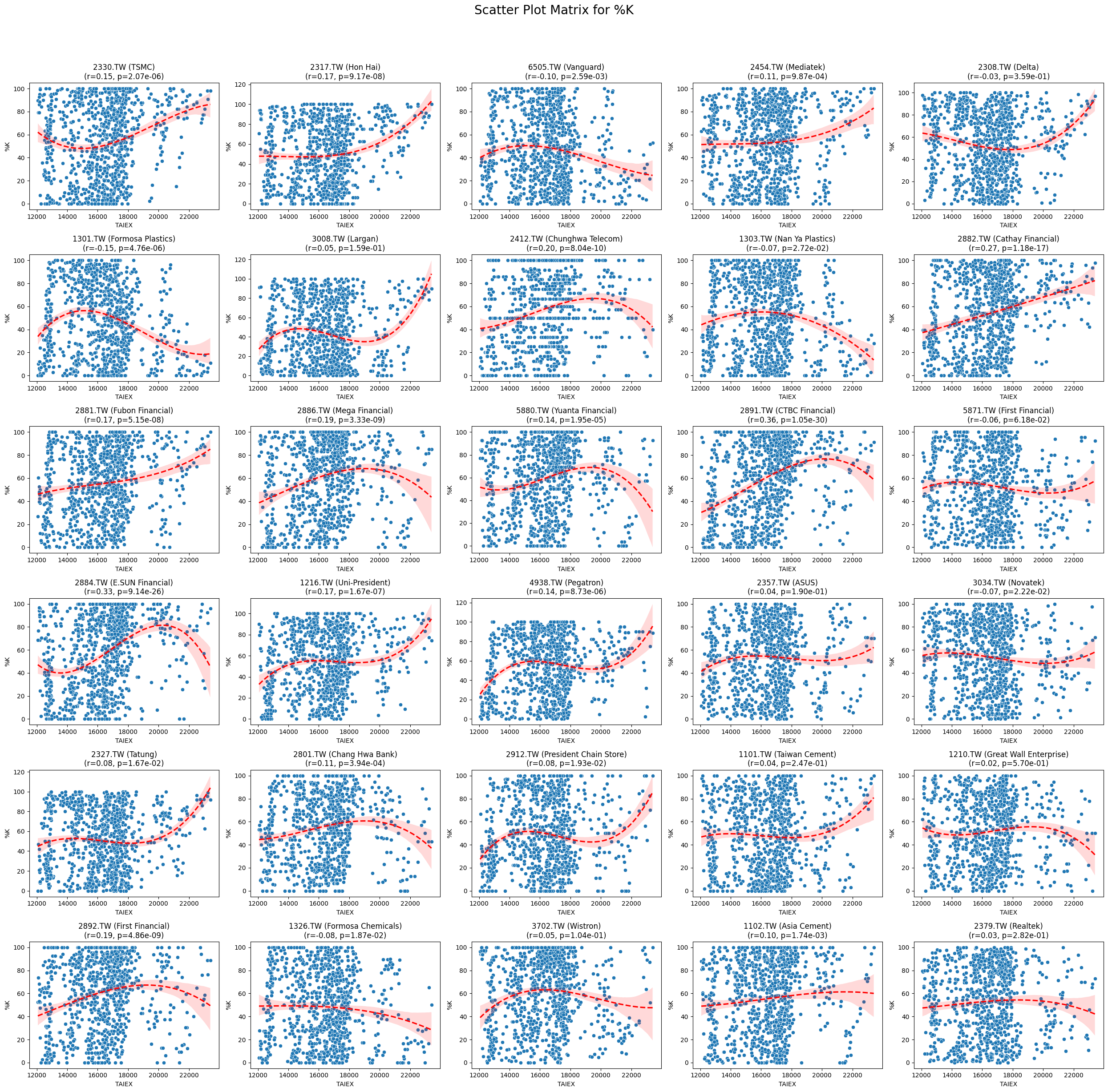

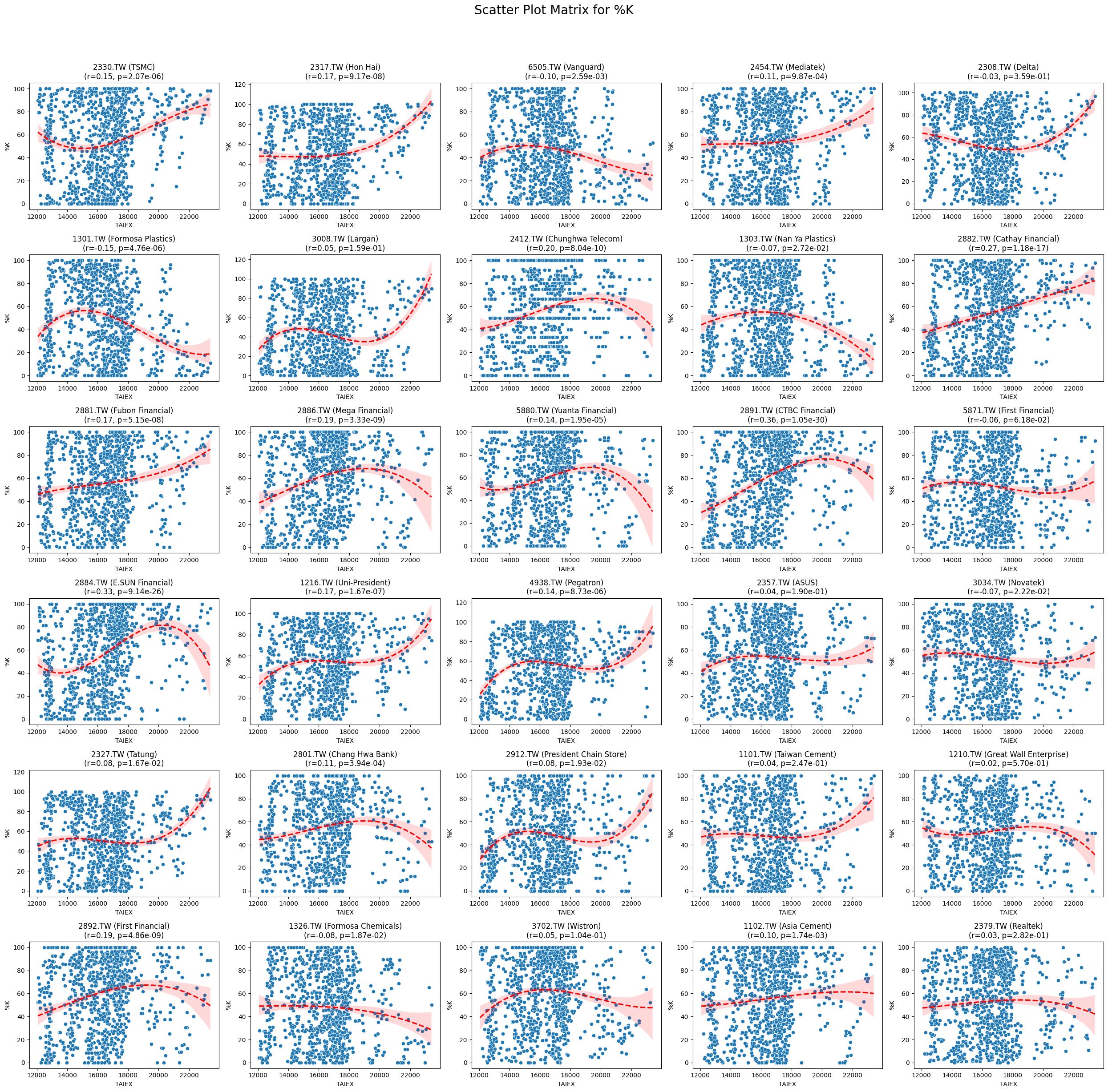

%K 0.063084 7.404786e-30

Market Return 0.053582 3.279364e-22

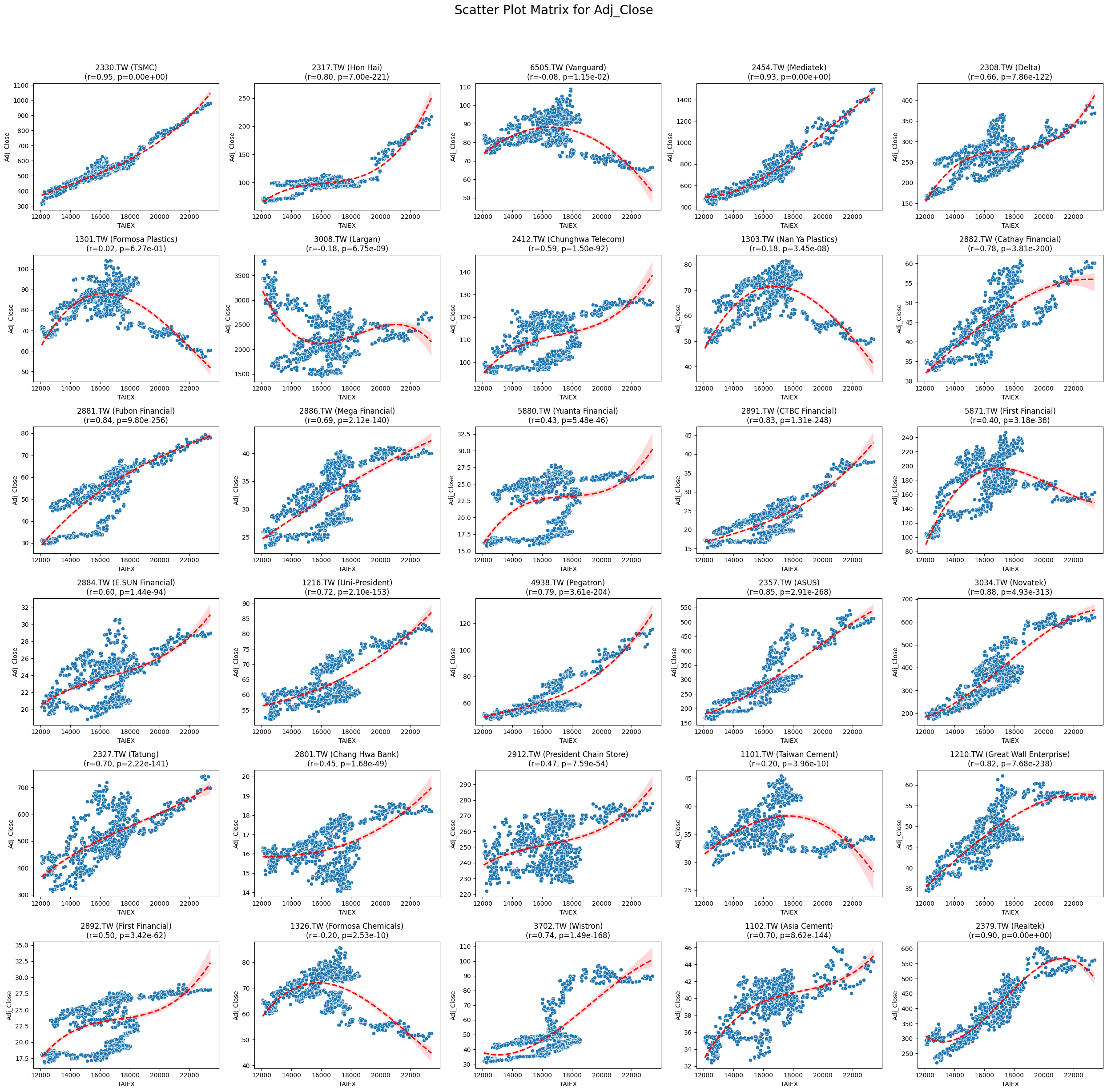

Adj_Close 0.040832 1.508200e-13

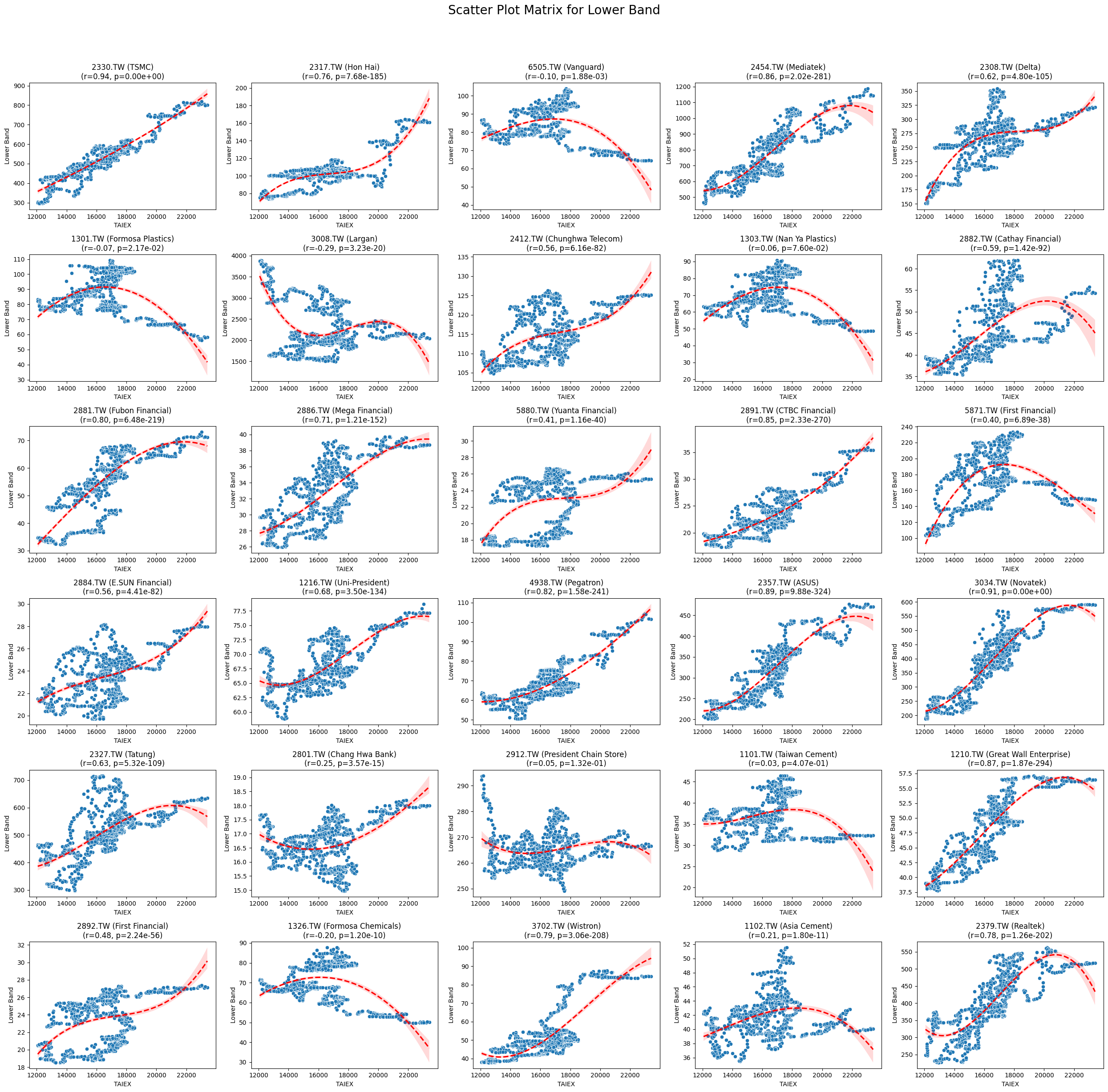

Lower Band 0.025671 4.182478e-06

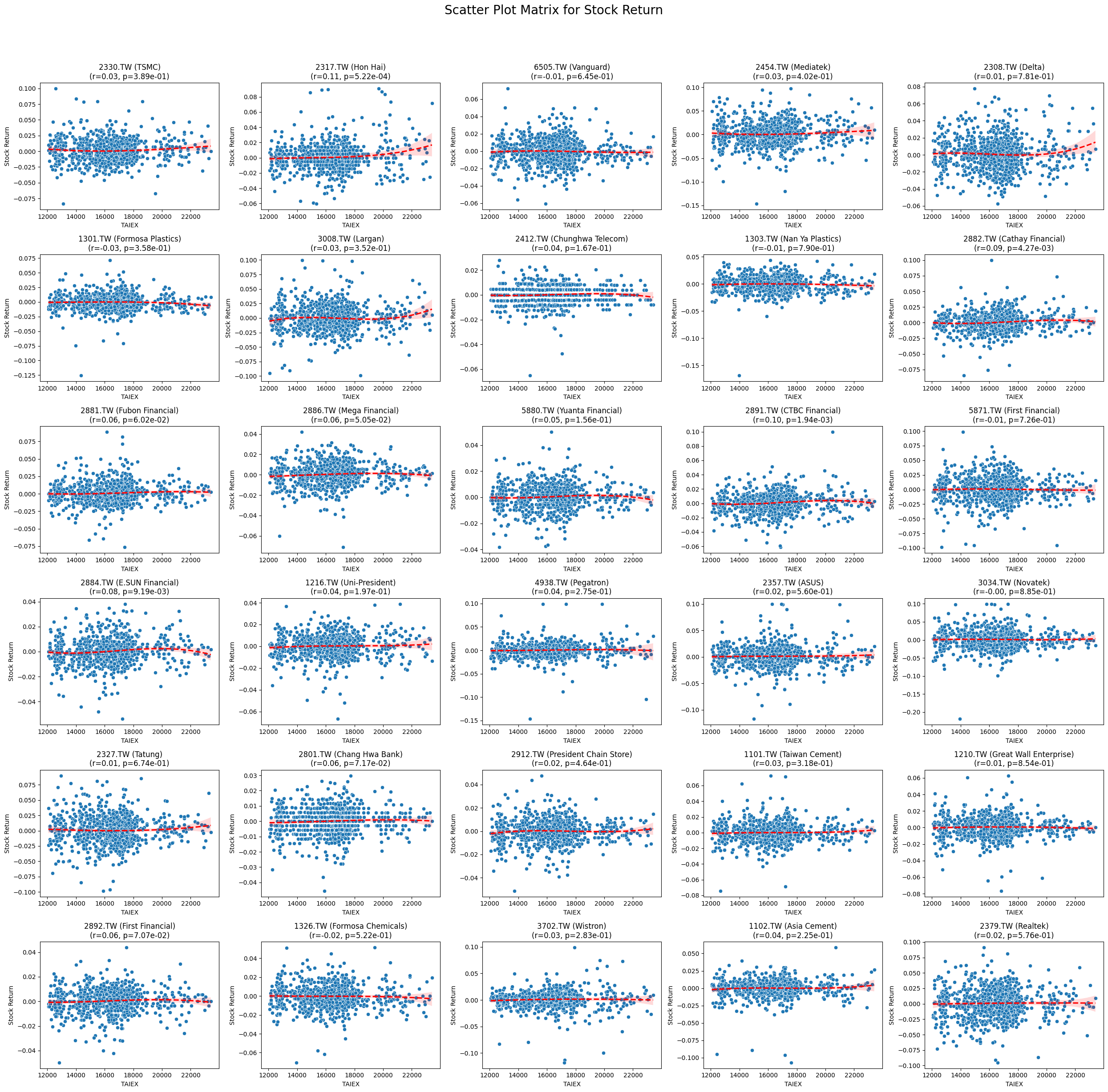

Stock Return 0.024979 6.320338e-06

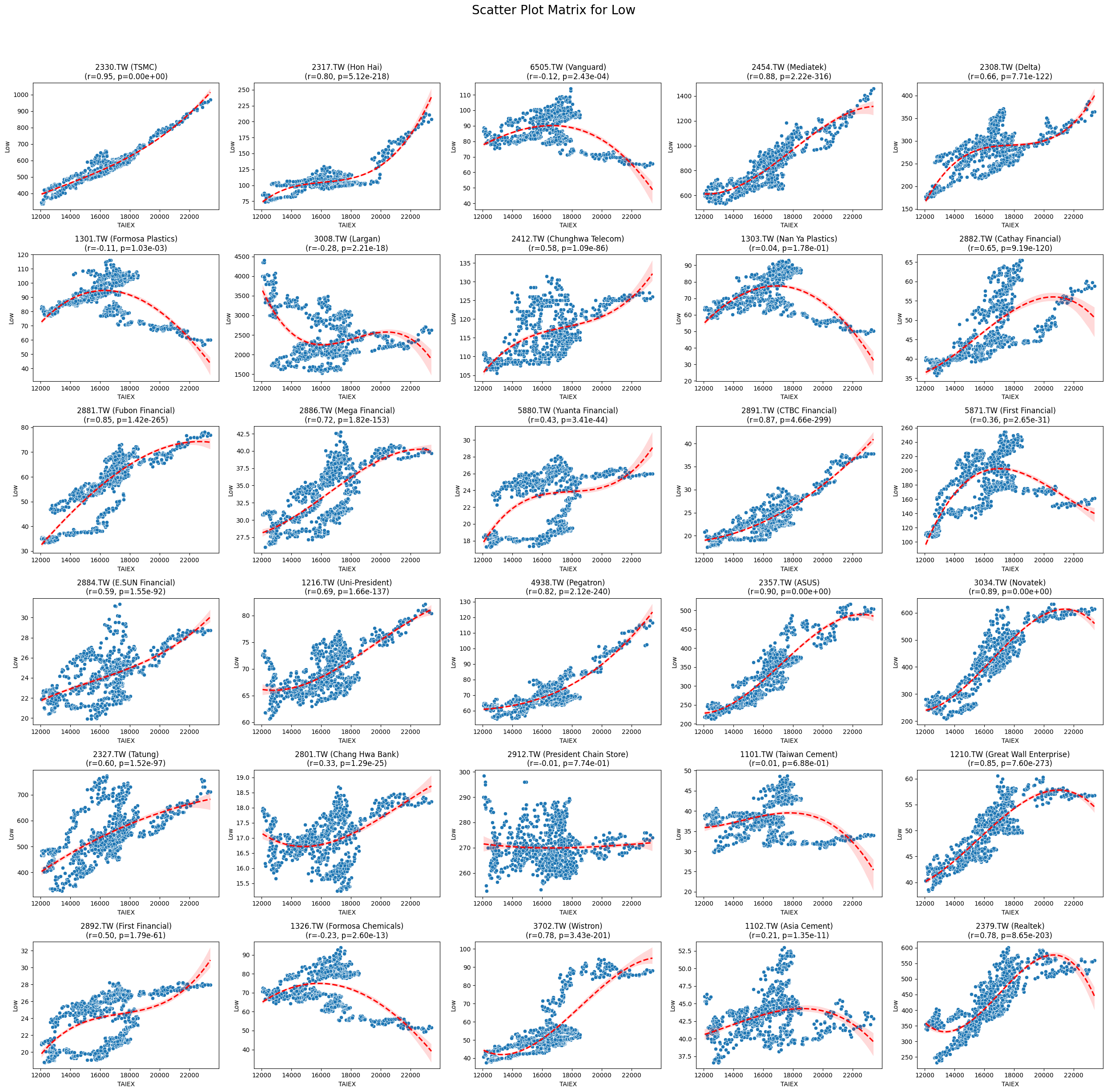

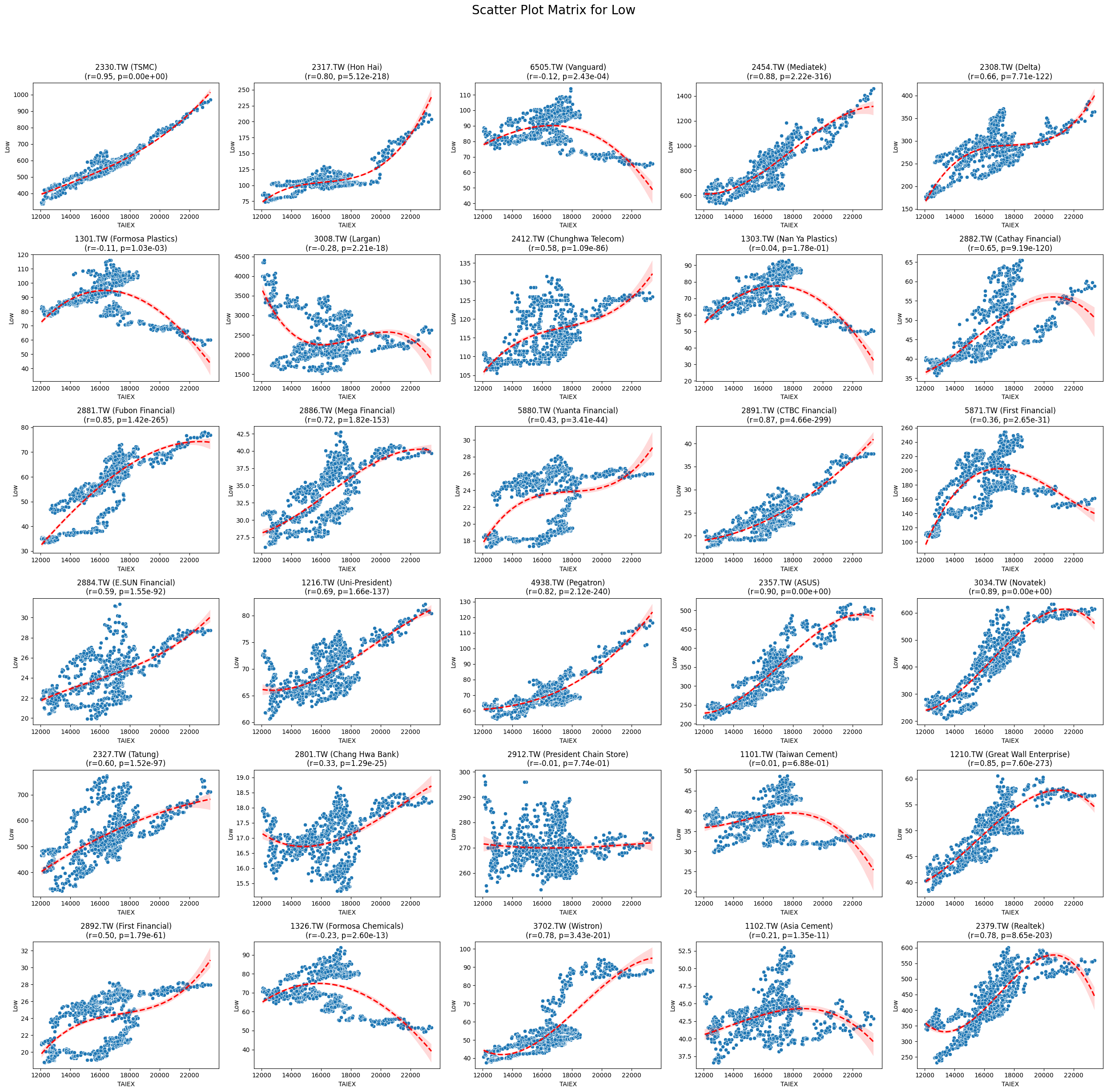

Low 0.022923 3.390795e-05

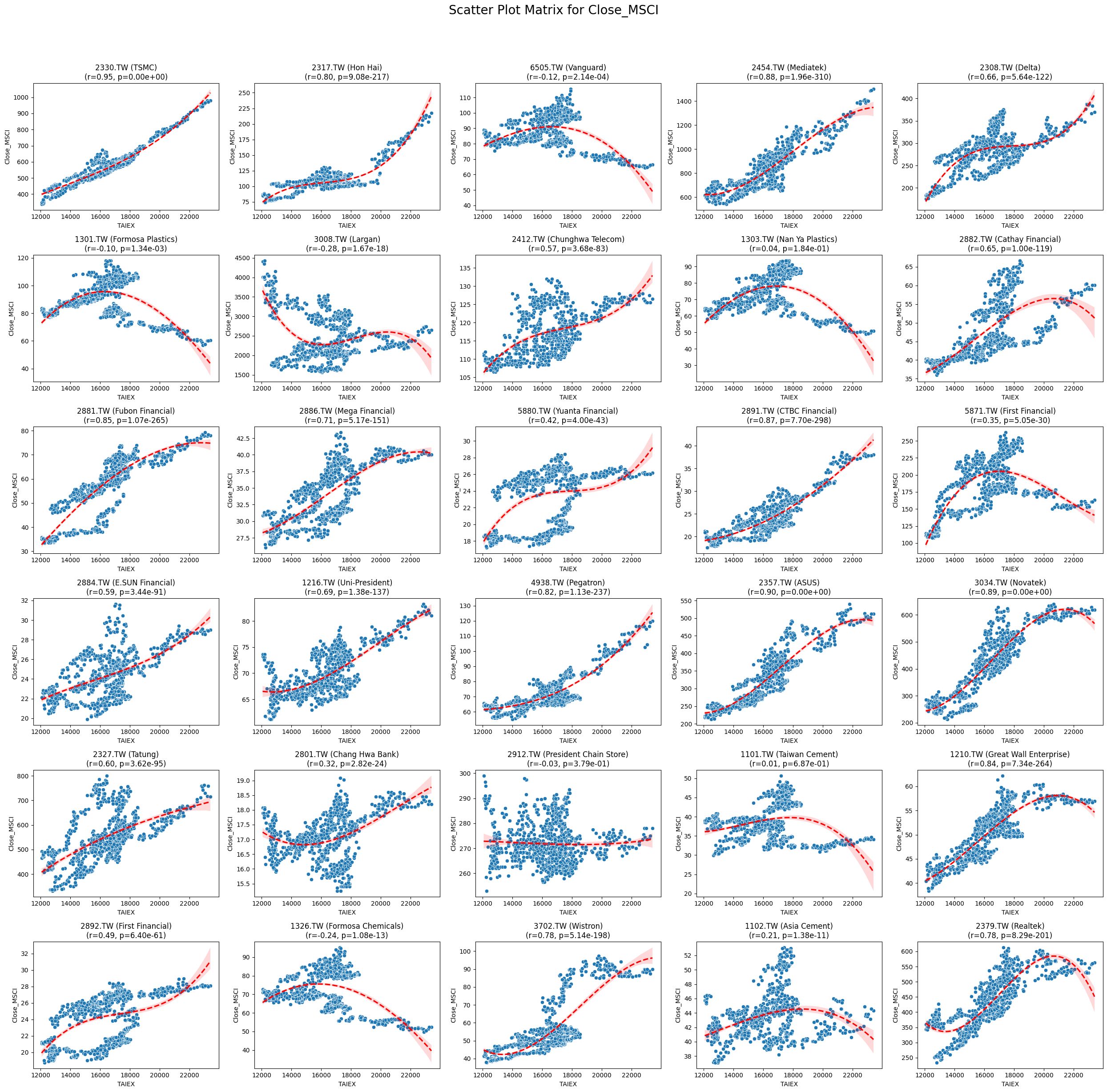

Close_MSCI 0.022754 3.870897e-05

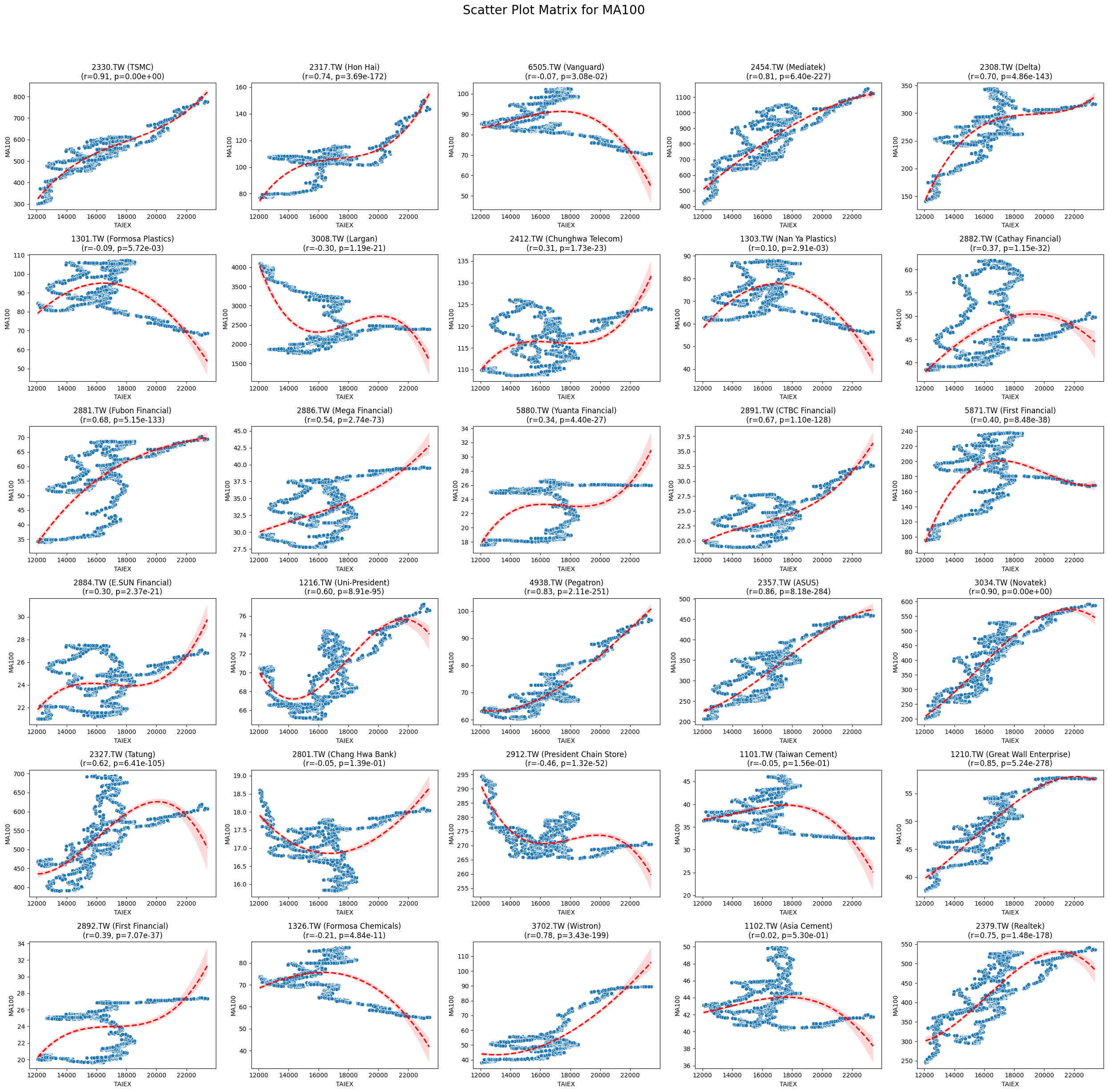

MA100 0.022563 9.995018e-05

MA7 0.022436 5.204963e-05

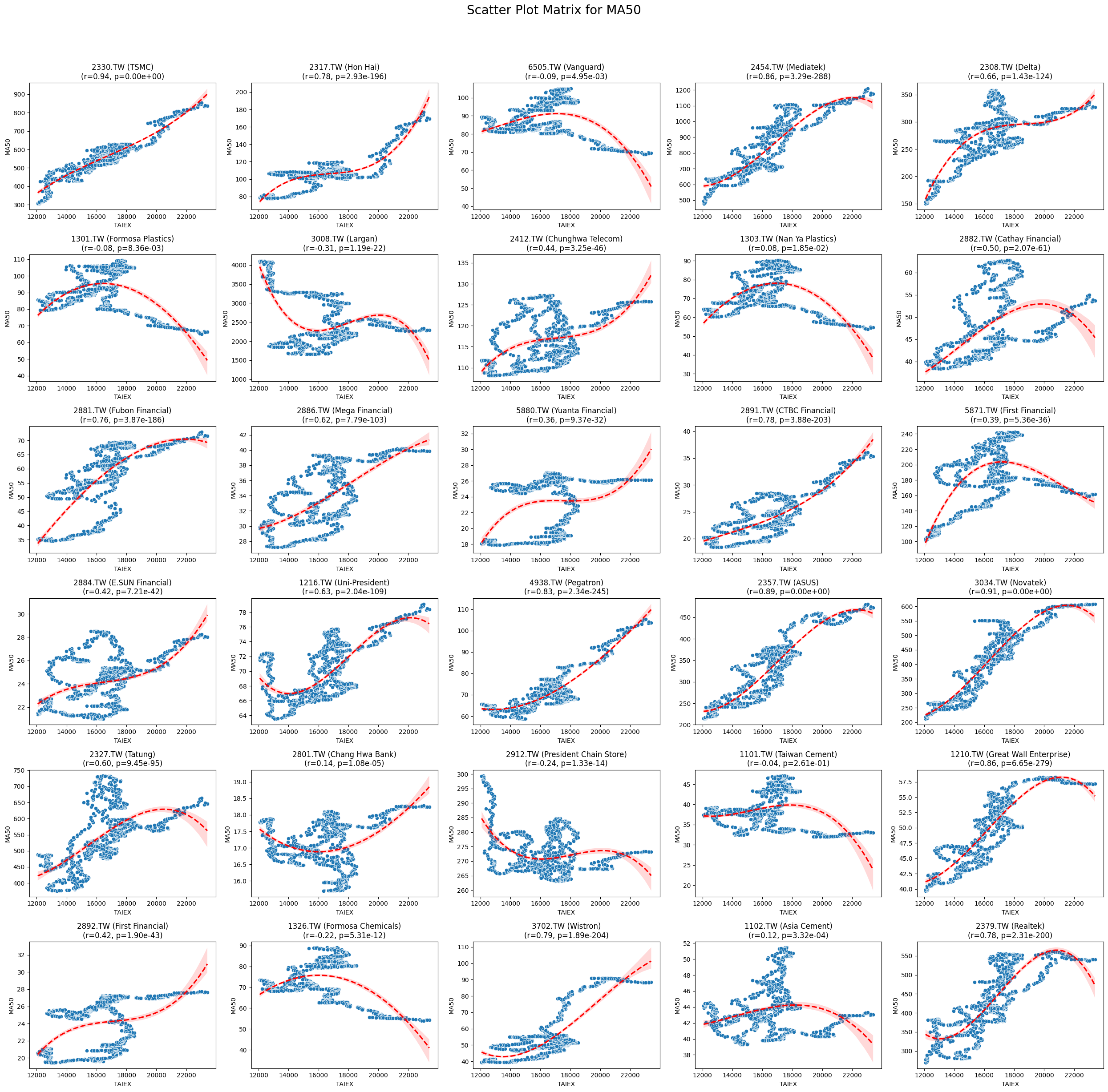

MA50 0.022385 7.611907e-05

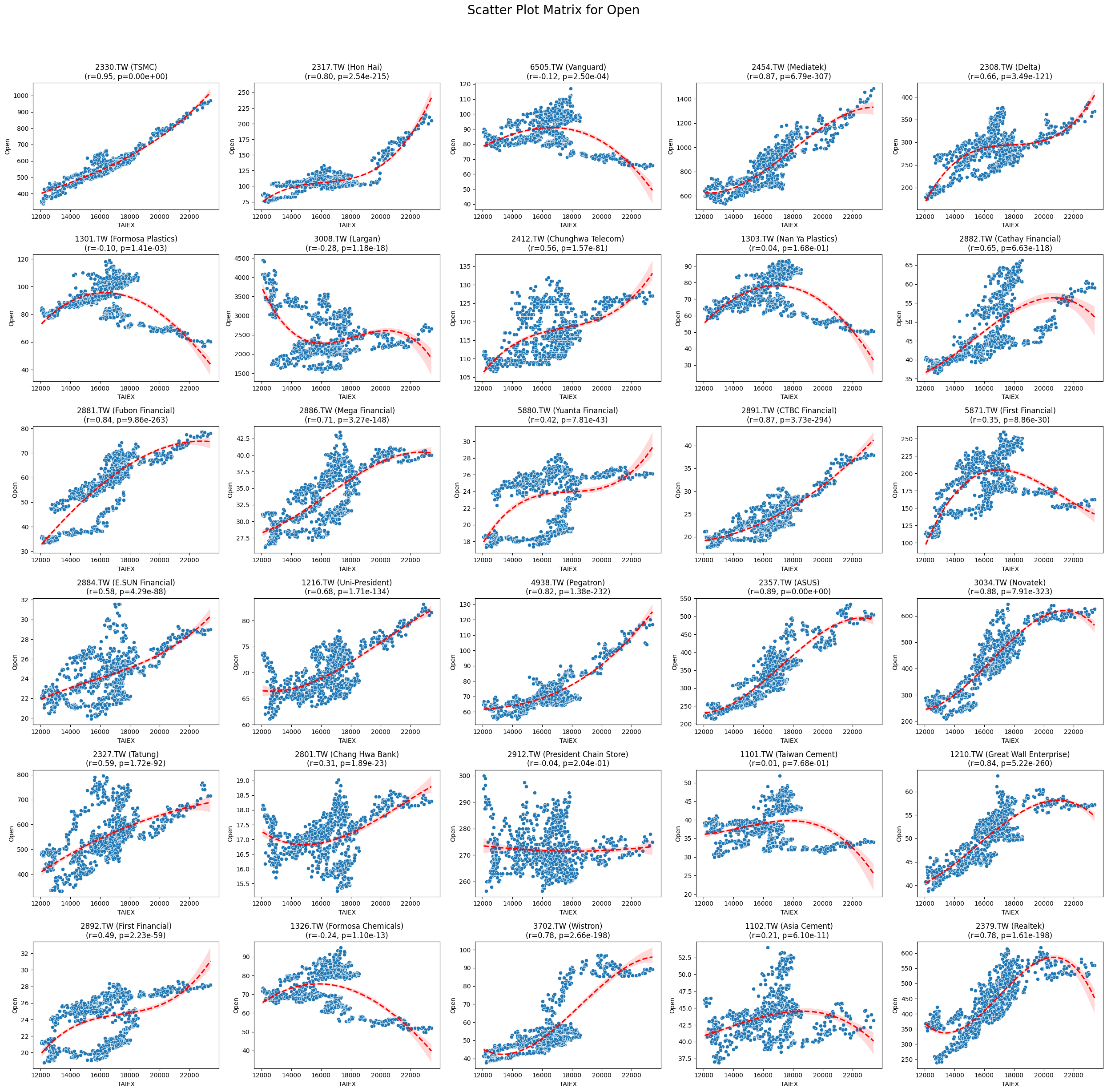

Open 0.022309 5.473519e-05

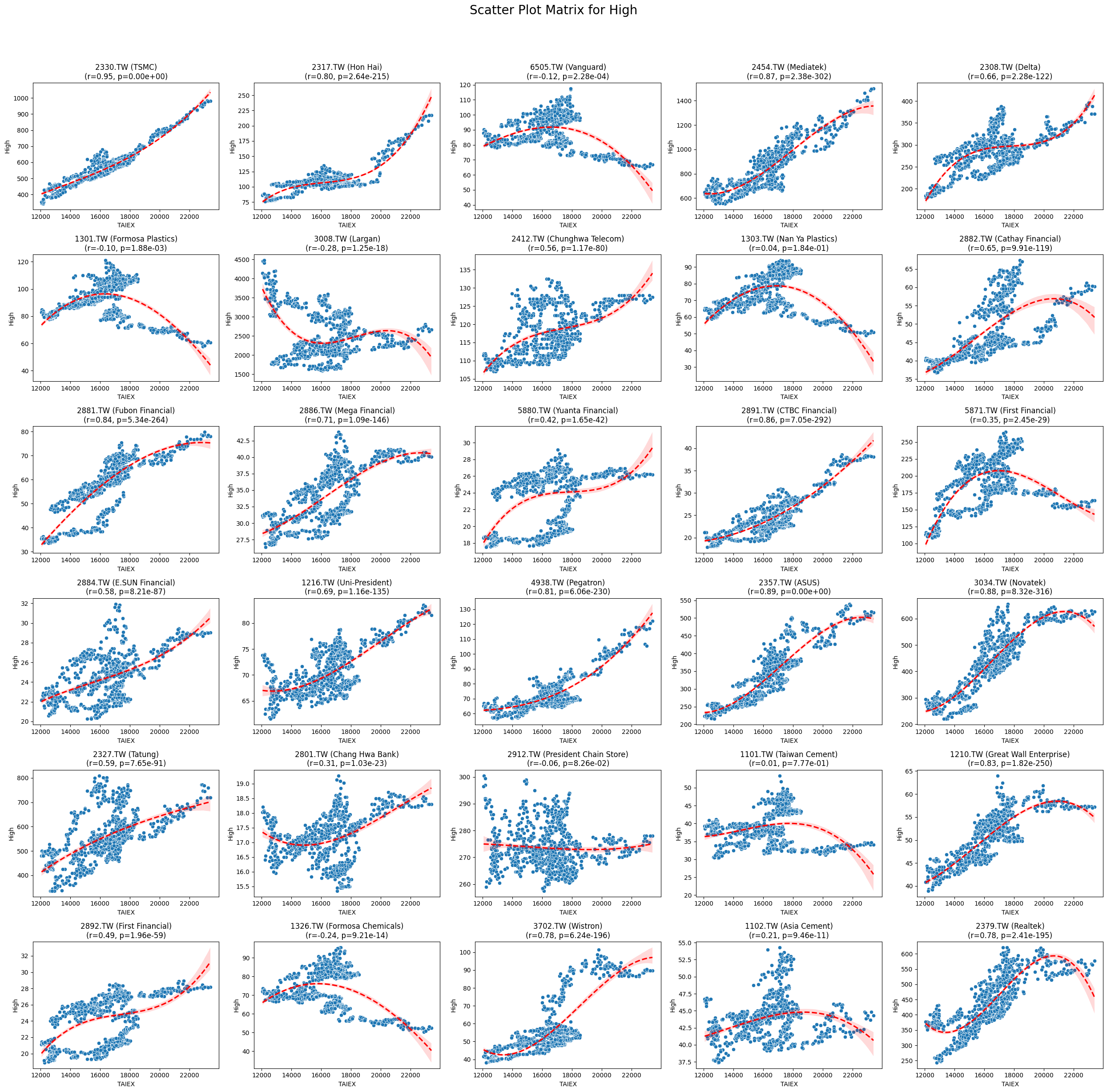

High 0.022106 6.395461e-05

Middle Band 0.021825 9.140844e-05

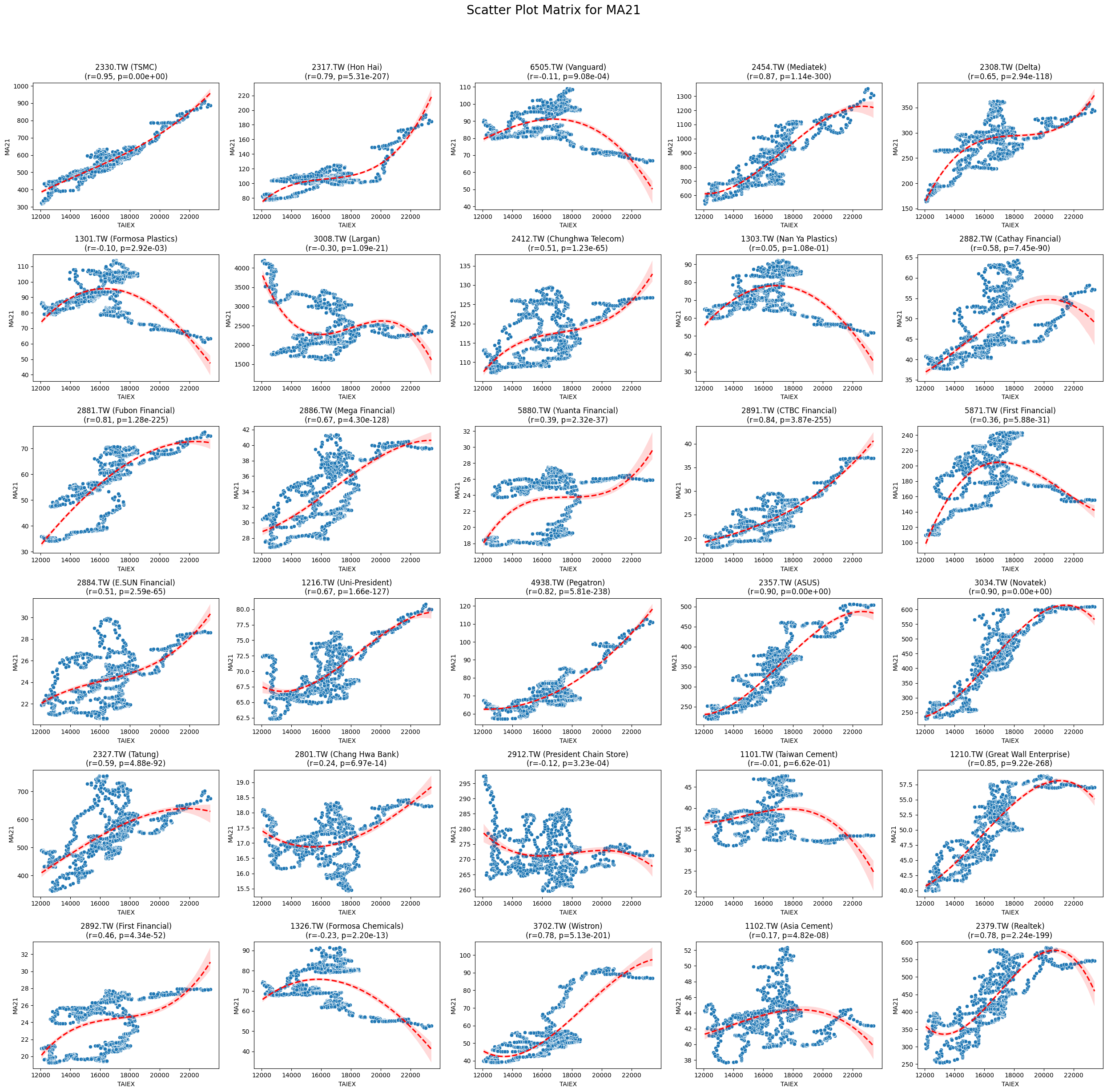

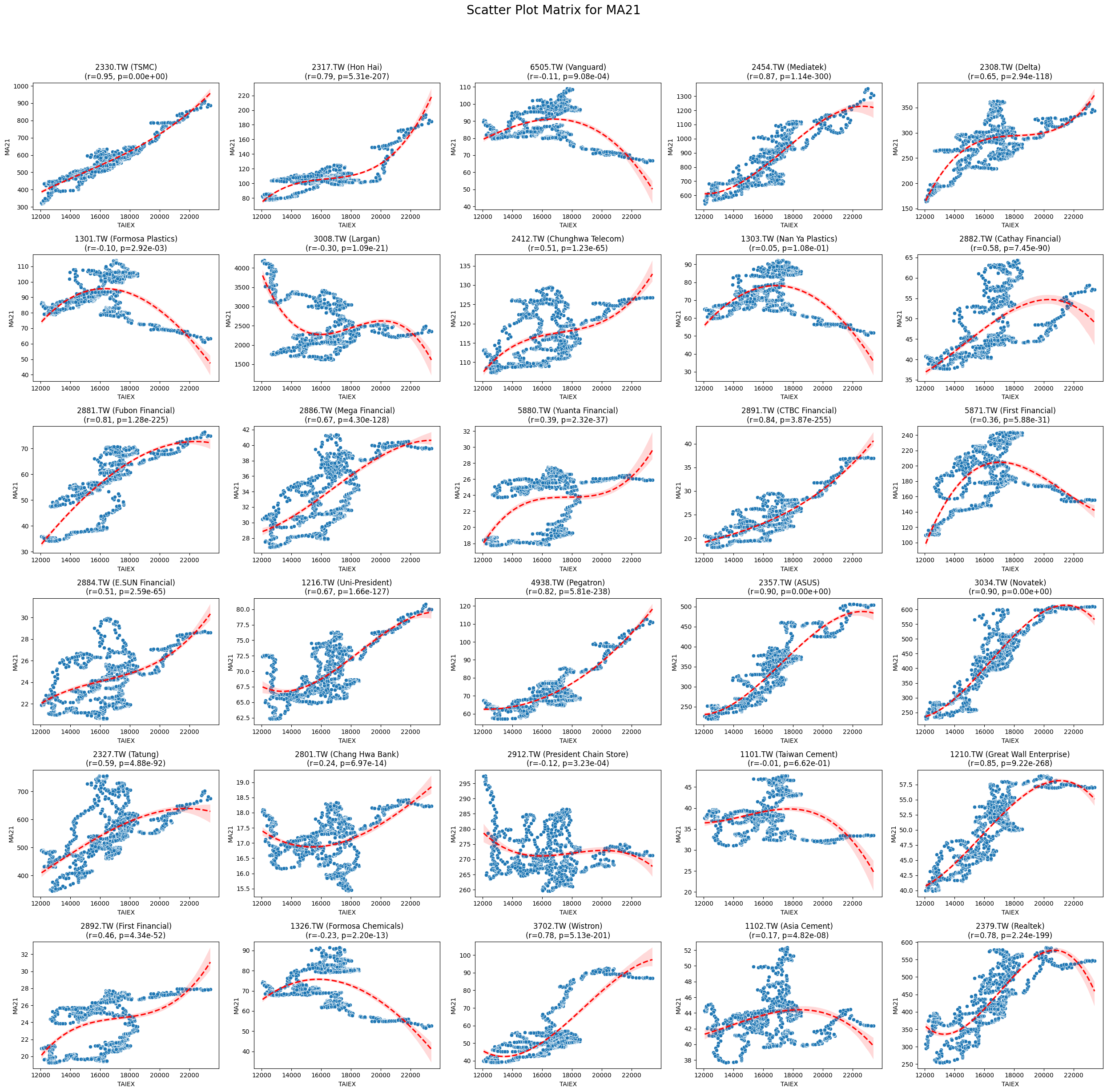

MA21 0.021806 9.338782e-05

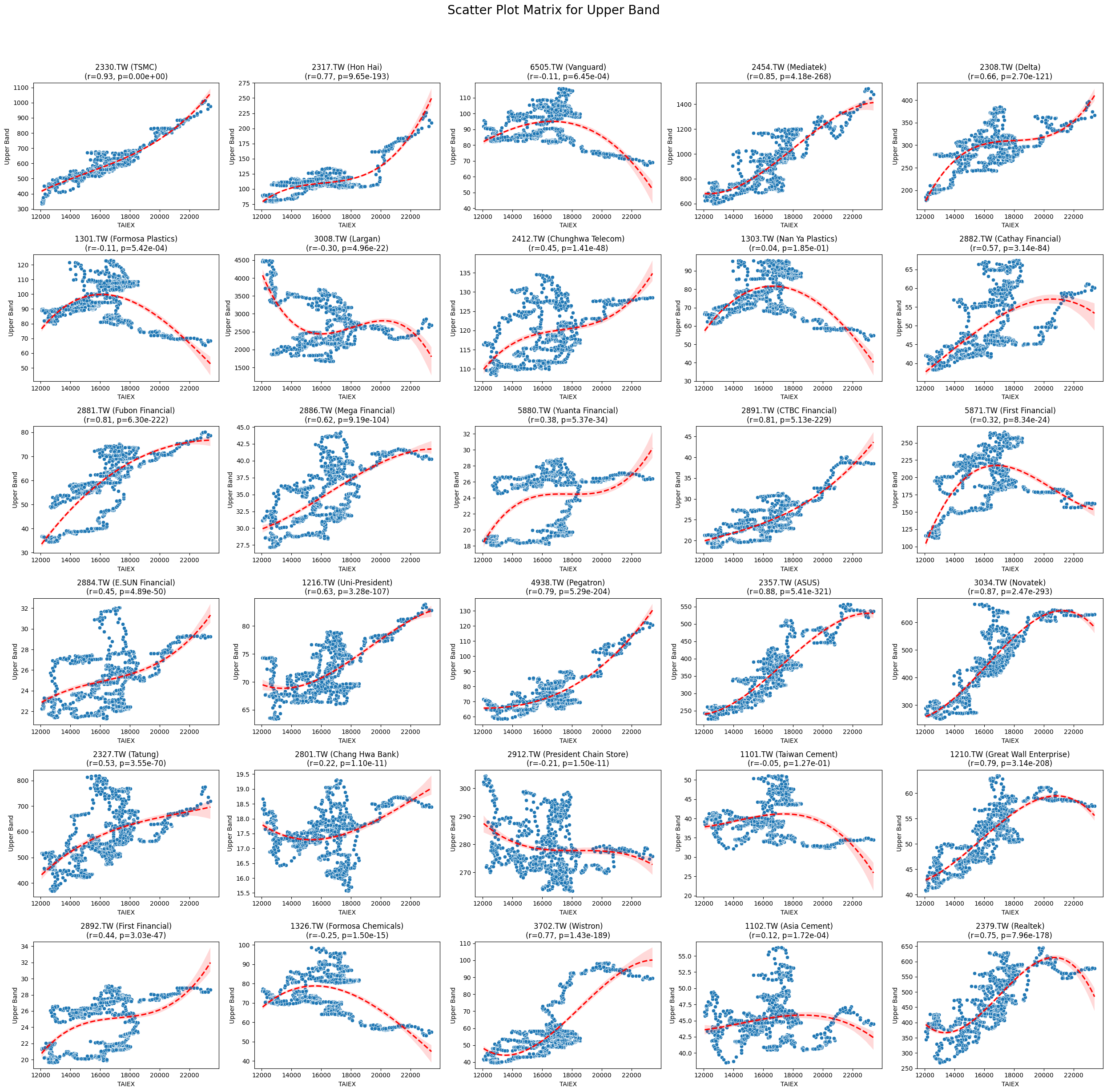

Upper Band 0.018484 9.214753e-04

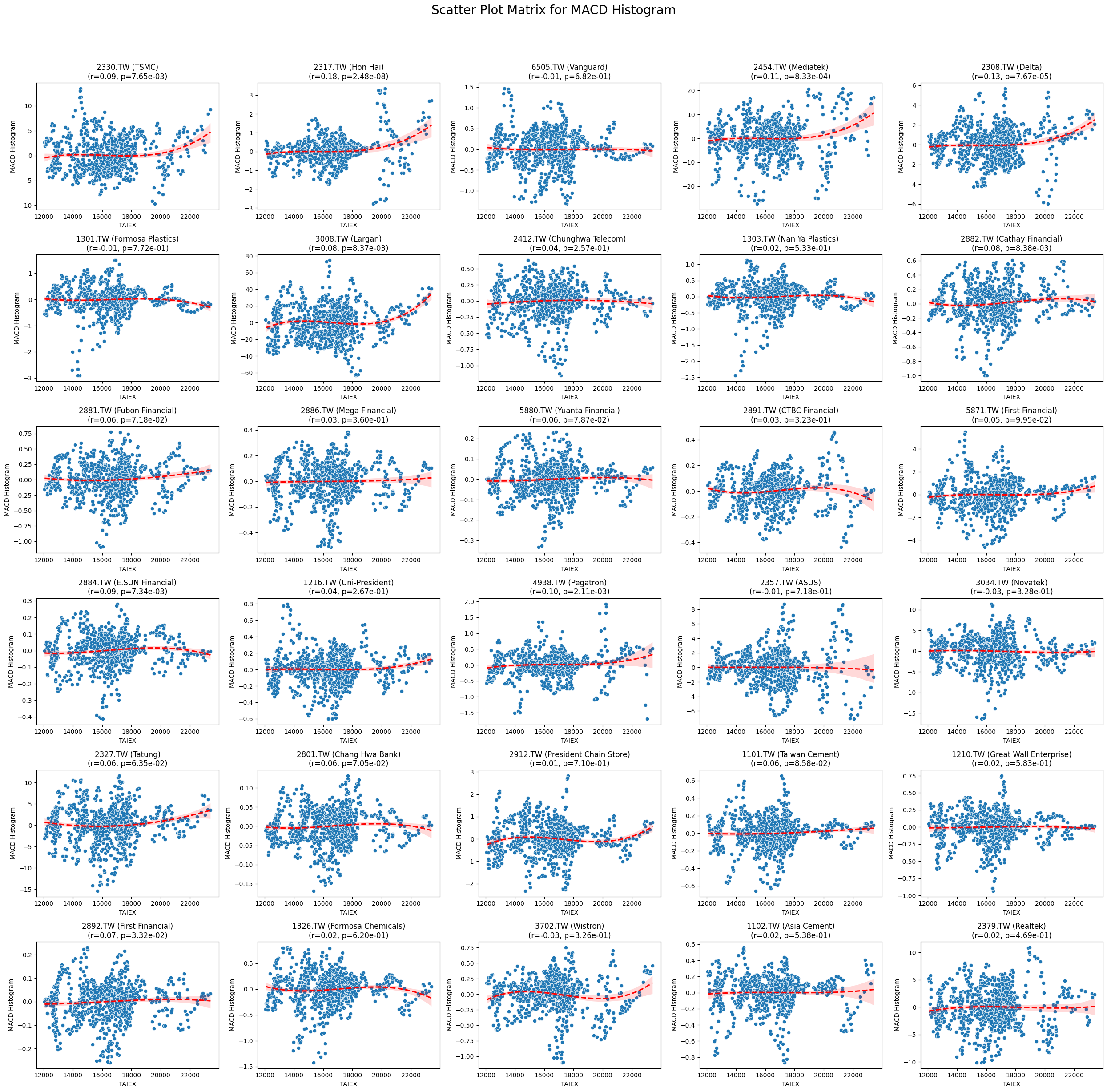

MACD Histogram 0.012701 2.371481e-02

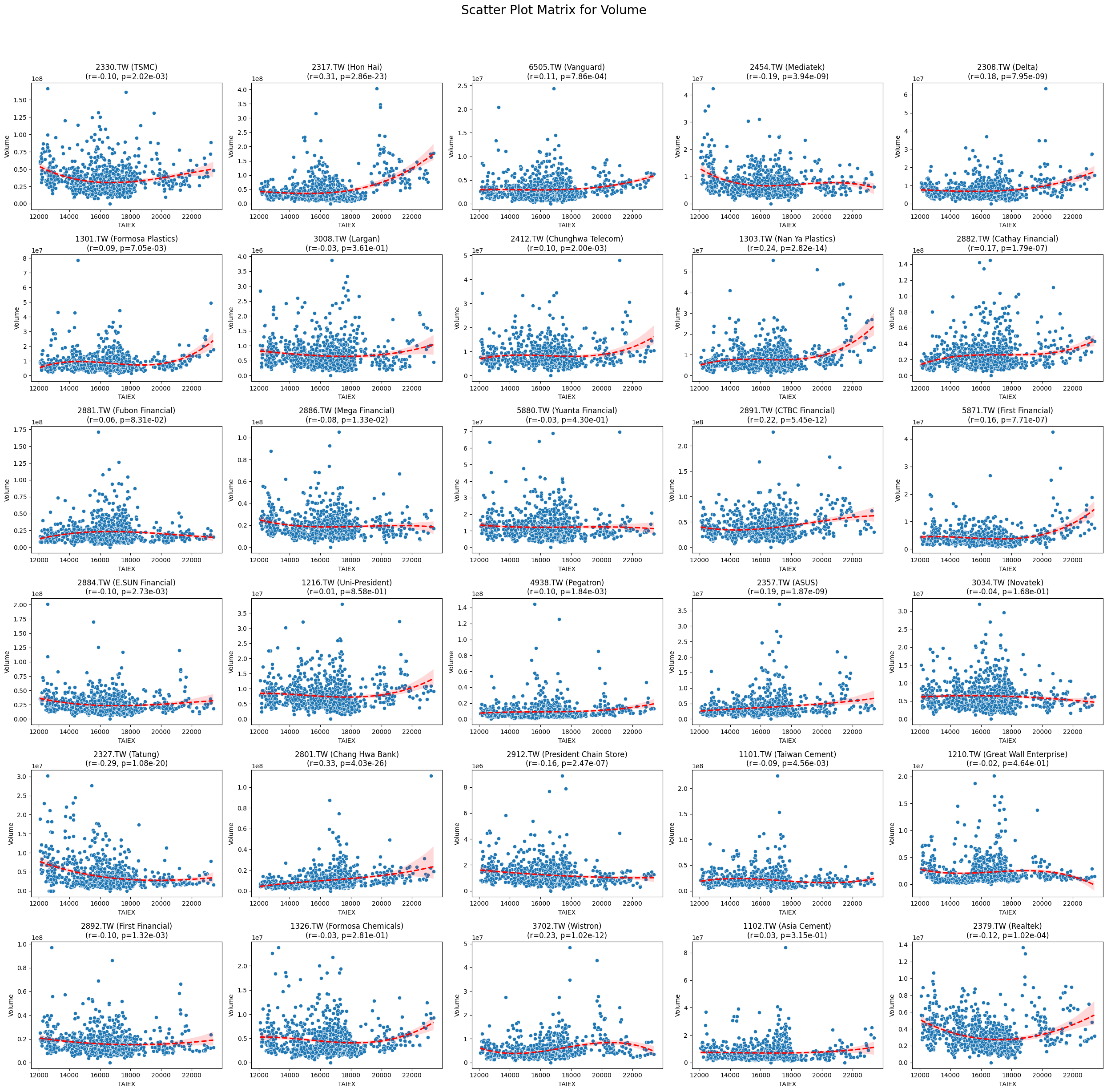

Volume -0.014191 1.028059e-02

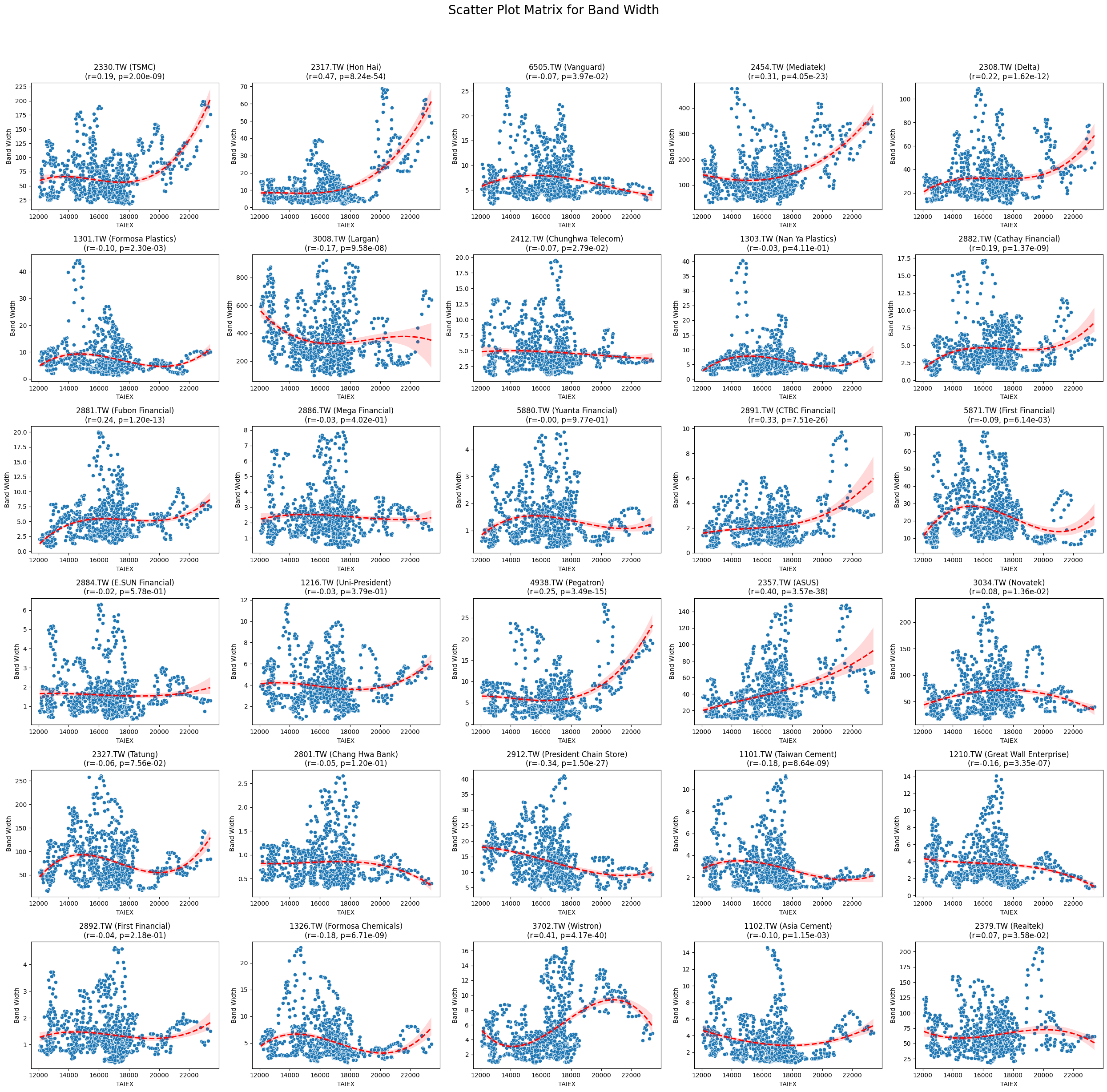

Band Width -0.022150 7.169296e-05

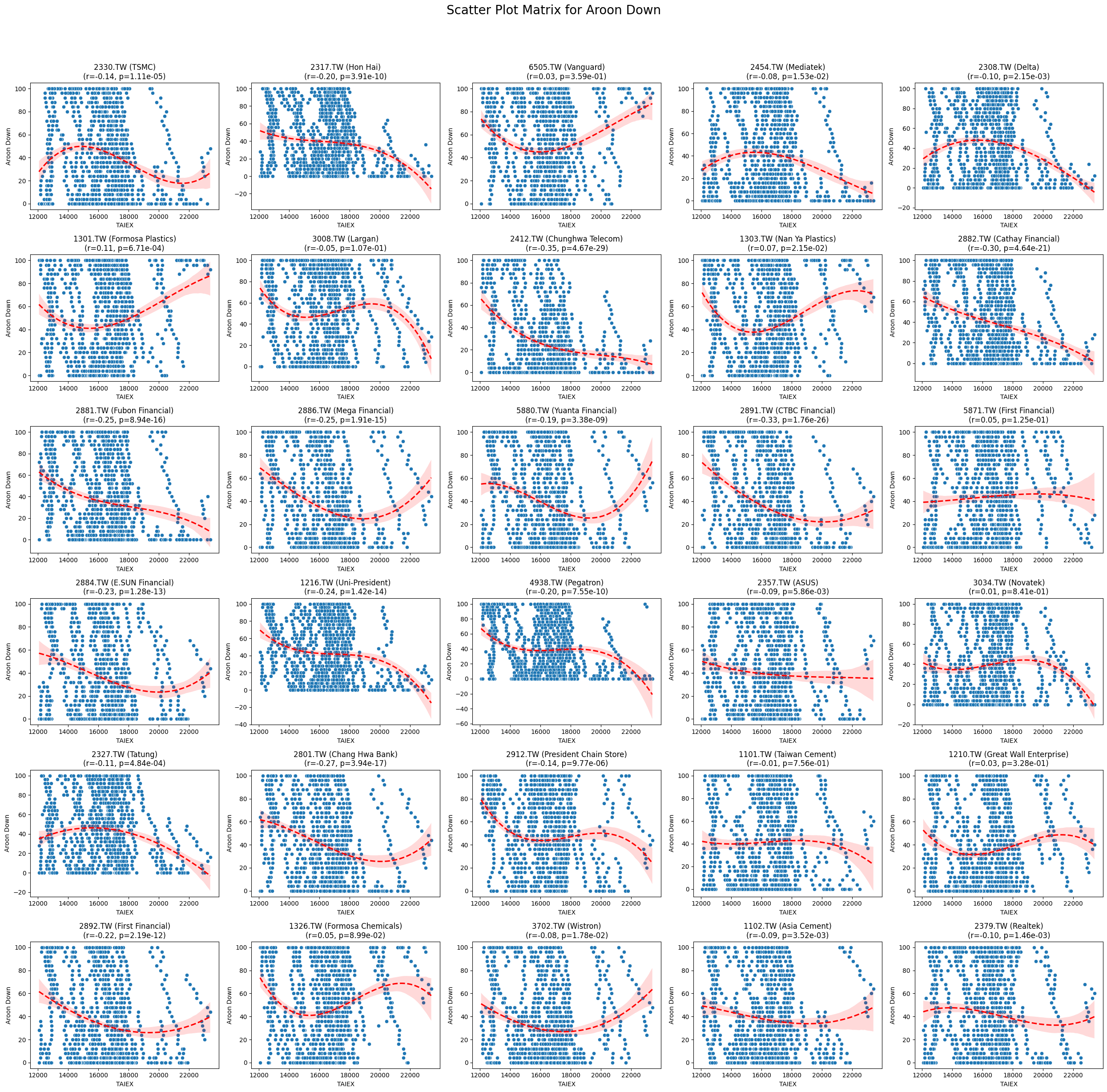

Aroon Down -0.084144 2.690046e-51

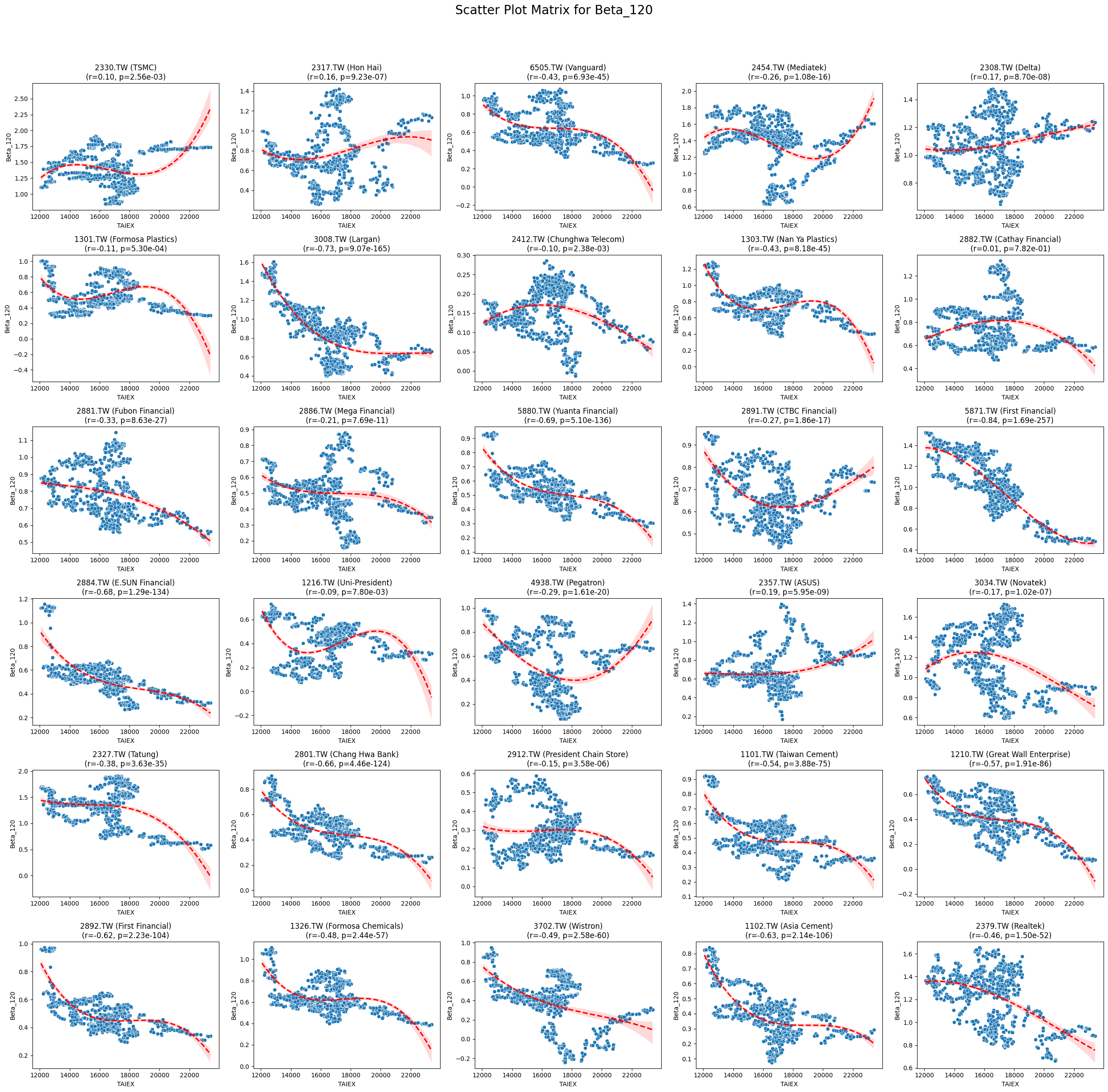

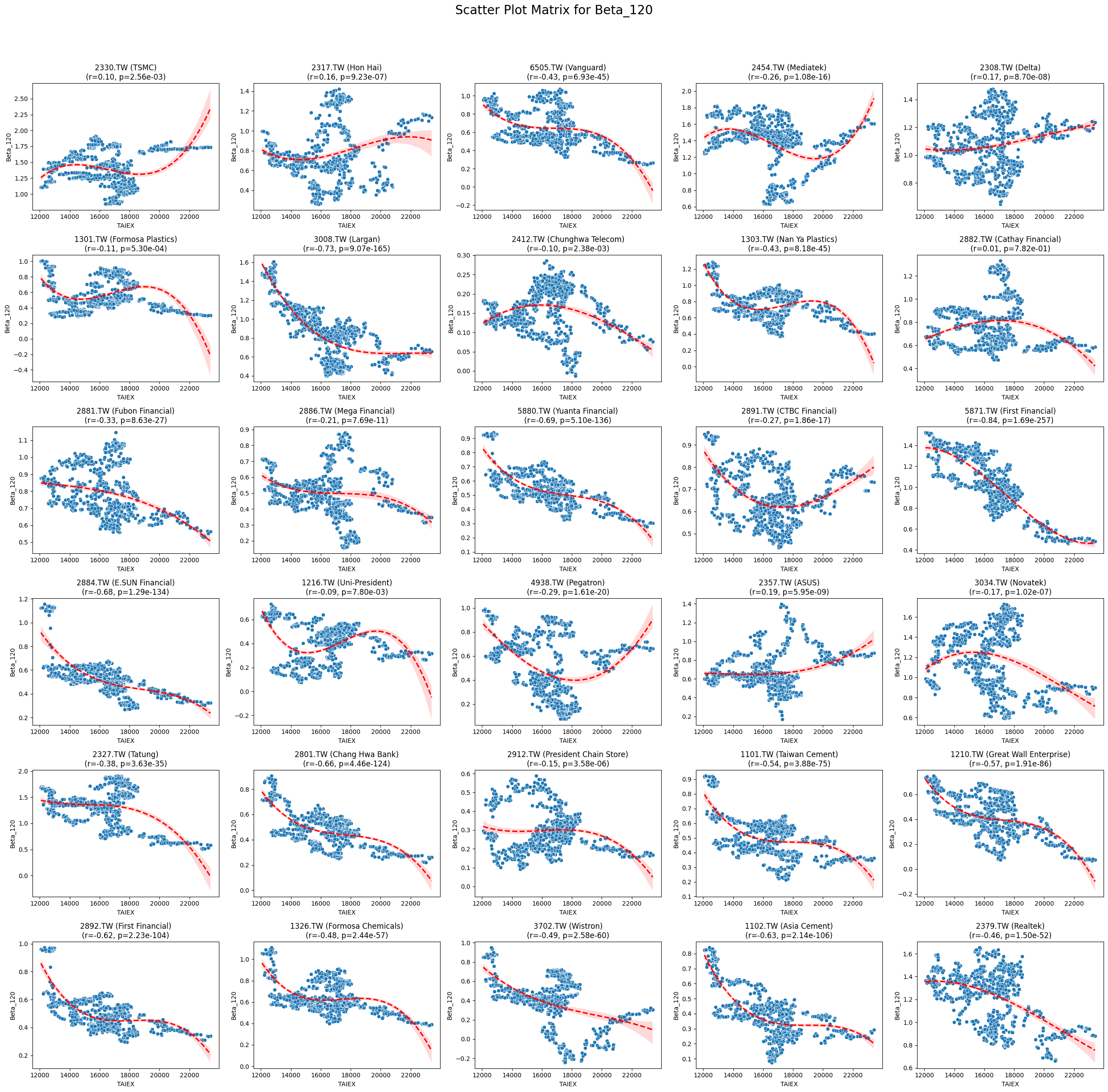

Beta_120 -0.161654 1.405573e-169

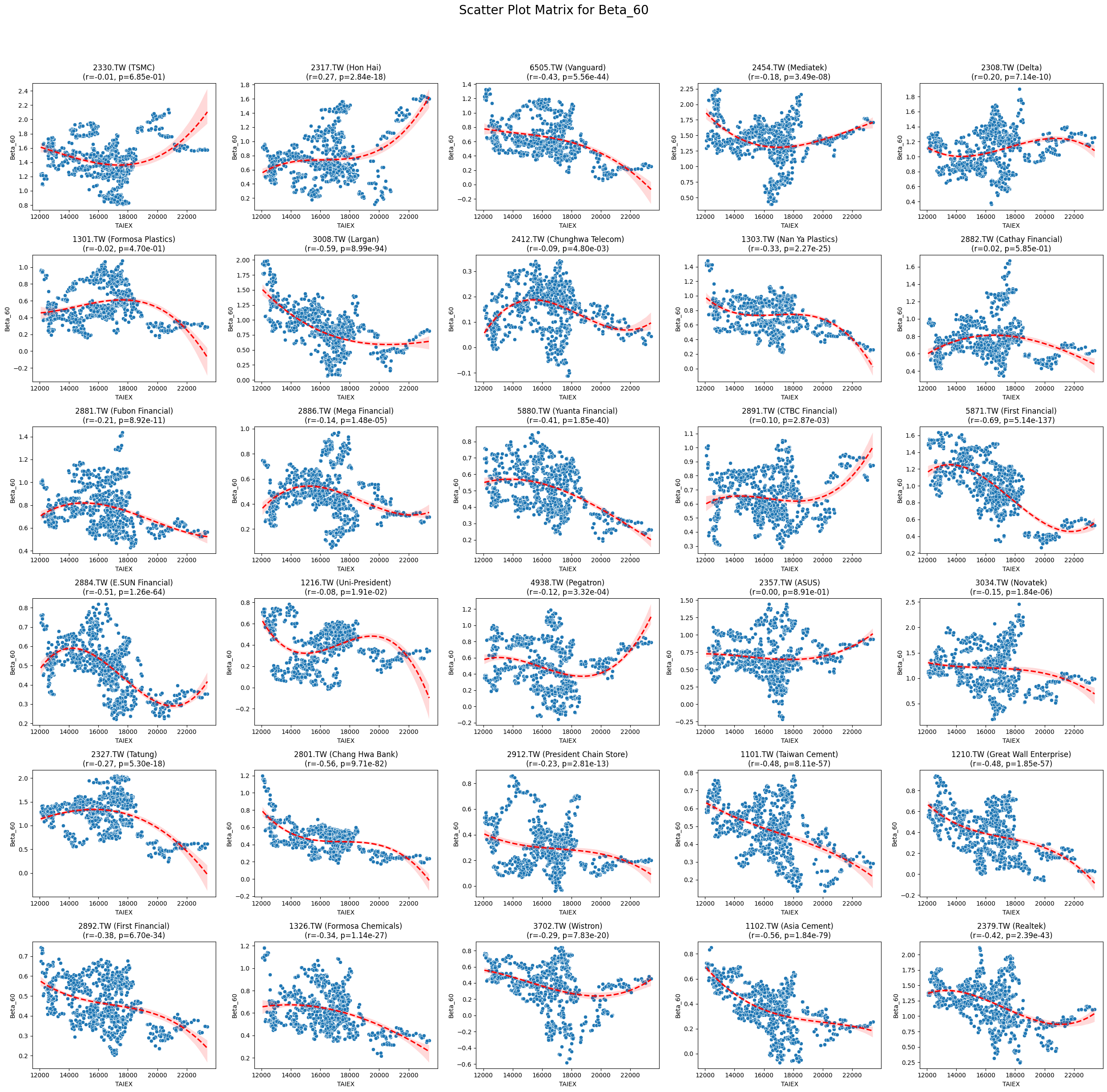

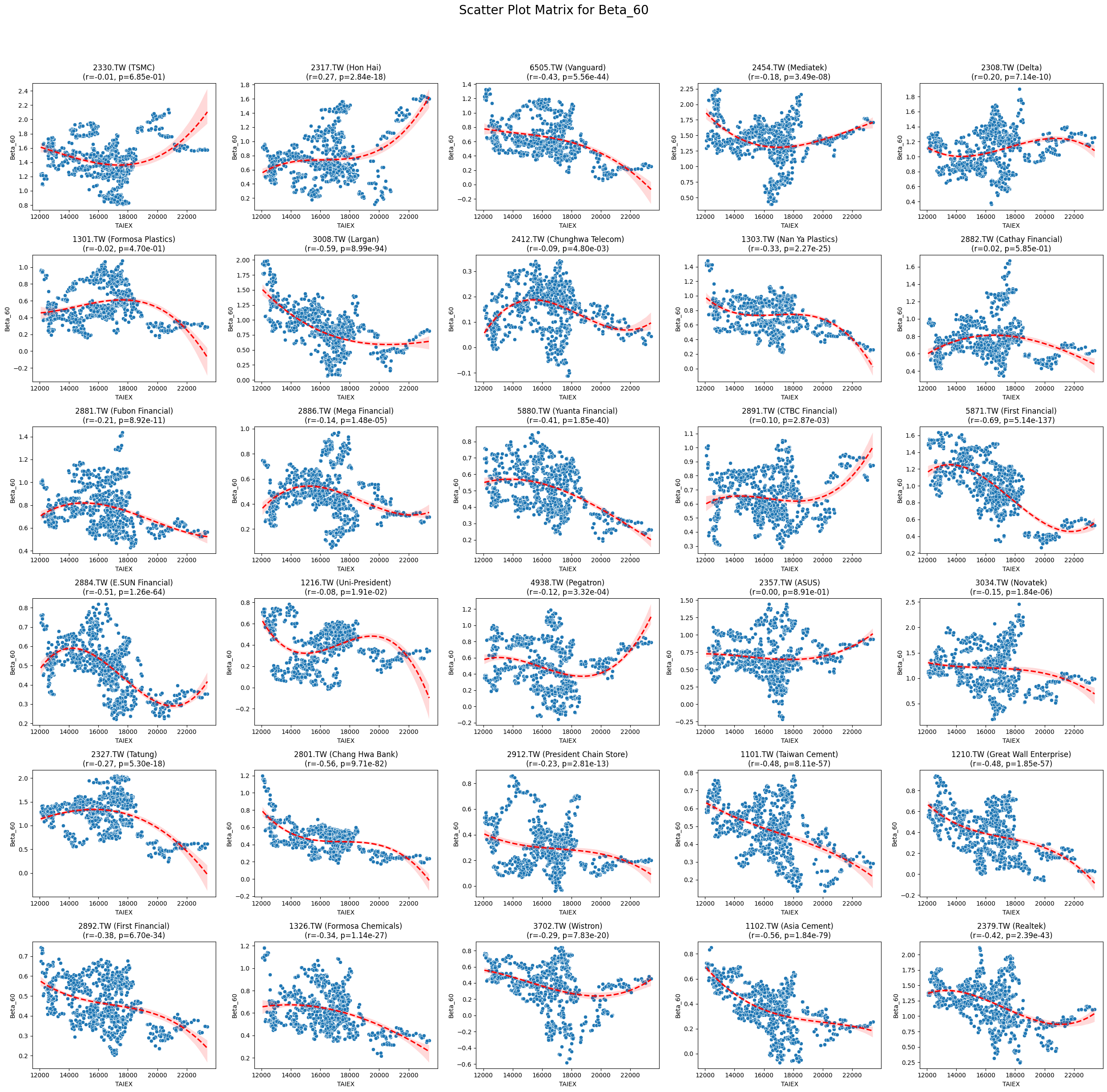

Beta_60 -0.183652 1.560559e-232

Stock Pearson Correlation with Close_TAIEX:

Code

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

from scipy.stats import pearsonr

import statsmodels.api as sm

# Mount Google Drive

from google.colab import drive

drive.mount('/content/drive', force_remount=True)

# Load the data

file_path = '/content/drive/My Drive/MSCI_Taiwan_30_data.csv'

data = pd.read_csv(file_path)

# Convert 'Date' column to datetime

data['Date'] = pd.to_datetime(data['Date'], format='%Y/%m/%d')

# Define the target variable

target_variable = 'Close_TAIEX'

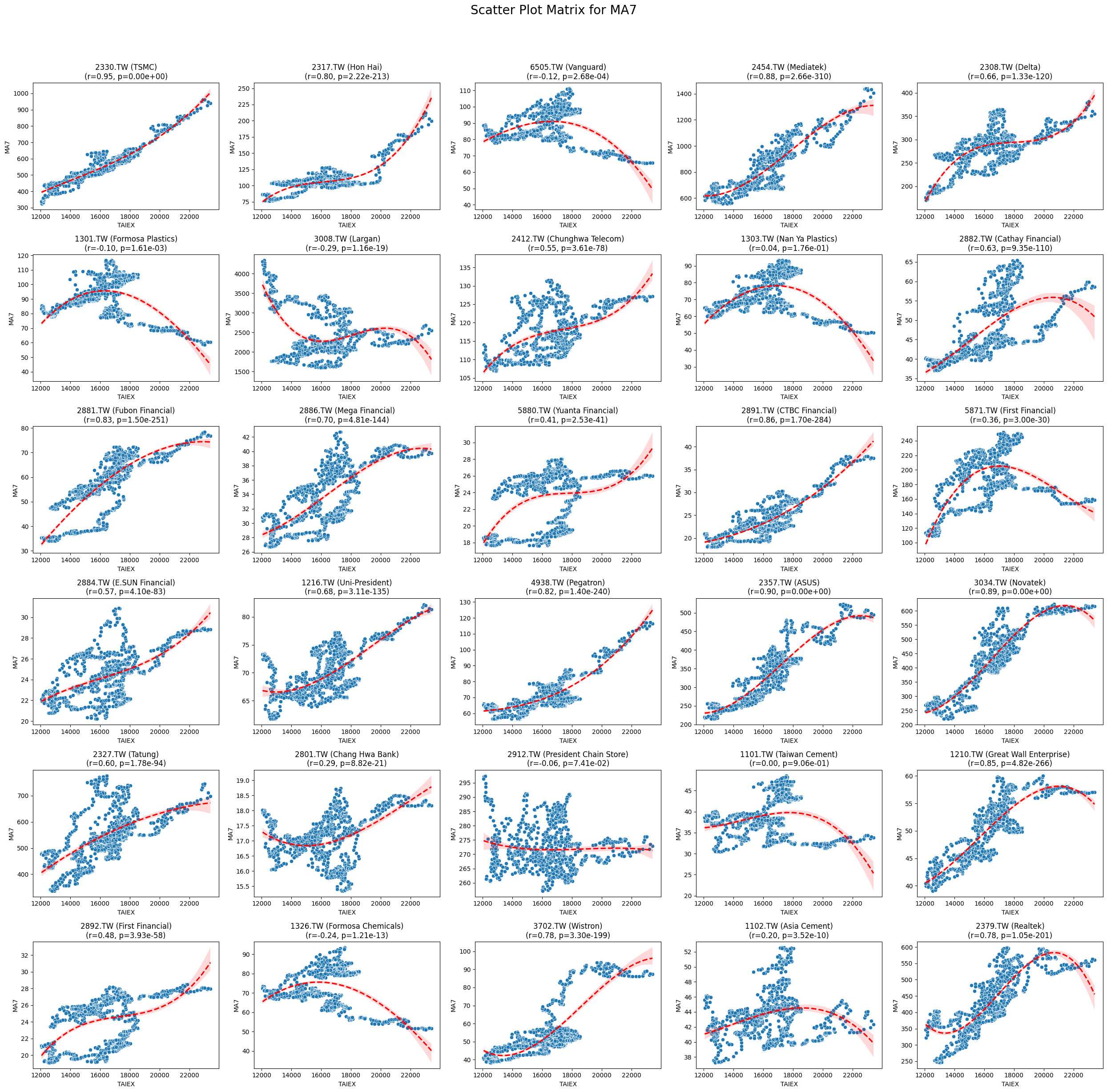

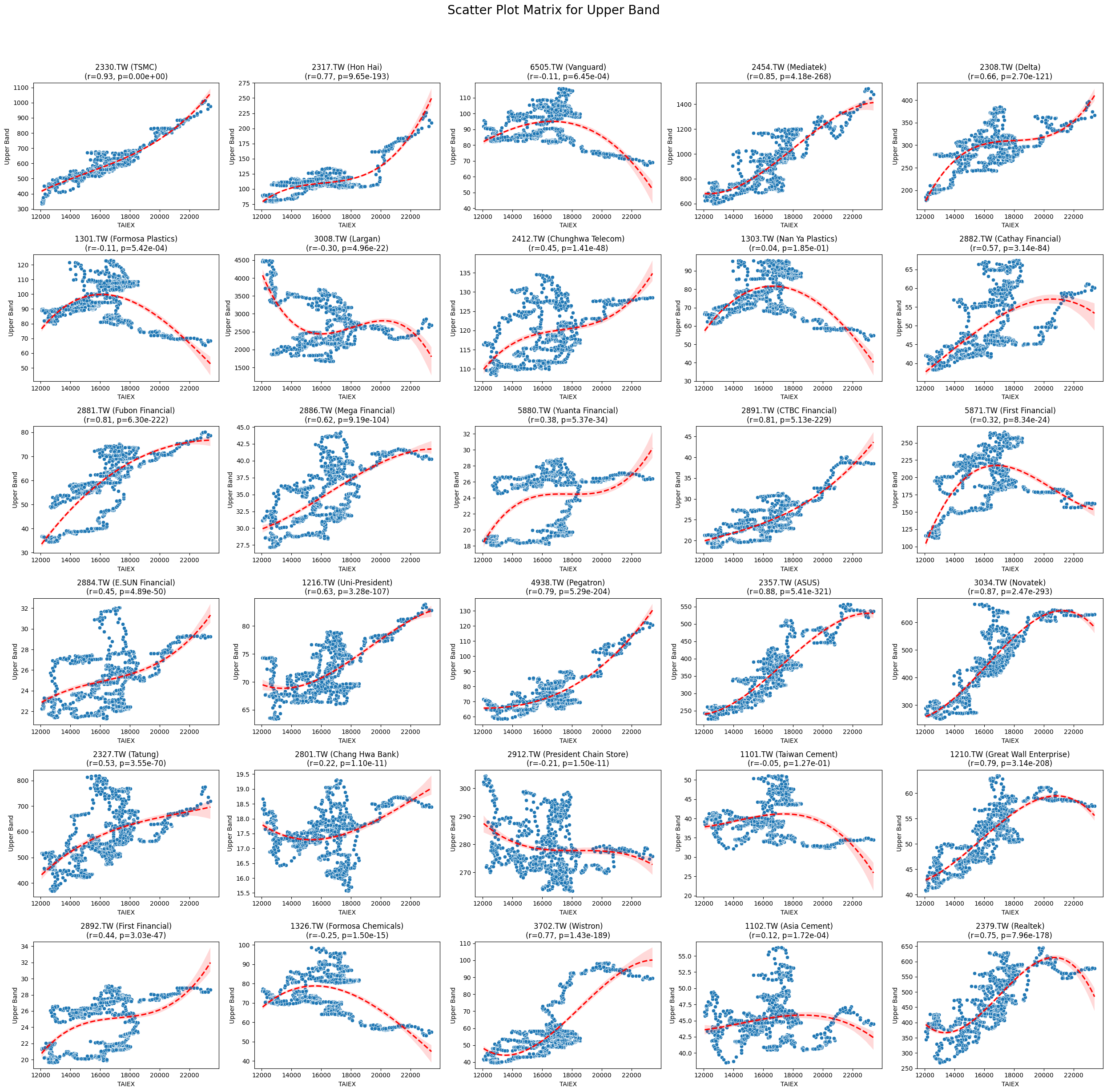

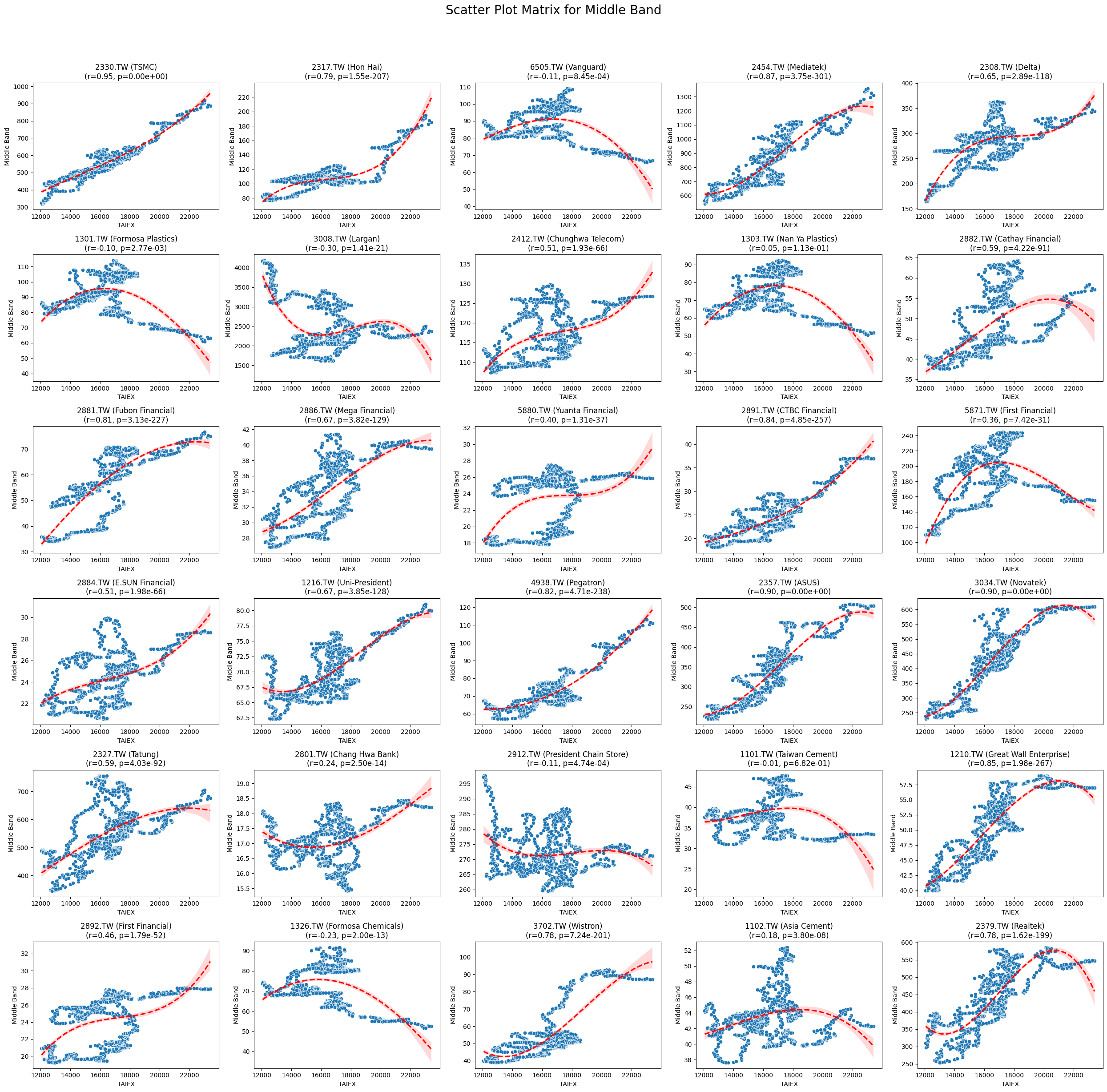

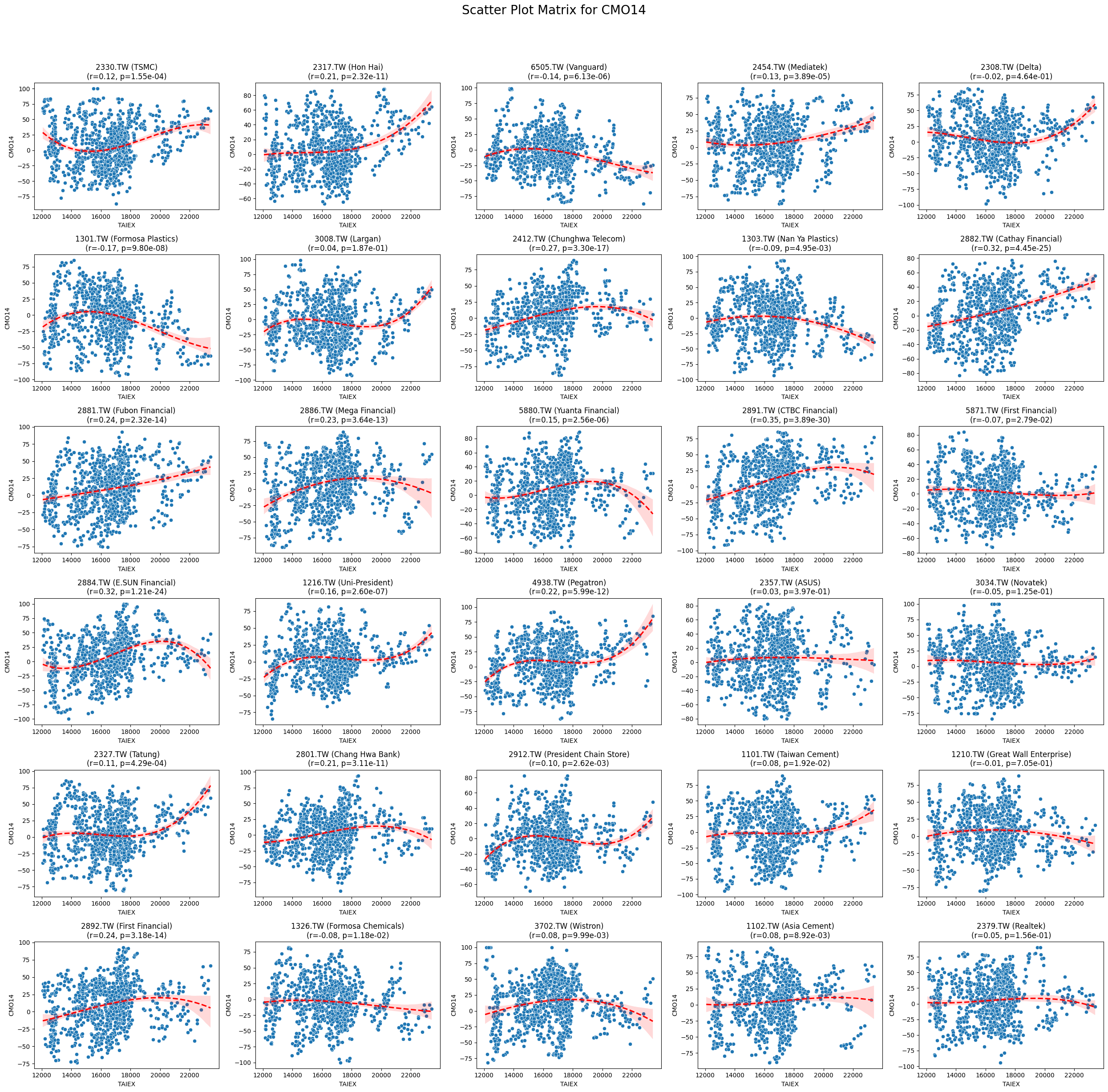

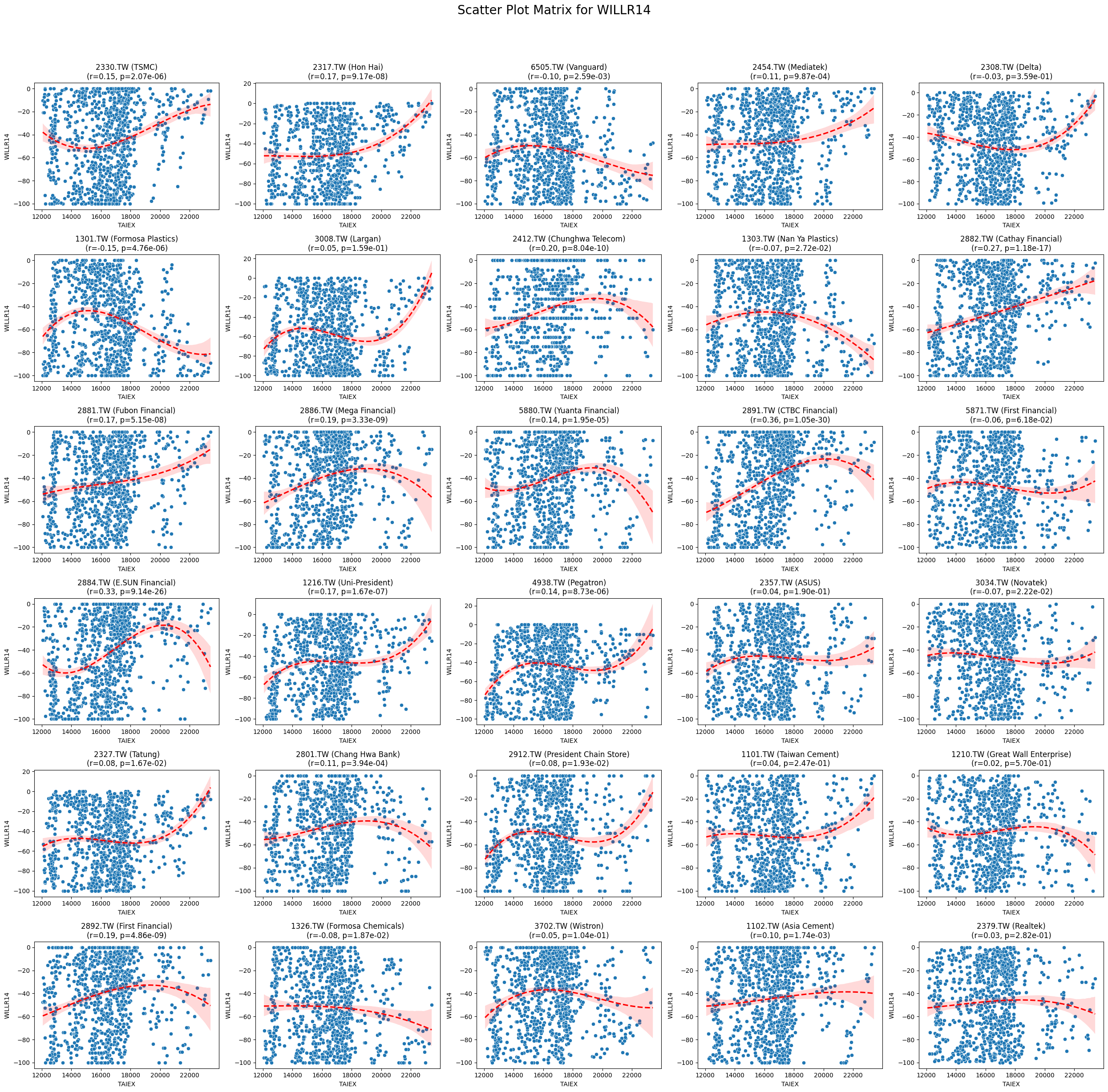

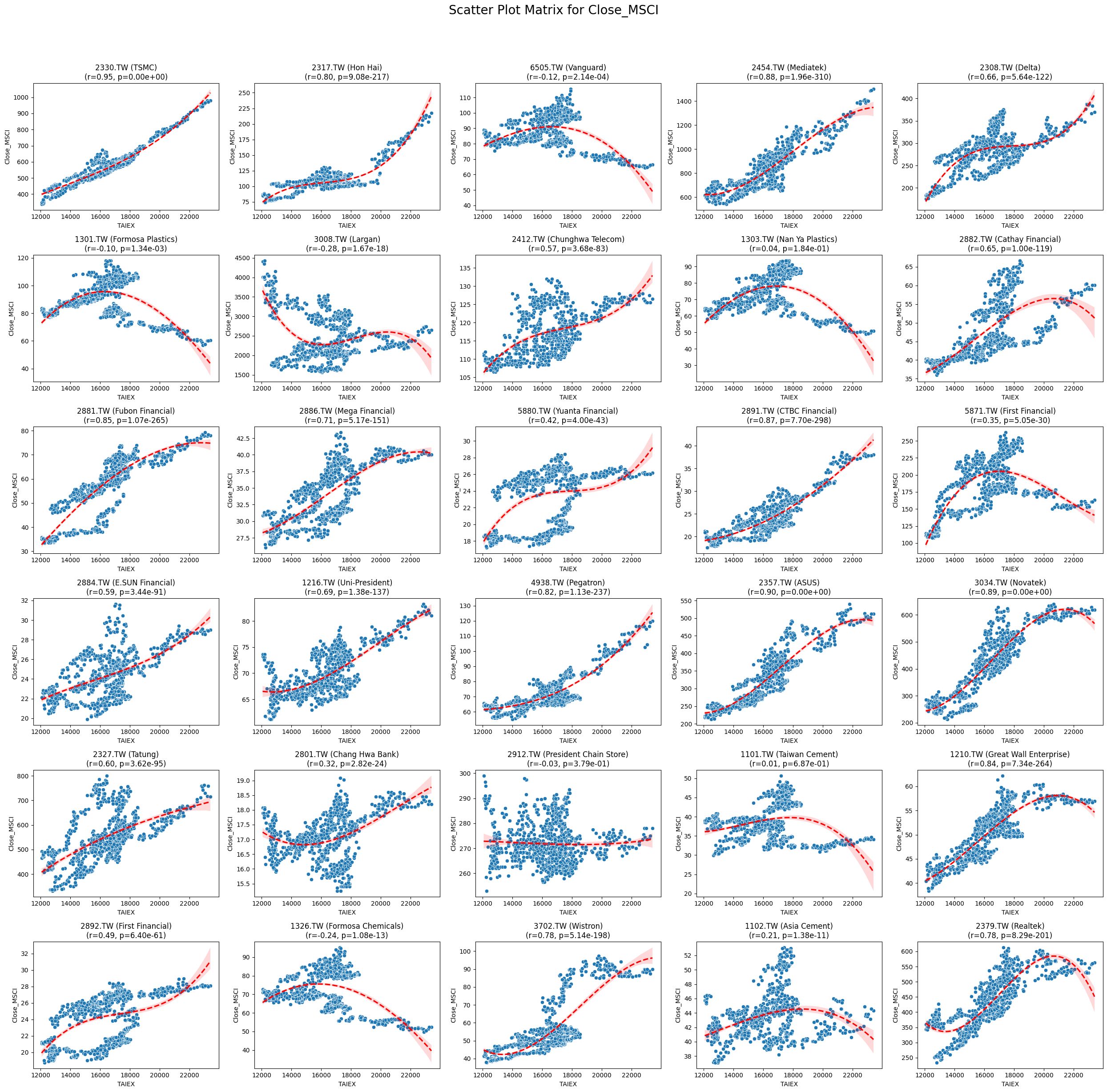

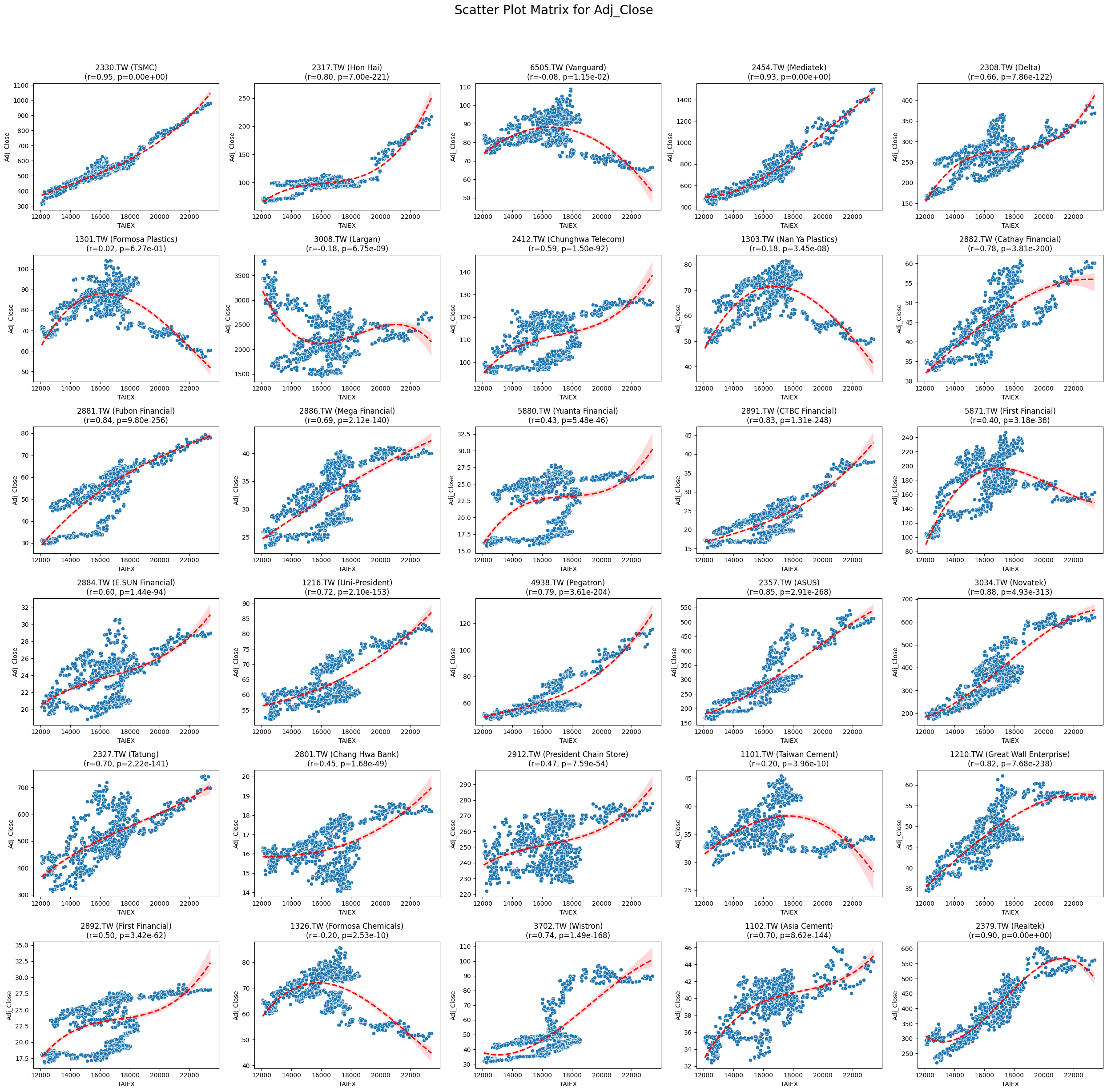

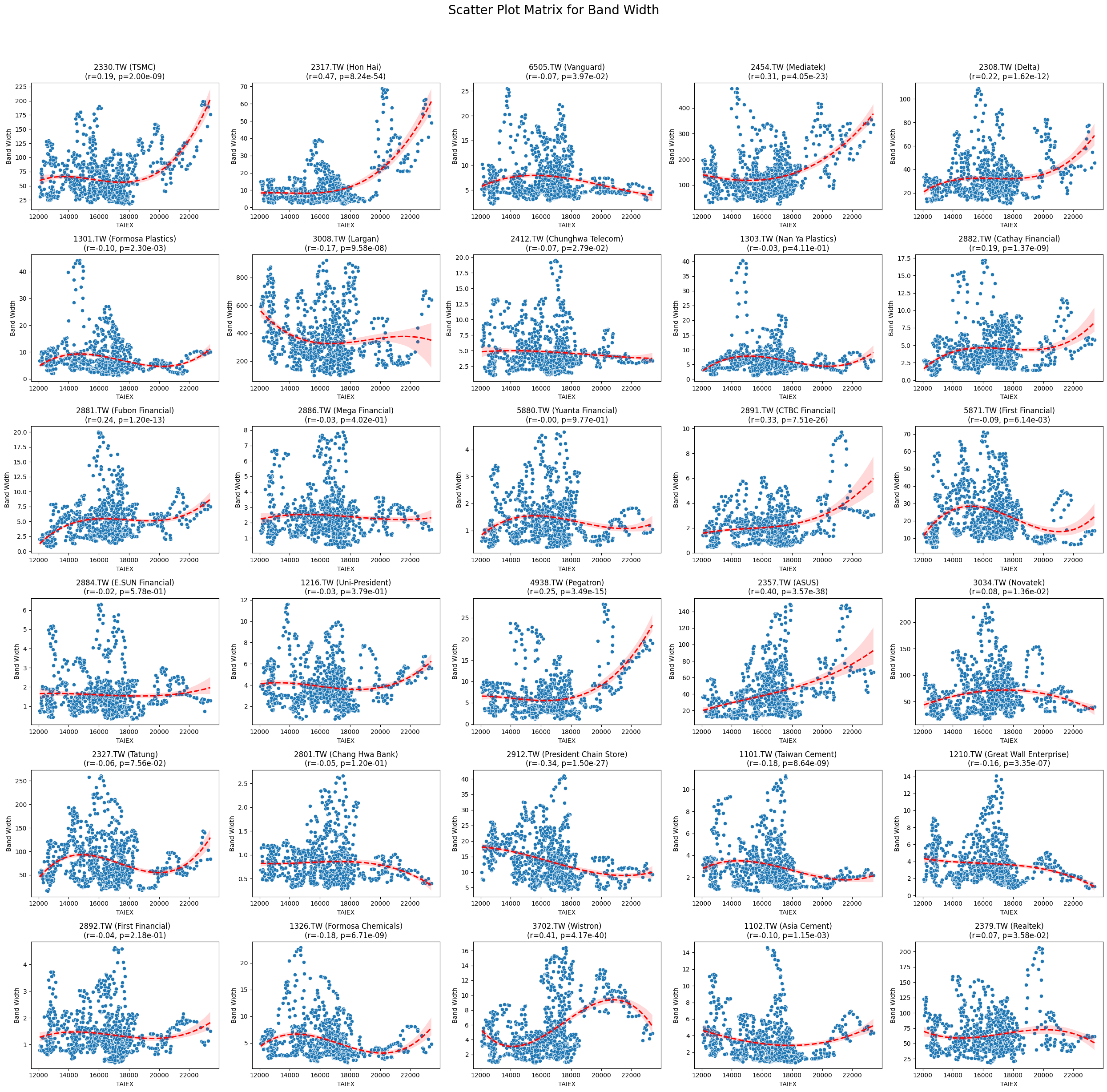

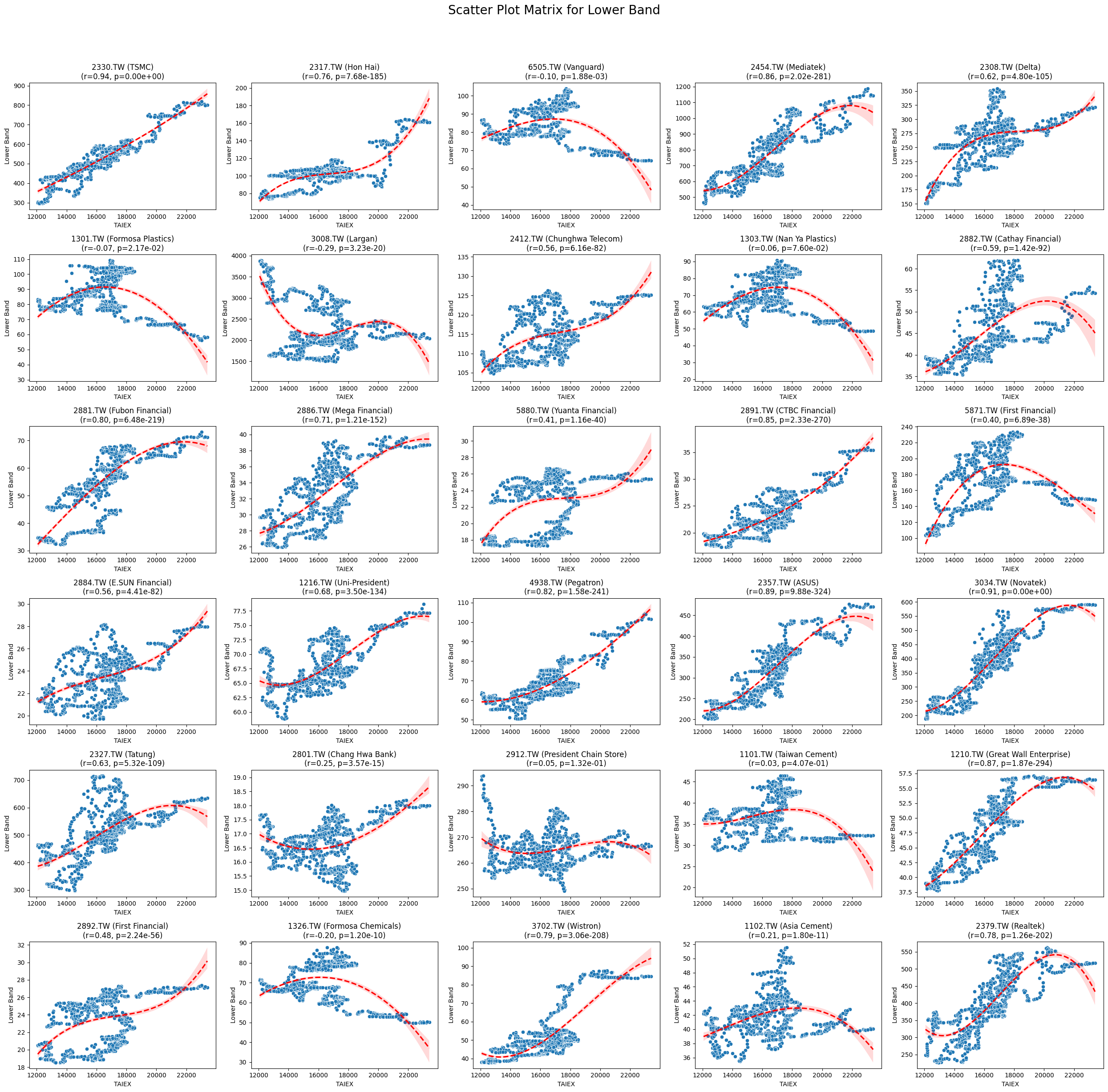

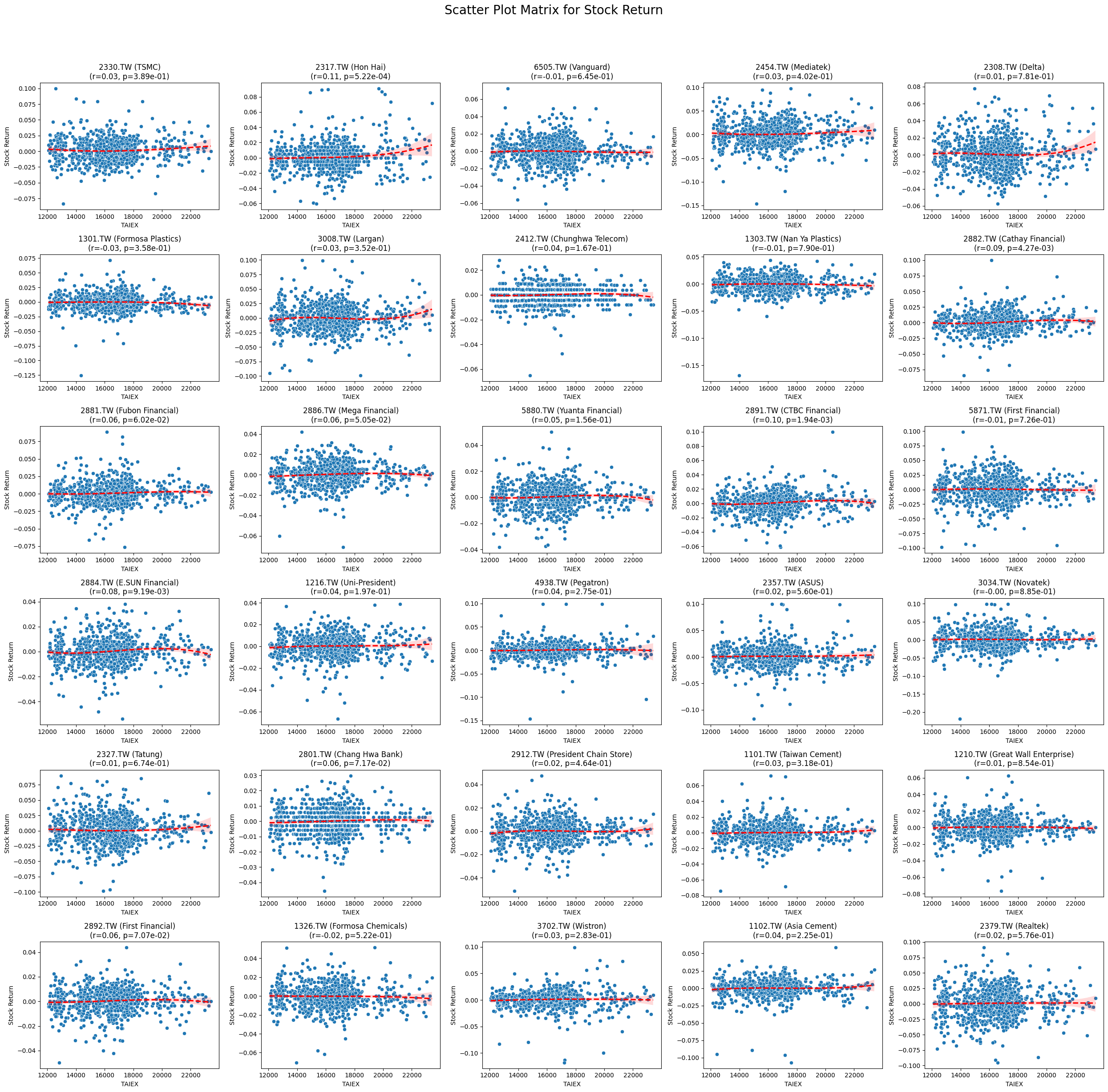

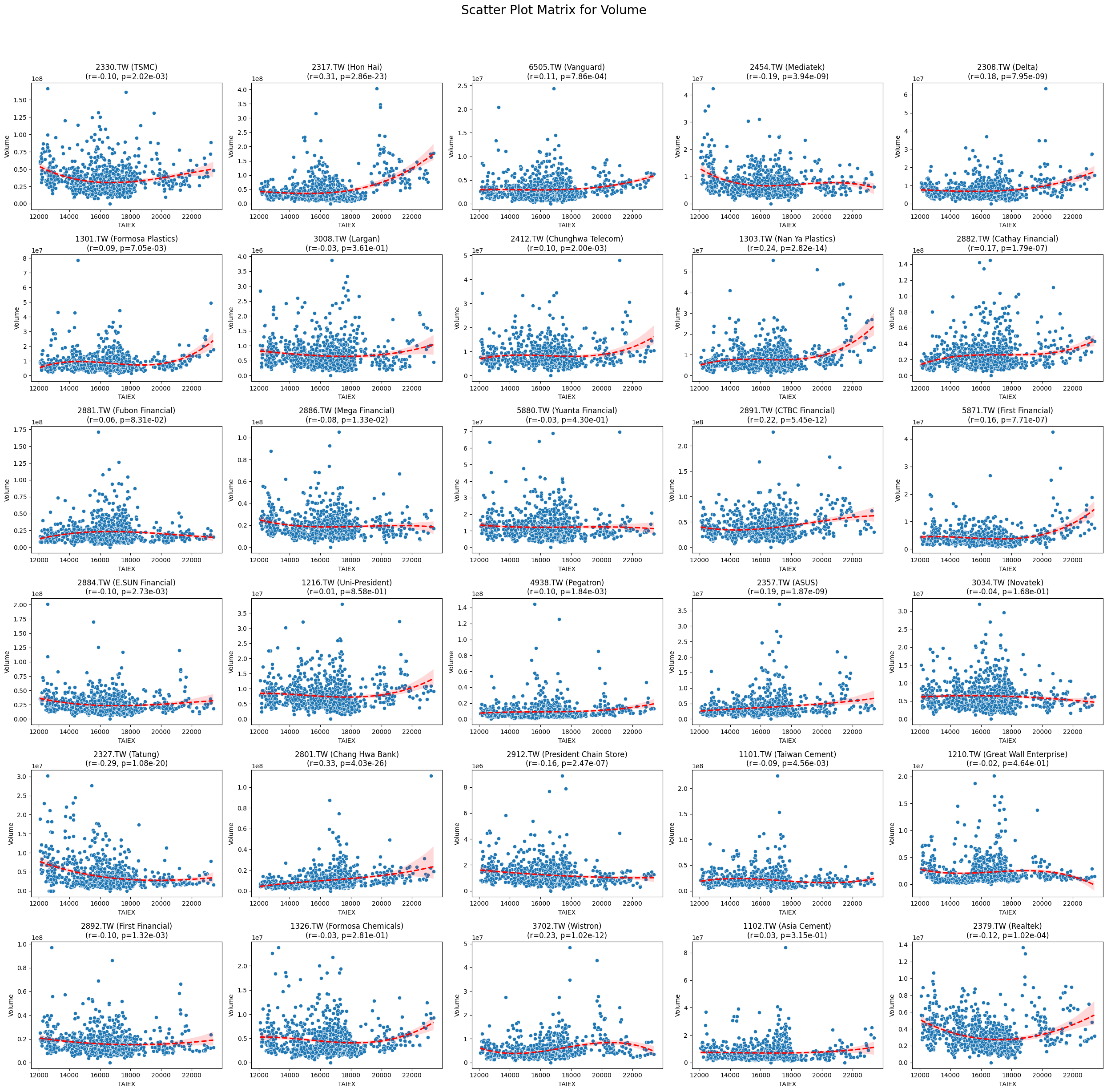

# Function to create scatter plot matrix by variable

def scatter_plot_matrix_by_variable():

variables = [col for col in data.columns if col not in ['Date', 'ST_Code', 'ST_Name', target_variable]]

significant_variables = []

# Identify significant variables

for variable in variables:

for stock_code in data['ST_Code'].unique():

stock_data = data[data['ST_Code'] == stock_code]

taiex_data = data[['Date', target_variable]].drop_duplicates()

aligned_data = pd.merge(stock_data, taiex_data, on='Date', suffixes=('', '_TAIEX'))

aligned_data = aligned_data.replace([np.inf, -np.inf], np.nan).dropna()

if aligned_data.shape[0] > 0 and variable in aligned_data.columns:

correlation, p_value = pearsonr(aligned_data[target_variable], aligned_data[variable])

if p_value <= 0.05:

significant_variables.append(variable)

break

significant_variables = list(set(significant_variables)) # Remove duplicates

# Generate scatter plot matrix for each significant variable

for variable in significant_variables:

plt.figure(figsize=(25, 25))

unique_stock_codes = data['ST_Code'].unique()

for i, stock_code in enumerate(unique_stock_codes):

stock_data = data[data['ST_Code'] == stock_code]

taiex_data = data[['Date', target_variable]].drop_duplicates()

aligned_data = pd.merge(stock_data, taiex_data, on='Date', suffixes=('', '_TAIEX'))

aligned_data = aligned_data.replace([np.inf, -np.inf], np.nan).dropna()

if aligned_data.shape[0] > 0 and variable in aligned_data.columns:

correlation, p_value = pearsonr(aligned_data[target_variable], aligned_data[variable])

plt.subplot((len(unique_stock_codes) + 4) // 5, 5, i + 1)

sns.scatterplot(x=aligned_data[target_variable], y=aligned_data[variable])

sns.regplot(x=aligned_data[target_variable], y=aligned_data[variable], scatter=False, color='red', ci=95, order=3, line_kws={'linestyle': 'dashed'})

stock_name = aligned_data['ST_Name'].iloc[0] # Get the stock name from the first row

plt.title(f'{stock_code} ({stock_name})\n(r={correlation:.2f}, p={p_value:.2e})')

plt.xlabel('TAIEX')

plt.ylabel(variable)

plt.suptitle(f'Scatter Plot Matrix for {variable}', fontsize=20)

plt.tight_layout(rect=[0, 0, 1, 0.95])

plt.savefig(f'/content/drive/My Drive/scatter_plot_matrix_{variable}.png')

plt.show()

# Generate scatter plot matrix by variable

scatter_plot_matrix_by_variable()