# Missing values analysis

missing_values = data.isnull().sum()

print("Missing Values Analysis:")

print(missing_values)

Missing Values Analysis:

Date 0

ST_Code 0

ST_Name 0

Open 0

High 0

Low 0

Close_MSCI 0

Adj_Close 0

Volume 0

MA7 180

MA21 600

MA50 1470

MA100 2970

Middle Band 570

Upper Band 570

Lower Band 570

Band Width 570

Aroon Up 750

Aroon Down 750

CCI20 570

CMO14 390

MACD Line 750

Signal Line 990

MACD Histogram 990

RSI7 180

RSI14 390

RSI21 600

%K 390

%D 450

WILLR14 390

Market Return 30

Stock Return 30

Beta_60 1800

Beta_120 3600

Close_TAIEX 0

OBV 0

dtype: int64

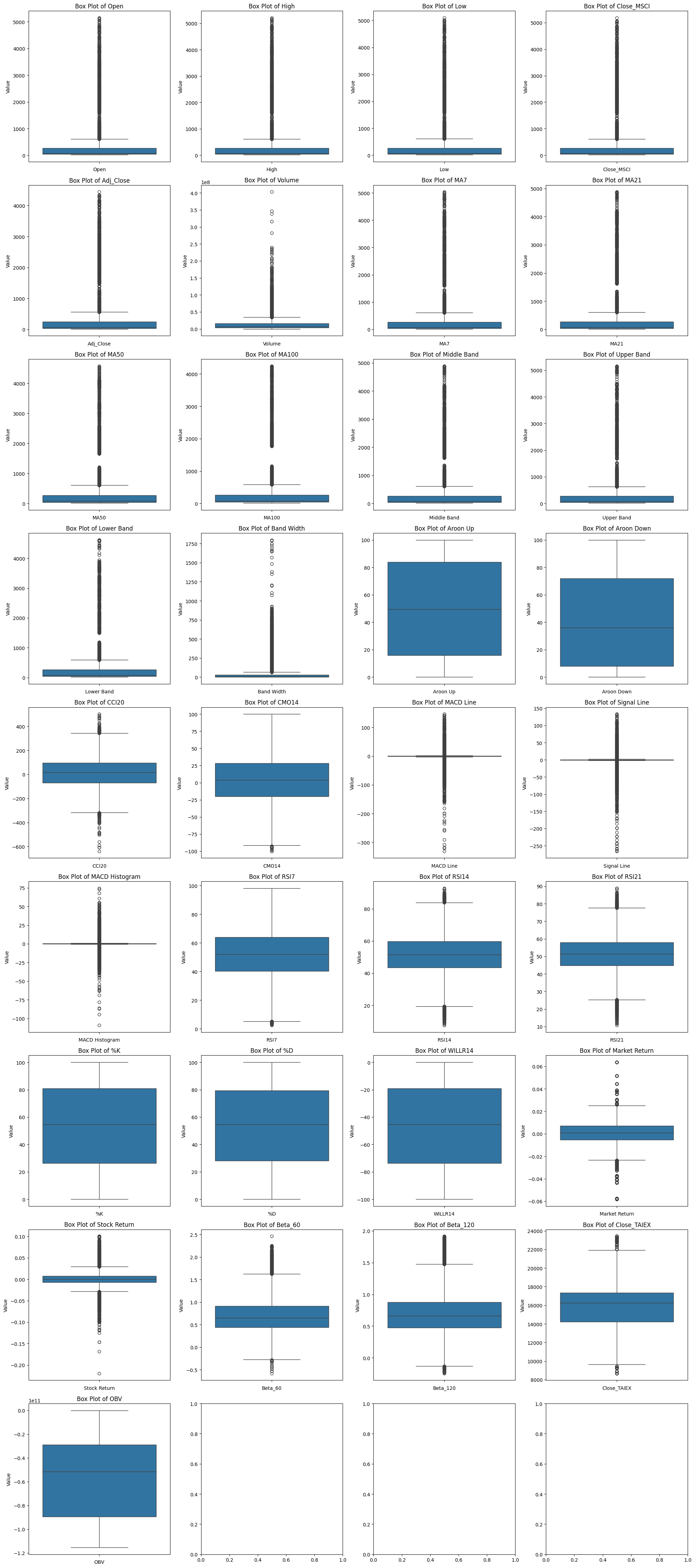

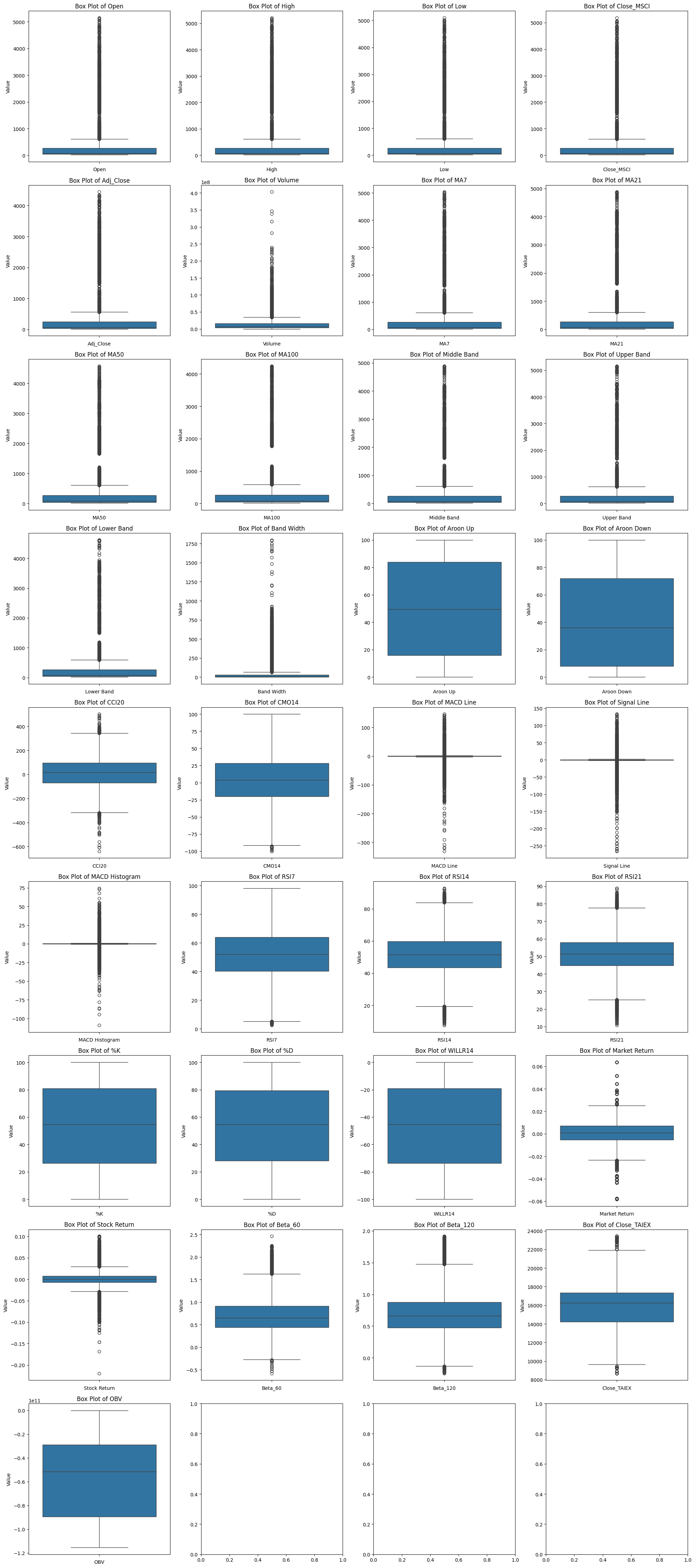

- 首先排除了非數值型數據

- 然後對數值型數據進行均值填補

- 並重新進行缺失值分析和描述性統計分析。

- 接著重新繪製了每個變數的 Box Plot Matrix Map。

import pandas as pd

# 加載數據

file_path = '/content/drive/My Drive/MSCI_Taiwan_30_data_with_OBV.csv'

data = pd.read_csv(file_path)

# 顯示缺失值分析結果

missing_values = data.isnull().sum()

print("Missing Values Analysis:")

print(missing_values)

# 排除非數值列

numeric_data = data.select_dtypes(include=[float, int])

# 填補缺失值,使用列的均值

data_filled = numeric_data.fillna(numeric_data.mean())

# 顯示填補後的缺失值分析結果

missing_values_filled = data_filled.isnull().sum()

print("Missing Values Analysis After Filling:")

print(missing_values_filled)

# 確認填補後數據集是否仍有缺失值

assert missing_values_filled.sum() == 0, "There are still missing values after filling!"

print("All missing values have been successfully filled.")

# 描述性統計

descriptive_stats_filled = data_filled.describe()

print("Descriptive Statistics After Filling Missing Values:")

print(descriptive_stats_filled)

[1]

26 秒

from google.colab import drive

drive.mount('/content/drive')

Mounted at /content/drive

[10]

12 秒

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

from scipy import stats

# Load the data

file_path = '/content/drive/My Drive/MSCI_Taiwan_30_data_with_OBV.csv'

data = pd.read_csv(file_path)

# Descriptive statistics

descriptive_stats = data.describe()

print("Descriptive Statistics:")

print(descriptive_stats)

# Plot histograms

data.hist(bins=50, figsize=(20, 15))

plt.suptitle('Histograms of Variables')

plt.show()

[11]

15 分鐘

# Sample data

sampled_data = data.sample(n=1000, random_state=42)

# Plot pairwise relationships

sns.pairplot(sampled_data)

plt.suptitle('Scatter Plot of Variables', y=1.02)

plt.show()

[18]

4 秒

sns.heatmap(correlation_matrix, annot=True, cmap='coolwarm', annot_kws={"size": 6.5})

plt.title('Correlation Heatmap')

plt.show()

[21]

0 秒

# Normality test

print("Normality Test:")

for column in numeric_data.columns:

stat, p = stats.shapiro(numeric_data[column].dropna())

print(f'{column}: Statistics={stat}, p={p}')

Normality Test:

Open: Statistics=0.44388264417648315, p=0.0

High: Statistics=0.44386327266693115, p=0.0

Low: Statistics=0.44448310136795044, p=0.0

Close_MSCI: Statistics=0.44464701414108276, p=0.0

Adj_Close: Statistics=0.44800859689712524, p=0.0

Volume: Statistics=0.616114616394043, p=0.0

MA7: Statistics=0.4454984664916992, p=0.0

MA21: Statistics=0.4475475549697876, p=0.0

MA50: Statistics=0.4513601064682007, p=0.0

MA100: Statistics=0.45628875494003296, p=0.0

Middle Band: Statistics=0.44740188121795654, p=0.0

Upper Band: Statistics=0.44556015729904175, p=0.0

Lower Band: Statistics=0.44893014430999756, p=0.0

Band Width: Statistics=0.37196314334869385, p=0.0

Aroon Up: Statistics=0.8953447341918945, p=0.0

Aroon Down: Statistics=0.8862640261650085, p=0.0

CCI20: Statistics=0.9935651421546936, p=1.4978255776941871e-34

CMO14: Statistics=0.9970583319664001, p=4.02672471348255e-24

MACD Line: Statistics=0.4291476607322693, p=0.0

Signal Line: Statistics=0.4337118864059448, p=0.0

MACD Histogram: Statistics=0.4151105284690857, p=0.0

RSI7: Statistics=0.9972341656684875, p=1.9062553984236165e-23

RSI14: Statistics=0.9991347789764404, p=1.0700896765913903e-11

RSI21: Statistics=0.998984158039093, p=5.296772677583494e-13

%K: Statistics=0.9418363571166992, p=0.0

%D: Statistics=0.9411165714263916, p=0.0

WILLR14: Statistics=0.9418363571166992, p=0.0

Market Return: Statistics=0.9587656259536743, p=0.0

Stock Return: Statistics=0.9099488854408264, p=0.0

Beta_60: Statistics=0.9558936357498169, p=0.0

Beta_120: Statistics=0.9457791447639465, p=0.0

Close_TAIEX: Statistics=0.9737288951873779, p=0.0

OBV: Statistics=0.9423521161079407, p=0.0

[25]

18 秒

import math

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

# 加載數據

file_path = '/content/drive/My Drive/MSCI_Taiwan_30_data_with_OBV.csv'

data = pd.read_csv(file_path)

# 排除非數值列

numeric_data = data.drop(columns=['Date', 'ST_Code', 'ST_Name'])

# 獲取變數列表

variables = numeric_data.columns

# 設置圖表大小

num_vars = len(variables)

num_cols = 4

num_rows = math.ceil(num_vars / num_cols)

fig, axes = plt.subplots(num_rows, num_cols, figsize=(20, num_rows * 5))

# 繪製每個變數的 Box Plot

for i, var in enumerate(variables):

row = i // num_cols

col = i % num_cols

sns.boxplot(data=numeric_data[var], ax=axes[row, col])

axes[row, col].set_title(f'Box Plot of {var}')

axes[row, col].set_xlabel(var)

axes[row, col].set_ylabel('Value')

# 調整佈局

plt.tight_layout()

plt.show()

[29]

0 秒

import pandas as pd

# 加載數據

file_path = '/content/drive/My Drive/MSCI_Taiwan_30_data_with_OBV.csv'

data = pd.read_csv(file_path)

# 顯示缺失值分析結果

missing_values = data.isnull().sum()

print("Missing Values Analysis:")

print(missing_values)

Missing Values Analysis:

Date 0

ST_Code 0

ST_Name 0

Open 0

High 0

Low 0

Close_MSCI 0

Adj_Close 0

Volume 0

MA7 180

MA21 600

MA50 1470

MA100 2970

Middle Band 570

Upper Band 570

Lower Band 570

Band Width 570

Aroon Up 750

Aroon Down 750

CCI20 570

CMO14 390

MACD Line 750

Signal Line 990

MACD Histogram 990

RSI7 180

RSI14 390

RSI21 600

%K 390

%D 450

WILLR14 390

Market Return 30

Stock Return 30

Beta_60 1800

Beta_120 3600

Close_TAIEX 0

OBV 0

dtype: int64

[30]

2 秒

# 填補缺失值,使用列的均值

data_filled = data.fillna(data.mean())

# 顯示填補後的缺失值分析結果

missing_values_filled = data_filled.isnull().sum()

print("Missing Values Analysis After Filling:")

print(missing_values_filled)

後續步驟:

[31]

1 秒

import pandas as pd

# 加載數據

file_path = '/content/drive/My Drive/MSCI_Taiwan_30_data_with_OBV.csv'

data = pd.read_csv(file_path)

# 顯示缺失值分析結果

missing_values = data.isnull().sum()

print("Missing Values Analysis:")

print(missing_values)

…

Missing Values Analysis:

Date 0

ST_Code 0

ST_Name 0

Open 0

High 0

Low 0

Close_MSCI 0

Adj_Close 0

Volume 0

MA7 180

MA21 600

MA50 1470

MA100 2970

Middle Band 570

Upper Band 570

Lower Band 570

Band Width 570

Aroon Up 750

Aroon Down 750

CCI20 570

CMO14 390

MACD Line 750

Signal Line 990

MACD Histogram 990

RSI7 180

RSI14 390

RSI21 600

%K 390

%D 450

WILLR14 390

Market Return 30

Stock Return 30

Beta_60 1800

Beta_120 3600

Close_TAIEX 0

OBV 0

dtype: int64

Missing Values Analysis After Filling:

Open 0

High 0

Low 0

Close_MSCI 0

Adj_Close 0

Volume 0

MA7 0

MA21 0

MA50 0

MA100 0

Middle Band 0

Upper Band 0

Lower Band 0

Band Width 0

Aroon Up 0

Aroon Down 0

CCI20 0

CMO14 0

MACD Line 0

Signal Line 0

MACD Histogram 0

RSI7 0

RSI14 0

RSI21 0

%K 0

%D 0

WILLR14 0

Market Return 0

Stock Return 0

Beta_60 0

Beta_120 0

Close_TAIEX 0

OBV 0

dtype: int64

All missing values have been successfully filled.

Descriptive Statistics After Filling Missing Values:

Open High Low Close_MSCI Adj_Close \

count 32700.000000 32700.000000 32700.000000 32700.000000 32700.000000

mean 250.214867 253.012017 247.112520 249.812194 227.177200

std 512.800070 518.951093 505.316701 511.027804 460.886560

min 14.345764 14.653801 13.949715 14.125737 12.343324

25% 40.170254 40.400002 39.900002 40.146721 36.394313

50% 75.599998 76.350002 75.000000 75.750000 70.308552

75% 269.000000 271.000000 267.500000 269.500000 245.990616

max 5150.000000 5210.000000 5095.000000 5180.000000 4442.363770

Volume MA7 MA21 MA50 MA100 \

count 3.270000e+04 32700.000000 32700.000000 32700.000000 32700.000000

mean 1.272284e+07 249.524745 248.895559 247.962300 247.195609

std 1.695529e+07 508.009952 501.046905 487.944386 469.043215

min 0.000000e+00 15.081283 15.427423 15.700038 15.818984

25% 3.443974e+06 40.276786 40.652381 41.666417 43.076875

50% 7.088050e+06 76.400000 77.657143 80.338000 85.189000

75% 1.574579e+07 268.928571 267.982143 266.787500 261.248750

max 4.030225e+08 5036.428571 4880.000000 4576.800000 4244.050000

... RSI21 %K %D WILLR14 \

count ... 32700.000000 32700.000000 32700.000000 32700.000000

mean ... 51.413402 53.223367 53.259936 -46.776633

std ... 10.145010 30.615820 28.442260 30.615820

min ... 10.758806 0.000000 0.000000 -100.000000

25% ... 44.886641 26.470588 28.029442 -73.529412

50% ... 51.413402 54.545470 54.578062 -45.454530

75% ... 57.965856 80.769314 79.334948 -19.230686

max ... 88.817477 100.000000 100.000000 -0.000000

Market Return Stock Return Beta_60 Beta_120 Close_TAIEX \

count 32700.000000 32700.000000 32700.000000 32700.000000 32700.000000

mean 0.000655 0.000402 0.712610 0.714384 15758.957189

std 0.011264 0.016314 0.402210 0.363794 2624.183112

min -0.058287 -0.219634 -0.582232 -0.244632 8681.339844

25% -0.005186 -0.006981 0.435734 0.473435 14217.059570

50% 0.000982 0.000000 0.649880 0.662866 16260.699707

75% 0.007072 0.007561 0.912558 0.874754 17341.250000

max 0.063671 0.100000 2.458626 1.914347 23406.099609

OBV

count 3.270000e+04

mean -5.788608e+10

std 3.404984e+10

min -1.153348e+11

25% -8.955733e+10

50% -5.153808e+10

75% -2.896390e+10

max 0.000000e+00

[8 rows x 33 columns]

重新繪製 Box Plot Matrix Map