讀取數據

from google.colab import drive

drive.mount('/content/drive')

import pandas as pd

df = pd.read_csv('/content/drive/My Drive/Semicon_Analysis/semiconductor_merged_0923.csv')

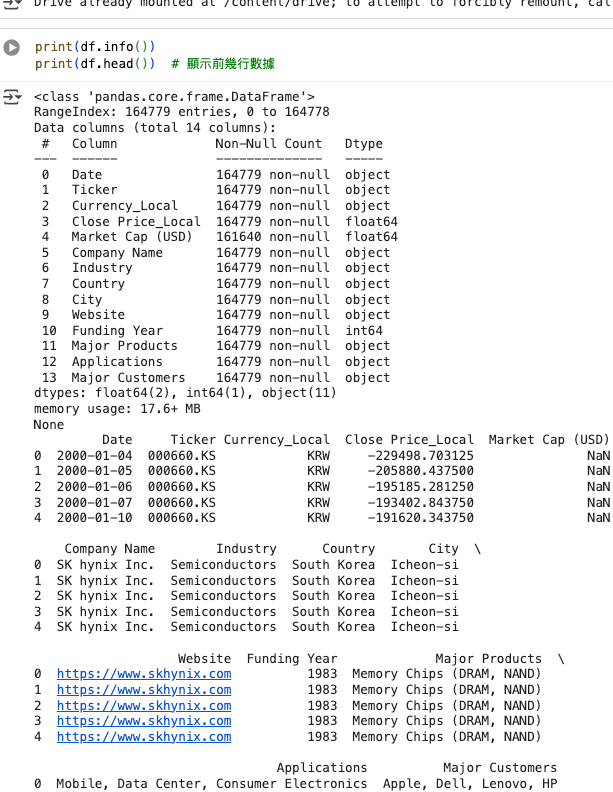

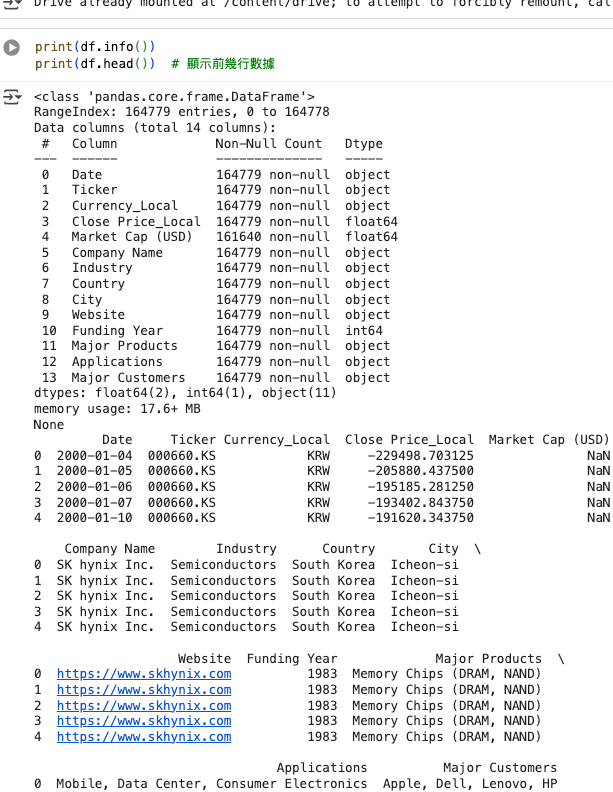

檢視資料結構

print(df.info())

print(df.head()) # 顯示前幾行數據

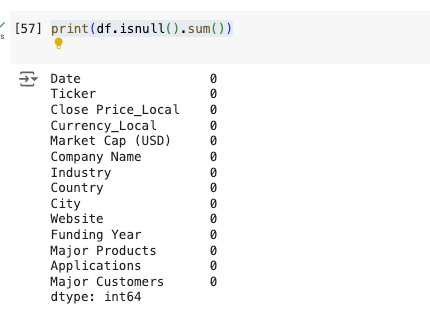

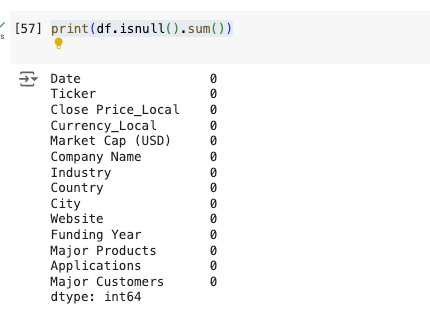

檢查缺失值

print(df.isnull().sum())

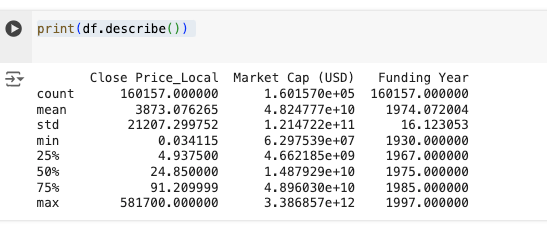

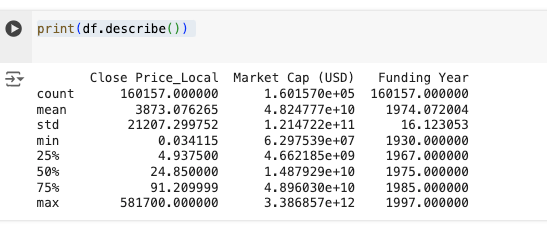

基本敘述統計

print(df.describe())

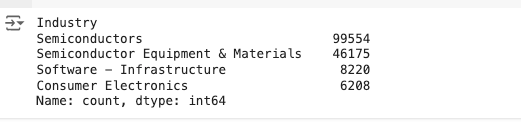

類別變數的分佈

print(df['Industry'].value_counts())

數據的分佈和統計圖形

import matplotlib.pyplot as plt

import pandas as pd

# 假設 df 已包含日期資料

# 轉換日期欄位為 datetime 格式

df['Date'] = pd.to_datetime(df['Date'])

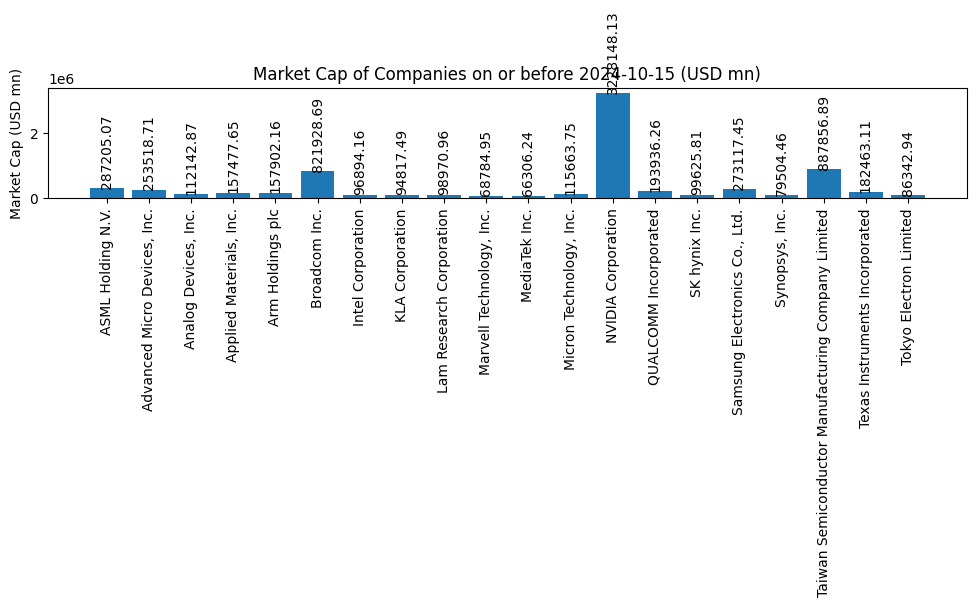

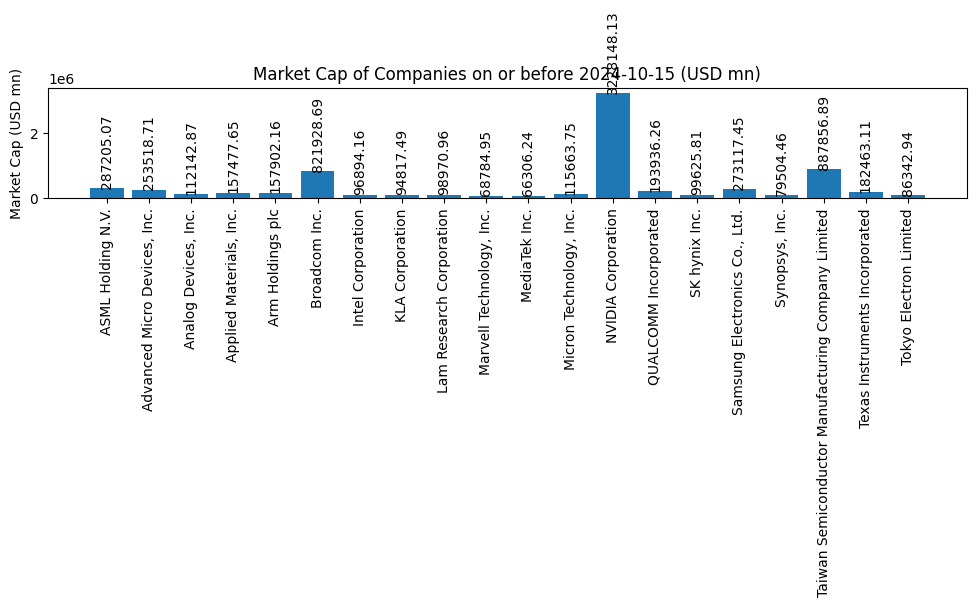

# 選擇 2024-10-15 或最近一天的數據

target_date = pd.Timestamp('2024-10-15')

# 找出 <= 2024-10-15 的最近一日數據

df_filtered = df[df['Date'] <= target_date].sort_values(by='Date', ascending=False).groupby('Company Name').first().reset_index()

# 將 Market Cap 的單位轉換為百萬

df_filtered['Market Cap (USD mn)'] = df_filtered['Market Cap (USD)'] / 1e6

# 繪製長條圖

plt.figure(figsize=(10, 6))

bars = plt.bar(df_filtered['Company Name'], df_filtered['Market Cap (USD mn)'])

# 設定 X 軸標籤並旋轉 90 度

plt.xticks(rotation=90)

# 添加 Market Cap 數值在每個長條的上方,並旋轉 90 度

for bar in bars:

yval = bar.get_height()

plt.text(bar.get_x() + bar.get_width()/2, yval, f'{yval:.2f}',

ha='center', va='bottom', rotation=90)

# 設定 Y 軸標籤

plt.ylabel('Market Cap (USD mn)')

# 設定標題

plt.title('Market Cap of Companies on or before 2024-10-15 (USD mn)')

# 顯示圖形

plt.tight_layout()

plt.show()

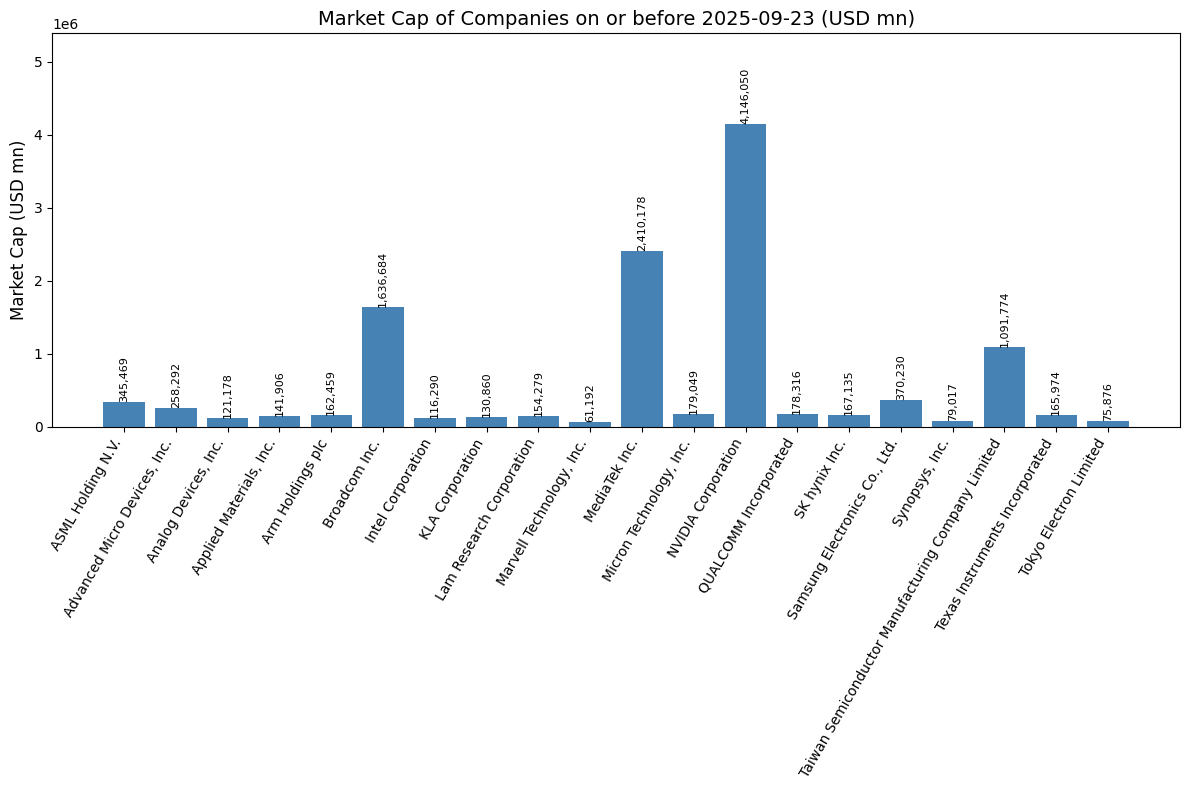

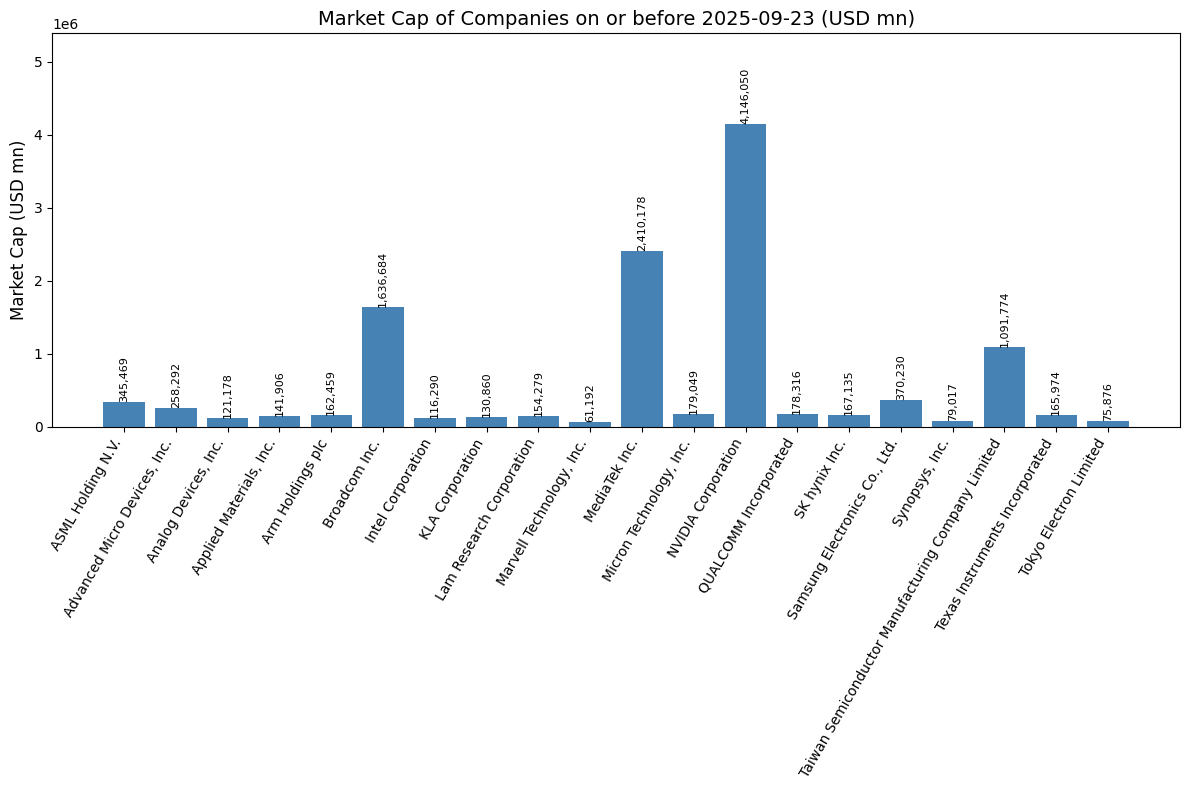

圖形修正

import matplotlib.pyplot as plt

import pandas as pd

# 假設 df 已包含日期資料

df['Date'] = pd.to_datetime(df['Date'])

# 選擇 2025-09-17 或最近一天的數據

target_date = pd.Timestamp('2025-09-17')

# 找出 <= target_date 的最近一日數據

df_filtered = (

df[df['Date'] <= target_date]

.sort_values(by='Date', ascending=False)

.groupby('Company Name')

.first()

.reset_index()

)

# 將 Market Cap 的單位轉換為百萬

df_filtered['Market Cap (USD mn)'] = df_filtered['Market Cap (USD)'] / 1e6

# 設定圖表大小(高度拉高)

plt.figure(figsize=(12, 8))

bars = plt.bar(df_filtered['Company Name'], df_filtered['Market Cap (USD mn)'], color='steelblue')

# 設定 X 軸標籤並旋轉 60 度,避免擠在一起

plt.xticks(rotation=60, ha='right', fontsize=10)

# 設定 Y 軸上限,多留 30% 空間

ymax = df_filtered['Market Cap (USD mn)'].max()

plt.ylim(0, ymax * 1.3)

# 添加數值標籤在每個長條上方,文字旋轉 90 度

for bar in bars:

yval = bar.get_height()

plt.text(bar.get_x() + bar.get_width()/2, yval,

f'{yval:,.0f}',

ha='center', va='bottom',

rotation=90, fontsize=8)

# 設定標籤與標題

plt.ylabel('Market Cap (USD mn)', fontsize=12)

plt.title('Market Cap of Companies on or before 2025-09-23 (USD mn)', fontsize=14)

plt.tight_layout()

plt.show()

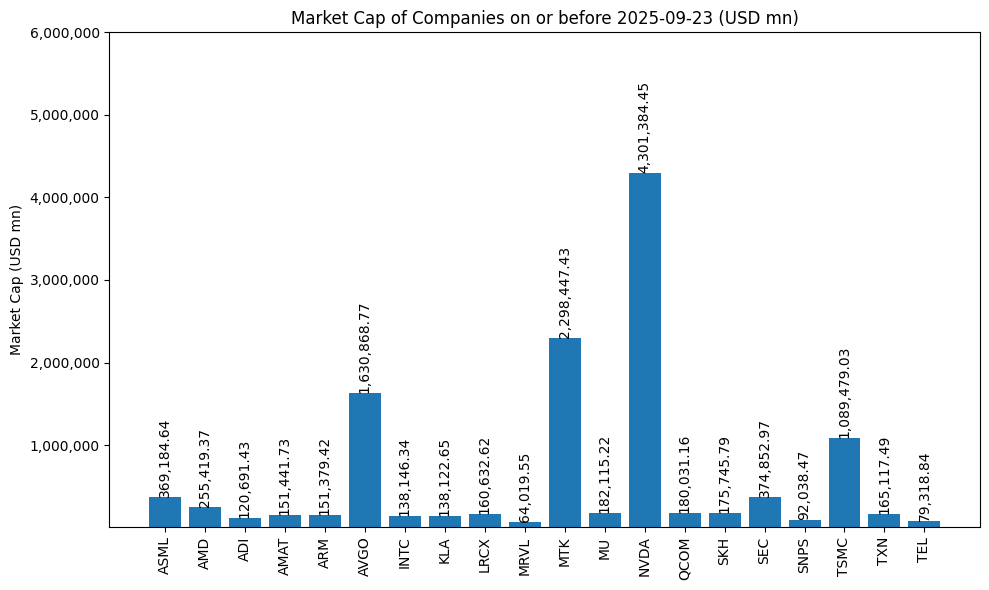

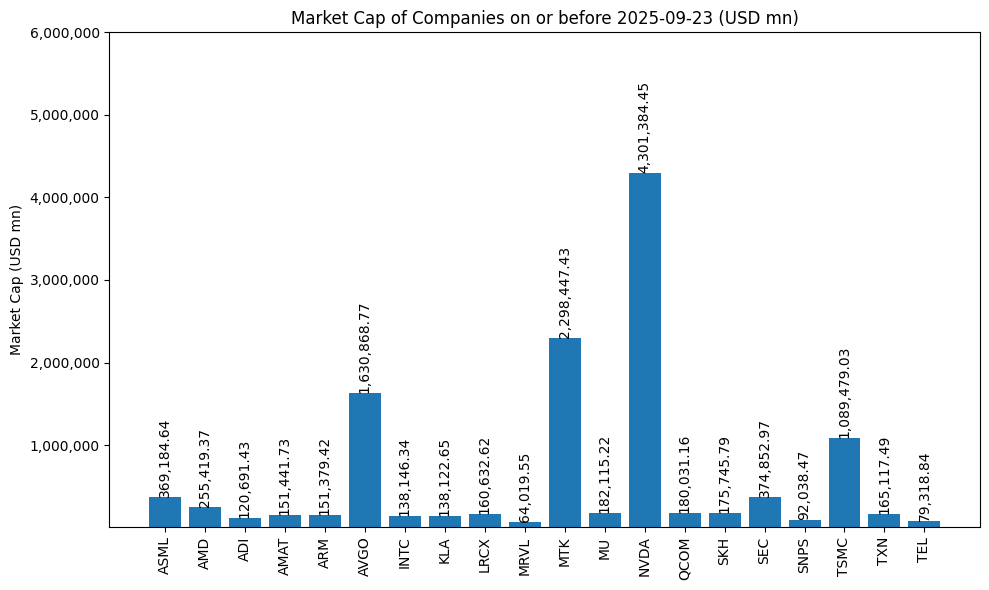

公司代碼簡寫修正

import matplotlib.pyplot as plt

import matplotlib.ticker as ticker

import pandas as pd

# 假設 df 已包含日期資料

# 轉換日期欄位為 datetime 格式

df['Date'] = pd.to_datetime(df['Date'])

# 選擇 2025-09-23 或最近一天的數據

target_date = pd.Timestamp('2025-09-23')

# 找出 <= 2025-09-23 的最近一日數據

df_filtered = df[df['Date'] <= target_date].sort_values(by='Date', ascending=False).groupby('Company Name').first().reset_index()

# 將 Market Cap 的單位轉換為百萬

df_filtered['Market Cap (USD mn)'] = df_filtered['Market Cap (USD)'] / 1e6

# 使用公司簡稱作為 X 軸標籤 (可手動定義簡稱)

company_abbr = {

'ASML Holding N.V.': 'ASML',

'Advanced Micro Devices, Inc.': 'AMD',

'Analog Devices, Inc.': 'ADI',

'Applied Materials, Inc.': 'AMAT',

'Arm Holdings plc': 'ARM',

'Broadcom Inc.': 'AVGO',

'Intel Corporation': 'INTC',

'KLA Corporation': 'KLA',

'Lam Research Corporation': 'LRCX',

'Marvell Technology, Inc.': 'MRVL',

'MediaTek Inc.': 'MTK',

'Micron Technology, Inc.': 'MU',

'NVIDIA Corporation': 'NVDA',

'QUALCOMM Incorporated': 'QCOM',

'SK hynix Inc.': 'SKH',

'Samsung Electronics Co., Ltd.': 'SEC',

'Synopsys, Inc.': 'SNPS',

'Taiwan Semiconductor Manufacturing Company Limited': 'TSMC',

'Texas Instruments Incorporated': 'TXN',

'Tokyo Electron Limited': 'TEL'

}

df_filtered['Company Abbr'] = df_filtered['Company Name'].map(company_abbr)

# 繪製長條圖

plt.figure(figsize=(10, 6))

bars = plt.bar(df_filtered['Company Abbr'], df_filtered['Market Cap (USD mn)'])

# 設定 X 軸標籤並旋轉 90 度

plt.xticks(rotation=90)

# 設定 Y 軸範圍和千分號格式

plt.ylim(10000, 6000000)

plt.gca().yaxis.set_major_formatter(ticker.FuncFormatter(lambda x, _: f'{int(x):,}'))

# 添加 Market Cap 數值在每個長條的上方,並旋轉 90 度

for bar in bars:

yval = bar.get_height()

plt.text(bar.get_x() + bar.get_width()/2, yval, f'{yval:,.2f}',

ha='center', va='bottom', rotation=90)

# 設定 Y 軸標籤

plt.ylabel('Market Cap (USD mn)')

# 設定標題

plt.title('Market Cap of Companies on or before 2024-10-15 (USD mn)')

# 顯示圖形

plt.tight_layout()

plt.show()

安裝 Cartopy ( 英國氣象局地圖包 )

pip install cartopy

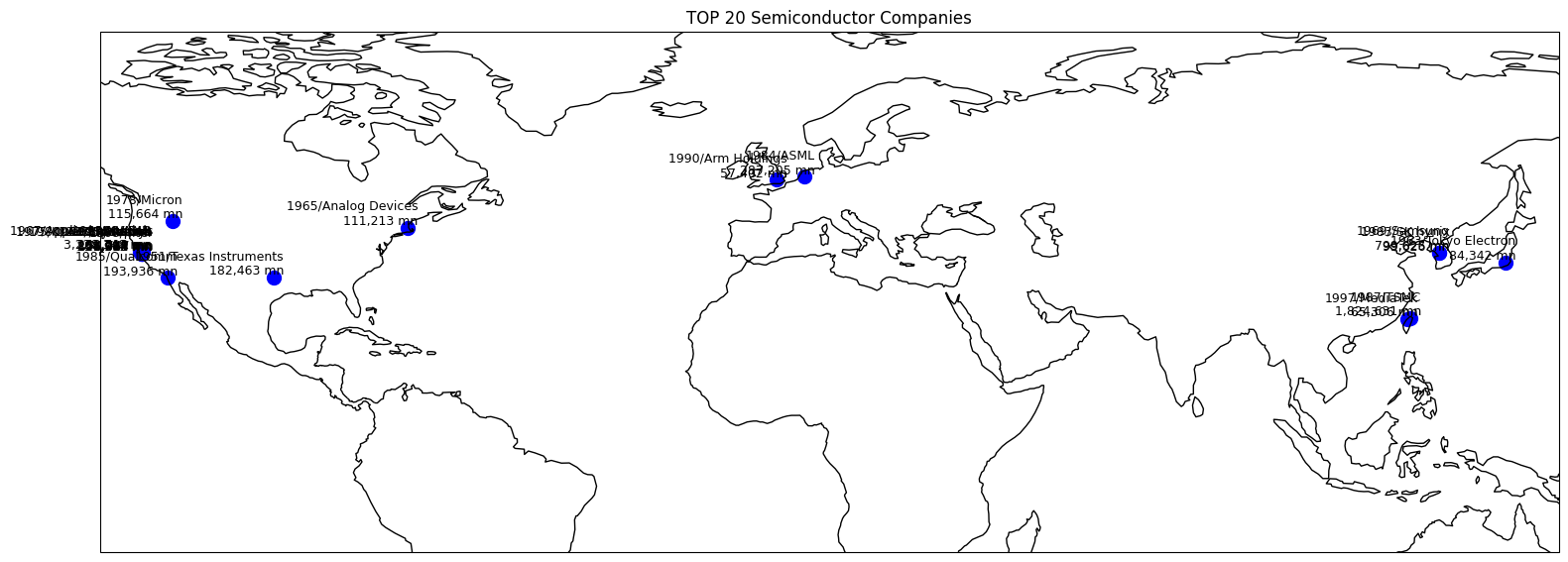

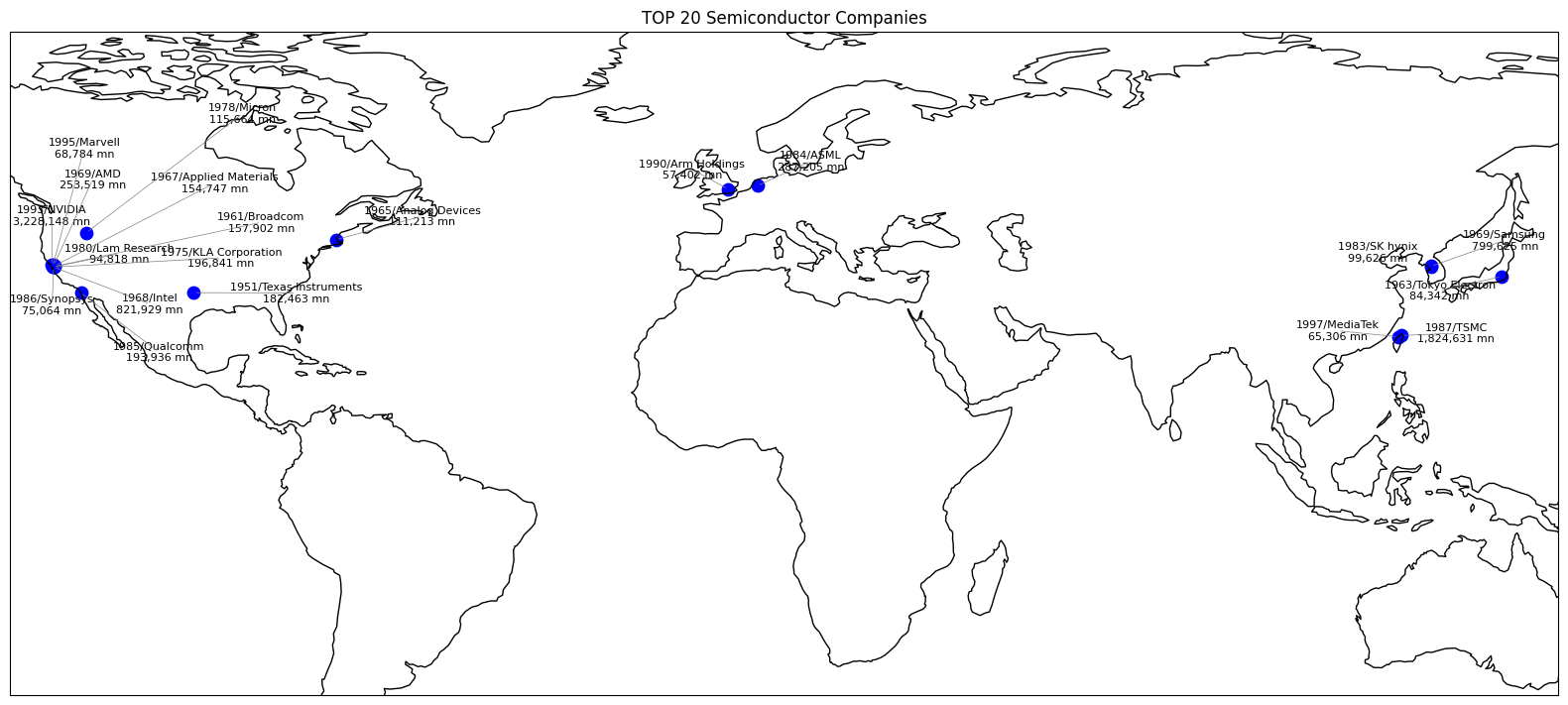

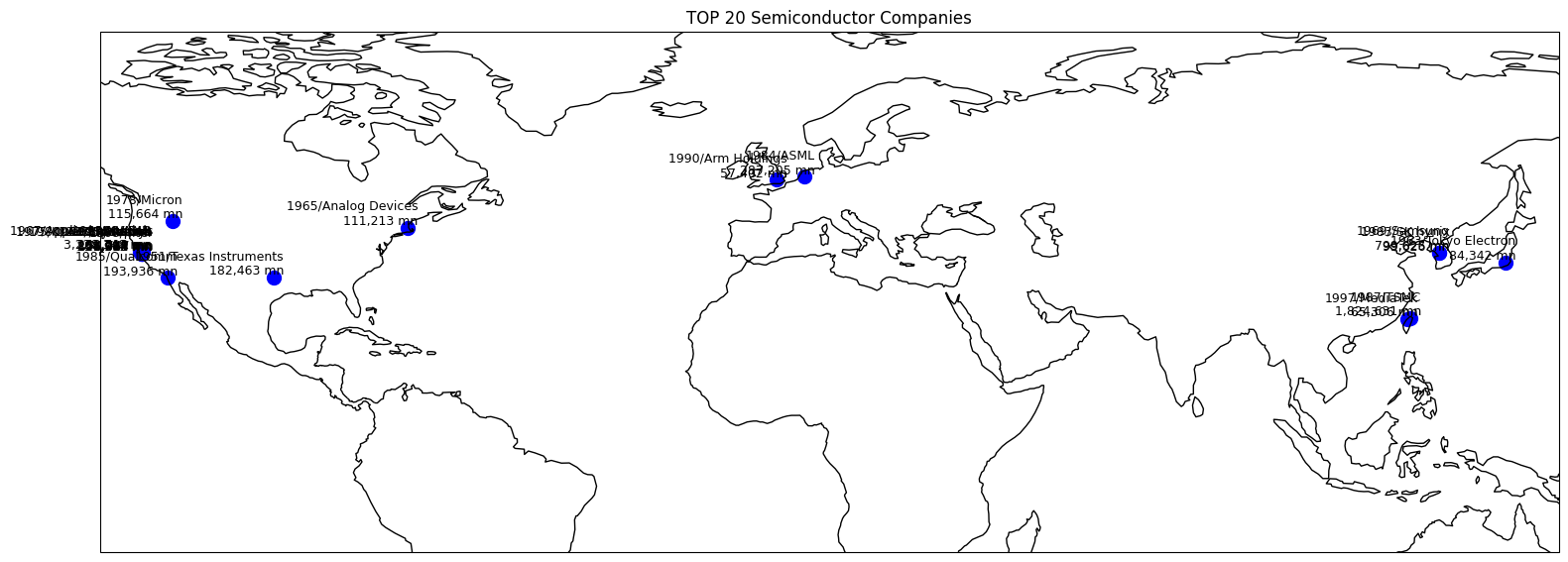

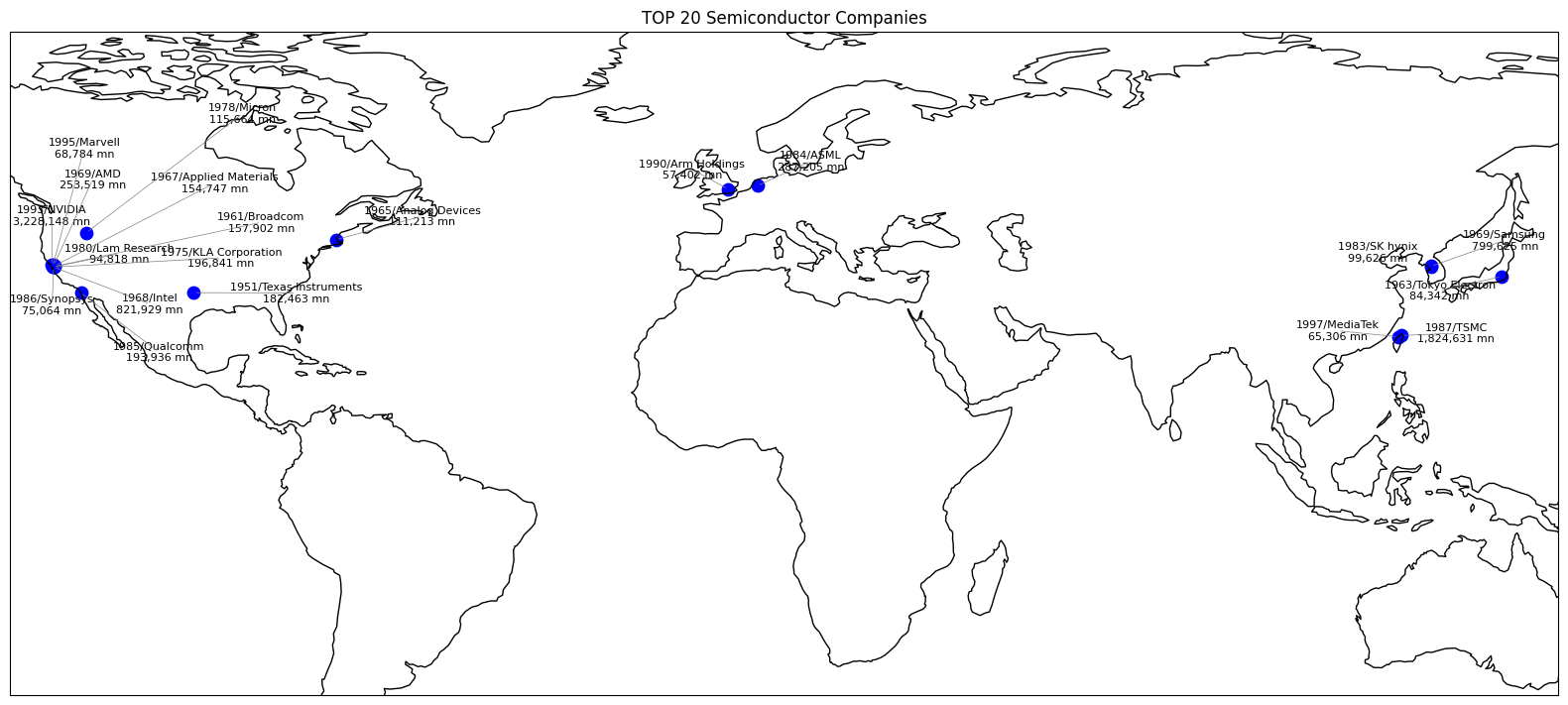

畫一張地圖

import cartopy.crs as ccrs

import matplotlib.pyplot as plt

import pandas as pd

# 20 家公司總部位置資料

data = {

'Company Name': ['NVIDIA', 'ASML', 'TSMC', 'Samsung', 'Intel', 'Qualcomm', 'Broadcom',

'Micron', 'Texas Instruments', 'SK hynix', 'MediaTek', 'Applied Materials',

'AMD', 'KLA Corporation', 'Lam Research', 'Analog Devices', 'Arm Holdings',

'Synopsys', 'Tokyo Electron', 'Marvell'],

'Latitude': [37.7749, 52.0907, 25.0330, 37.5665, 37.3875, 32.7157, 37.4848,

43.6150, 32.7775, 37.4563, 24.7945, 37.6624, 37.7510, 37.4102,

37.4674, 42.3601, 51.5074, 37.3859, 35.6895, 37.5337],

'Longitude': [-122.4194, 5.1214, 121.5654, 126.9780, -122.0575, -117.1611, -122.1483,

-116.2023, -96.7970, 127.0419, 120.9615, -121.8747, -122.0312, -122.0595,

-121.9630, -71.0589, -0.1276, -122.0867, 139.6917, -122.2712],

'Funding Year': [1993, 1984, 1987, 1969, 1968, 1985, 1961,

1978, 1951, 1983, 1997, 1967, 1969, 1975,

1980, 1965, 1990, 1986, 1963, 1995],

'Market Cap (USD mn)': [3228148, 287205, 1824631, 799625, 821929, 193936, 157902,

115664, 182463, 99626, 65306, 154747, 253519, 196841,

94818, 111213, 57402, 75064, 84342, 68784]

}

# 創建DataFrame

df = pd.DataFrame(data)

# 創建地圖,設定 16:9 比例 (16 x 9 英吋)

fig, ax = plt.subplots(figsize=(16, 9), subplot_kw={'projection': ccrs.PlateCarree()})

ax.coastlines() # 繪製海岸線

# 設置地圖的視野範圍 (經度從 -130 到 150,緯度從 20 到 60)

ax.set_extent([-130, 150, -40, 80], crs=ccrs.PlateCarree())

# 標註公司位置,根據不同區域調整偏移

for idx, row in df.iterrows():

x_offset = 2 if row['Longitude'] < 0 else -2 # 西半球向右偏移,東半球向左偏移

y_offset = 0.5 if row['Latitude'] > 35 else -0.5 # 北緯度地區向上偏移,南緯度向下

ax.scatter(row['Longitude'], row['Latitude'], color='blue', s=100, transform=ccrs.PlateCarree()) # 標註地點

ax.text(row['Longitude'] + x_offset, row['Latitude'] + y_offset,

f"{row['Funding Year']}/{row['Company Name']}\n{row['Market Cap (USD mn)']:,} mn",

fontsize=8, ha='right', va='bottom', transform=ccrs.PlateCarree())

# 設定標題並顯示圖形

plt.title('TOP 20 Semiconductor Companies')

plt.tight_layout()

# 顯示圖形

plt.show()

新增一個欄位_Colse_Change %

import pandas as pd

# 讀取文件

input_file = '/content/drive/My Drive/Semicon_Analysis/semiconductor_merged_0923.csv'

output_file = '/content/drive/My Drive/Semicon_Analysis/semiconductor_merged_09231.csv'

# 讀取 CSV 文件

df = pd.read_csv(input_file)

# 計算每日的收盤價變動百分比(使用 Close_Price_Local)

df['Close_Price_Change%'] = df.groupby('Company Name')['Close Price_Local'].pct_change() * 100

# 保存結果為新的 CSV 文件

df.to_csv(output_file, index=False)

print(f"新文件已保存為: {output_file}")

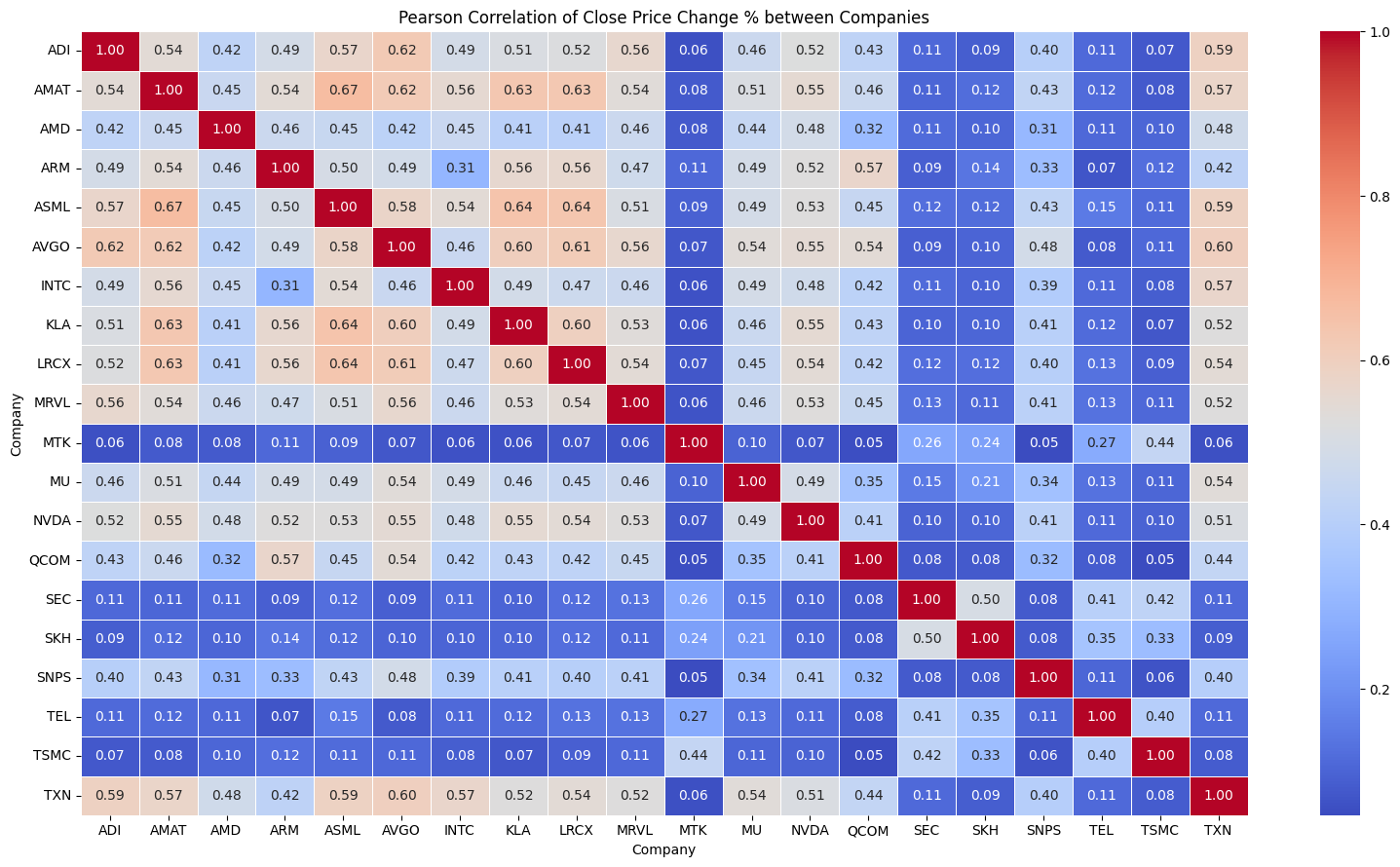

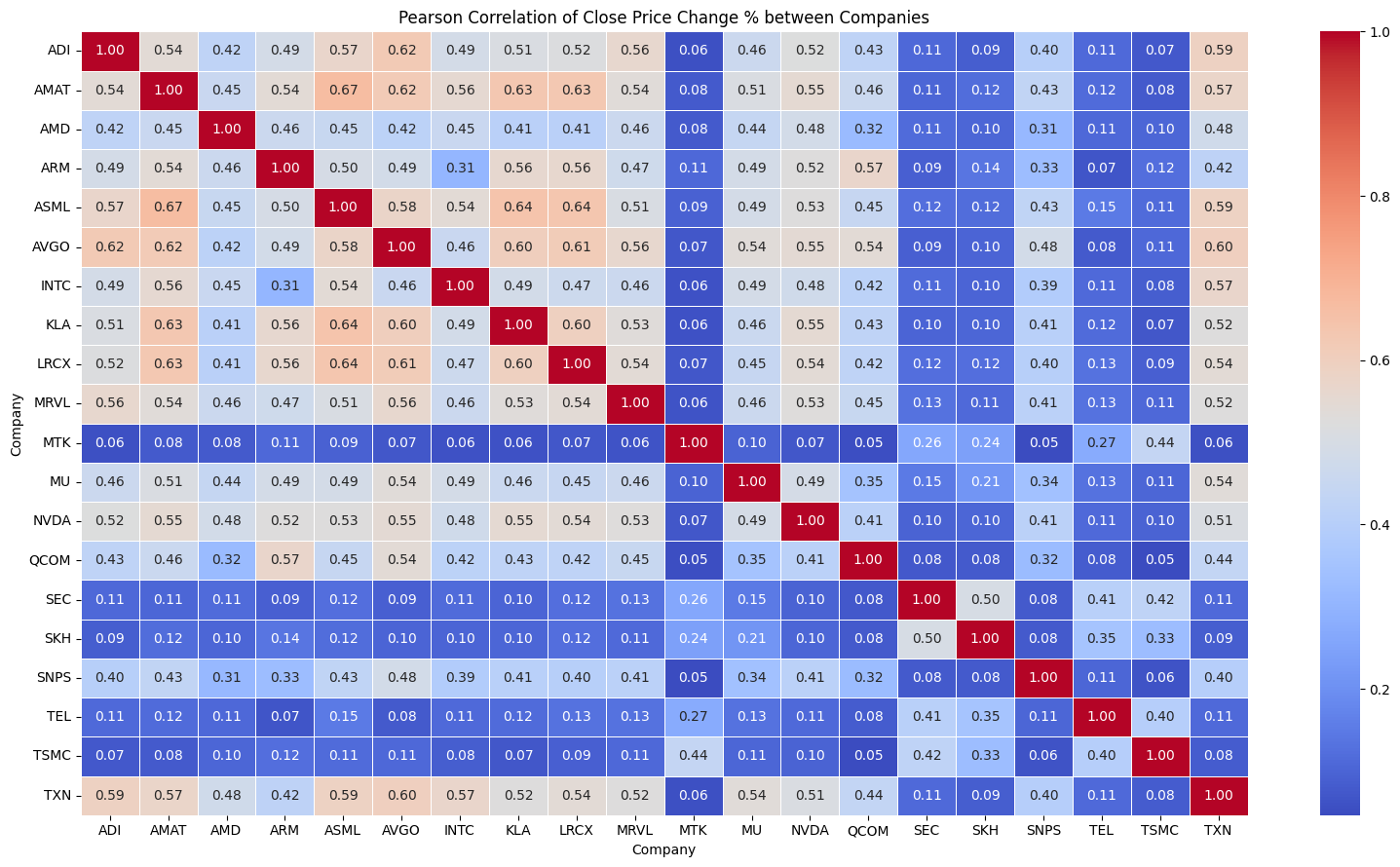

相關性分析

import pandas as pd

import seaborn as sns

import matplotlib.pyplot as plt

from scipy.stats import pearsonr

# 定義公司簡稱

company_abbr = {

'ASML Holding N.V.': 'ASML',

'Advanced Micro Devices, Inc.': 'AMD',

'Analog Devices, Inc.': 'ADI',

'Applied Materials, Inc.': 'AMAT',

'Arm Holdings plc': 'ARM',

'Broadcom Inc.': 'AVGO',

'Intel Corporation': 'INTC',

'KLA Corporation': 'KLA',

'Lam Research Corporation': 'LRCX',

'Marvell Technology, Inc.': 'MRVL',

'MediaTek Inc.': 'MTK',

'Micron Technology, Inc.': 'MU',

'NVIDIA Corporation': 'NVDA',

'QUALCOMM Incorporated': 'QCOM',

'SK hynix Inc.': 'SKH',

'Samsung Electronics Co., Ltd.': 'SEC',

'Synopsys, Inc.': 'SNPS',

'Taiwan Semiconductor Manufacturing Company Limited': 'TSMC',

'Texas Instruments Incorporated': 'TXN',

'Tokyo Electron Limited': 'TEL'

}

# 讀取文件

input_file = '/content/drive/My Drive/Semicon_Analysis/semiconductor_merged_09231.csv'

df = pd.read_csv(input_file)

# 使用簡稱替換公司名稱

df['Company'] = df['Company Name'].replace(company_abbr)

# 計算每日的收盤價變動百分比(使用 Close_Price_Local)

df['Close_Price_Change%'] = df.groupby('Company Name')['Close Price_Local'].pct_change() * 100

# 透過 pivot_table 生成檢定所需的格式

pivot_data = df.pivot_table(index='Date', columns='Company', values='Close_Price_Change%')

# 計算 Pearson 檢定的相關性矩陣

correlation_matrix = pivot_data.corr(method='pearson')

# 打印相關性矩陣

print(correlation_matrix)

# 繪製相關性矩陣的熱力圖

plt.figure(figsize=(16, 9))

sns.heatmap(correlation_matrix, cmap='coolwarm', annot=True, fmt='.2f', linewidths=0.5)

# 設置標題和標籤

plt.title('Pearson Correlation of Close Price Change % between Companies')

plt.xlabel('Company')

plt.ylabel('Company')

# 顯示圖形

plt.tight_layout()

plt.show()

Company ADI AMAT AMD ARM ASML AVGO INTC \

Company

ADI 1.000000 0.541918 0.423366 0.486624 0.568896 0.621776 0.487018

AMAT 0.541918 1.000000 0.454196 0.544436 0.666901 0.619881 0.555079

AMD 0.423366 0.454196 1.000000 0.463046 0.451012 0.415794 0.453819

ARM 0.486624 0.544436 0.463046 1.000000 0.495585 0.485536 0.305722

ASML 0.568896 0.666901 0.451012 0.495585 1.000000 0.578797 0.544514

AVGO 0.621776 0.619881 0.415794 0.485536 0.578797 1.000000 0.455889

INTC 0.487018 0.555079 0.453819 0.305722 0.544514 0.455889 1.000000

KLA 0.510681 0.632632 0.410530 0.558197 0.643390 0.603210 0.485578

LRCX 0.516641 0.630973 0.408571 0.562002 0.635982 0.613218 0.465112

MRVL 0.561540 0.535809 0.461225 0.474167 0.508250 0.561123 0.461089

MTK 0.057143 0.077351 0.078549 0.108997 0.091158 0.071464 0.058916

MU 0.460685 0.511019 0.443854 0.487499 0.488852 0.536306 0.488299

NVDA 0.522410 0.552755 0.482511 0.524515 0.526296 0.547520 0.478040

QCOM 0.425003 0.458807 0.319627 0.569955 0.446204 0.544711 0.417745

SEC 0.109014 0.105563 0.114888 0.089351 0.120939 0.087458 0.113838

SKH 0.085792 0.119534 0.104326 0.135799 0.119577 0.100415 0.099826

SNPS 0.401077 0.430971 0.312300 0.326379 0.426871 0.484249 0.386781

TEL 0.110707 0.116325 0.107175 0.066312 0.149715 0.078622 0.113225

TSMC 0.072692 0.077878 0.103152 0.122251 0.114173 0.106240 0.083760

TXN 0.590414 0.574693 0.477645 0.420051 0.589021 0.597949 0.569759

Company KLA LRCX MRVL MTK MU NVDA QCOM \

Company

ADI 0.510681 0.516641 0.561540 0.057143 0.460685 0.522410 0.425003

AMAT 0.632632 0.630973 0.535809 0.077351 0.511019 0.552755 0.458807

AMD 0.410530 0.408571 0.461225 0.078549 0.443854 0.482511 0.319627

ARM 0.558197 0.562002 0.474167 0.108997 0.487499 0.524515 0.569955

ASML 0.643390 0.635982 0.508250 0.091158 0.488852 0.526296 0.446204

AVGO 0.603210 0.613218 0.561123 0.071464 0.536306 0.547520 0.544711

INTC 0.485578 0.465112 0.461089 0.058916 0.488299 0.478040 0.417745

KLA 1.000000 0.597073 0.532974 0.059414 0.456168 0.550244 0.426259

LRCX 0.597073 1.000000 0.542129 0.072306 0.447227 0.544406 0.423479

MRVL 0.532974 0.542129 1.000000 0.062846 0.462426 0.527370 0.451346

MTK 0.059414 0.072306 0.062846 1.000000 0.098443 0.070321 0.051490

MU 0.456168 0.447227 0.462426 0.098443 1.000000 0.491772 0.350716

NVDA 0.550244 0.544406 0.527370 0.070321 0.491772 1.000000 0.414545

QCOM 0.426259 0.423479 0.451346 0.051490 0.350716 0.414545 1.000000

SEC 0.099445 0.121546 0.130619 0.260848 0.149158 0.095688 0.075216

SKH 0.104053 0.122636 0.109864 0.242886 0.213560 0.102754 0.076789

SNPS 0.405212 0.403582 0.412785 0.046350 0.343524 0.414020 0.323829

TEL 0.115637 0.131608 0.131444 0.271901 0.128999 0.110760 0.080498

TSMC 0.070768 0.090978 0.105954 0.440420 0.105783 0.096346 0.046957

TXN 0.524982 0.542830 0.524364 0.055881 0.537954 0.510233 0.435174

Company SEC SKH SNPS TEL TSMC TXN

Company

ADI 0.109014 0.085792 0.401077 0.110707 0.072692 0.590414

AMAT 0.105563 0.119534 0.430971 0.116325 0.077878 0.574693

AMD 0.114888 0.104326 0.312300 0.107175 0.103152 0.477645

ARM 0.089351 0.135799 0.326379 0.066312 0.122251 0.420051

ASML 0.120939 0.119577 0.426871 0.149715 0.114173 0.589021

AVGO 0.087458 0.100415 0.484249 0.078622 0.106240 0.597949

INTC 0.113838 0.099826 0.386781 0.113225 0.083760 0.569759

KLA 0.099445 0.104053 0.405212 0.115637 0.070768 0.524982

LRCX 0.121546 0.122636 0.403582 0.131608 0.090978 0.542830

MRVL 0.130619 0.109864 0.412785 0.131444 0.105954 0.524364

MTK 0.260848 0.242886 0.046350 0.271901 0.440420 0.055881

MU 0.149158 0.213560 0.343524 0.128999 0.105783 0.537954

NVDA 0.095688 0.102754 0.414020 0.110760 0.096346 0.510233

QCOM 0.075216 0.076789 0.323829 0.080498 0.046957 0.435174

SEC 1.000000 0.499564 0.076720 0.407232 0.423196 0.112434

SKH 0.499564 1.000000 0.079850 0.352210 0.326435 0.086746

SNPS 0.076720 0.079850 1.000000 0.105648 0.061736 0.397336

TEL 0.407232 0.352210 0.105648 1.000000 0.396922 0.111470

TSMC 0.423196 0.326435 0.061736 0.396922 1.000000 0.082757

TXN 0.112434 0.086746 0.397336 0.111470 0.082757 1.000000

Pearson 檢定

import pandas as pd

import seaborn as sns

import matplotlib.pyplot as plt

from scipy.stats import pearsonr

# 定義公司簡稱

company_abbr = {

'ASML Holding N.V.': 'ASML',

'Advanced Micro Devices, Inc.': 'AMD',

'Analog Devices, Inc.': 'ADI',

'Applied Materials, Inc.': 'AMAT',

'Arm Holdings plc': 'ARM',

'Broadcom Inc.': 'AVGO',

'Intel Corporation': 'INTC',

'KLA Corporation': 'KLA',

'Lam Research Corporation': 'LRCX',

'Marvell Technology, Inc.': 'MRVL',

'MediaTek Inc.': 'MTK',

'Micron Technology, Inc.': 'MU',

'NVIDIA Corporation': 'NVDA',

'QUALCOMM Incorporated': 'QCOM',

'SK hynix Inc.': 'SKH',

'Samsung Electronics Co., Ltd.': 'SEC',

'Synopsys, Inc.': 'SNPS',

'Taiwan Semiconductor Manufacturing Company Limited': 'TSMC',

'Texas Instruments Incorporated': 'TXN',

'Tokyo Electron Limited': 'TEL'

}

# 讀取文件

input_file = '/content/drive/My Drive/Semicon_Analysis/semiconductor_merged_09231.csv'

df = pd.read_csv(input_file)

# 使用簡稱替換公司名稱

df['Company'] = df['Company Name'].replace(company_abbr)

# 計算每日的收盤價變動百分比(使用 Close_Price_Local)

df['Close_Price_Change%'] = df.groupby('Company Name')['Close Price_Local'].pct_change() * 100

# 透過 pivot_table 生成檢定所需的格式

pivot_data = df.pivot_table(index='Date', columns='Company', values='Close_Price_Change%')

# 創建一個空的 DataFrame 來存放結果

results = pd.DataFrame(columns=['Company 1', 'Company 2', 'Pearson R', 'P-value'])

# 計算每兩家公司之間的 Pearson R 和 P 值

companies = pivot_data.columns

for i in range(len(companies)):

for j in range(i+1, len(companies)): # 避免重複計算相同的組合

comp1 = companies[i]

comp2 = companies[j]

# 去除 NaN 值,避免影響計算

valid_data = pivot_data[[comp1, comp2]].dropna()

if not valid_data.empty:

# 計算 Pearson 相關性和 P 值

r_value, p_value = pearsonr(valid_data[comp1], valid_data[comp2])

# 將結果存入 DataFrame

new_row = pd.DataFrame({

'Company 1': [comp1],

'Company 2': [comp2],

'Pearson R': [r_value],

'P-value': [p_value]

})

results = pd.concat([results, new_row], ignore_index=True)

# 顯示結果

print(results)

# 保存為 CSV 文件,如果需要保存結果到文件

output_file = '/content/drive/My Drive/Semicon_Analysis/pearson_correlation_results.csv'

results.to_csv(output_file, index=False)

results = pd.concat([results, new_row], ignore_index=True)

Company 1 Company 2 Pearson R P-value

0 ADI AMAT 0.541918 0.000000e+00

1 ADI AMD 0.423366 0.000000e+00

2 ADI ARM 0.486624 2.209092e-31

3 ADI ASML 0.568896 0.000000e+00

4 ADI AVGO 0.621776 0.000000e+00

.. ... ... ... ...

185 SNPS TSMC 0.061736 1.185282e-06

186 SNPS TXN 0.397336 1.231097e-317

187 TEL TSMC 0.396922 4.839307e-231

188 TEL TXN 0.111470 1.351283e-18

189 TSMC TXN 0.082757 7.163894e-11

[190 rows x 4 columns]

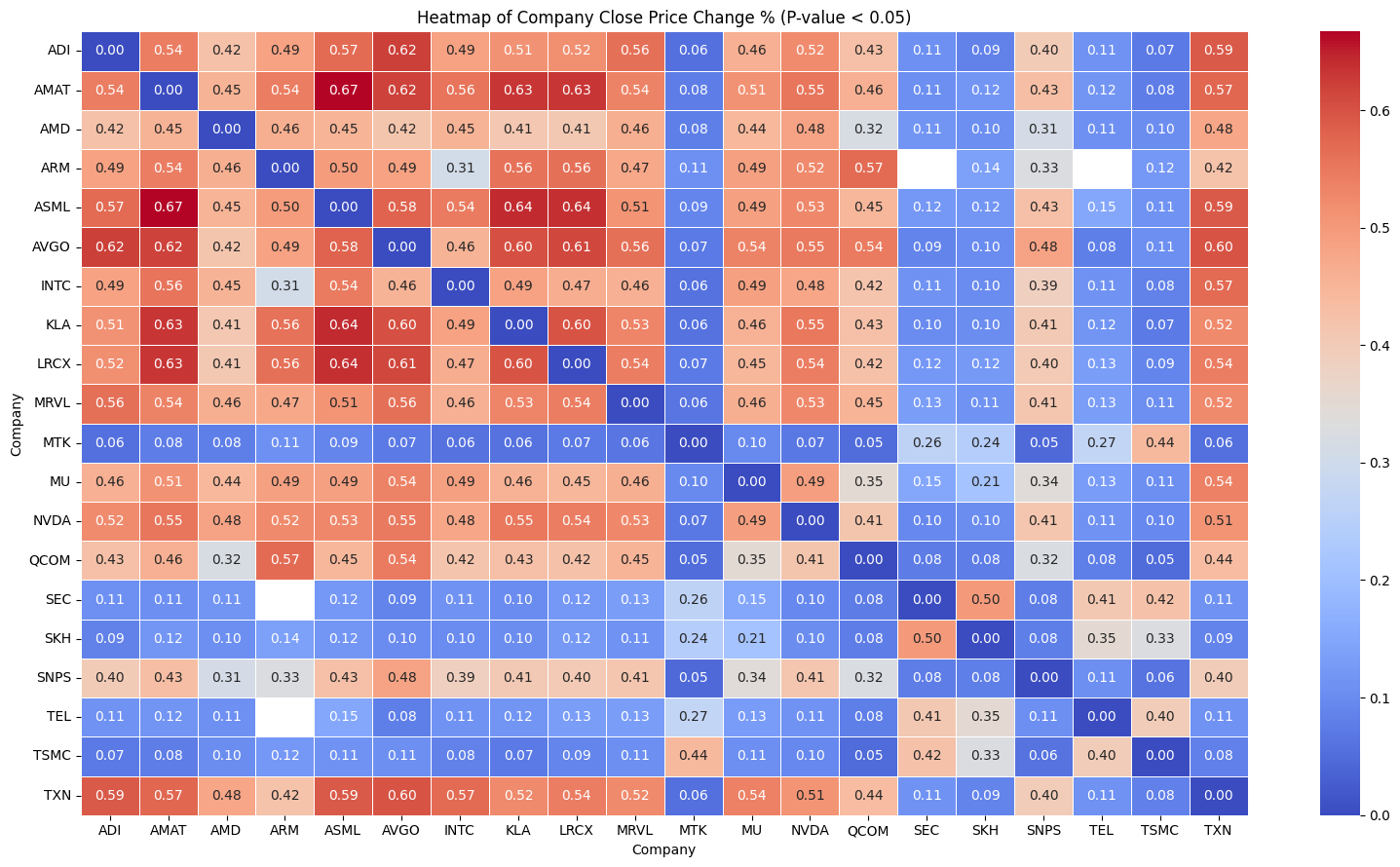

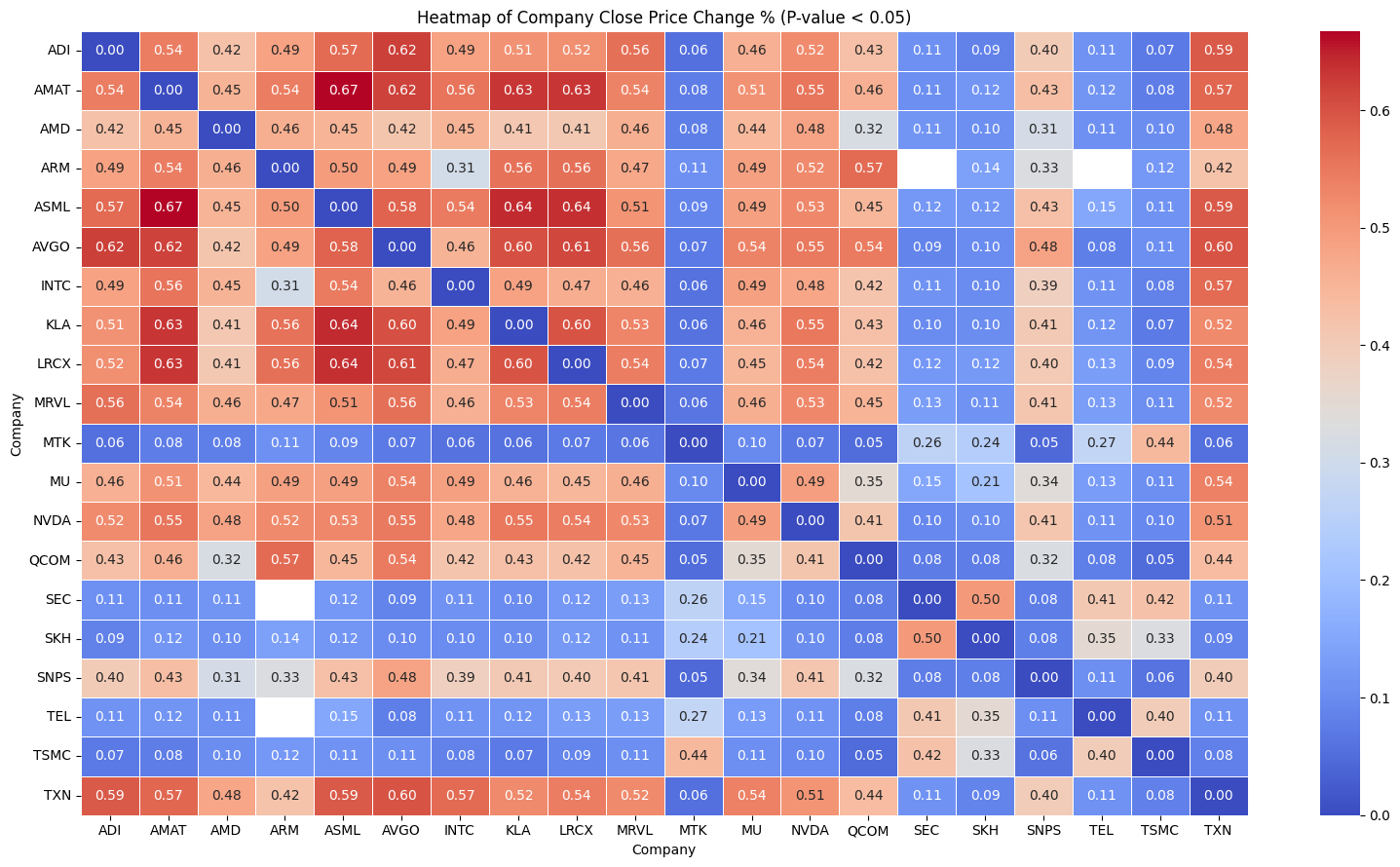

重新提供 Heatmap of Price Change% , 基於 P-value <0.05

import pandas as pd

import seaborn as sns

import matplotlib.pyplot as plt

from scipy.stats import pearsonr

import numpy as np

# 定義公司簡稱

company_abbr = {

'ASML Holding N.V.': 'ASML',

'Advanced Micro Devices, Inc.': 'AMD',

'Analog Devices, Inc.': 'ADI',

'Applied Materials, Inc.': 'AMAT',

'Arm Holdings plc': 'ARM',

'Broadcom Inc.': 'AVGO',

'Intel Corporation': 'INTC',

'KLA Corporation': 'KLA',

'Lam Research Corporation': 'LRCX',

'Marvell Technology, Inc.': 'MRVL',

'MediaTek Inc.': 'MTK',

'Micron Technology, Inc.': 'MU',

'NVIDIA Corporation': 'NVDA',

'QUALCOMM Incorporated': 'QCOM',

'SK hynix Inc.': 'SKH',

'Samsung Electronics Co., Ltd.': 'SEC',

'Synopsys, Inc.': 'SNPS',

'Taiwan Semiconductor Manufacturing Company Limited': 'TSMC',

'Texas Instruments Incorporated': 'TXN',

'Tokyo Electron Limited': 'TEL'

}

# 讀取文件

input_file = '/content/drive/My Drive/Semicon_Analysis/semiconductor_merged_09231.csv'

df = pd.read_csv(input_file)

# 使用簡稱替換公司名稱

df['Company'] = df['Company Name'].replace(company_abbr)

# 計算每日的收盤價變動百分比(使用 Close_Price_Local)

df['Close_Price_Change%'] = df.groupby('Company Name')['Close Price_Local'].pct_change() * 100

# 透過 pivot_table 生成檢定所需的格式

pivot_data = df.pivot_table(index='Date', columns='Company', values='Close_Price_Change%')

# 創建一個空的 DataFrame 來存放結果

correlation_matrix = pd.DataFrame(np.zeros((len(pivot_data.columns), len(pivot_data.columns))),

columns=pivot_data.columns, index=pivot_data.columns)

# 計算每兩家公司之間的 Pearson R 和 P 值

for i in range(len(pivot_data.columns)):

for j in range(i+1, len(pivot_data.columns)): # 避免重複計算相同的組合

comp1 = pivot_data.columns[i]

comp2 = pivot_data.columns[j]

# 去除 NaN 值,避免影響計算

valid_data = pivot_data[[comp1, comp2]].dropna()

if not valid_data.empty:

# 計算 Pearson 相關性和 P 值

r_value, p_value = pearsonr(valid_data[comp1], valid_data[comp2])

# 只在 p-value < 0.05 的情況下填入 Pearson R 值,否則設為 NaN

if p_value < 0.05:

correlation_matrix.loc[comp1, comp2] = r_value

correlation_matrix.loc[comp2, comp1] = r_value

else:

correlation_matrix.loc[comp1, comp2] = np.nan

correlation_matrix.loc[comp2, comp1] = np.nan

# 繪製相關性矩陣的熱力圖,只顯示符合條件的公司 P Value < 0.05

plt.figure(figsize=(16, 9))

sns.heatmap(correlation_matrix, cmap='coolwarm', annot=True, fmt='.2f', linewidths=0.5, mask=correlation_matrix.isnull())

# 設置標題和標籤

plt.title('Heatmap of Company Close Price Change % (P-value < 0.05)')

plt.xlabel('Company')

plt.ylabel('Company')

# 顯示圖形

plt.tight_layout()

plt.show()